Pennsylvania Telecommuting Policy

Description

How to fill out Telecommuting Policy?

If you wish to complete, acquire, or print authorized document templates, utilize US Legal Forms, the largest selection of legal forms, accessible online.

Employ the site’s user-friendly and efficient search to find the documents you need.

An assortment of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document format you purchase is yours permanently. You will have access to all forms you saved in your account.

Click on the My documents section and select a form to print or download again. Compete and acquire, and print the Pennsylvania Telecommuting Policy with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal requirements.

- Use US Legal Forms to obtain the Pennsylvania Telecommuting Policy with just a few clicks.

- If you are already a customer of US Legal Forms, Log In to your account and click on the Obtain button to access the Pennsylvania Telecommuting Policy.

- You may also access forms you previously stored in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/region.

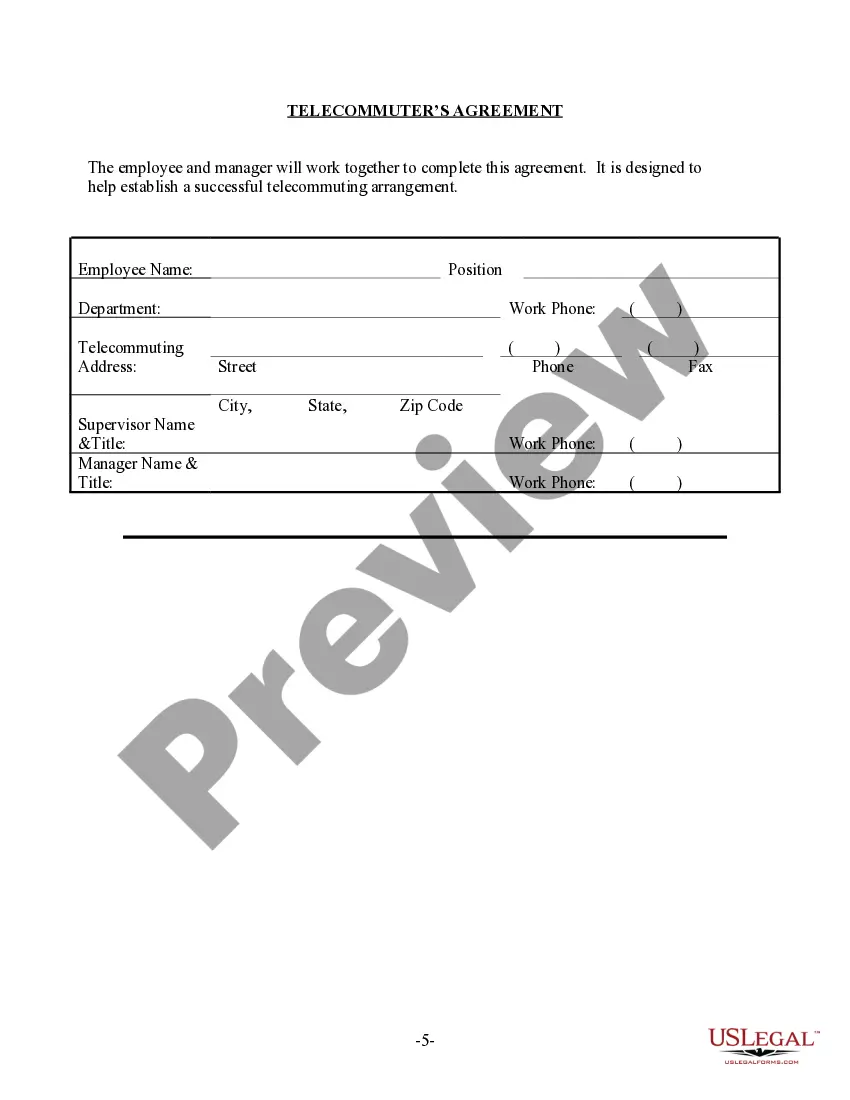

- Step 2. Use the Preview option to review the contents of the form. Do not forget to check the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other types in the legal form format.

- Step 4. Once you have found the form you need, click the Acquire now button.

- Step 5. Complete the transaction. You can use your Visa, MasterCard, or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Pennsylvania Telecommuting Policy.

Form popularity

FAQ

The tax is based on the taxpayer's place of residence (domicile) and NOT their place of employment. The EIT is separate from the Pennsylvania personal income tax (your state income tax).

A corporation is considered to have nexus in Pennsylvania for CNIT purposes when it has one or more employees conducting business activities on its behalf in Pennsylvania.

Teleworking. Unless not possible, all businesses are required to conduct their operations in whole, or in part, remotely through individual teleworking of their employees in the jurisdiction or jurisdictions in which they do business.

Can an agency force an employee to telework? No. The language of the Telework Enhancement Act does not contain language that would lead us to revise our understanding that telework is a voluntary flexibility.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

Yes, as long as you have access to WiFi and don't miss any deadlines you can work remotely from anywhere. I have really enjoyed living and working in over a dozen countries for almost 10 years.

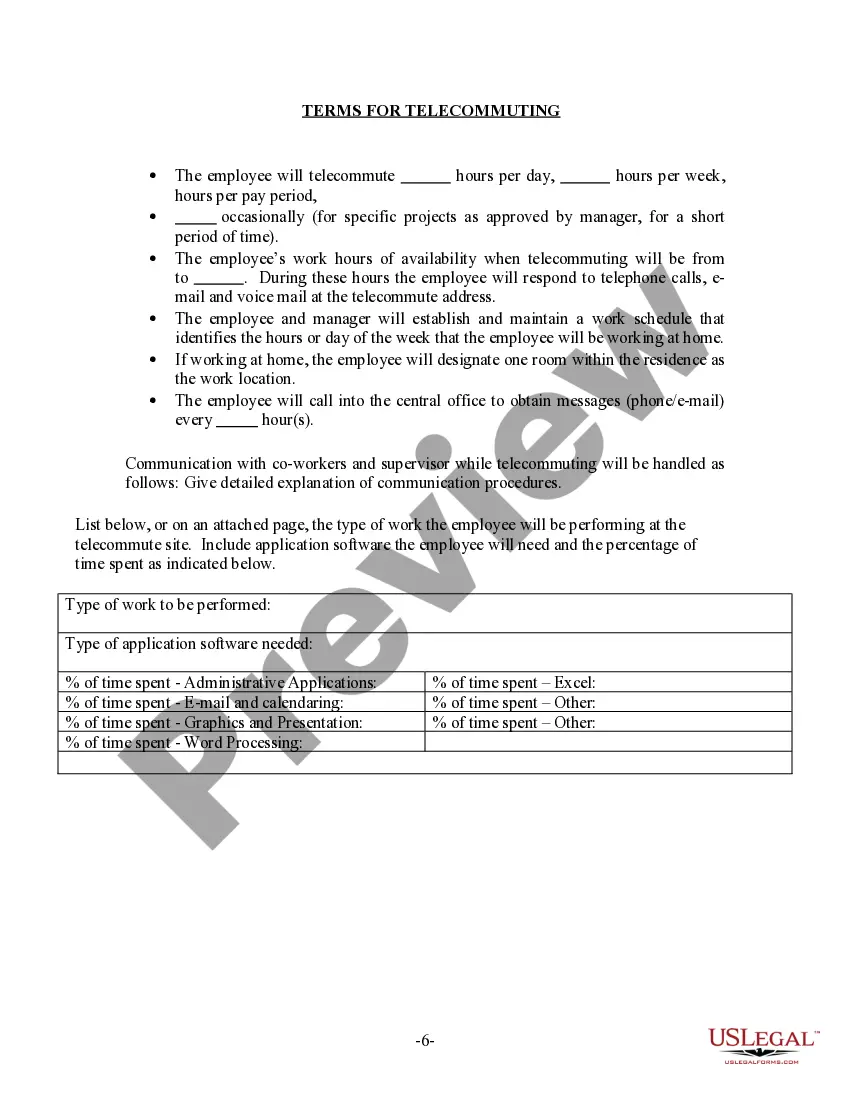

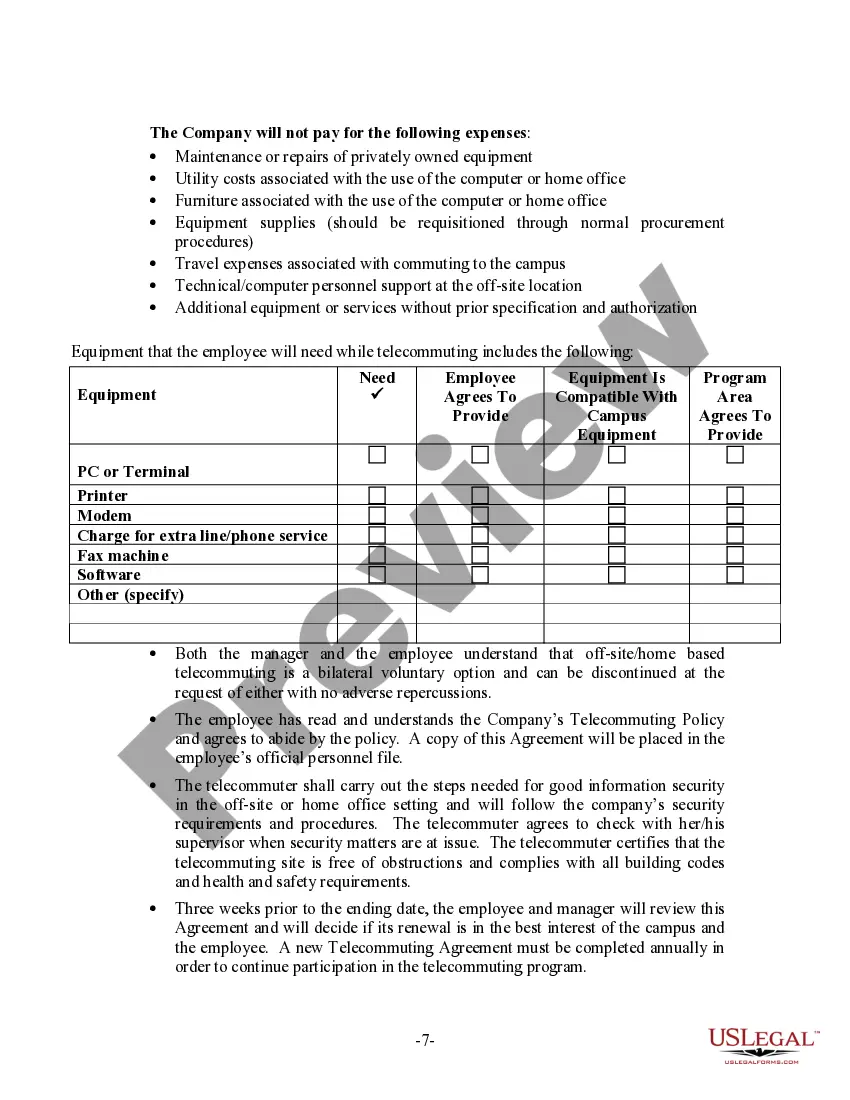

The Act mandates that each teleworker and his/her manager must enter into a written telework agreement for every type of telework, whether the employee teleworks regularly or not.

Telework has existed in the Federal Government for many years. At least since the Telework Enhancement Act of 2010 (Public Law 111-292) became law, executive branch departments and agencies (agencies) have demonstrated that telework is an efficient and effective way of working to deliver on agency missions.

Teleworking will no longer be mandated but highly encouraged, the Pennsylvania Department of Health said in a statement Thursday afternoon. It comes at the same time that other Covid-19 restrictions are being eased, including Sunday's increases in occupancy at restaurants and indoor and outdoor gathering limits.

If you're among the employed Americans who were allowed to work remotely during the pandemic last year, count your blessings. But if you worked from a state other than the one where your employer is based, you may have to pay up for that privilege come tax time.