Puerto Rico Sample Letter for Instructions to Execute Complaint to Probate Will

Description

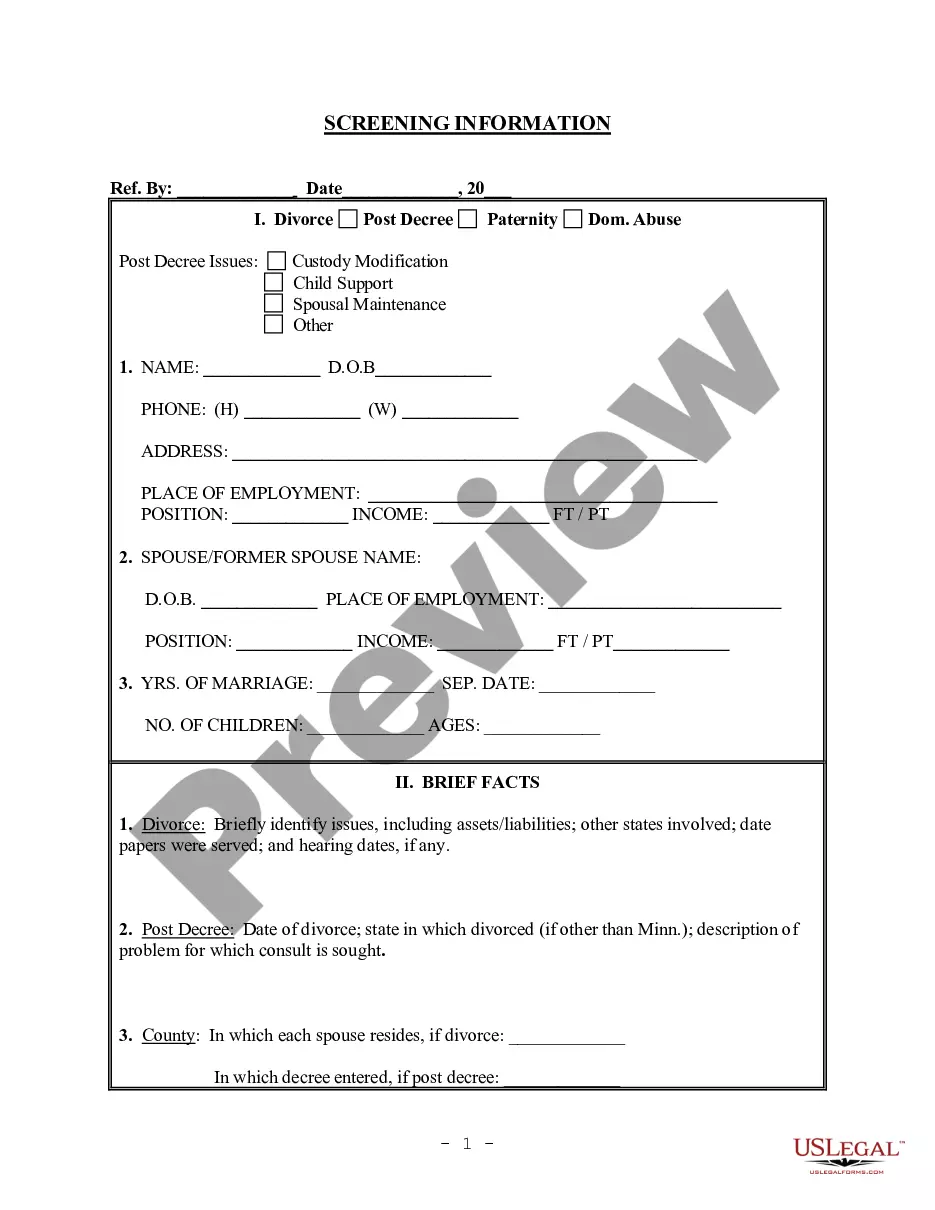

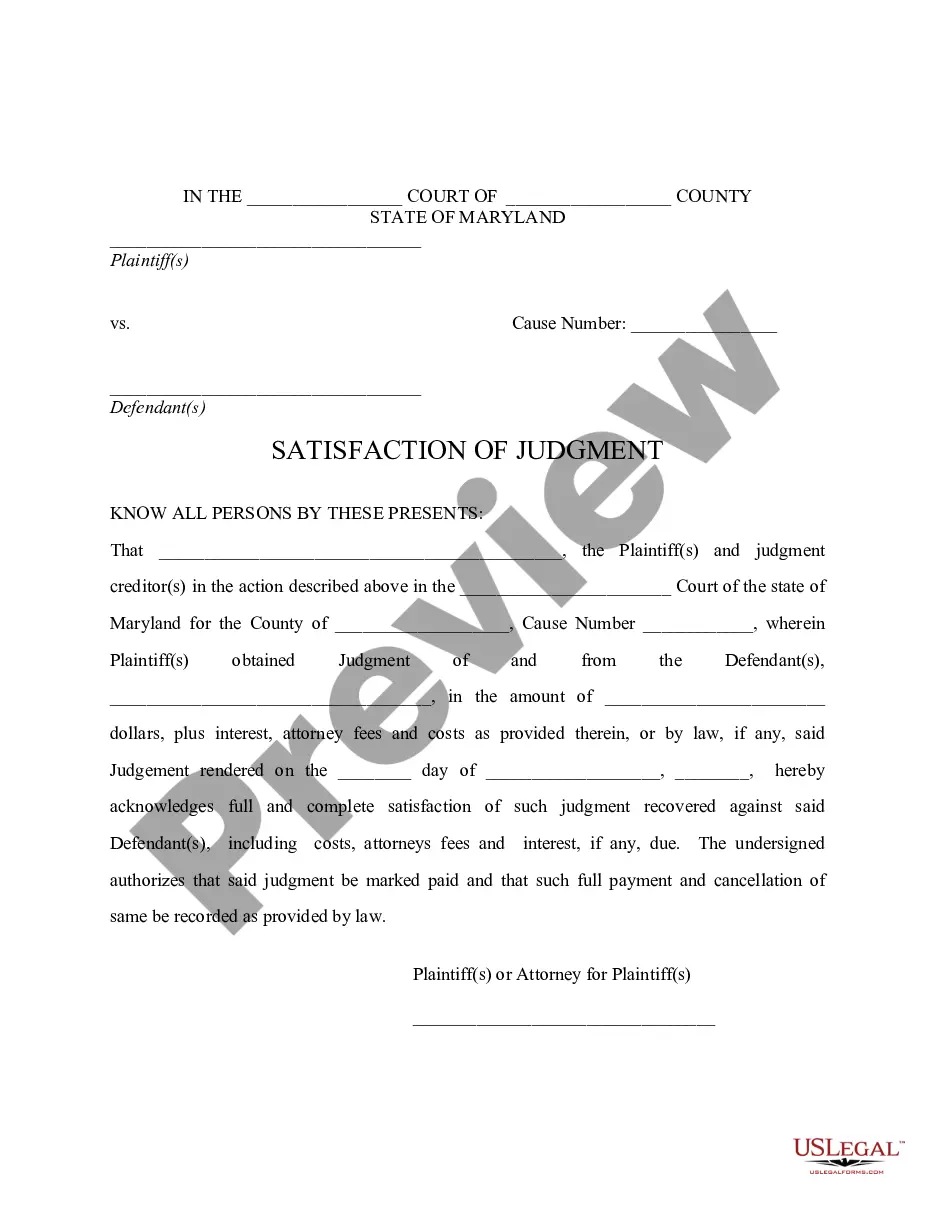

How to fill out Sample Letter For Instructions To Execute Complaint To Probate Will?

US Legal Forms - one of several biggest libraries of authorized varieties in the States - gives a variety of authorized file themes it is possible to acquire or produce. Making use of the website, you may get thousands of varieties for company and personal functions, sorted by classes, says, or keywords and phrases.You will discover the newest models of varieties just like the Puerto Rico Sample Letter for Instructions to Execute Complaint to Probate Will within minutes.

If you have a subscription, log in and acquire Puerto Rico Sample Letter for Instructions to Execute Complaint to Probate Will from the US Legal Forms library. The Download button will appear on each develop you view. You have accessibility to all earlier delivered electronically varieties from the My Forms tab of your respective profile.

If you want to use US Legal Forms the very first time, allow me to share easy guidelines to obtain started:

- Be sure to have selected the correct develop for your city/state. Select the Preview button to review the form`s content. Browse the develop information to actually have chosen the proper develop.

- When the develop does not suit your demands, use the Research industry at the top of the display screen to discover the one that does.

- Should you be happy with the form, validate your choice by simply clicking the Get now button. Then, opt for the prices strategy you like and supply your credentials to sign up to have an profile.

- Approach the financial transaction. Make use of your credit card or PayPal profile to complete the financial transaction.

- Find the formatting and acquire the form in your device.

- Make changes. Fill up, revise and produce and indicator the delivered electronically Puerto Rico Sample Letter for Instructions to Execute Complaint to Probate Will.

Every single format you added to your account does not have an expiry particular date which is yours for a long time. So, if you wish to acquire or produce yet another copy, just check out the My Forms section and click on about the develop you will need.

Gain access to the Puerto Rico Sample Letter for Instructions to Execute Complaint to Probate Will with US Legal Forms, the most substantial library of authorized file themes. Use thousands of specialist and condition-particular themes that meet up with your small business or personal demands and demands.

Form popularity

FAQ

Property That May Avoid Probate Property held in a trust3 Jointly held property (but not common property) Death benefits from insurance policies (unless payable to the estate)4 Property given away before you die. Assets in a pay-on-death account. Retirement accounts with a named beneficiary.

How the Probate Process Works. The first thing that happens is that the will is delivered to the probate court or the person designated to handle the estate. There is a 30-day deadline to do this. The court will name a personal representative for the estate.

In South Carolina, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

In South Carolina, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

Step One: Application and Opening. Once documents are filed, it may take from one to three weeks for the estate to be opened. Full probate is usually an eight month to one year process. Once the estate is opened, our office will complete FORM 370PC, NOTICE TO CREDITORS.

In Pennsylvania, it is only necessary to probate if the decedent owned assets, whether financial or real estate holdings, solely in their name which did not already have a beneficiary designated. Such assets are called probate assets, and in order to convey ownership of them it is necessary to probate.

One way to avoid probate in South Carolina is by using a transfer-on-death (TOD) deed for real estate. This allows the property to be transferred to the beneficiary upon the owner's death, bypassing the probate process.

In South Carolina, you can use an Affidavit if an estate value is less than $25,000. You must wait 30 days after the death, and a probate judge will need to approve it. There is also potential to use a summary probate procedure, which is a possibility when an estate value is less than $25,000.