Puerto Rico Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out Agreement For Sale Of Retail Store By Sole Proprietorship With Goods And Fixtures At Invoice Cost Plus Percentage?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides an extensive assortment of legal document templates that you can download or print.

By utilizing the website, you have access to thousands of forms for business and personal needs, categorized by types, states, or keywords. You can find the latest editions of forms such as the Puerto Rico Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage in mere seconds.

If you already possess a subscription, Log In and download the Puerto Rico Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Complete, modify, print, and sign the acquired Puerto Rico Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage. Each template you add to your account has no expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

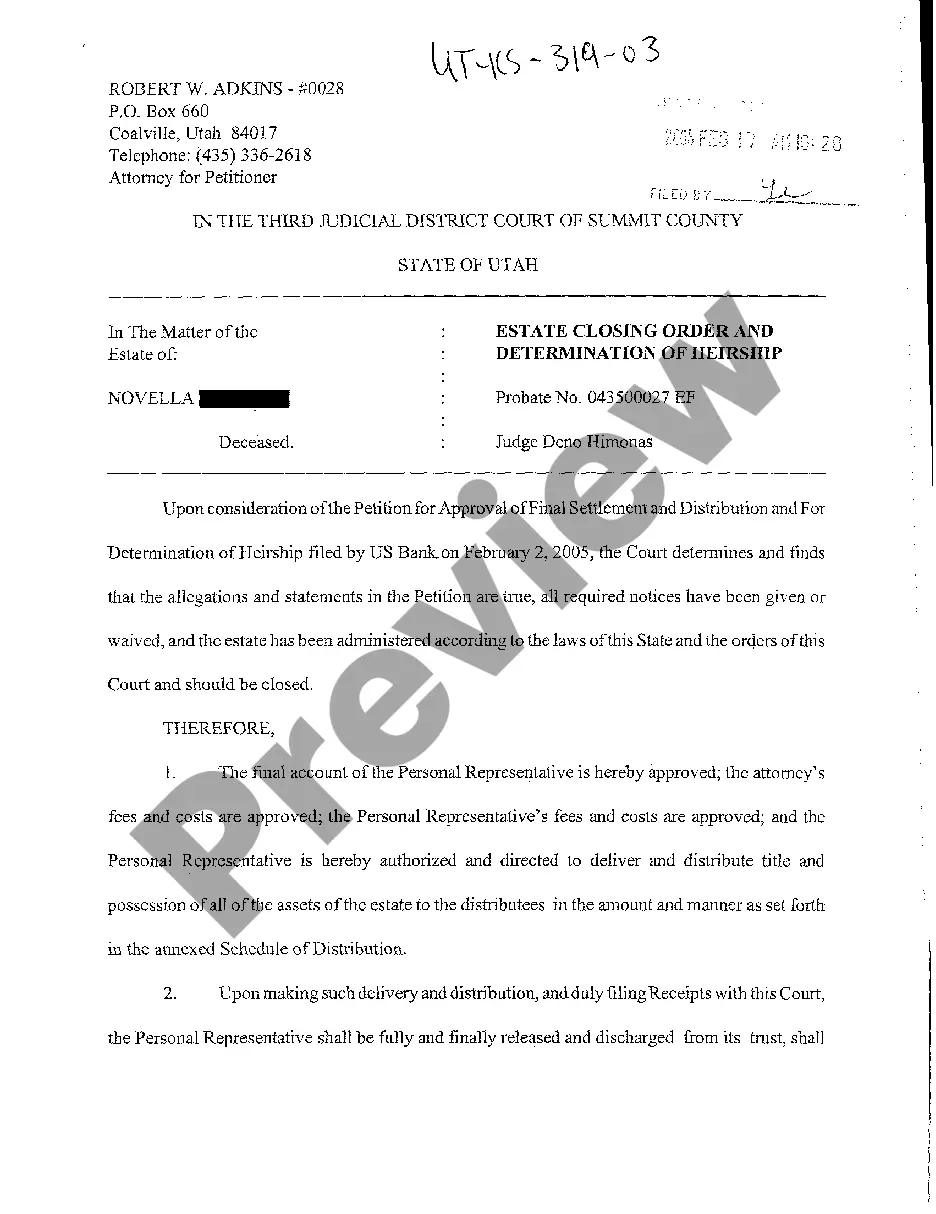

- Ensure you have selected the correct form for your city/state. Click the Review button to check the content of the form.

- Read the form summary to make sure you have chosen the right one.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Generally, resellers to do pay sales tax when they purchase the items, but must collect sales tax when those items are sold to the end user. While the products sold by resale businesses may be very different, they all buy products and then resell them in the same form in which they were acquired.

Ordinary Business Expenses As a sole proprietor, you can deduct most of your regular business expenses by filling out a Schedule C, Profit (Or Loss) From Business, and turning that over to the IRS along with a Form 1040 tax return.

Sales or transfers of taxable goods and services will be subject to a 16% VAT. The following transactions will be subject to a 0% VAT: Exportations of tangible personal property.

Generally, if you produce, purchase, or sell merchandise in your business, you must keep an inventory and use the accrual method for purchases and sales of merchandise.

Generally, if you produce, purchase, or sell merchandise in your business, you must keep an inventory and use the accrual method for purchases and sales of merchandise. However, the following taxpayers can use the cash method of accounting even if they produce, purchase, or sell merchandise.

The IRS recommends treating all your startup costs as capital expenses. While you can deduct interest and taxes in some circumstances, they cannot be deducted as startup costs on your sole proprietorship taxes.

If you present a valid Puerto Rico resale certificate to your vendor, you won't be required to pay sales tax on that purchase, since you are purchasing for resale. You can also use a resale certificate to avoid paying sales tax if you are buying equipment used in manufacturing or ingredients in an item for resale.

Consequently, while all Puerto Rico residents pay federal taxes, many residents are not required to pay federal income taxes. Aside from income tax, U.S. federal taxes include customs taxes, federal commodity taxes, and federal payroll taxes (Social Security, Medicare, and Unemployment taxes).

Annually - For tax purposes, a physical inventory count needs to be done at least once per year. Annual inventory counts require the least effort, and any losses recorded in your inventory can be used to reduce your tax burden.

Common Business Expenses for Sole Proprietors & Partnerships Better Understanding the T2125Understanding your Expenses.Breaking it Down.Advertising. Line 8521: this line includes expenses related to advertising your business.Meals and Entertainment.Bad Debts.Taxes, Fees, etc.Supplies.Professional Fees.More items...?