Pennsylvania Charitable Contribution Payroll Deduction Form

Description

How to fill out Charitable Contribution Payroll Deduction Form?

You might spend hours online searching for the legal document template that meets the federal and state criteria you require.

US Legal Forms offers a vast array of legal templates that are reviewed by experts.

You can download or print the Pennsylvania Charitable Contribution Payroll Deduction Form from the service.

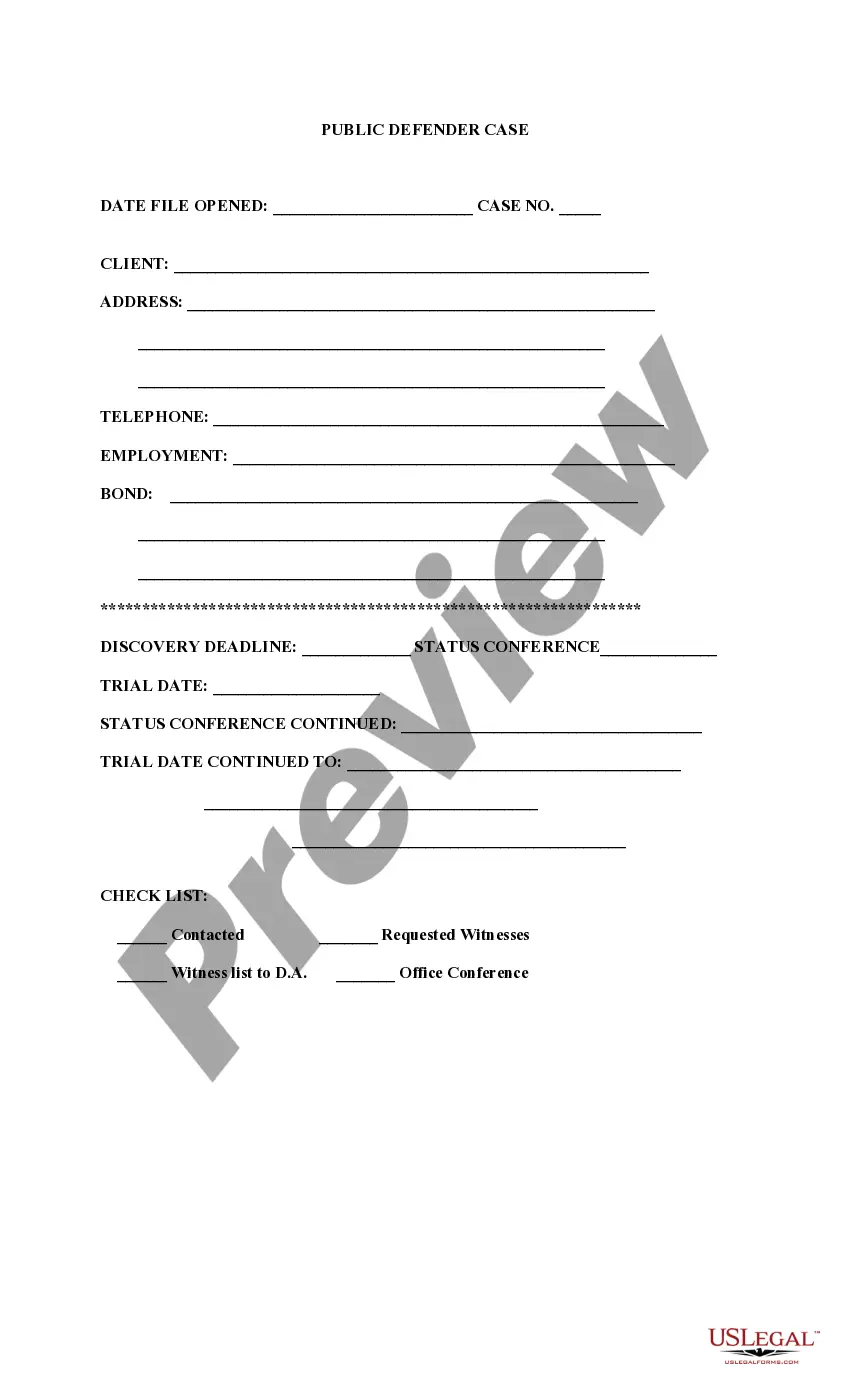

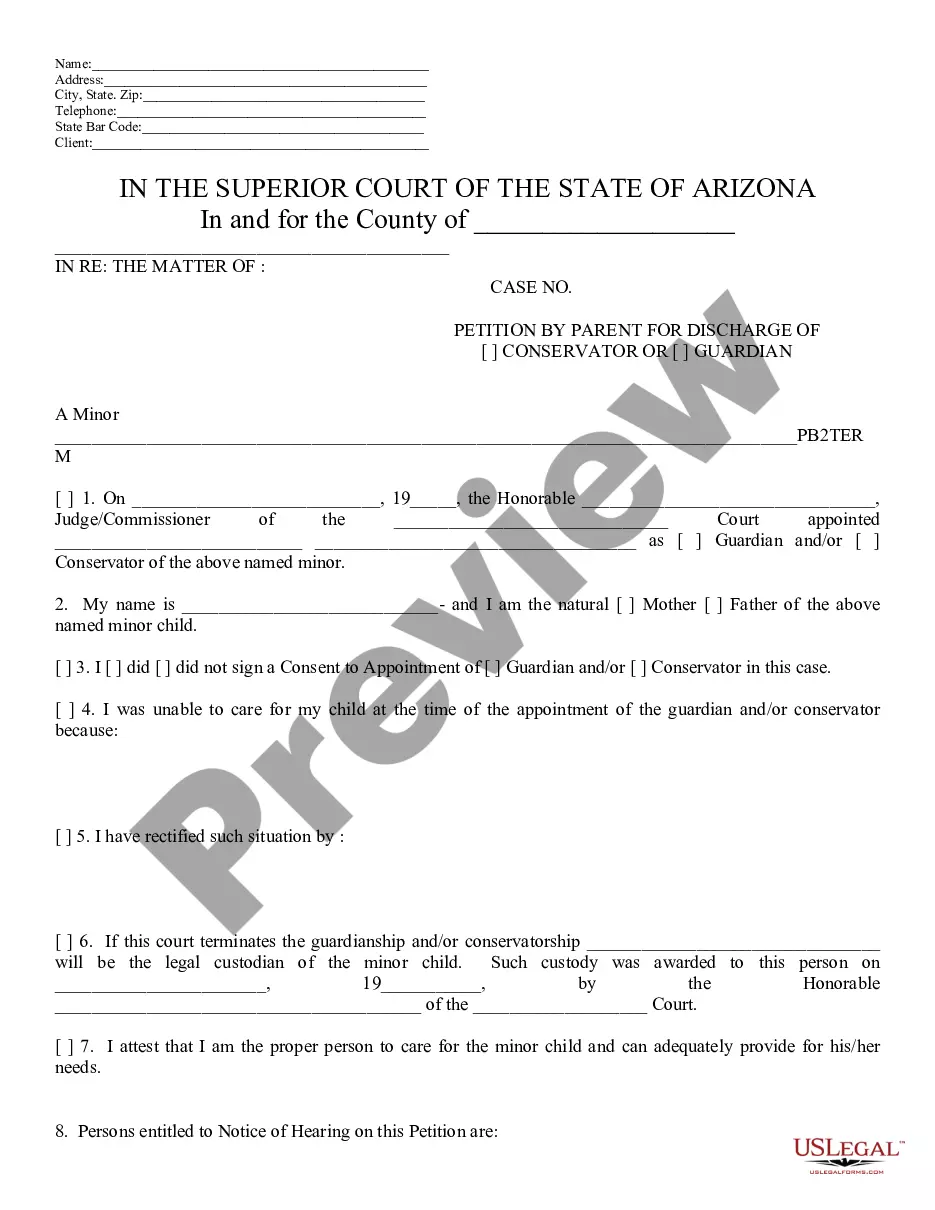

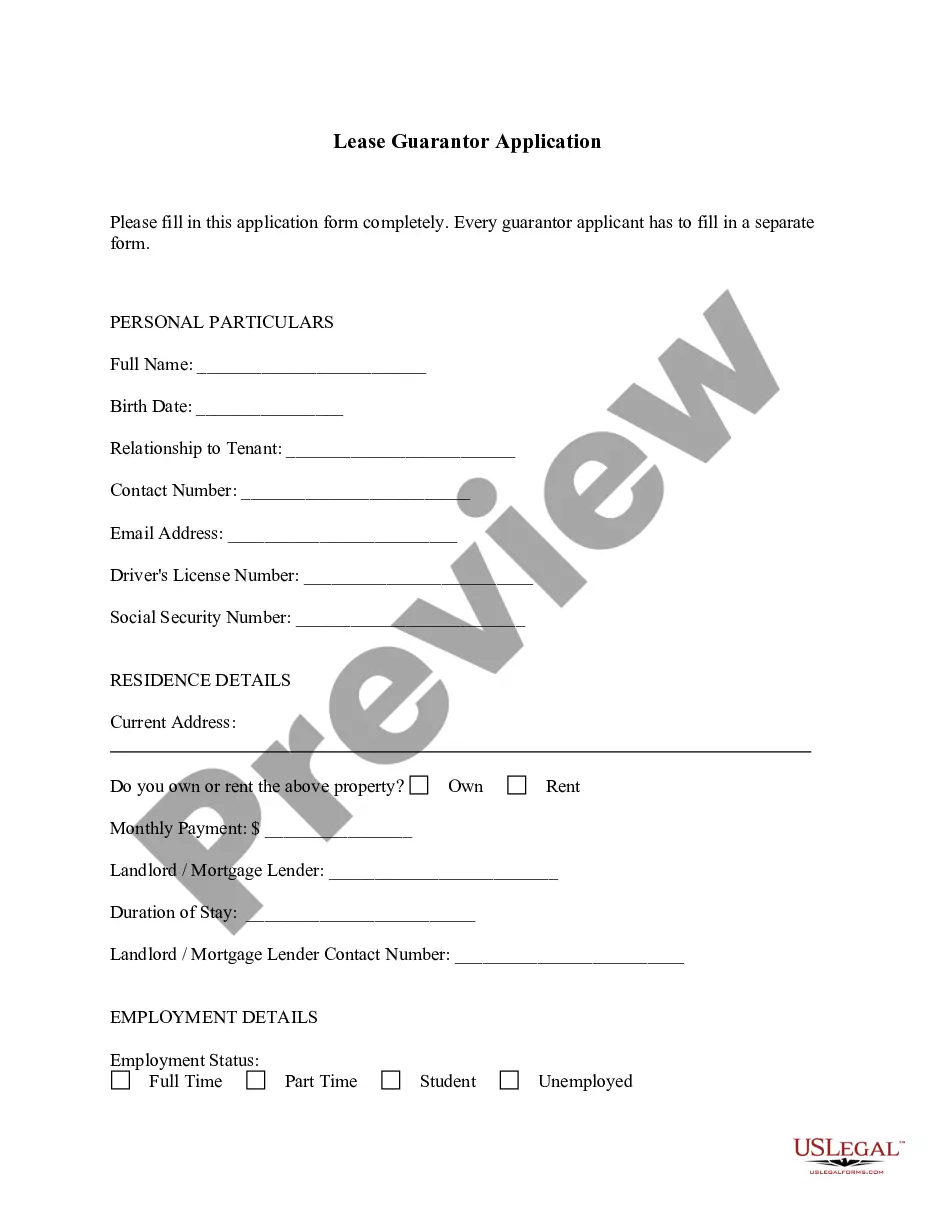

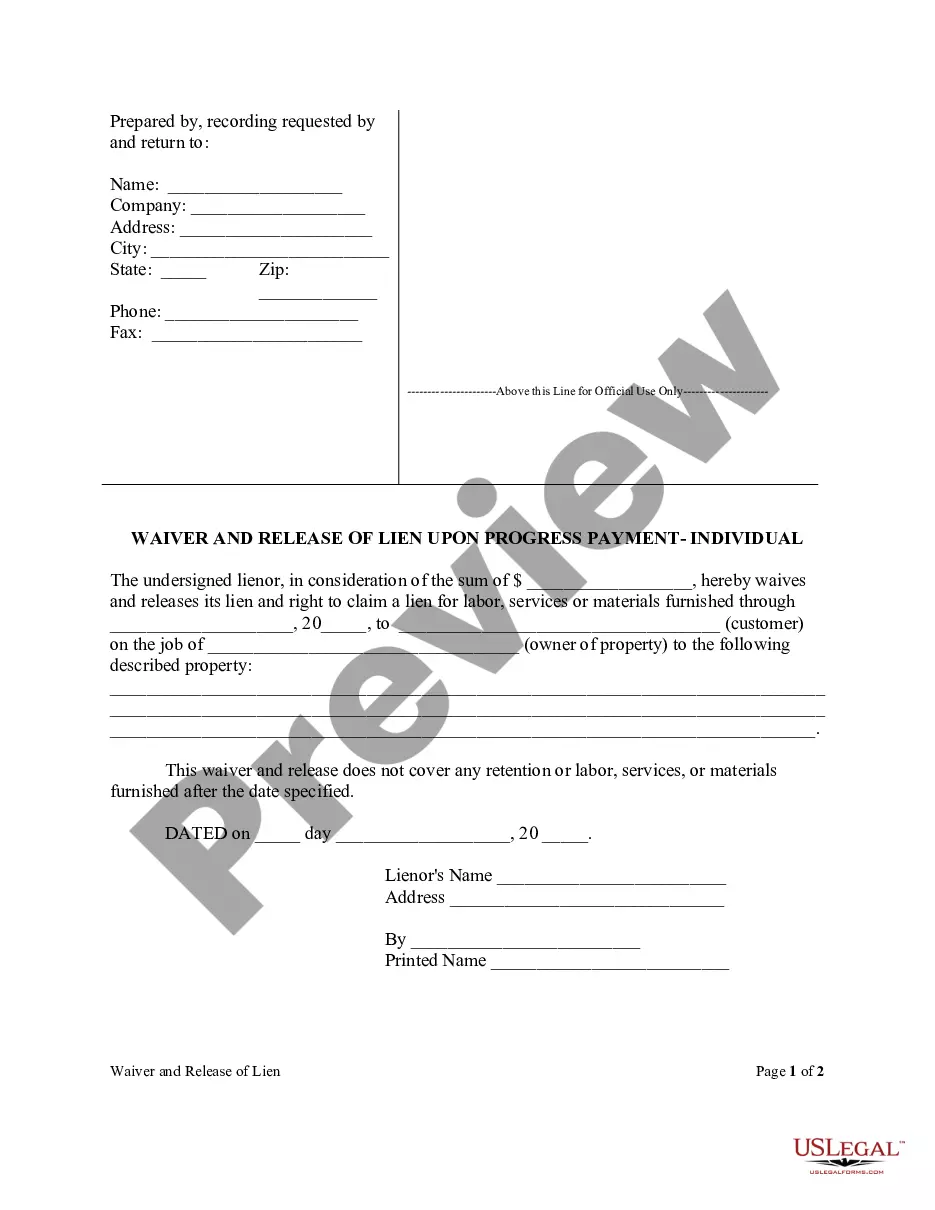

If available, use the Preview button to view the document template simultaneously.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Pennsylvania Charitable Contribution Payroll Deduction Form.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your area/city of choice.

- Review the form description to confirm you’ve selected the proper form.

Form popularity

FAQ

Pennsylvania personal income law does not allow deductions for charitable contributions.

Purpose. Complete Form REV-419 so that your employer can withhold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial situa- tion changes. Photocopies of this form are acceptable.

Disallowed deductions include the federal standard deduction and itemized deductions (with the limited exception for unreimbursed employee business expenses deducted from gross compensation). Additionally, Pennsylvania does not allow a deduction for the personal exemption.

40 form is the Pennsylvania Department of Revenue's official paper form that the state's residents use to file state income taxes. Pennsylvania is one of the 41 U.S. states that require residents to pay a personal income tax each year.

For 2020, the charitable limit was $300 per tax unit meaning that those who are married and filing jointly can only get a $300 deduction. For the 2021 tax year, however, those who are married and filing jointly can each take a $300 deduction, for a total of $600.

Purpose. Complete Form REV-419 so that your employer can withhold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial situa- tion changes. Photocopies of this form are acceptable.

The PA-501 is a deposit statement used to make a payment and to insure it is properly applied to your employer withholding account. The PA-W3 is used to reconcile the employer withholding activities...

In general, you can deduct up to 60% of your adjusted gross income via charitable donations, but you may be limited to 20%, 30% or 50% depending on the type of contribution and the organization (contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations come

501 is a payment coupon and can not be amended. If you reported more than you owed on the PA501 Deposit Statement, deduct the amount of the overpayment from your next PA501 Deposit Statement within the same quarter.

Taxpayers who take the standard deduction can claim a deduction of up to $300 for cash contributions to qualifying charities made in 2021. Married couples filing jointly can claim up to $600.