Sample Letter for Official Notice of Intent to Administratively Dissolve or Revoke

Description

How to fill out Sample Letter For Official Notice Of Intent To Administratively Dissolve Or Revoke?

Use US Legal Forms to obtain a printable Sample Letter for Official Notice of Intent to Administratively Dissolve or Revoke. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms catalogue online and offers cost-effective and accurate samples for consumers and legal professionals, and SMBs. The documents are grouped into state-based categories and a few of them might be previewed before being downloaded.

To download templates, users need to have a subscription and to log in to their account. Press Download next to any template you want and find it in My Forms.

For those who don’t have a subscription, follow the tips below to quickly find and download Sample Letter for Official Notice of Intent to Administratively Dissolve or Revoke:

- Check out to make sure you have the right form with regards to the state it’s needed in.

- Review the document by reading the description and by using the Preview feature.

- Press Buy Now if it is the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it many times.

- Make use of the Search engine if you want to find another document template.

US Legal Forms provides thousands of legal and tax samples and packages for business and personal needs, including Sample Letter for Official Notice of Intent to Administratively Dissolve or Revoke. Above three million users already have used our service successfully. Choose your subscription plan and have high-quality documents within a few clicks.

Form popularity

FAQ

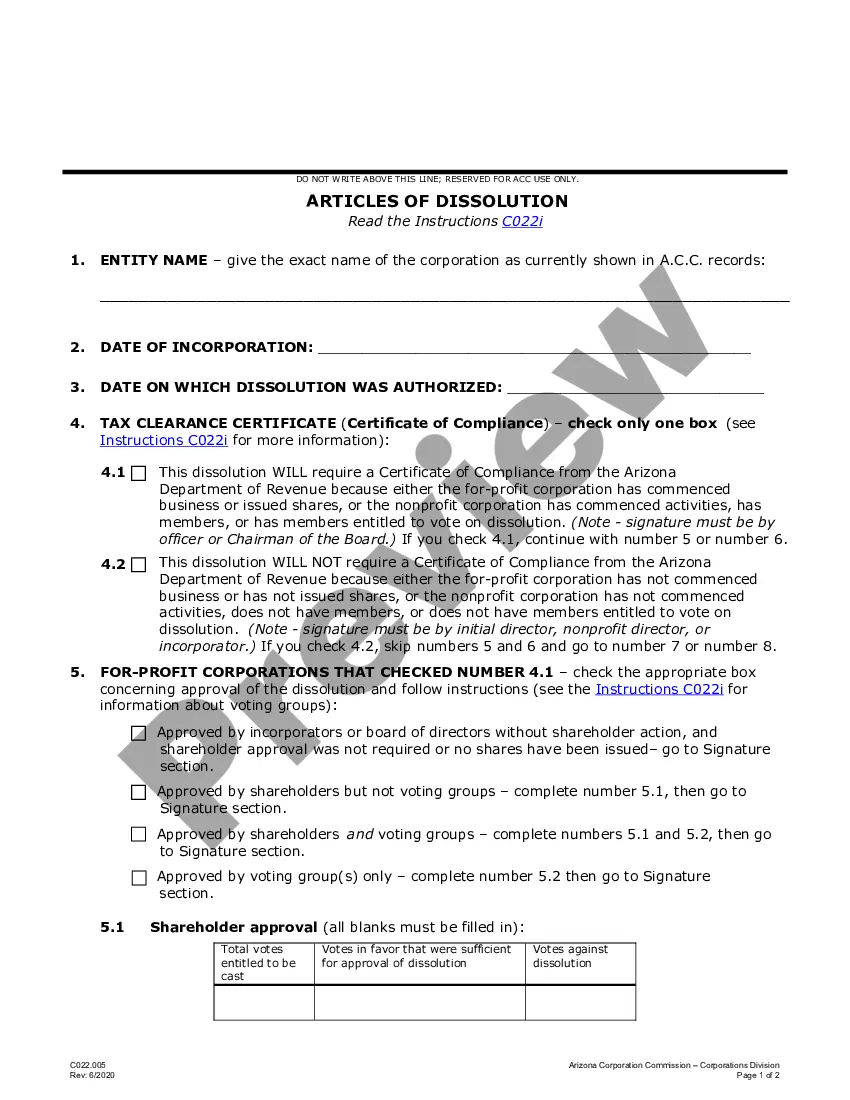

Administrative Dissolution of an LLC Occasionally, owners elect to end the business or the business ends involuntarily. If it ends involuntarily, the business may end with administration dissolution. LLCs begin when owners file articles of organization with the secretary of state.

It takes at least three months for a company to be officially dissolved. However, if the process is complex and some tasks need to be completed to close the business, it will take longer.

In legal terms, when a company is dissolved, it ceases to exist. It cannot still be trading - although a person may trade (misleadingly) using its name.

Admin dissolution for annual report definition is the temporary removal of a company's ability to conduct business in the state of registration because they failed to file the required annual reports or follow other legal guidelines.

In theory, a dissolved corporation can be sued. However, getting a lawsuit to stick is tricky. For one, each state's laws allow a specific period of time for lawsuits to be brought against a dissolved corporation typically, this is allowed for a period of up to three years.

The maximum penalty is for the LLC to be administratively dissolved or terminated. This means that the LLC's right to conduct business is ended and the only action the LLC can lawfully take is to wind up its affairs, pay its remaining debts and distribute the remaining assets to the owners.

Administrative dissolution is an action taken by the Secretary of State that results in the loss of a business entity's rights, powers and authority. Reinstatement is the action taken that restores an administratively dissolved business entity's rights, powers, and authority.