Pennsylvania Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock

Description

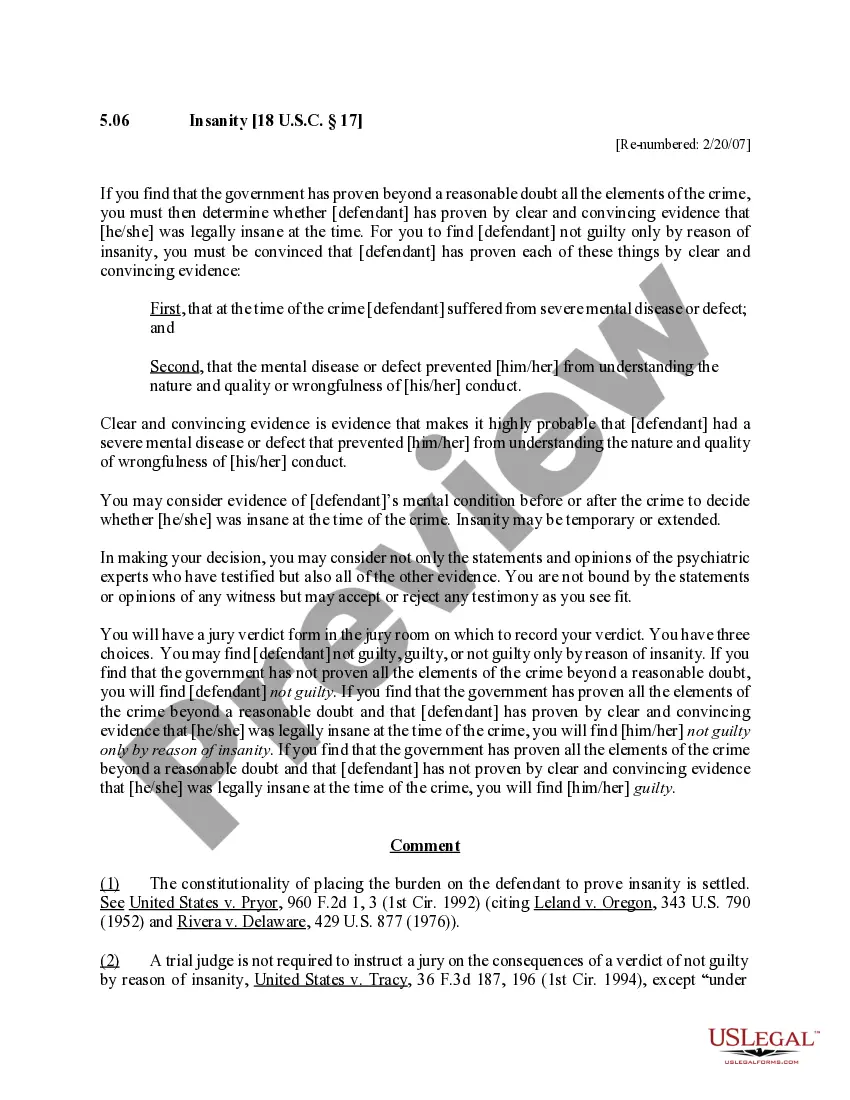

How to fill out Share Exchange Agreement Regarding Shareholders Issued Exchangeable Nonvoting Shares Of Capital Stock?

Have you been inside a placement that you will need paperwork for both business or person purposes nearly every day time? There are tons of legal papers layouts available on the net, but getting kinds you can depend on isn`t simple. US Legal Forms provides a huge number of form layouts, such as the Pennsylvania Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock, which can be created to fulfill state and federal requirements.

If you are previously acquainted with US Legal Forms site and have a merchant account, simply log in. Afterward, you may acquire the Pennsylvania Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock format.

Unless you offer an accounts and would like to begin using US Legal Forms, abide by these steps:

- Discover the form you need and make sure it is for that correct town/state.

- Take advantage of the Review switch to analyze the shape.

- Browse the explanation to ensure that you have chosen the correct form.

- When the form isn`t what you are searching for, use the Search field to find the form that suits you and requirements.

- Whenever you get the correct form, click Purchase now.

- Select the rates prepare you want, fill in the necessary information to produce your money, and pay money for your order with your PayPal or bank card.

- Pick a practical data file format and acquire your copy.

Find all the papers layouts you have bought in the My Forms food selection. You can aquire a further copy of Pennsylvania Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock anytime, if necessary. Just click on the needed form to acquire or produce the papers format.

Use US Legal Forms, probably the most comprehensive selection of legal varieties, in order to save some time and avoid mistakes. The assistance provides appropriately manufactured legal papers layouts that can be used for a range of purposes. Generate a merchant account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

A share for share exchange is where one or more shareholders exchange shares they hold in one company for shares in another company. A common example of this is where a new holding company B is put on top of existing company A.

What to Think about When You Begin Writing a Shareholder Agreement. ... Name Your Shareholders. ... Specify the Responsibilities of Shareholders. ... The Voting Rights of Your Shareholders. ... Decisions Your Corporation Might Face. ... Changing the Original Shareholder Agreement. ... Determine How Stock can be Sold or Transferred.

An Investment Agreement is a legal agreement between an investor and a company or business in which the investor agrees to provide funding in exchange for equity or debt in the company.

A shareholders' agreement is an agreement entered into between all or some of the shareholders in a company. It regulates the relationship between the shareholders, the management of the company, ownership of the shares and the protection of the shareholders. They also govern the way in which the company is run.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

The parties to an investment agreement are the company and the investor. A shareholders agreement is between the company and all its shareholders, including the investor(s), if they are to become a shareholder as a result of the investment.

A shareholders' agreement is an arrangement among the shareholders of a company. It contains provisions regarding the operation of the company and the relationship between its shareholders. A shareholders' agreement is also known as a stockholders' agreement.