Hawaii Charitable Gift Annuity

Description

How to fill out Charitable Gift Annuity?

If you require authorized document templates for download, completion, or printing, utilize US Legal Forms, the premier source of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you seek.

Various templates for business and personal purposes are categorized by types and titles, or keywords. Utilize US Legal Forms to find the Hawaii Charitable Gift Annuity with just a few clicks.

Every legal document template you acquire is yours forever. You have access to every form you downloaded in your account. Visit the My documents section to choose a form to print or download again.

Search, download, and print the Hawaii Charitable Gift Annuity with US Legal Forms. There are countless professional and state-specific forms available for your personal or business needs.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Hawaii Charitable Gift Annuity.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for your specific city/state.

- Step 2. Use the Review option to examine the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the page to find alternative forms within the legal form template.

- Step 4. After finding the form you need, select the Acquire now button. Choose your desired payment plan and enter your information to create an account.

- Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the payment.

- Step 6. Select the format of the legal form and download it onto your device.

- Step 7. Complete, edit, and print or sign the Hawaii Charitable Gift Annuity.

Form popularity

FAQ

As long as you do not withdraw your investment gains and keep them in the annuity, they are not taxed. A variable annuity is linked to market performance. If you do not withdraw your earnings from the investments in the annuity, they are tax-deferred until you withdraw them.

Annuity rates Younger donors may often see significantly lower rates based on the longer expected term. For illustrative purposes, a 60-year-old who donates $10,000 may receive a rate of 4.4% (paying $440 annually) while an 85-year-old will see a rate of 7.8% (paying $780 annually) for the same gift.

According to Kiplinger, your tax deduction is usually 25 to 55 percent of the amount you transferred to charity. Your tax deduction is calculated by taking the full amount of your contribution and subtracting the present value of the lifetime payments you're scheduled to receive.

The Bottom Line. If you want to make a significant contribution to a charity you care about but also want the security of a fixed, reliable income for life a charitable gift annuity could be a great choice.

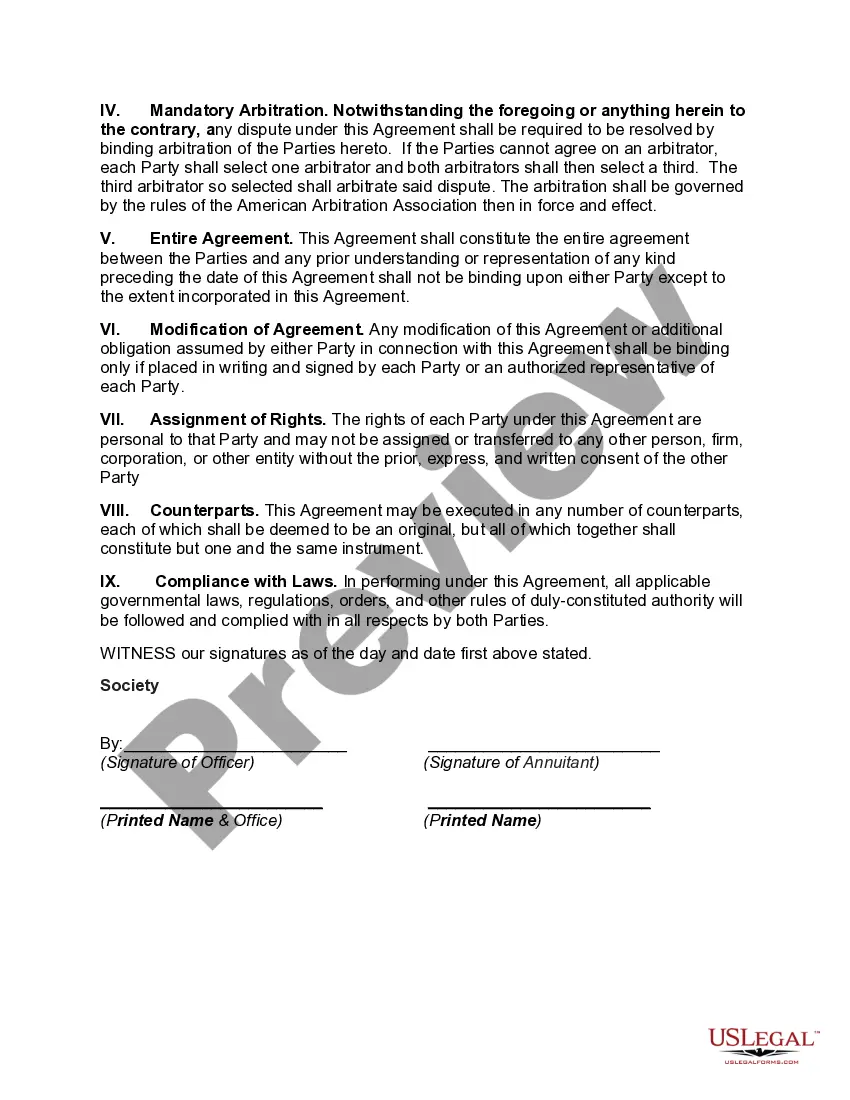

It is possible to donate an annuity to a charity. Doing so requires adjusting either the owner or the beneficiary of the annuity; these are two of the four parties in an annuity contract. The insurance company issues the contract. The annuitant receives payments during his/her lifetime.

The Bottom Line. If you want to make a significant contribution to a charity you care about but also want the security of a fixed, reliable income for life a charitable gift annuity could be a great choice.

Most nonprofits that offer charitable gift annuities use rates established by the American Council on Gift Annuities (ACGA). These annuity rates are designed to offer you an attractive payment stream while also securing a good gift for the charity.

Determining the Present Value of the Annuity For single life immediate gift annuities, the present value of the annuity is determined by multiplying the annual annuity amount payable under the agreement by the Pub. 1457, Table S factor which corresponds to the annuity rate and the age of the annuitant.

Individuals or couples can set up a charitable gift annuity. (You are the annuitants, which is the specific name for beneficiaries of annuities and many insurance policies.) Depending on the charity, your annuity can be funded with cash donations, but potentially also securities and gifts of personal property.

It is a non-taxable event. Even though any money coming out of an IRA will be taxed as ordinary income levels, transferring an annuity from one IRA to another will NOT trigger any taxes at all.