Pennsylvania Telecommuting Application Form

Description

How to fill out Telecommuting Application Form?

If you intend to finalize, obtain, or produce sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly search feature to locate the documents you require.

Different templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 3. If you are not satisfied with the document, utilize the Search field at the top of the screen to find other variations of the legal form template.

Step 4. Once you have identified the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

- Employ US Legal Forms to find the Pennsylvania Telecommuting Application Form with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to download the Pennsylvania Telecommuting Application Form.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the guidelines below.

- Step 1. Make sure you have selected the form for the correct city/state.

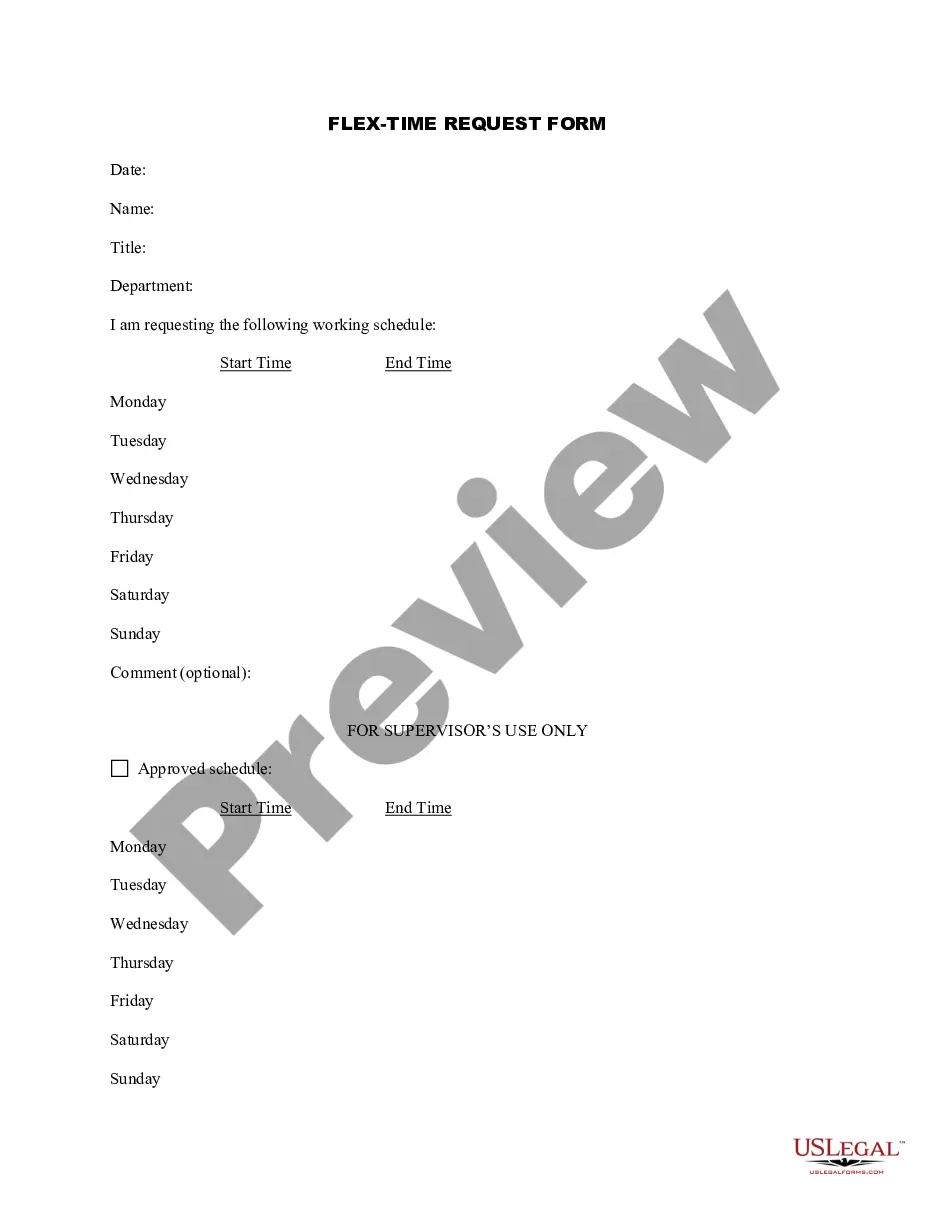

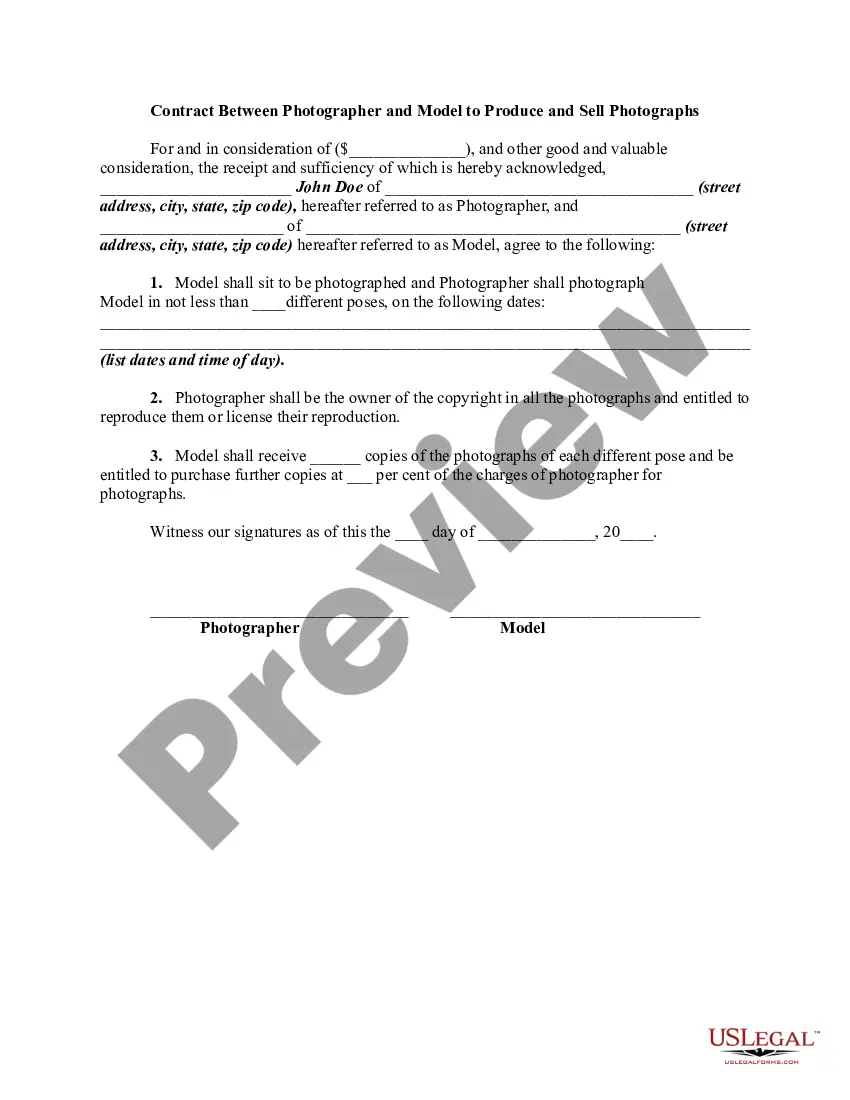

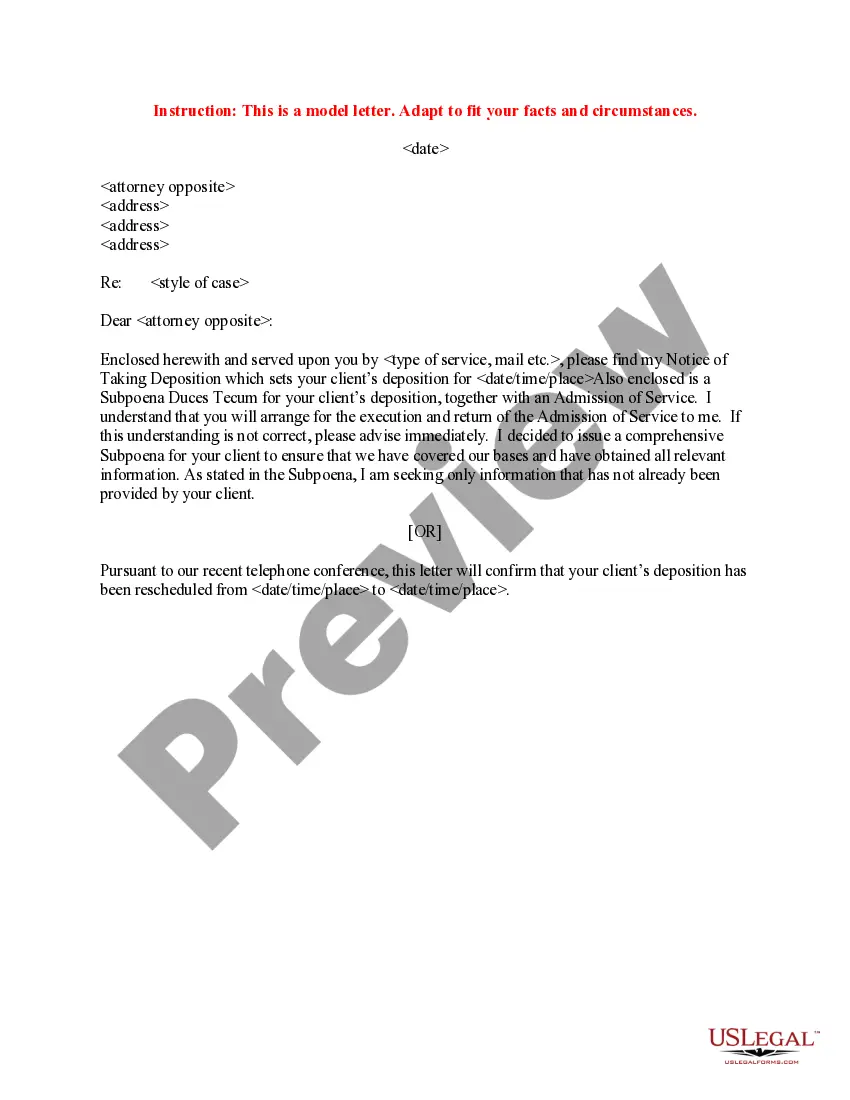

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

Form popularity

FAQ

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

Why, yes yes, you can. Working from home and working remotely have given people the freedom to gain those long hours spent commuting back into their lives.

If the tax is withheld in another PA community where I work, do I also pay the PA District in which I live? No. Generally the tax withheld by your employer will be remitted to your resident jurisdiction. However, you are still required to file an annual tax return with your resident taxing jurisdiction.

Teleworking will no longer be mandated but highly encouraged, the Pennsylvania Department of Health said in a statement Thursday afternoon. It comes at the same time that other Covid-19 restrictions are being eased, including Sunday's increases in occupancy at restaurants and indoor and outdoor gathering limits.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

An individual employee's local Earned Income Tax (EIT) Rate is determined by comparing the employee's Total Resident EIT Rate (for the municipality in which the employee lives) to the Work Location Non-Resident EIT Rate (for the municipality in which the employee works).

The tax is based on the taxpayer's place of residence (domicile) and NOT their place of employment. The EIT is separate from the Pennsylvania personal income tax (your state income tax).

If you're among the employed Americans who were allowed to work remotely during the pandemic last year, count your blessings. But if you worked from a state other than the one where your employer is based, you may have to pay up for that privilege come tax time.

When you live in one state and work in another, the state where you work usually gets to tax you and will withhold the appropriate amount from your paycheck each week. In this situation, you will have to pay out of state taxes. At the end of the year, you will file two returns.

Yes, as long as you have access to WiFi and don't miss any deadlines you can work remotely from anywhere.