Pennsylvania Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock

Description

How to fill out Notice And Proxy Statement To Effect A 2-for-1 Split Of Outstanding Common Stock?

Have you been in a place in which you require papers for sometimes business or personal purposes nearly every day? There are a lot of legitimate file templates available on the Internet, but getting types you can rely isn`t effortless. US Legal Forms offers thousands of develop templates, much like the Pennsylvania Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock, which can be composed to meet state and federal needs.

When you are presently acquainted with US Legal Forms website and possess a merchant account, just log in. Next, you are able to obtain the Pennsylvania Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock design.

Should you not have an accounts and wish to begin using US Legal Forms, adopt these measures:

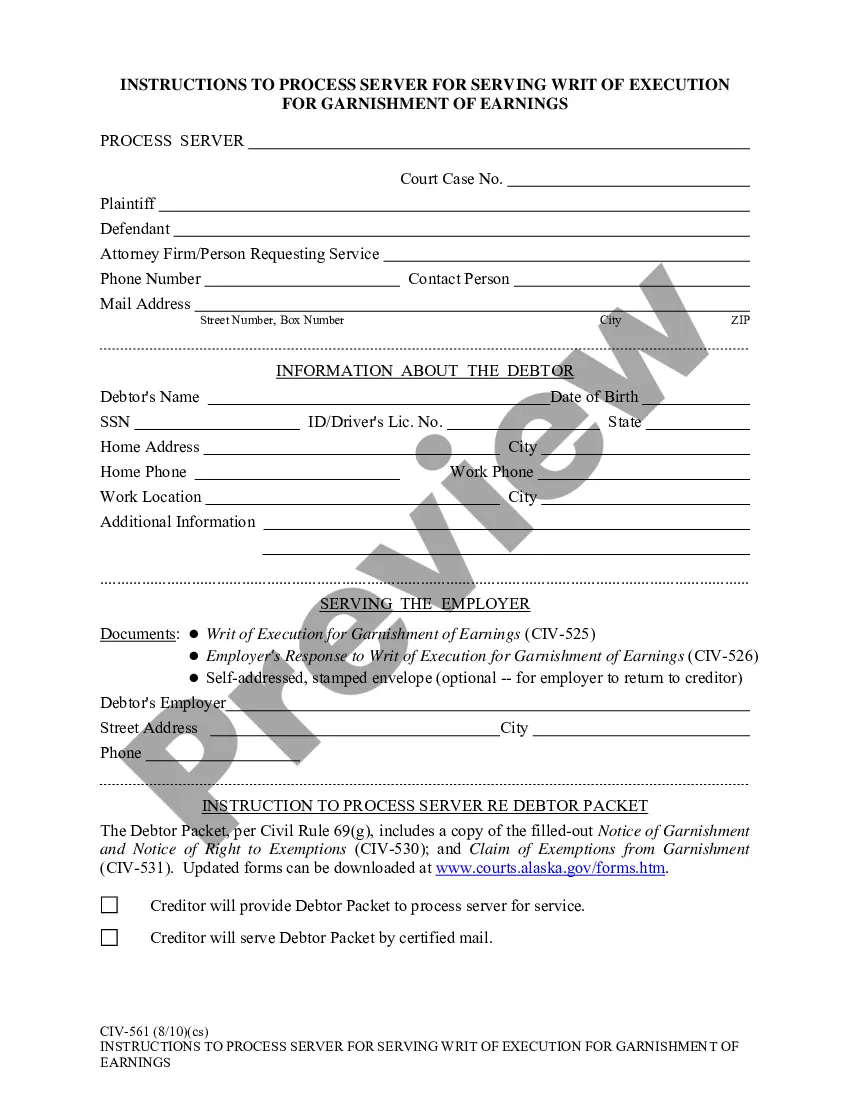

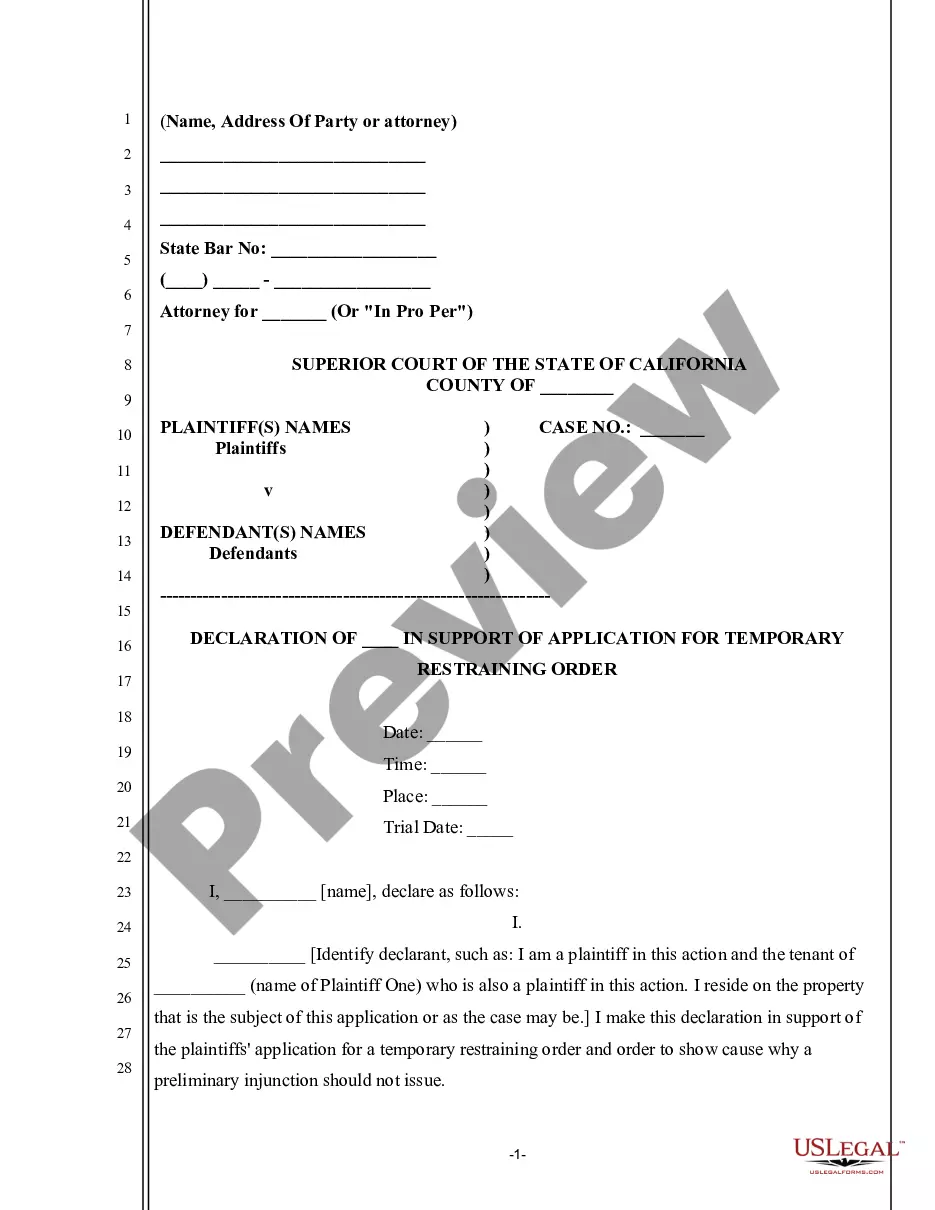

- Obtain the develop you will need and ensure it is for your right city/region.

- Make use of the Preview switch to check the shape.

- Look at the description to actually have chosen the right develop.

- If the develop isn`t what you are searching for, utilize the Lookup discipline to discover the develop that fits your needs and needs.

- If you obtain the right develop, just click Acquire now.

- Select the costs plan you want, complete the desired information to make your account, and pay for the order making use of your PayPal or bank card.

- Select a convenient paper file format and obtain your backup.

Get every one of the file templates you may have bought in the My Forms food list. You can obtain a additional backup of Pennsylvania Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock anytime, if required. Just click on the essential develop to obtain or produce the file design.

Use US Legal Forms, probably the most substantial selection of legitimate types, to conserve time and prevent faults. The service offers professionally manufactured legitimate file templates which can be used for an array of purposes. Produce a merchant account on US Legal Forms and begin producing your life easier.

Form popularity

FAQ

split. Exercise value: # of shares X the strike price= 100 shares x 50= $5,000. New number of shares= 100 X 3/2= 150 shares. New strike price= exercise value/ new shares= $5,000/ 150= $33.33.

A stock split can make the shares seem more affordable, even though the underlying value of the company has not changed. It can also increase the stock's liquidity. When a stock splits, it can also result in a share price increase?even though there may be a decrease immediately after the stock split.

For example, a common stock split ratio is a forward 2-1 split (i.e., 2 for 1), where a stockholder would receive 2 shares for every 1 share owned. This results in an increase in the total number of shares outstanding for the company, though no change in a shareholder's proportional ownership.

For example, a 1-for-3 reverse split is one that replaces every three shares owned by a company's investors with a single share of stock. So, if you owned 30 shares of a company's stock before such a reverse split went into effect, you'd own 10 shares afterward.

Calculating total shares after stock split Shareholders who wish to estimate the total number of shares that they will own after a stock split can use the following formula: Total number of shares post stock split = number of shares held * number of new shares issued for each existing share.

Does it matter to buy before or after a stock split? If you buy a stock before it splits, you'll pay more per share than what it'll cost after it splits. If you're looking to buy into a stock at a cheaper price, you may want to wait until after the stock split.

Or, in a 3-for-2 split, the company would give you three shares with a market-adjusted worth of about $66.67 in exchange for two existing $100 shares, leaving you with 15 shares. While you now have more shares than you started with, the total value of those shares is the same as it was before the split: $1,000.

Hold a share transfer committee meeting of the Board of Directors and take the proposal of issuing split share certificates to that meeting for approval and also for affixing common seal on the new share certificates which are to be issued in lieu of the share certificates surrendered to the company.