Puerto Rico Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Qualifying Subchapter-S Revocable Trust Agreement?

If you desire to finalize, obtain, or manufacture legal document templates, utilize US Legal Forms, the largest range of legal forms, which are accessible online.

Employ the site's simple and convenient search feature to locate the documents you require. A variety of templates for business and personal applications are categorized by types and states, or keywords.

Utilize US Legal Forms to find the Puerto Rico Qualifying Subchapter-S Revocable Trust Agreement with just a few clicks.

Every legal document template you acquire is yours permanently. You have access to every form you downloaded from your account. Click the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the Puerto Rico Qualifying Subchapter-S Revocable Trust Agreement with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal requirements.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Puerto Rico Qualifying Subchapter-S Revocable Trust Agreement.

- You can also access forms you have previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions listed below.

- Step 1. Make sure you have selected the form for the correct city/country.

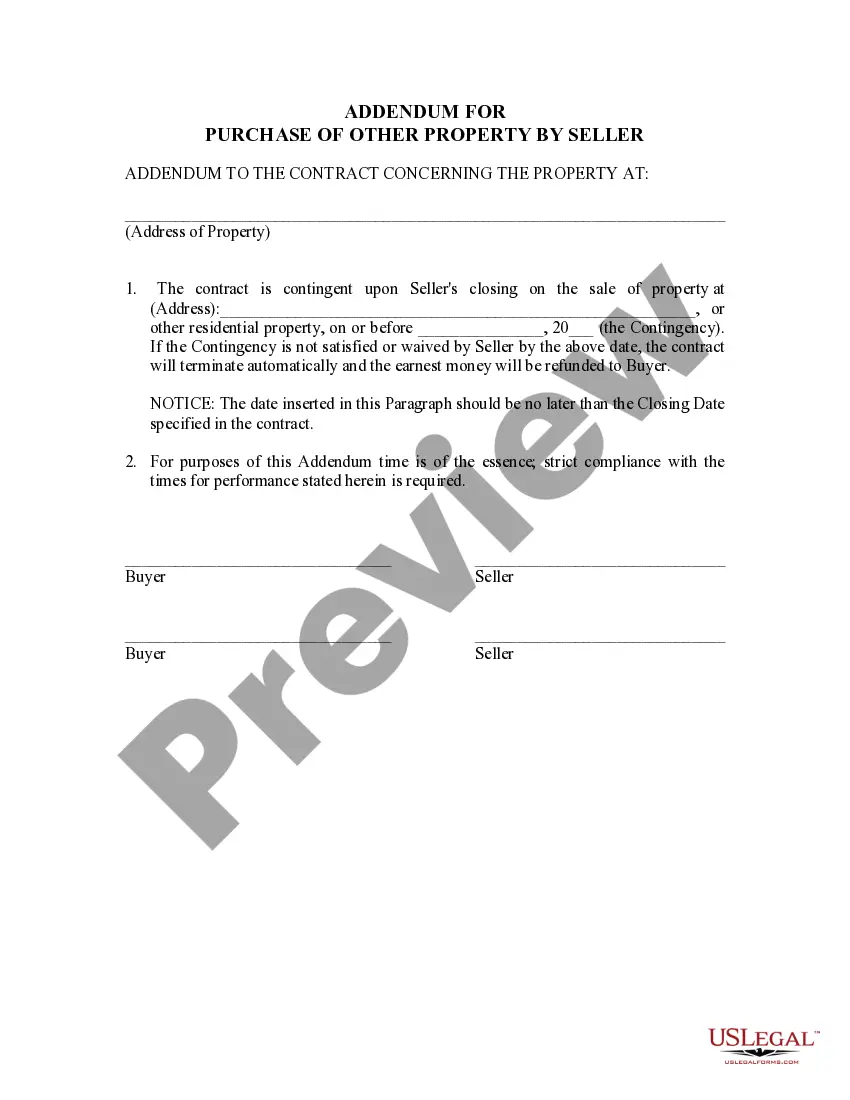

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the information.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click on the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the purchase. You may use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Puerto Rico Qualifying Subchapter-S Revocable Trust Agreement.

Form popularity

FAQ

A qualified revocable trust (QRT) is any trust (or part of a trust) that was treated as owned by a decedent (on that decedent's date of death) by reason of a power to revoke that was exercisable by the decedent (without regard to whether the power was held by the decedent's spouse).

Since a revocable trust is not treated as separate from the grantor, it is an eligible S corporation shareholder while the grantor is alive.

The main difference between an ESBT and a QSST is that an ESBT may have multiple income beneficiaries, and the trust does not have to distribute all income. Unlike with the QSST, the trustee, rather than the beneficiary, must make the election.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

Yes, the IRS allows the estate of a deceased shareholder to be an S-Corporation shareholder. Note the language deceased shareholder. This indicates, correctly, that an estate can step in and become an S-Corp shareholder when a typical shareholder dies.

You can put your S-Corp into your living trust by simply transferring your shares ownership to yourself as trustee of your living trust, but again, there are certain procedures that must be strictly followed....These trusts include:Electing small business trusts (ESBT)Grantor trusts.Qualified subchapter S trusts (QSST)

The main difference between an ESBT and a QSST is that an ESBT may have multiple income beneficiaries, and the trust does not have to distribute all income. Unlike with the QSST, the trustee, rather than the beneficiary, must make the election.

Three commonly used types of ongoing trusts qualify as S corporation shareholders: grantor trusts, qualified subchapter S trusts (QSSTs) and electing small business trusts (ESBTs).

A trust can hold stock in an S corp only if it (1) is treated as owned by its grantor for income tax purposes under us grantor trust rules, (2) was a grantor trust immediately before its grantor's death (the trust can be a shareholder only for two years from that date), (3) received stock from the will of a decedent (

Designing a QSSTThe trust must have only one income beneficiary during the life of the current income beneficiary, and that beneficiary must be a U.S. citizen or resident;All of the income of the trust must be (or must be required to be) distributed currently to the one income beneficiary;More items...?