Pennsylvania Nonqualified Stock Option Plan of ASA Holdings, Inc.

Description

How to fill out Nonqualified Stock Option Plan Of ASA Holdings, Inc.?

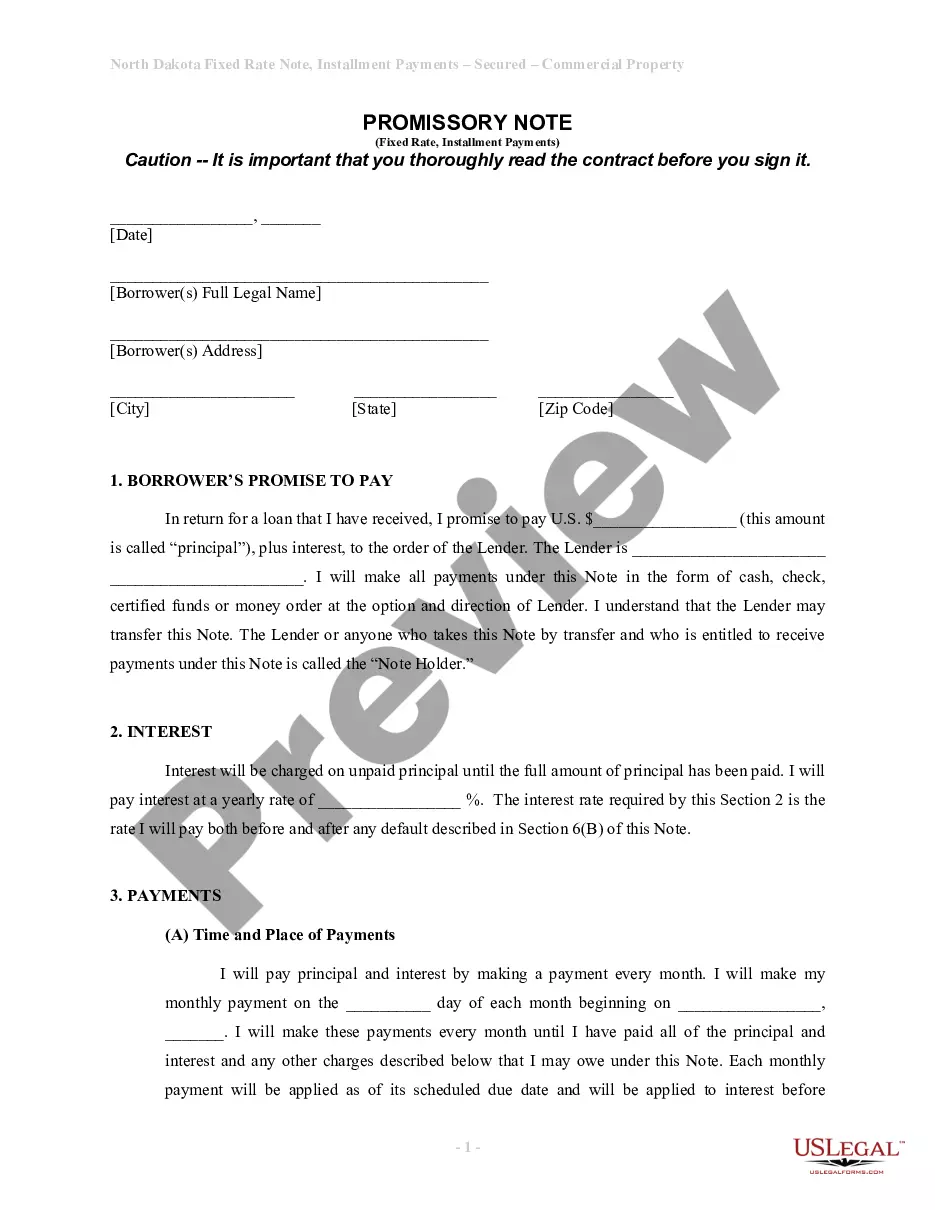

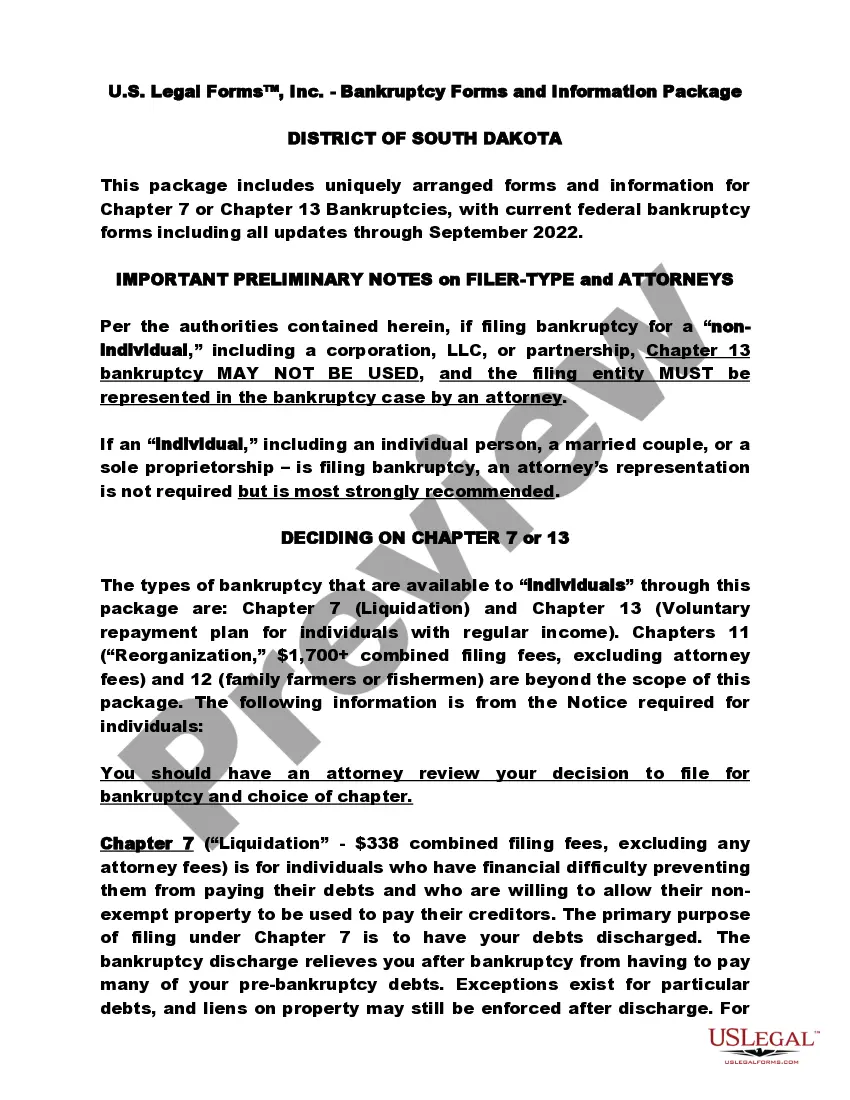

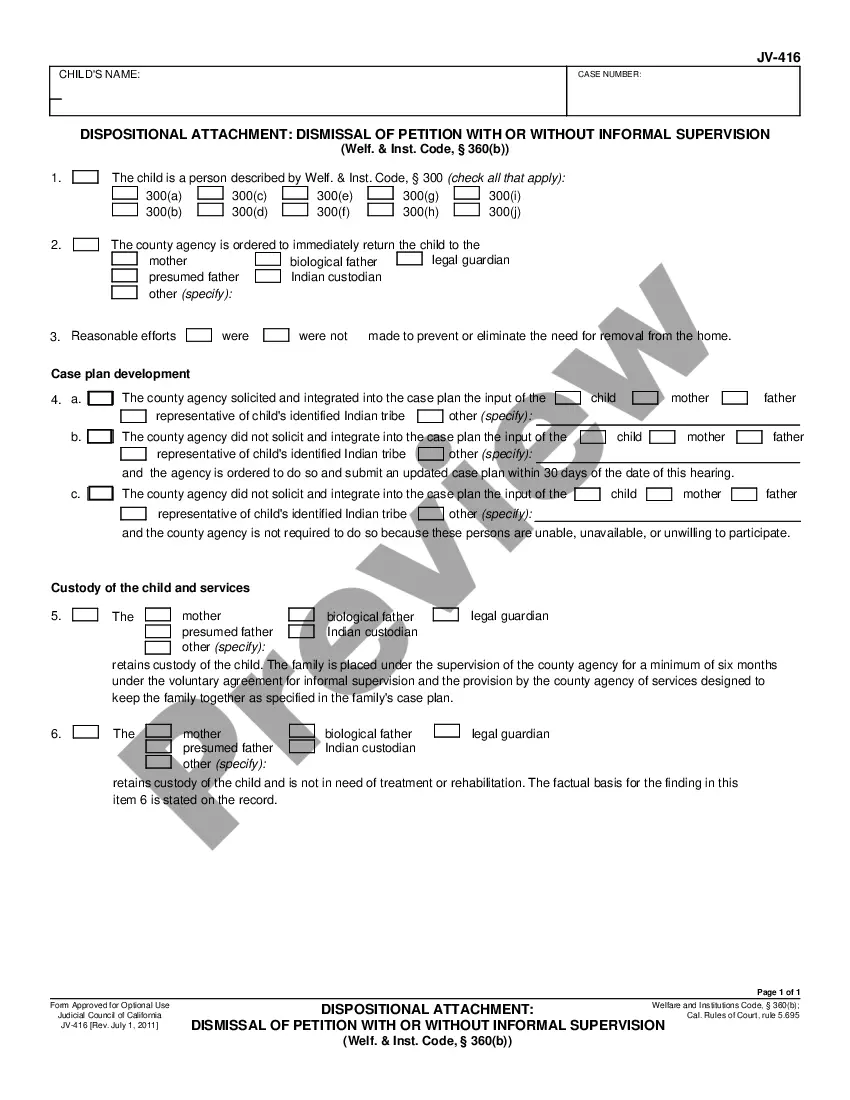

Have you been in a placement in which you require documents for sometimes business or individual functions nearly every working day? There are plenty of legitimate papers layouts accessible on the Internet, but locating ones you can trust is not simple. US Legal Forms delivers a huge number of develop layouts, much like the Pennsylvania Nonqualified Stock Option Plan of ASA Holdings, Inc., which are written to fulfill federal and state demands.

When you are already familiar with US Legal Forms internet site and also have a merchant account, just log in. Following that, it is possible to obtain the Pennsylvania Nonqualified Stock Option Plan of ASA Holdings, Inc. web template.

Unless you come with an account and need to begin to use US Legal Forms, follow these steps:

- Obtain the develop you want and make sure it is to the appropriate town/state.

- Use the Review button to examine the shape.

- Read the explanation to actually have chosen the appropriate develop.

- When the develop is not what you are trying to find, utilize the Search discipline to get the develop that meets your needs and demands.

- Once you discover the appropriate develop, click Acquire now.

- Pick the costs prepare you need, submit the specified info to generate your account, and buy the order with your PayPal or bank card.

- Choose a hassle-free paper format and obtain your version.

Get all the papers layouts you might have purchased in the My Forms menus. You can get a further version of Pennsylvania Nonqualified Stock Option Plan of ASA Holdings, Inc. any time, if needed. Just click the necessary develop to obtain or printing the papers web template.

Use US Legal Forms, one of the most considerable variety of legitimate types, to save efforts and steer clear of faults. The support delivers skillfully made legitimate papers layouts that can be used for a selection of functions. Generate a merchant account on US Legal Forms and commence making your way of life a little easier.

Form popularity

FAQ

Theoretically, ISOs receive favorable tax treatment and additional restrictions to offset their benefit, while NQSOs receive double taxation. Anyone ? including employees, advisors, or other service providers ? may receive NQSOs. NQSOs may vest over time or immediately, and may contain certain restrictions.

Hear this out loud PauseWhat are non-qualified stock options? Non-qualified stock options (NSOs or NQSOs) are a type of stock option that does not qualify for tax-advantaged treatment for the employee like ISOs do. NSOs can also be issued to other non-employee service providers like consultants, advisors, and independent board members.

As with other types of stock options, when you're granted NSOs, you're getting the right to buy a set number of shares at a fixed price, also called the strike price, grant price, or exercise price. A company's 409A valuation or fair market value (FMV) determines the strike price of an option.