Pennsylvania Telecommuting Worksheet

Description

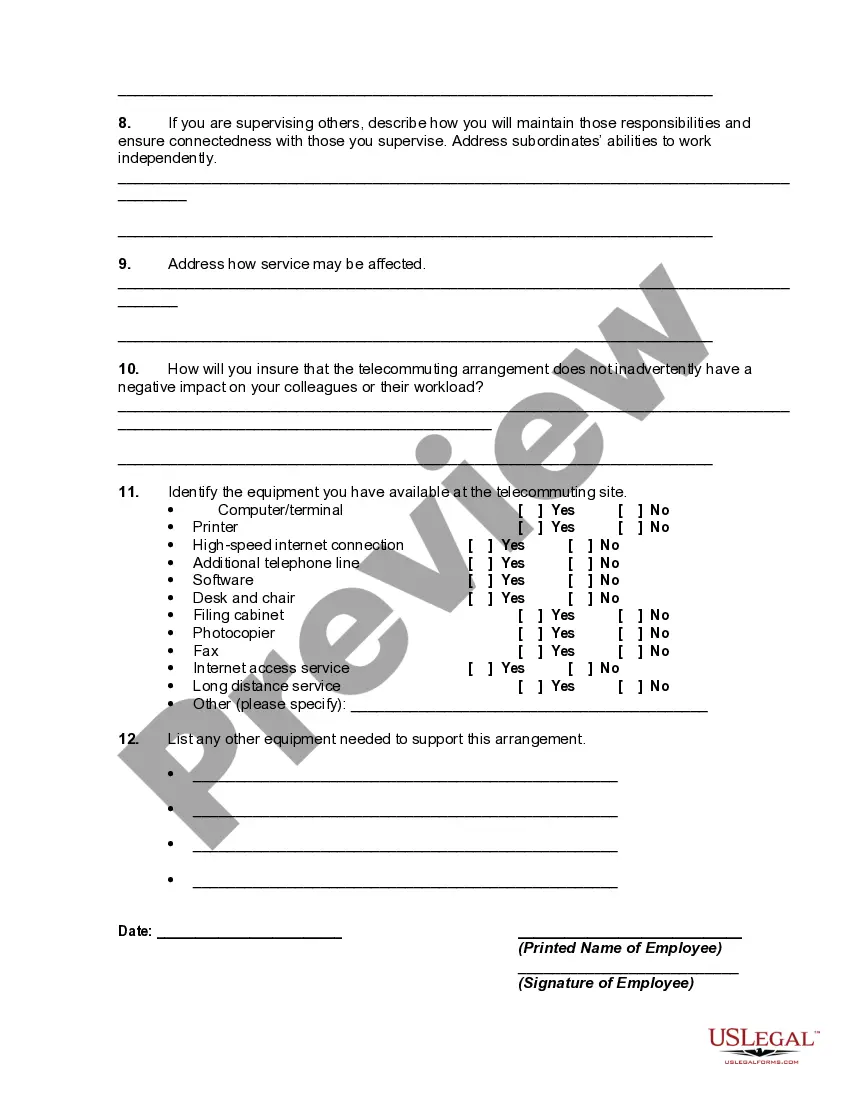

How to fill out Telecommuting Worksheet?

If you need to download, retrieve, or create legal document templates, utilize US Legal Forms, the largest array of legal forms available online.

Employ the website's straightforward and user-friendly search to find the documents you require.

Numerous templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. After you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the payment. You can use your debit or credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to acquire the Pennsylvania Telecommuting Worksheet in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to find the Pennsylvania Telecommuting Worksheet.

- You can also access forms you have previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm you have selected the form for the correct city/state.

- Step 2. Use the Preview option to examine the form's details. Make sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The home office deduction is available to qualifying self-employed taxpayers, independent contractors and those working in the gig economy. However, the Tax Cuts and Jobs Act suspended the business use of home deduction from 2018 through 2025 for employees.

Beginning in 2013, the IRS will accept a simplified option for claiming home office deductions and eligible home-based businesses may deduct up to $1,500. Will PA allow this same deduction? No, PA will not be accepting this same deduction. Taxpayers must calculate and report their actual expenses.

In general, you qualify for the home office deduction if part of your home is used "regularly and exclusively" for the conduct of business. Your home office does not need to be a separate room, but it must be an area of your home where you do not do anything else.

To reiterate, expenses related to a home office will be allowed as a deduction if the part of the home is specifically equipped for purposes of the taxpayer's trade and regularly and exclusively used for such purposes.

The provisions in the Income Tax Act that allow employees to claim a tax deduction for home office expenses are not new in our law, nor are they COVID-19 tax relief measures. Many employees have simply not previously made use of these provisions as they mainly worked from their employers' premises.

Highlights of the simplified option: Standard deduction of $5 per square foot of home used for business (maximum 300 square feet). Allowable home-related itemized deductions claimed in full on Schedule A. (For example: Mortgage interest, real estate taxes).

The deduction is allowable for taxpayers who are temporarily working from home during the COVID-19 pandemic if they meet the qualifications outlined in the section below. However, even if you meet the qualifications, there are other considerations that have to be accounted for when claiming the deduction.

You can only deduct the portion of your total business expenses, including business expenses unrelated to your home office, that exceed two percent of your adjusted gross income. As a telecommuting employee, you must complete Form 2106, Employee Business Expenses, along with Form 1040 and Schedule A.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

Yes. You may elect to use either the simplified method or the standard method for any taxable year. However, once you have elected a method for a taxable year, you cannot later change to the other method for that same year.