Puerto Rico Affidavit of Domicile

Description

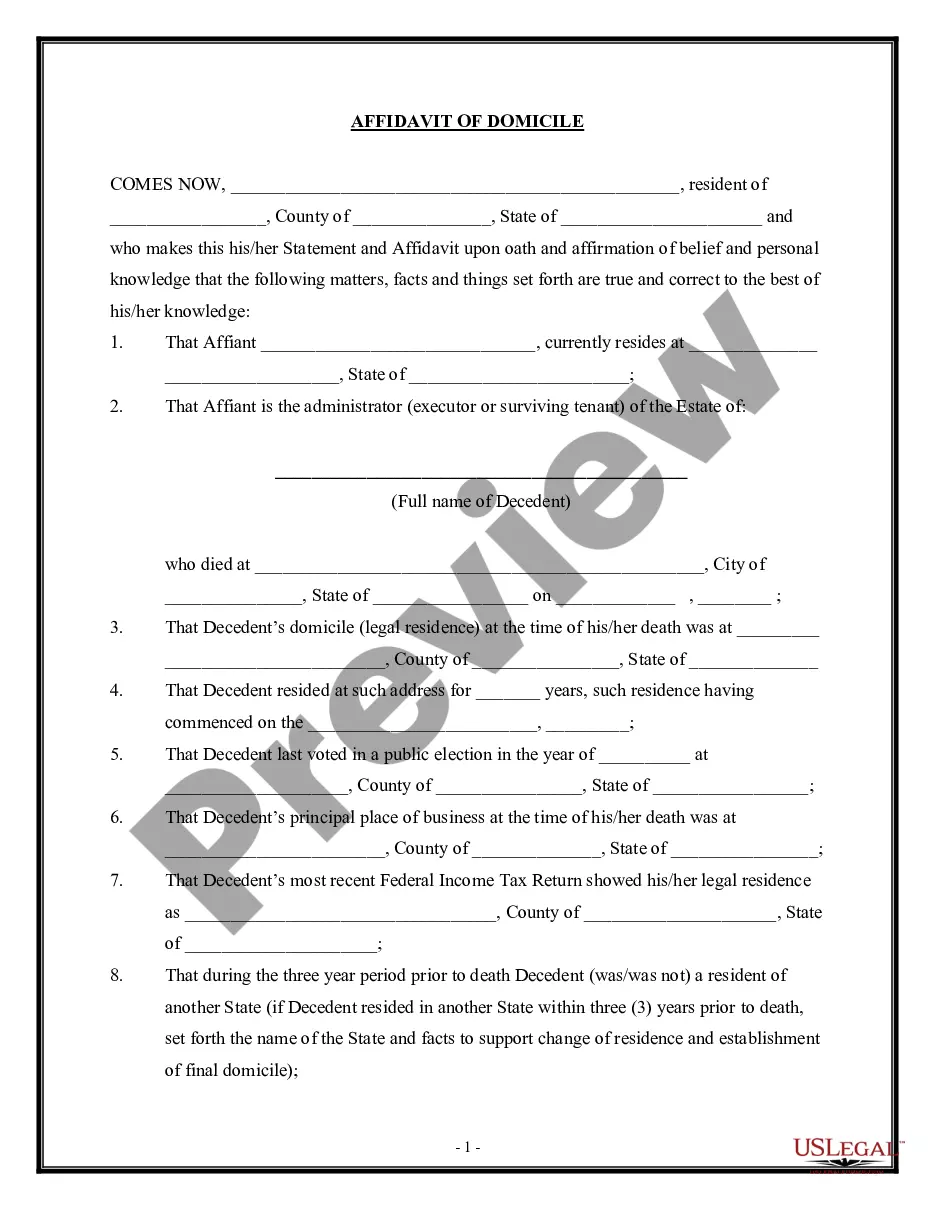

How to fill out Affidavit Of Domicile?

If you need to full, obtain, or print lawful papers layouts, use US Legal Forms, the largest selection of lawful kinds, which can be found on-line. Take advantage of the site`s basic and practical look for to discover the files you need. Different layouts for enterprise and specific reasons are sorted by types and states, or search phrases. Use US Legal Forms to discover the Puerto Rico Affidavit of Domicile in just a handful of mouse clicks.

When you are already a US Legal Forms customer, log in to the profile and click the Down load switch to find the Puerto Rico Affidavit of Domicile. You can also accessibility kinds you previously downloaded inside the My Forms tab of your respective profile.

Should you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form to the appropriate metropolis/nation.

- Step 2. Utilize the Review solution to check out the form`s content material. Never overlook to see the description.

- Step 3. When you are not satisfied with the form, take advantage of the Search discipline on top of the monitor to get other types of the lawful form format.

- Step 4. Upon having discovered the form you need, go through the Purchase now switch. Choose the costs program you choose and add your qualifications to register for the profile.

- Step 5. Procedure the deal. You can utilize your credit card or PayPal profile to complete the deal.

- Step 6. Choose the file format of the lawful form and obtain it on the system.

- Step 7. Comprehensive, revise and print or signal the Puerto Rico Affidavit of Domicile.

Each and every lawful papers format you acquire is the one you have forever. You have acces to each form you downloaded inside your acccount. Click the My Forms segment and select a form to print or obtain once again.

Contend and obtain, and print the Puerto Rico Affidavit of Domicile with US Legal Forms. There are many expert and state-specific kinds you can use for your personal enterprise or specific needs.

Form popularity

FAQ

Establishing residency in Puerto Rico typically takes a few months, depending on your personal circumstances. You need to demonstrate physical presence and intent, which can be shown through the Puerto Rico Affidavit of Domicile. It’s essential to stay on the island for at least 183 days within a tax year to qualify as a resident for tax purposes. Once you have established your presence and intent, gathering the necessary documents will help solidify your residency status.

Proof of residency in Puerto Rico can include a variety of documents, such as utility bills, bank statements, or a lease agreement that shows your name and address on the island. A Puerto Rico Affidavit of Domicile can also serve as a strong form of proof, as it validates your intent to live in Puerto Rico. It’s crucial to gather these documents to demonstrate your residency status when needed, such as for tax purposes or legal matters. Ensure you have multiple forms ready to present if required.

To claim residency in Puerto Rico, you need to establish your physical presence and intent to remain on the island. Start by obtaining a Puerto Rico Affidavit of Domicile, which serves as a formal declaration of your residency. This document helps affirm your commitment to living in Puerto Rico, as it outlines your intent to stay and your current living situation. Additionally, ensure that you change your address on important documents and register to vote in Puerto Rico.

Yes, Puerto Rico allows online notarization, providing a convenient option for individuals needing to execute legal documents remotely. This feature is particularly beneficial for those handling a Puerto Rico Affidavit of Domicile, as it saves time and eliminates the need for in-person meetings. With the rise of digital solutions, using an online notary can streamline your document preparation process. US Legal Forms offers resources and support to help you navigate the online notarization process effectively.

Filling out an affidavit example, such as a Puerto Rico Affidavit of Domicile, requires careful attention to detail. Start by reviewing a sample to understand the required sections, then input your specific information accordingly. US Legal Forms provides examples and templates that can guide you through this process efficiently.

A decedent's domicile refers to the legal residence of a person at the time of their death. This is significant when settling an estate, as it determines the jurisdiction for probate proceedings. Understanding the concept of domicile is essential, and if needed, a Puerto Rico Affidavit of Domicile can clarify residency issues during estate administration.

Typically, any individual who is changing their legal residence can complete a Puerto Rico Affidavit of Domicile. This includes residents moving within Puerto Rico or relocating from another state. It's crucial that the person completing the affidavit has the authority to declare their domicile, ensuring that all information is truthful and accurate.

Claiming inheritance in Puerto Rico involves several steps, including gathering necessary documents like a death certificate and a Puerto Rico Affidavit of Domicile if applicable. You may also need to file for probate in the local court. Using a trusted service like US Legal Forms can offer you the tools and forms required to navigate this process effectively.

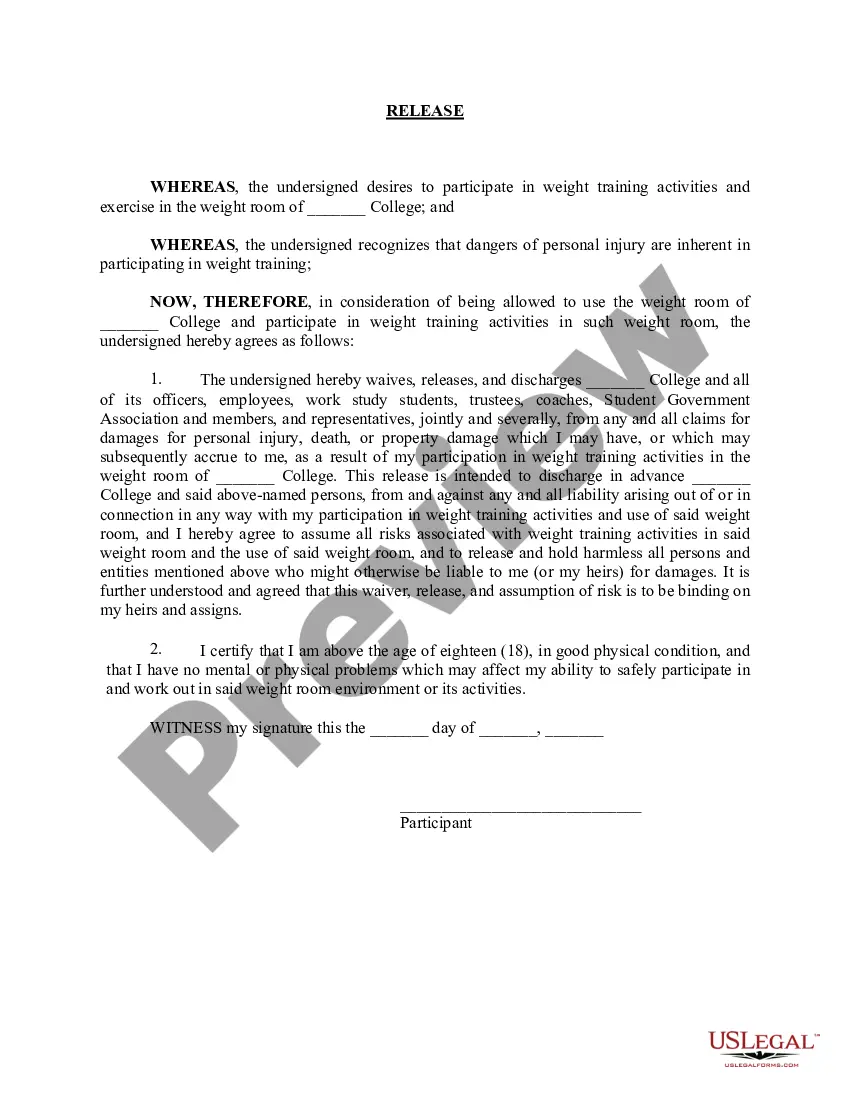

To fill out a Puerto Rico Affidavit of Domicile, begin by entering your personal information, including your name and addresses. Next, articulate your intent to change your domicile and provide the effective date of this change. Ensure all information is accurate, and consider utilizing US Legal Forms for a straightforward completion process.

Writing a Puerto Rico Affidavit of Domicile involves including essential information such as your current address, the new address, and the reason for the change. It's important to clearly state your intent and provide any supporting documentation if necessary. Using a reliable platform like US Legal Forms can help simplify this process by offering templates and guidance.