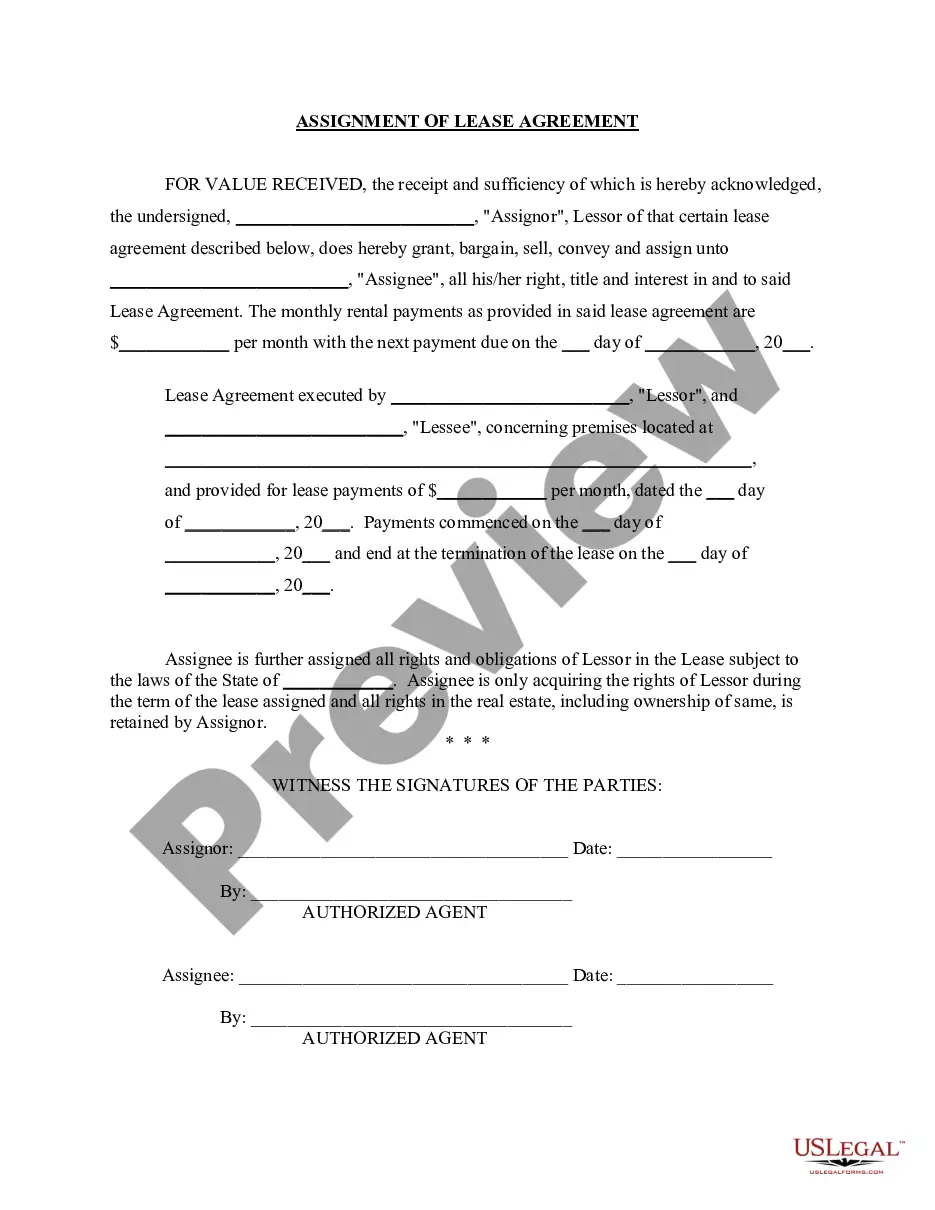

Pennsylvania Proxy Statement of Bank of Montana System

Description

How to fill out Proxy Statement Of Bank Of Montana System?

US Legal Forms - one of many largest libraries of legal forms in the States - provides a wide range of legal file templates you are able to obtain or printing. Using the internet site, you may get a huge number of forms for business and personal uses, categorized by categories, suggests, or key phrases.You will find the most up-to-date types of forms such as the Pennsylvania Proxy Statement of Bank of Montana System within minutes.

If you have a monthly subscription, log in and obtain Pennsylvania Proxy Statement of Bank of Montana System through the US Legal Forms collection. The Down load key can look on every single kind you view. You have access to all in the past downloaded forms within the My Forms tab of your own account.

If you would like use US Legal Forms initially, listed below are simple recommendations to help you get started off:

- Be sure you have selected the right kind for the area/area. Select the Review key to examine the form`s information. See the kind information to actually have selected the appropriate kind.

- When the kind doesn`t fit your specifications, take advantage of the Search area towards the top of the monitor to get the one which does.

- In case you are content with the form, verify your selection by clicking on the Purchase now key. Then, opt for the costs program you want and supply your accreditations to register to have an account.

- Method the deal. Utilize your bank card or PayPal account to finish the deal.

- Select the structure and obtain the form in your gadget.

- Make adjustments. Complete, revise and printing and indicator the downloaded Pennsylvania Proxy Statement of Bank of Montana System.

Each design you put into your bank account lacks an expiry day and it is the one you have eternally. So, if you want to obtain or printing yet another copy, just go to the My Forms area and then click in the kind you will need.

Get access to the Pennsylvania Proxy Statement of Bank of Montana System with US Legal Forms, probably the most extensive collection of legal file templates. Use a huge number of skilled and condition-certain templates that satisfy your organization or personal requires and specifications.