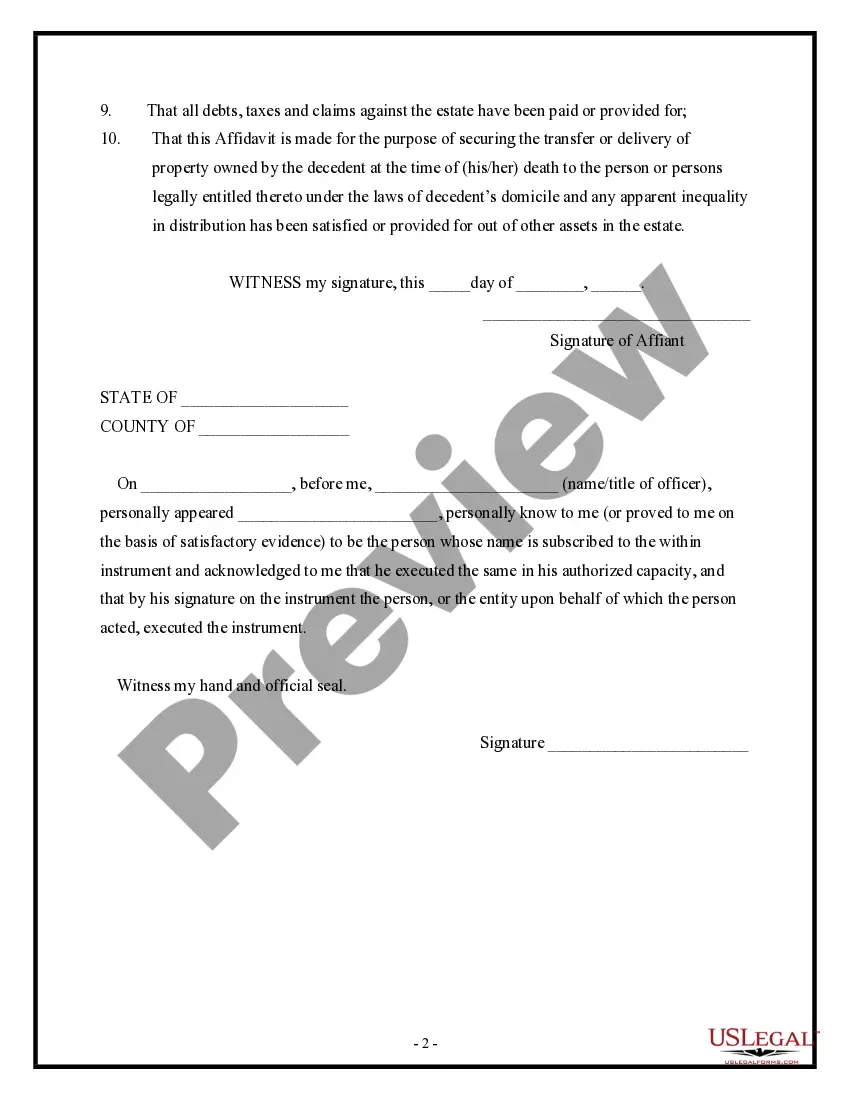

Puerto Rico Affidavit of Domicile

Description

How to fill out Affidavit Of Domicile?

Are you presently inside a position the place you will need documents for both business or person purposes just about every day? There are tons of authorized document templates available on the Internet, but locating versions you can rely isn`t easy. US Legal Forms provides a huge number of type templates, such as the Puerto Rico Affidavit of Domicile, which are written to fulfill state and federal specifications.

Should you be previously familiar with US Legal Forms internet site and possess a merchant account, merely log in. Following that, it is possible to acquire the Puerto Rico Affidavit of Domicile format.

Unless you have an profile and want to start using US Legal Forms, follow these steps:

- Obtain the type you require and ensure it is to the right city/area.

- Utilize the Preview switch to analyze the shape.

- Look at the information to actually have chosen the right type.

- If the type isn`t what you are searching for, take advantage of the Lookup area to obtain the type that meets your needs and specifications.

- If you get the right type, click on Acquire now.

- Choose the costs prepare you need, submit the desired info to generate your money, and pay money for your order with your PayPal or Visa or Mastercard.

- Decide on a handy data file file format and acquire your backup.

Locate all the document templates you might have purchased in the My Forms food list. You can get a additional backup of Puerto Rico Affidavit of Domicile any time, if needed. Just select the required type to acquire or printing the document format.

Use US Legal Forms, probably the most considerable variety of authorized varieties, to save some time and avoid faults. The services provides appropriately made authorized document templates that you can use for a variety of purposes. Generate a merchant account on US Legal Forms and initiate producing your life easier.

Form popularity

FAQ

Generally, under IRS §937 and the regulations thereunder, a bona fide resident of Puerto Rico is an individual who: Is physically present in Puerto Rico for at least 183 days during the taxable year; Does not have a tax home outside of Puerto Rico during the taxable year; and.

It should be presumed that an individual is a resident of Puerto Rico if they have been present in Puerto Rico for a period of 183 days during the calendar year.

To qualify as a bona fide resident of Puerto Rico for any tax year, a person must satisfy each of three distinct tests: (1) the ?Presence Test?; (2) the ?Tax Home Test?; and (3) the ?Closer Connection Test?. [4] It is not enough merely to be present in Puerto Rico for 183 days in a given tax year.

Bona Fide Residents of Puerto Rico: Generally, you are a bona fide resident of Puerto Rico if during the tax year, you: Meet the presence test ? Do not have a tax home outside Puerto Rico, and ? Do not have a closer connection to the United States or to a foreign country than to Puerto Rico.

To qualify for the exemptions, you must become a bonafide resident of Puerto Rico. This implies residing on the island for more than 183 days per year, filling out IRS forms, such as form 8898 and applying for a tax exemption decree from the Secretary of Economic Development and Commerce of Puerto Rico.

While the Commonwealth government has its own tax laws, Puerto Rico residents are also required to pay US federal taxes, but most residents do not have to pay the federal personal income tax.

Generally, under IRS §937 and the regulations thereunder, a bona fide resident of Puerto Rico is an individual who: Is physically present in Puerto Rico for at least 183 days during the taxable year; Does not have a tax home outside of Puerto Rico during the taxable year; and.

U.S. citizens who become bona fide residents of Puerto Rico can maintain their U.S. citizenship, avoid U.S. federal income tax on capital gains, including U.S.-source capital gains, and avoid paying any income tax on interest and dividends from Puerto Rican sources.