Puerto Rico Agreement to Partners to Incorporate Partnership

Description

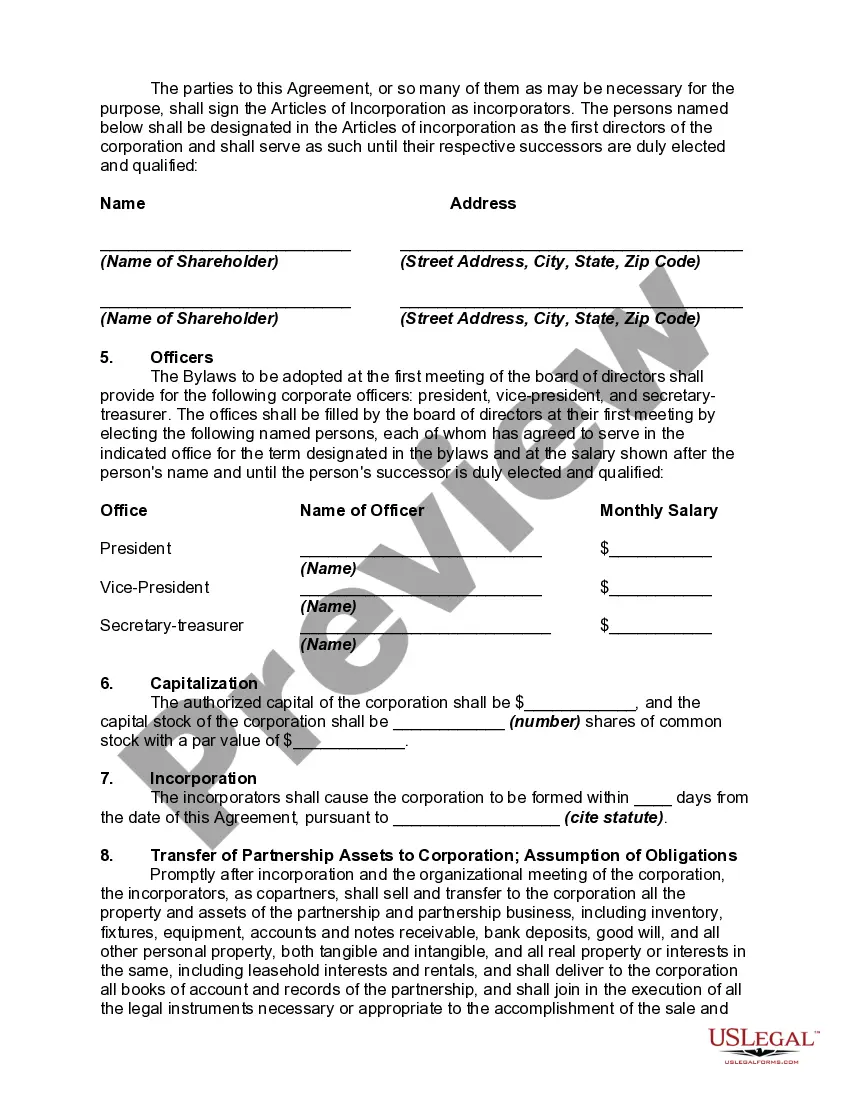

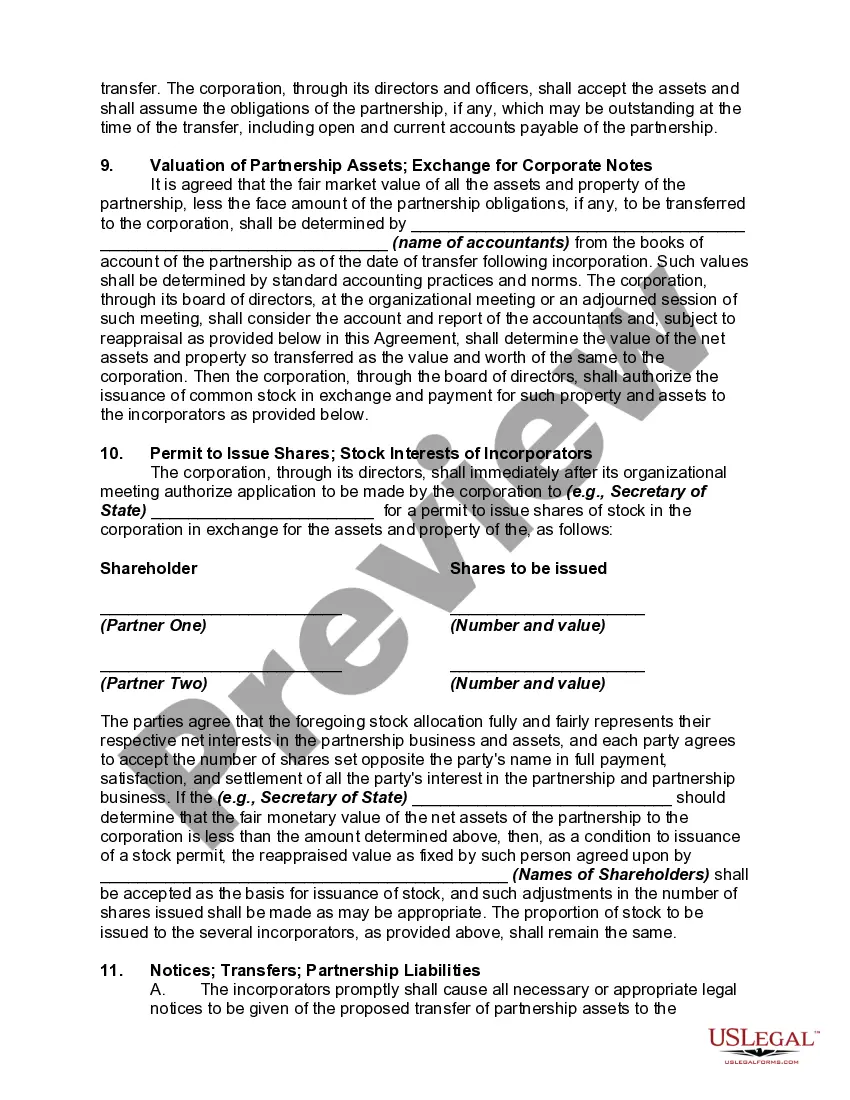

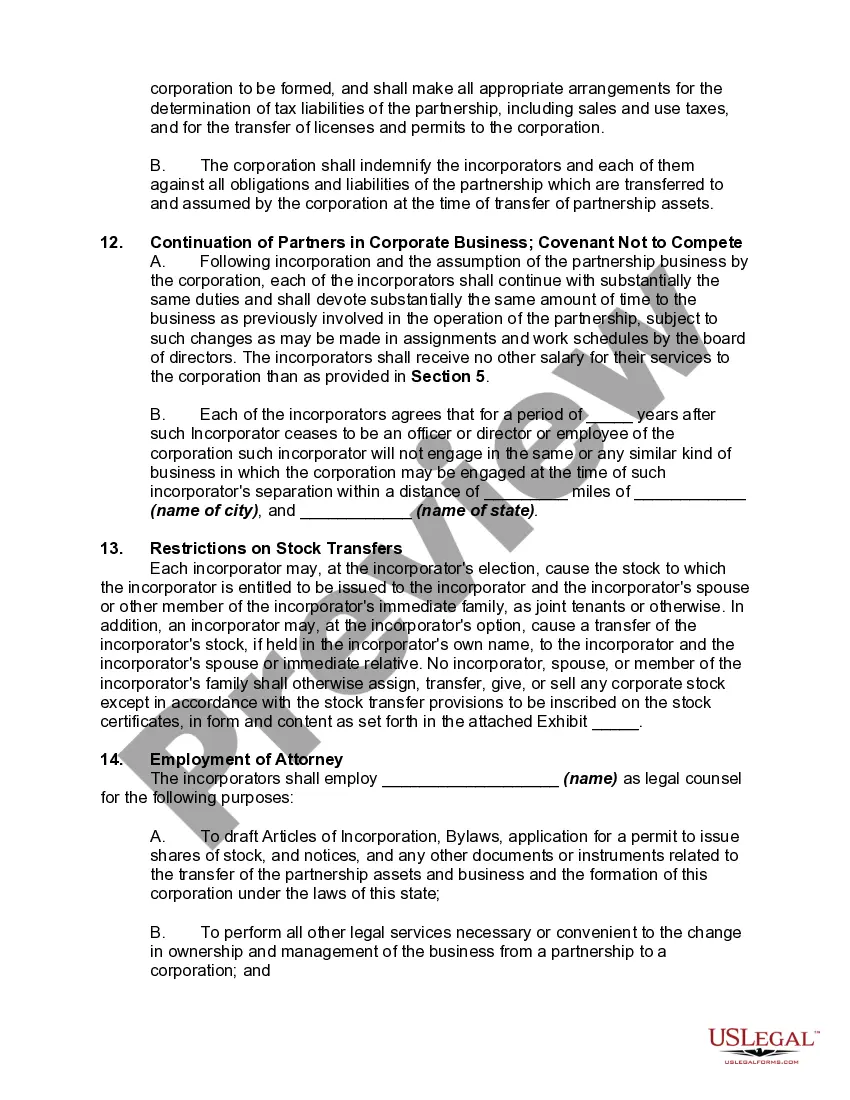

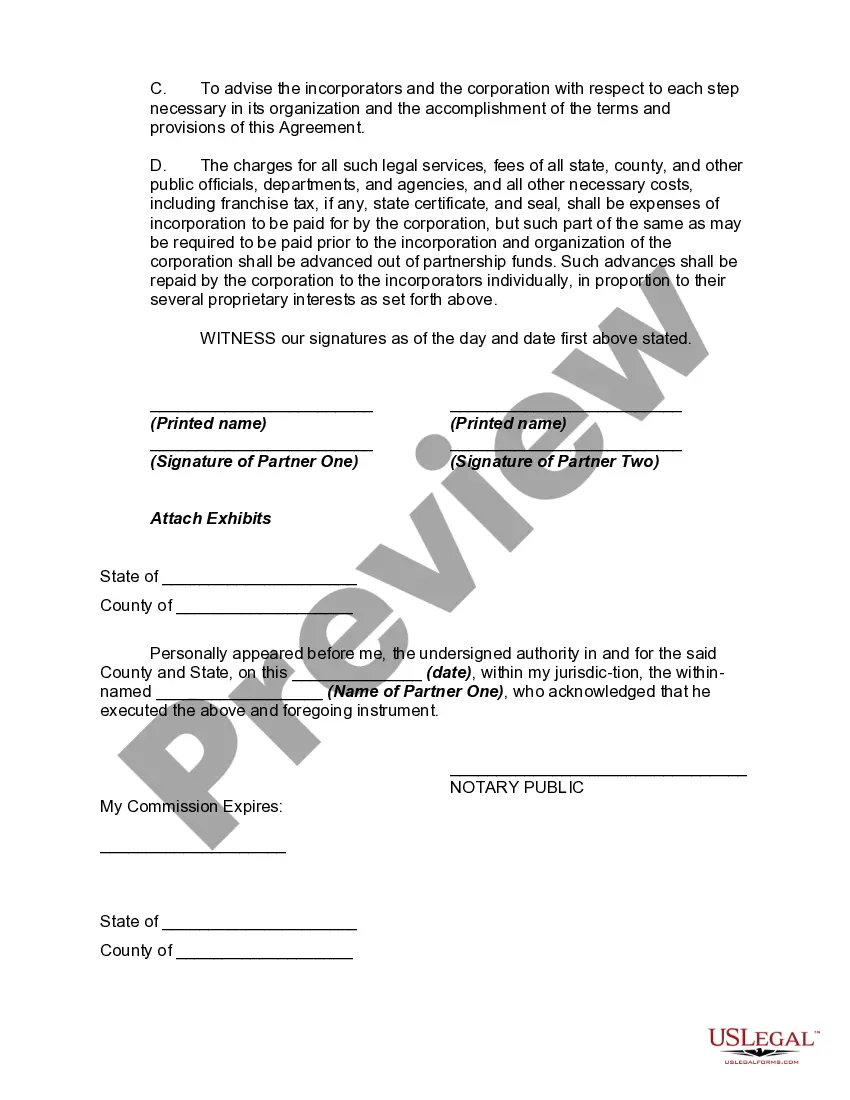

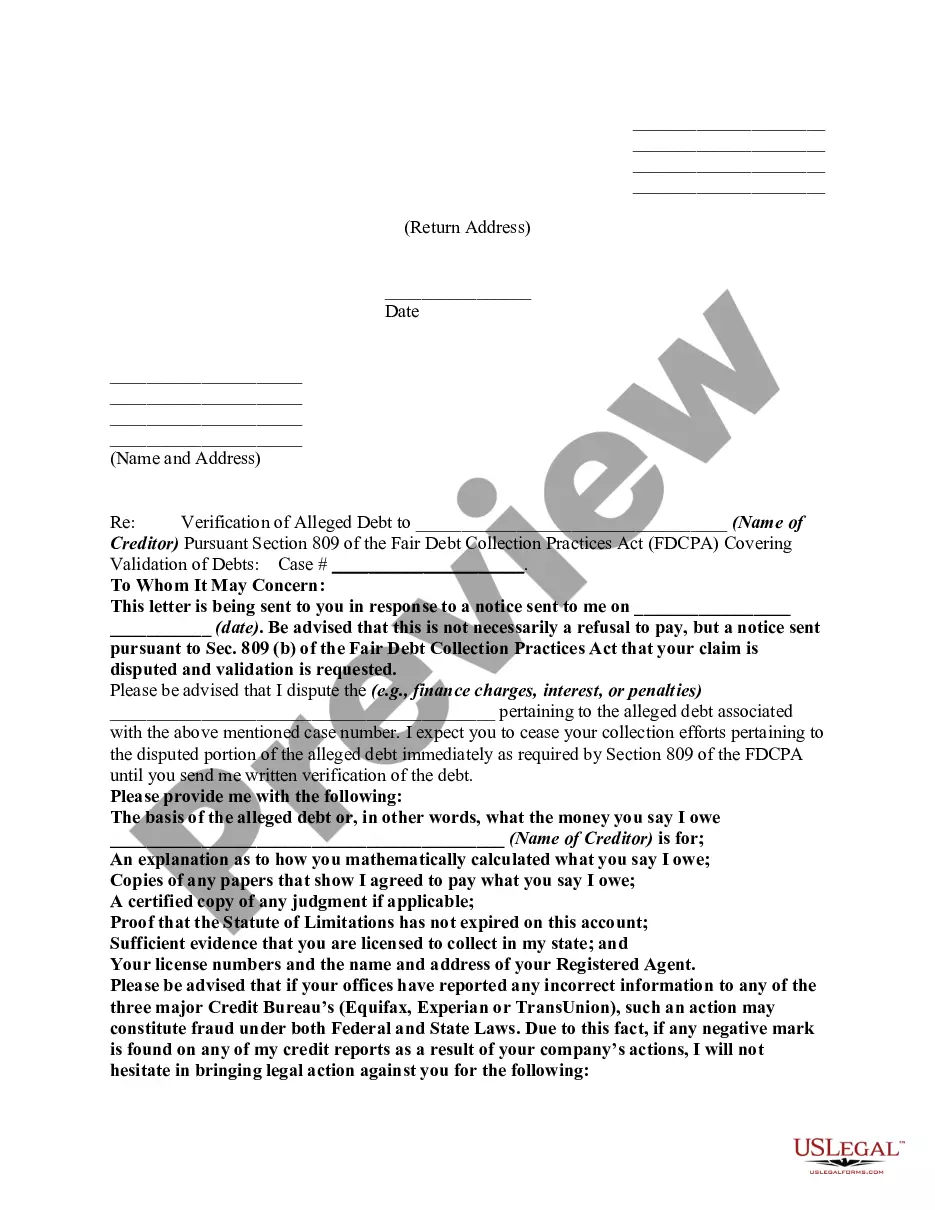

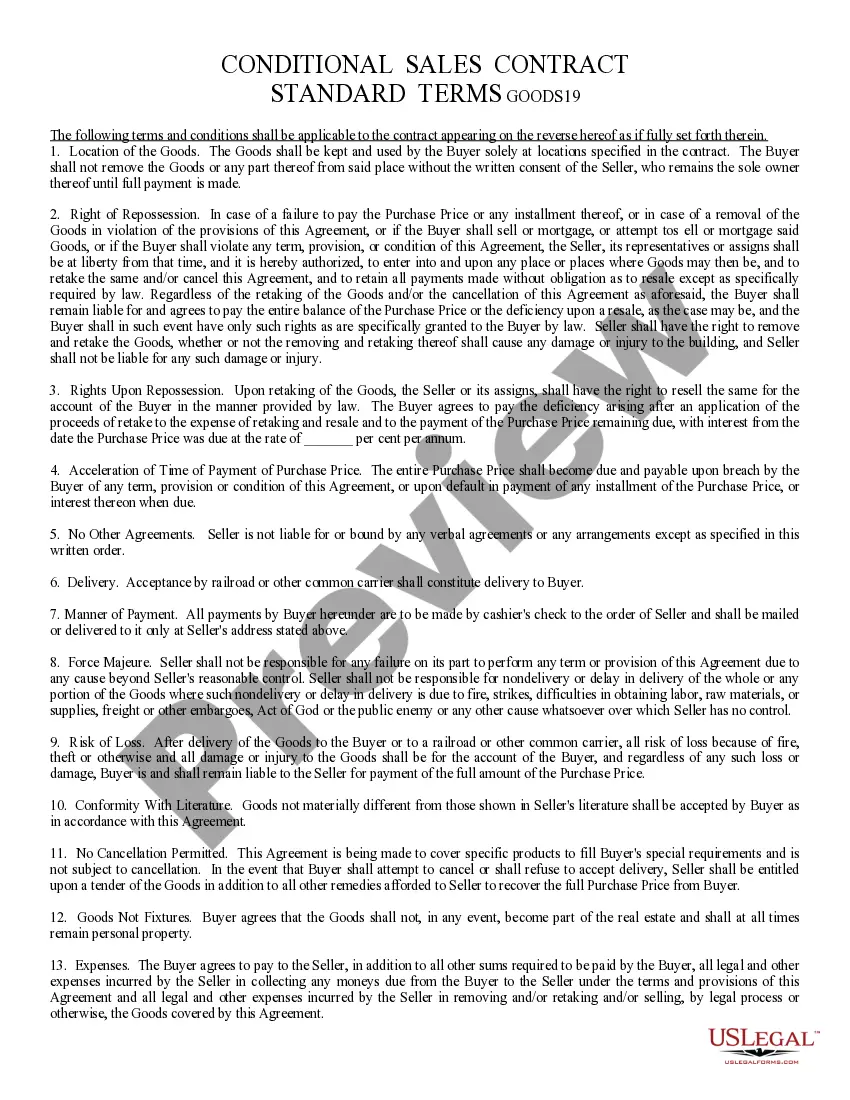

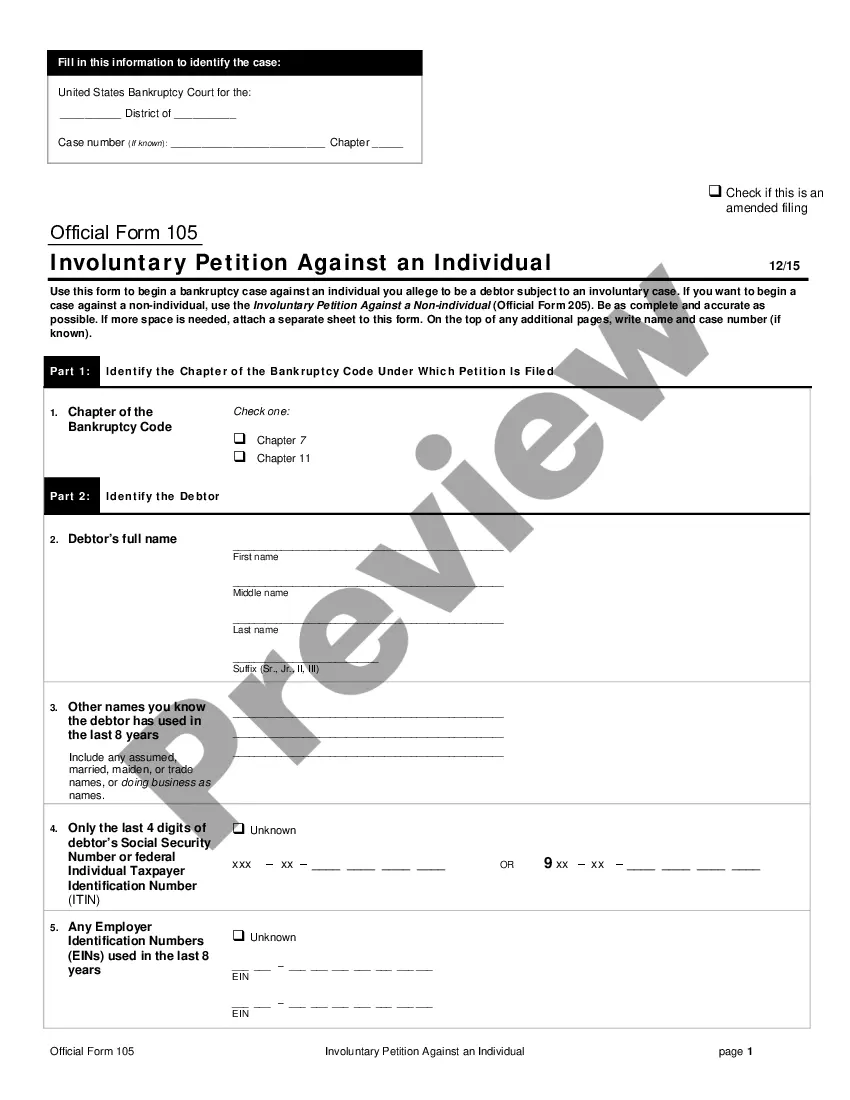

The articles of incorporation is a document that must be filed with a state in order to incorporate. Information typically required to be included are the name and address of the corporation, its general purpose and the number and type of shares of stock to be issued.

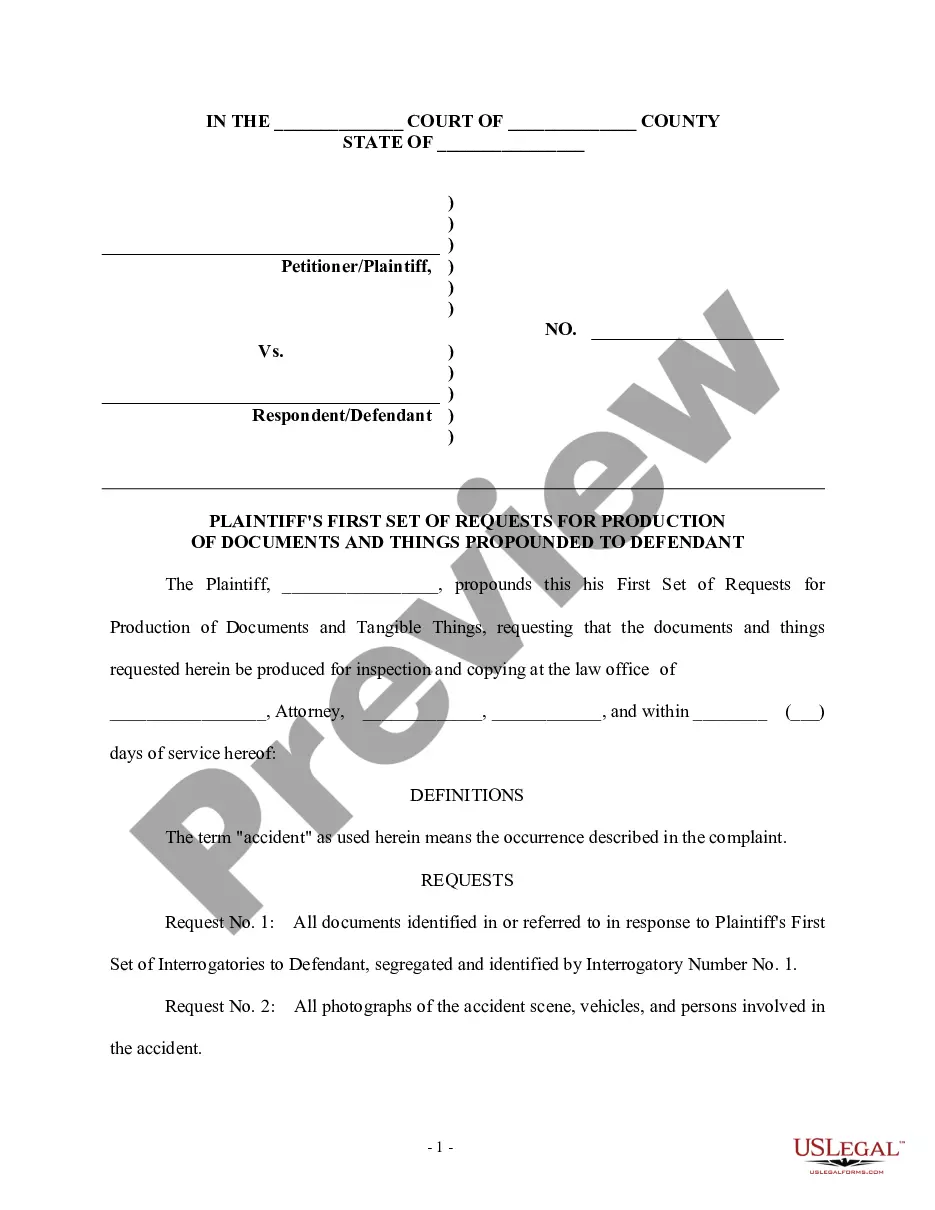

How to fill out Agreement To Partners To Incorporate Partnership?

US Legal Forms - one of the most extensive collections of sanctioned documents in the United States - provides a range of legal document templates available for download or printing.

By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will find the most recent versions of forms, including the Puerto Rico Agreement to Partners to Incorporate Partnership in a matter of seconds.

If you already have a membership, Log In and download the Puerto Rico Agreement to Partners to Incorporate Partnership from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms from the My documents section of your account.

Make changes. Fill out, edit, and print and sign the downloaded Puerto Rico Agreement to Partners to Incorporate Partnership.

Each template you added to your account does not have an expiration date and is yours indefinitely. So, to download or print another copy, simply visit the My documents section and click on the form you need. Access the Puerto Rico Agreement to Partners to Incorporate Partnership with US Legal Forms, the most extensive library of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- If you wish to use US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure you have selected the correct form for your jurisdiction/county. Click on the Review button to examine the form’s content. Read the form description to confirm you have chosen the right document.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Get now button. Then, choose the pricing plan you prefer and provide your information to register for the account.

- Complete the payment. Use a credit card or PayPal account to finalize the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

To fully benefit from Act 60, you generally need to establish residency in Puerto Rico for at least 183 days each year. This requirement helps ensure compliance with the tax benefits associated with the Puerto Rico Agreement to Partners to Incorporate Partnership. Planning your move strategically can facilitate this transition. Considering professional advice can improve your understanding and help you meet these residency requirements effectively.

Yes, Puerto Rico remains an unincorporated territory of the United States. This status means that while Puerto Ricans are U.S. citizens, not all U.S. laws apply automatically. Unique financial incentives, like those found in the Puerto Rico Agreement to Partners to Incorporate Partnership, are in place to encourage economic development. Understanding this status can clarify the benefits available to potential business owners in Puerto Rico.

Americans who relocate to Puerto Rico may access significant tax breaks, such as reduced income tax rates and exemptions for capital gains. Under the Puerto Rico Agreement to Partners to Incorporate Partnership, qualifying individuals can benefit from tax incentives that are not available on the mainland. These opportunities make Puerto Rico an attractive destination for business owners and investors. It’s crucial to understand the eligibility requirements to maximize these benefits.

Act 60 in Puerto Rico combines various tax incentives to promote economic growth on the island. It provides tax breaks for eligible individuals and businesses, particularly in the fields of export services and tourism. The Act is designed to stimulate investment and support the local economy. Understanding the Puerto Rico Agreement to Partners to Incorporate Partnership can enhance your ability to leverage these benefits effectively.

You can indeed incorporate a business in Puerto Rico, gaining access to unique tax incentives. Many entrepreneurs choose Puerto Rico to take advantage of the favorable tax landscape established by the Puerto Rico Agreement to Partners to Incorporate Partnership. Forming a company there allows businesses to enjoy lower corporate tax rates and other benefits. Utilizing platforms like uslegalforms can simplify the incorporation process significantly.

Yes, moving to Puerto Rico can provide significant tax benefits, particularly for cryptocurrency investors. Under the Puerto Rico Agreement to Partners to Incorporate Partnership, individuals who qualify can enjoy a zero percent capital gains tax rate. However, relocating requires careful planning and adherence to residency rules. Consulting with a professional can help you ensure compliance and maximize your benefits.

Puerto Rico Act 60 was passed in July 2019, aiming to attract new residents and businesses to the island. This Act consolidates several previous tax incentive laws into one streamlined framework. It is especially appealing to individuals and businesses looking to benefit from favorable tax rates. Understanding the Puerto Rico Agreement to Partners to Incorporate Partnership can help you navigate these incentives effectively.

A US LLC can do business in Puerto Rico without significant hurdles. As a US territory, Puerto Rico allows LLCs to operate similarly to how they would on the mainland. However, registering as a foreign entity is necessary, and drafting a Puerto Rico Agreement to Partners to Incorporate Partnership could assist in defining the roles of partners in your business. Access resources on the US Legal Forms platform to ensure compliance and simplify the registration process.

Yes, US companies can hire employees in Puerto Rico. The local labor laws apply, so it’s essential to familiarize yourself with these regulations to ensure compliance. Proper hiring practices not only help in legality but also foster a positive work environment. Establishing a Puerto Rico Agreement to Partners to Incorporate Partnership can clarify employment terms for any partners involved in your hiring strategy.

To form a partnership in Puerto Rico, you typically need to file a Partnership Registration application with the Department of State. Consider drafting a Puerto Rico Agreement to Partners to Incorporate Partnership to detail the partnership's terms and conditions. This documentation is critical, as it protects each partner's interests and ensures clarity in responsibilities. The US Legal Forms platform offers templates that simplify this process.