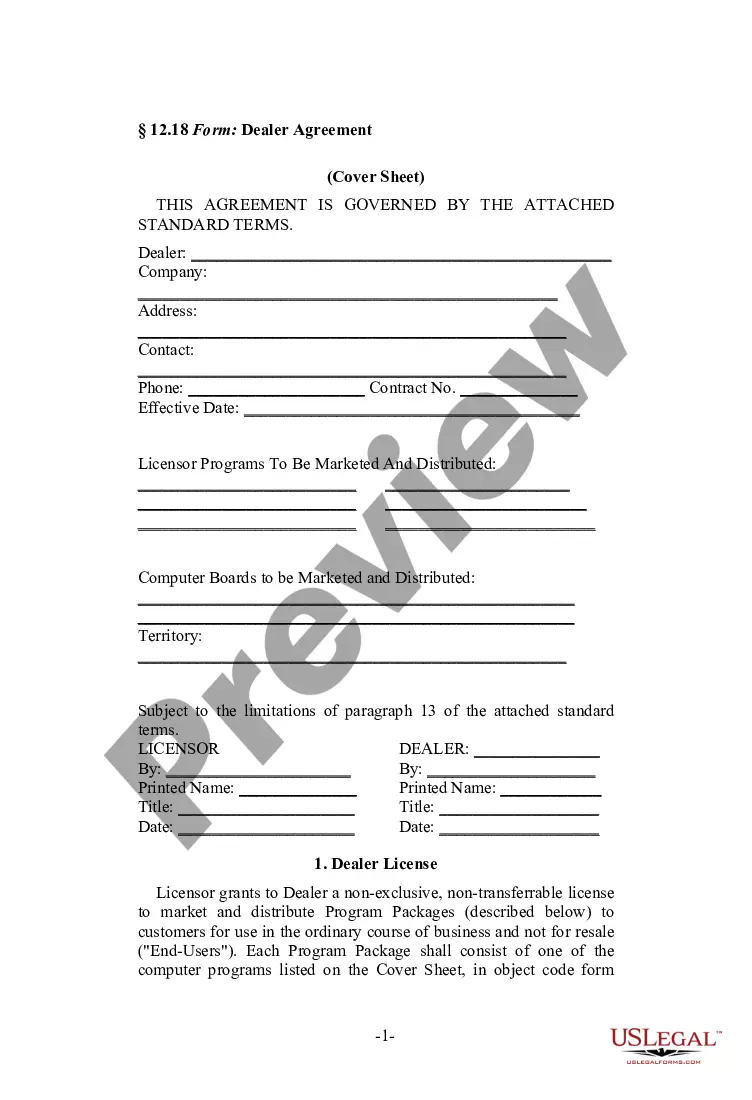

Pennsylvania Agreement between Licensor and Dealer for Sale of Computers, Internet Services, or Software

Description

How to fill out Agreement Between Licensor And Dealer For Sale Of Computers, Internet Services, Or Software?

You can spend numerous hours online trying to locate the legal document format that complies with the state and federal requirements you will need.

US Legal Forms provides thousands of legal forms that can be reviewed by professionals.

You can easily obtain or print the Pennsylvania Agreement between Licensor and Dealer for Sale of Computers, Internet Services, or Software from my assistance.

Review the form details to confirm that you have selected the right one. If available, use the Preview button to peruse the document format as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Pennsylvania Agreement between Licensor and Dealer for Sale of Computers, Internet Services, or Software.

- Each legal document format you acquire is yours forever.

- To obtain an additional copy of any purchased form, visit the My documents tab and click the respective button.

- If you are accessing the US Legal Forms site for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document format for your county/region of choice.

Form popularity

FAQ

Does California require sales tax on Downloadable Custom Software? California does not require sales tax on downloadable custom software.

Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for resale; and residential heating fuels such as oil, electricity, gas, coal and firewood. The Pennsylvania sales tax rate is 6 percent.

Generally, professional services are not taxable in Pennsylvania.

The Pennsylvania Department of Revenue ruled that cloud computing software is subject to Pennsylvania sales and use tax when used by people in-state (SUT-12-001).

Under current Pennsylvania law, Sales and Use Tax applies to sale at retail or use of computer hardware and canned software, as well as services thereto. According to the same law, computer programming, computer integrated systems design, computer processing, data preparation or processing, information retrieval,

When it comes to SaaS and cloud computing, taxability is determined by the user's location. Pennsylvania's Department of Revenue considers a license to access the software a tangible, taxable item, just as it defines electronically downloaded software to be tangible and therefore subject to taxes.

In summary, the Pennsylvania Department of Revenue considers both tangible and electronic canned software, such as QuickBooks, Microsoft Office, Adobe Creative Suite, as taxable tangible personal property and thus is taxable. Taxable tangible personal property also includes: streaming & digital downloads.

Recently, the Pennsylvania Department of Revenue issued Letter Ruling SUT-17-002, concluding that sales of information retrieval products accessed electronically are subject to Pennsylvania sales and use tax as sales of tangible personal property.

Services in Pennsylvania are generally not taxable. However if the service you provide includes selling, repairing or building a product that service may be taxable.

Yes. The Sales Tax regulation on computer services is found in the PA Code.