Pennsylvania Software Equipment Request

Description

How to fill out Software Equipment Request?

If you need to compile, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site's simple and convenient search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours indefinitely. You will have access to every form you acquired in your account. Navigate to the My documents section and choose a form to print or download again.

Be proactive and download and print the Pennsylvania Software Equipment Request with US Legal Forms. There are countless professional and state-specific templates available for your business or personal needs.

- Utilize US Legal Forms to access the Pennsylvania Software Equipment Request with just a few clicks.

- If you are already a US Legal Forms customer, Log Into your account and click on the Download button to retrieve the Pennsylvania Software Equipment Request.

- You can also find forms you previously acquired from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

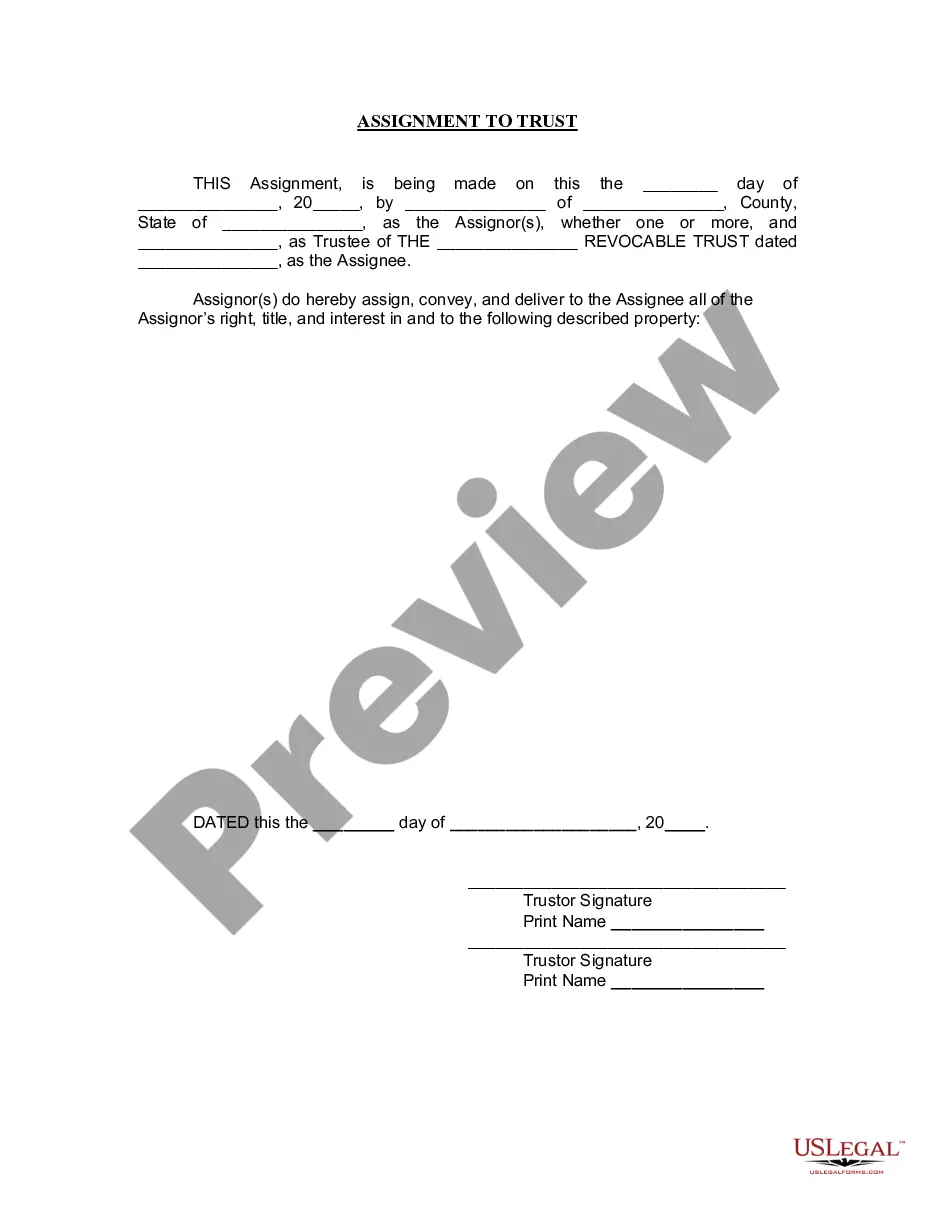

- Step 2. Use the Preview function to review the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Finalize the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Pennsylvania Software Equipment Request.

Form popularity

FAQ

The PA e-file mandate requires individuals and businesses to e-file their state tax returns if their income meets certain thresholds. This mandate streamlines processing and speeds up the return of any potential refunds. Utilizing the Pennsylvania Software Equipment Request can help ensure compliance with this mandate. Moreover, filing electronically minimizes errors and improves accuracy.

Yes. The Sales Tax regulation on computer services is found in the PA Code.

The Pennsylvania Department of Revenue ruled that cloud computing software is subject to Pennsylvania sales and use tax when used by people in-state (SUT-12-001).

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

Recently, the Pennsylvania Department of Revenue issued Letter Ruling SUT-17-002, concluding that sales of information retrieval products accessed electronically are subject to Pennsylvania sales and use tax as sales of tangible personal property.

The Pennsylvania Department of Revenue ruled that cloud computing software is subject to Pennsylvania sales and use tax when used by people in-state (SUT-12-001).

Services in Pennsylvania are generally not taxable. However if the service you provide includes selling, repairing or building a product that service may be taxable.

Pennsylvania Sales Tax Now Applies to Support, Maintenance and Updates of Canned Computer Software. The Pennsylvania legislature recently enacted changes to the state sales tax code that affect computer software providers and their customers. These changes went into effect on August 1, 2016.

Does California require sales tax on Downloadable Custom Software? California does not require sales tax on downloadable custom software.

Generally, professional services are not taxable in Pennsylvania.