Virgin Islands Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Are you presently in the location where you need to access documents for either business or specialized objectives almost every workday.

There are numerous authorized document formats accessible online, but locating ones you can trust is not simple.

US Legal Forms provides a vast array of document formats, such as the Virgin Islands Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which are designed to comply with federal and state regulations.

Choose a convenient file format and download your copy.

Access all the document formats you have purchased in the My documents section. You can acquire an additional copy of the Virgin Islands Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption at any time, if needed. Simply click the desired document to download or print the template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Virgin Islands Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Obtain the document you require and ensure it pertains to your specific city/state.

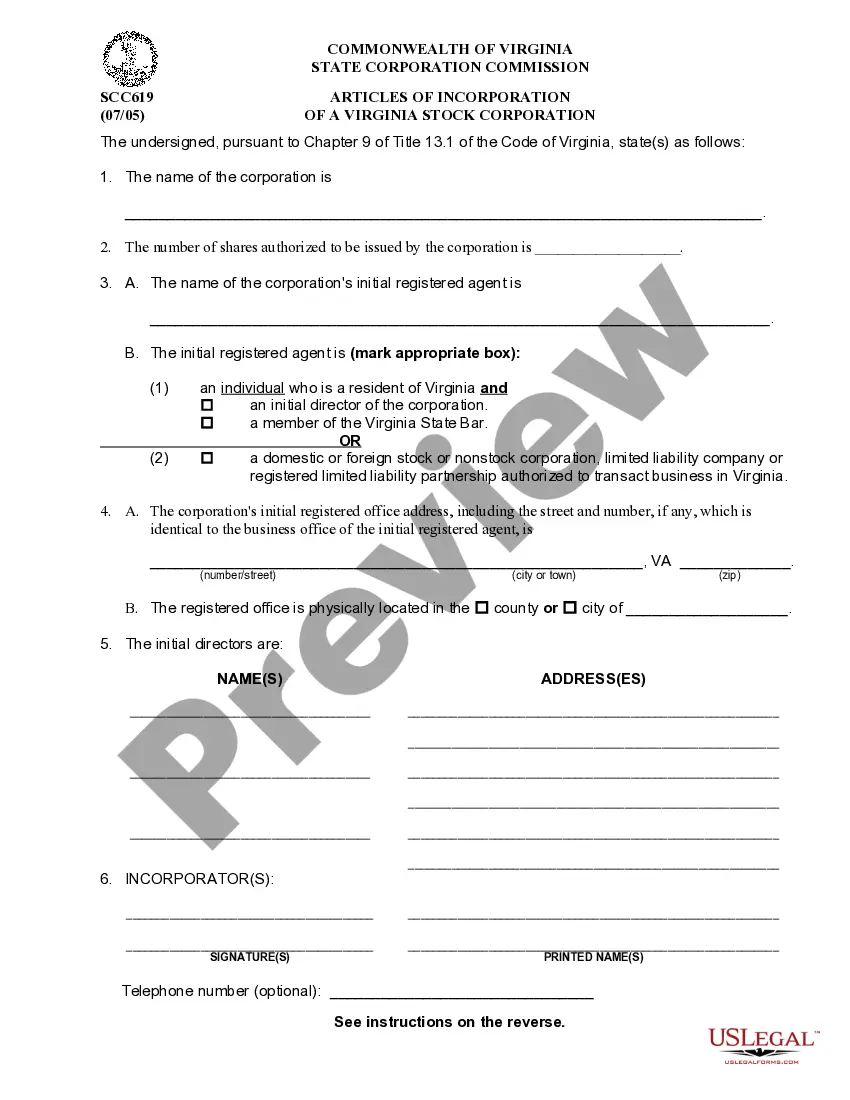

- Utilize the Preview button to examine the form.

- Review the description to confirm you have chosen the correct document.

- If the document is not what you need, use the Research field to find the form that fits your needs and requirements.

- If you find the correct document, click on Acquire now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and complete your order using PayPal or a credit card.

Form popularity

FAQ

Yes, the U.S. Virgin Islands is considered an unincorporated territory of the United States for tax purposes. However, tax regulations can vary significantly, particularly concerning the Virgin Islands Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. Therefore, understanding the specific tax laws applicable here is essential for residents and property sellers.

In a tax year in which you sold an inherited foreign property, you must report the sale on Schedule D of IRS Form 1040, U.S. Individual Income Tax Return. In addition, you will have to submit IRS Form 8949, Sales and Other Dispositions of Capital Assets.

An employer must withhold Additional Medicare Tax from wages it pays to an individual in excess of $200,000 in a calendar year, without regard to the individual's filing status or wages paid by another employer.

We'll automatically add Form 8959 to your return if your income exceeds the threshold amount for your filing status.

The IRS provides an exemption from the Form 1099-S reporting requirement for the sale of your principal residence if you are married and your gain from the sale is $500,000 or less. If you are unmarried, gains of $250,000 or less are exempt.

The Additional Medicare Tax helps to fund some elements of the Affordable Care Act. This includes the premium tax credit and other features. Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans.

When you sell property or real estate in the U.S. you need to report it and you may end up owing a capital gains tax. The same is true if sell overseas property. The U.S. is one of only a few countries that taxes you on worldwide income and gains made from foreign property sales are considered foreign income.

Buyers (transferees), who are generally the withholding agents, must use Forms 8288 and 8288-A to report and pay to the IRS any tax withheld on the acquisition of U.S. real property interests from foreign persons.

Yes, indeed. The law requires you to pay Medicare taxes on all your earnings for as long as you continue to work regardless of whether you're already receiving Medicare benefits.

Yes, you must report foreign properties on your U.S. tax return just like you would report any owned U.S. property. To do that, you first need to know what type of ownership you have because it affects what tax forms you must file.