Montana Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

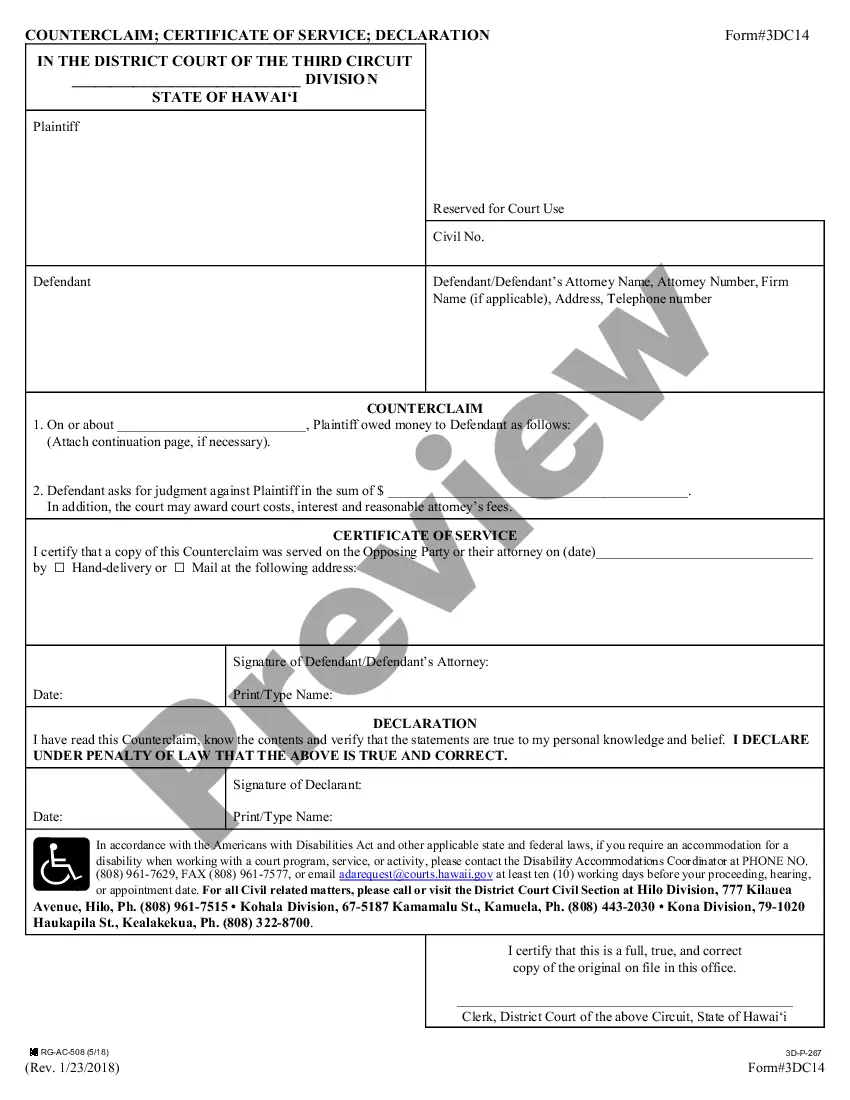

How to fill out Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

Selecting the finest legal document template can be a considerable challenge.

Of course, there are numerous templates accessible online, but how can you find the legal document you require.

Utilize the US Legal Forms website. This service provides a vast array of templates, such as the Montana Liquidation of Partnership with Authority, Rights and Obligations during Liquidation, suitable for both business and personal needs.

First, ensure you have selected the correct document for your region/community. You can review the document using the Preview option and check the document description to confirm it meets your needs. If the document does not satisfy your requirements, utilize the Search field to find the appropriate document. Once you are certain that the document is suitable, click the Purchase now button to acquire the document. Choose the payment plan you prefer and enter the necessary details. Create your account and complete the purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Montana Liquidation of Partnership with Authority, Rights and Obligations during Liquidation. US Legal Forms is the largest repository of legal documents where you can find a variety of document templates. Make use of the service to download properly crafted documents that comply with state regulations.

- All templates are reviewed by experts and comply with federal and state standards.

- If you are already registered, Log In to your account and click on the Download button to obtain the Montana Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

- Use your account to review the legal templates you have previously purchased.

- Go to the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward guidelines for you to follow.

Form popularity

FAQ

When partners opt to liquidate, it is essential to follow a structured approach to ensure all obligations are met. This includes notifying creditors, settling debts, and determining how assets will be divided. Engaging with the Montana Liquidation of Partnership with Authority, Rights and Obligations during Liquidation can provide clarity and guide partners through each step.

In order to dissolve a partnership, the following four accounting steps must be executed: sell noncash assets; allocate any gains or losses arising from the sale based on the partnership agreement; pay off liabilities; distribute the remaining funds based on capital account balances of the partners.

Simply put, a dissolution is a (typically) voluntary legal closure of a business while a liquidation involves the selling of a company's assets in order to pay creditors.

Generally, however, the liquidators of a partnership pay non-partner creditors first, followed by partners who are also creditors of the partnership. If any assets remain after satisfying these obligations, then partners who have contributed capital to the partnership are entitled to their capital contributions.

A Statement of Affairs is a document detailing a company's assets and liabilities. Generally prepared by a liquidator or appointed professional during certain insolvency proceedings, the document is later registered at Companies House, where it becomes available for public view.

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

Partners share the profits and are all responsible for paying the debts of the business. An insolvent partnership can be wound up through the same processes used for bankruptcy, liquidating (winding-up) a limited company or both.

Definition: Partnership liquidation is the process of closing the partnership and distributing its assets. Many times partners choose to dissolve and liquidate their partnerships to start new ventures. Other times, partnerships go bankrupt and are forced to liquidate in order to pay off their creditors.

In general, the statement of net assets in liquidation, which replaces the balance sheet, is presented in an unclassified format with the excess of assets over liabilities shown as a single amount designated net assets in liquidation (or vice versa if liabilities exceed assets).

A partnership liquidation happens where the partners have decided that the partnership has no viable future or purpose, and a decision may be made to cease trading and wind up the business.