Puerto Rico Bill of Sale for a Coin Collection

Description

How to fill out Bill Of Sale For A Coin Collection?

Locating the appropriate legal document template can be a challenge. Obviously, there are numerous templates available online, but how do you identify the legal form you need? Use the US Legal Forms website.

The service provides thousands of templates, such as the Puerto Rico Bill of Sale for a Coin Collection, which you can utilize for business and personal purposes. All the forms are vetted by professionals and meet federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to access the Puerto Rico Bill of Sale for a Coin Collection. Use your account to review the legal forms you have previously purchased. Navigate to the My documents section of your account to obtain another copy of the document you need.

US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain appropriately crafted paperwork that comply with state regulations.

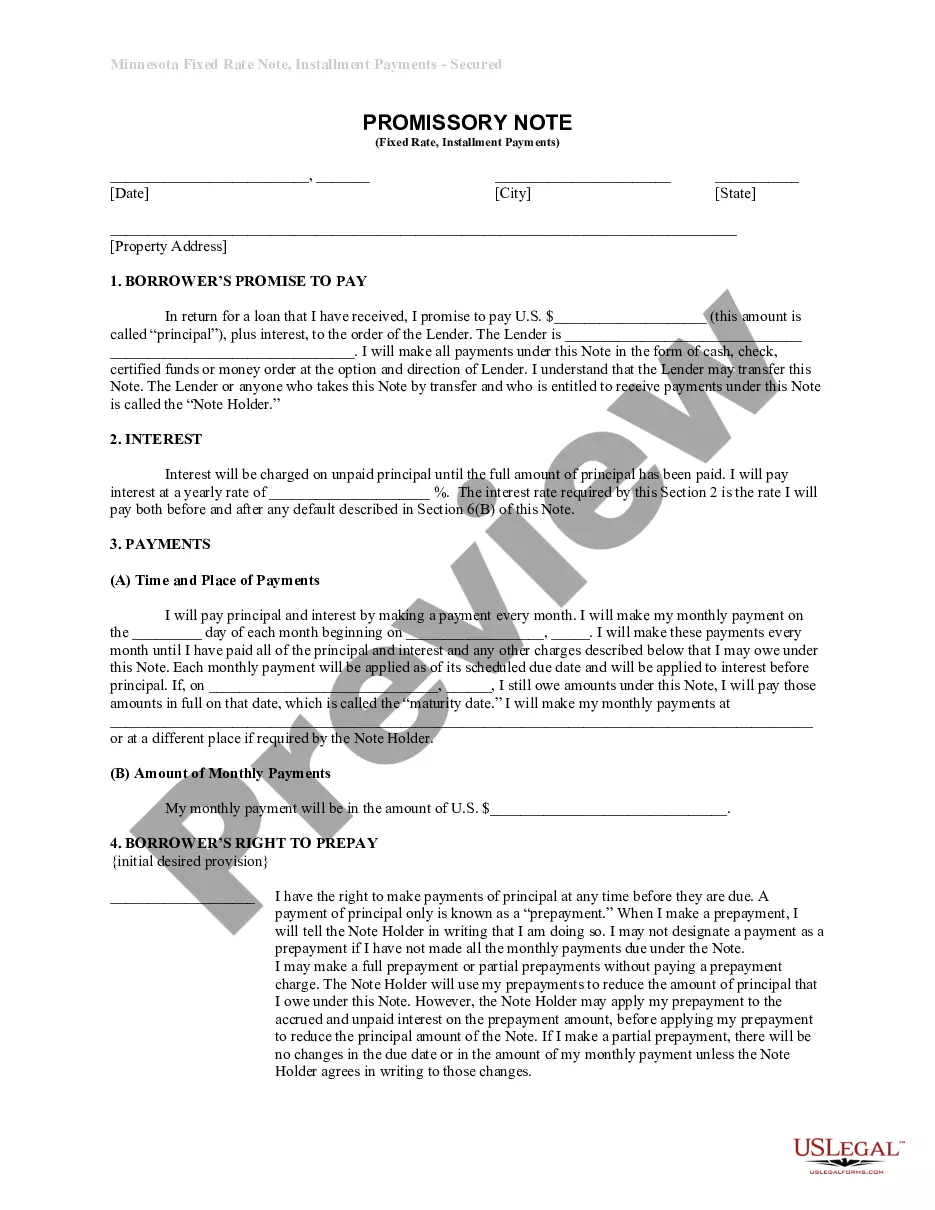

- First, make sure you have selected the correct form for your city/region. You can browse the form using the Review button and examine the form description to ensure it is the right one for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click the Buy Now button to acquire the form.

- Choose the pricing plan you prefer and input the required information. Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, modify, print, and sign the obtained Puerto Rico Bill of Sale for a Coin Collection.

Form popularity

FAQ

Puerto Rico uses U.S. coins, including pennies, nickels, dimes, quarters, and dollar coins. These coins circulate throughout the territory like in the continental United States, making them widely recognized. If you're buying or selling coins from Puerto Rico, using a Puerto Rico Bill of Sale for a Coin Collection ensures that you have the right documentation for your transactions.

In Puerto Rico, the primary currency is the United States dollar, and the quarter featuring Puerto Rico represents its unique culture and heritage. This quarter is part of the America the Beautiful series, celebrating the U.S. territories. When selling or buying such coins, a Puerto Rico Bill of Sale for a Coin Collection can help outline the specifics of the transaction.

The value of a Puerto Rico quarter depends on its condition and rarity. Generally, standard circulation quarters hold face value, but collectible or uncirculated coins can command higher prices. If you own a Puerto Rico quarter and are interested in selling it, consider creating a Puerto Rico Bill of Sale for a Coin Collection to document the transaction.

Registering for sales tax in Puerto Rico involves applying for a sales tax permit with the Department of Treasury. You will need to provide identification, business details, and the types of products you intend to sell. It's important to stay compliant, especially if you plan to use a Puerto Rico Bill of Sale for a Coin Collection in your transactions. For more guidance, check out resources available on the US Legal Forms platform.

To obtain a merchant certificate in Puerto Rico, you need to register your business with the Department of State. Gather required documents such as your identification and business structure information. After completing registration, apply for your merchant certificate through the relevant local municipality. Having this certificate is crucial for properly handling transactions tied to your Puerto Rico Bill of Sale for a Coin Collection.

Writing a Puerto Rico Bill of Sale for a Coin Collection involves a few simple steps. First, begin by clearly stating the date of the transaction and the names of both the seller and buyer. Next, describe the coin collection in detail, including the type, condition, and quantity of coins being sold. Finally, include terms of payment and a signature line for both parties to finalize the agreement.

Puerto Rico as 29 refers to the island's designation as a U.S. territory, which has certain tax advantages, especially for businesses. This status can be leveraged for various financial benefits, similar to how you can benefit from using a Puerto Rico Bill of Sale for a Coin Collection when buying or selling valuable items. Understanding this designation helps in making informed decisions regarding residency and business operations.

To avoid crypto taxes in Puerto Rico, you can take advantage of the Act 60 incentives. This law offers significant tax breaks for individuals who relocate and meet certain criteria. Additionally, conducting transactions through legitimate means, like a Puerto Rico Bill of Sale for a Coin Collection, provides clarity and documentation in case of audits.

A merchant certificate in Puerto Rico is a document that allows a business to collect and remit the sales tax. It proves your business's legitimate status and enables compliance with local regulations. By having this certificate, you can simplify transactions, similar to how a Puerto Rico Bill of Sale for a Coin Collection simplifies the buying and selling of collectibles.

Yes, the West Virginia DMV often requires a bill of sale for vehicle transactions to convey ownership legally. This document serves as proof of the sale and helps prevent future disputes. If you are dealing with coins, ensure you have the right documentation, like a Puerto Rico Bill of Sale for a Coin Collection, to make your process seamless.