Pennsylvania Nonqualified Stock Option Agreement of N(2)H(2), Inc.

Description

How to fill out Nonqualified Stock Option Agreement Of N(2)H(2), Inc.?

Are you in the place the place you need to have papers for possibly organization or personal purposes just about every time? There are tons of legal document themes available online, but finding types you can trust isn`t straightforward. US Legal Forms gives thousands of form themes, like the Pennsylvania Nonqualified Stock Option Agreement of N(2)H(2), Inc., that are composed in order to meet state and federal requirements.

Should you be previously familiar with US Legal Forms website and have a free account, just log in. After that, you can down load the Pennsylvania Nonqualified Stock Option Agreement of N(2)H(2), Inc. template.

Should you not have an accounts and wish to begin to use US Legal Forms, abide by these steps:

- Discover the form you want and make sure it is for your proper city/region.

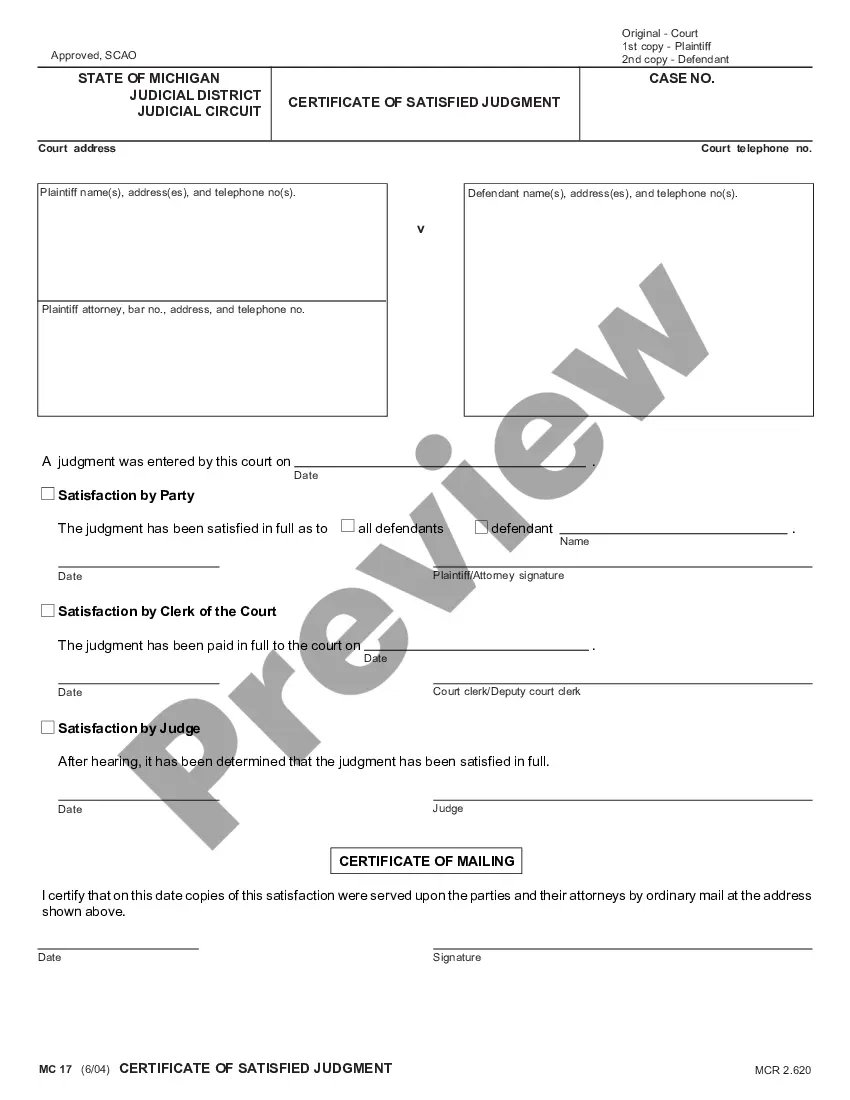

- Utilize the Review key to analyze the form.

- Browse the information to actually have chosen the proper form.

- When the form isn`t what you are seeking, take advantage of the Lookup industry to get the form that fits your needs and requirements.

- Once you get the proper form, just click Get now.

- Opt for the rates plan you want, fill out the specified info to produce your bank account, and purchase the transaction making use of your PayPal or Visa or Mastercard.

- Select a convenient data file file format and down load your duplicate.

Find each of the document themes you may have purchased in the My Forms food selection. You can obtain a extra duplicate of Pennsylvania Nonqualified Stock Option Agreement of N(2)H(2), Inc. whenever, if possible. Just select the needed form to down load or print out the document template.

Use US Legal Forms, by far the most extensive collection of legal forms, in order to save efforts and stay away from blunders. The support gives expertly produced legal document themes that you can use for an array of purposes. Produce a free account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

In this situation, you exercise your option to purchase the shares but you do not sell the shares. Your compensation element is the difference between the exercise price ($25) and the market price ($45) on the day you exercised the option and purchased the stock, times the number of shares you purchased.

If you exercised nonqualified stock options (NQSOs) last year, the income you recognized at exercise is reported on your W-2. It appears on the W-2 with other income in: Box 1: Wages, tips, and other compensation.

Stock options are taxable as compensation on the date they are exercised or when any substantial restrictions lapse. The difference between the fair market value of the stock on the date the option... Should people pay PA personal income tax on their gambling and lottery winnings?

Distributions from a nonqualified deferred compensation plan that are attributable to elective deferrals are subject to Pennsylvania Personal Income Tax.

Non-qualified stock options (NSOs or NQSOs) are a type of stock option that does not qualify for tax-advantaged treatment for the employee like ISOs do. NSOs can also be issued to other non-employee service providers like consultants, advisors, and independent board members.

If you exercise one of these NSOs, you'll pay your company $3 to buy a share. But the IRS views that share to be worth $35. The difference between the $3 and the $35 counts as a $32 phantom gain (also called the spread). The phantom gain is taxed at ordinary income rates.