Pennsylvania Release from Liability under Guaranty

Description

How to fill out Release From Liability Under Guaranty?

Are you presently in a position where you require documents for either your organization or specific objectives nearly every day.

There are numerous official document templates available online, yet finding forms you can trust is not straightforward.

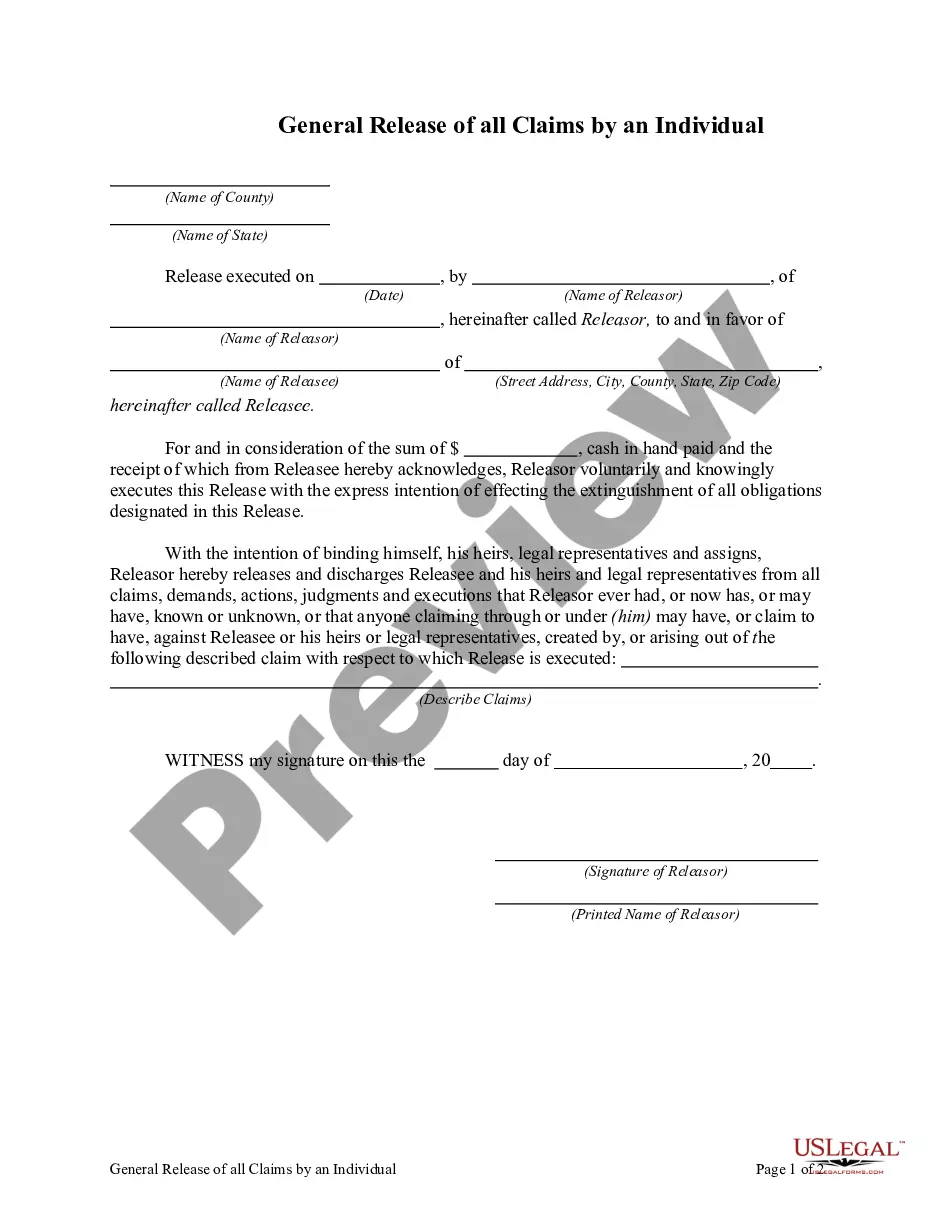

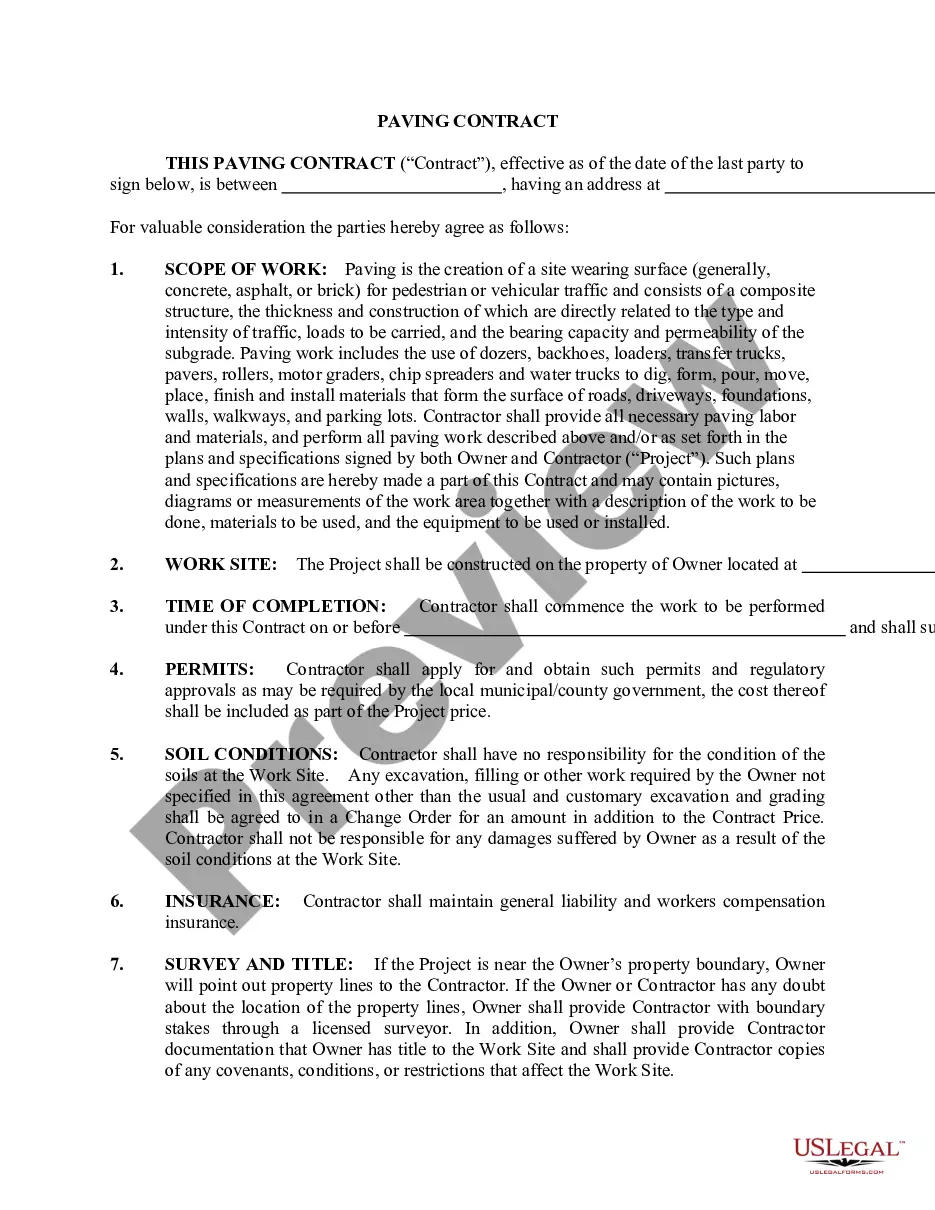

US Legal Forms offers a vast selection of form templates, including the Pennsylvania Release from Liability under Guaranty, tailored to comply with state and federal regulations.

Once you find the correct form, click Purchase now.

Select the pricing plan you prefer, fill out the necessary information to create your account, and pay for the order with your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Pennsylvania Release from Liability under Guaranty template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it pertains to the appropriate city/area.

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form does not match your requirements, utilize the Research section to find a form that meets your needs.

Form popularity

FAQ

Definition of guaranty (Entry 1 of 2) 1 : an undertaking to answer for the payment of a debt or the performance of a duty of another in case of the other's default or miscarriage. 2 : guarantee sense 3. 3 : guarantor. 4 : something given as security (see security sense 2) : pledge used our house as a guaranty for the

Purpose of GuarantyThe guarantor agrees to pay the obligations of the borrower under the loan agreement in the event that the borrower does not pay. In addition to being an alternate source of repayment, guaranties provide evidence that the guarantor intends to stand behind the borrower.

Discharge of Guarantor by Release of Principal Debtor: Section 134 of the ICA provides that the guarantor shall stand discharged from its liabilities under a contract of guarantee in case of any agreement arrived at between the creditor and the principal debtor, by which the principal debtor is released.

7 Ways to Avoid a Personal GuaranteeBuy insurance.Raise the interest rate.Increase Reporting.Increased the Frequency of Payments.Add a Fidelity Certificate.Limit the Guarantee Time Period.Use Other Collateral.

If a guarantor contacts the company to revoke the guaranty, best practices indicate that some consideration should be given for release of the guaranty and such release/revocation should be documented in writing by all parties involved.

A Release of Guarantee Form is a document that allows a guarantor to free themselves from being financially and/or legally bound to a contract. This is common for loan agreements and lease documents after expiration or when the contract has been fully satisfied.

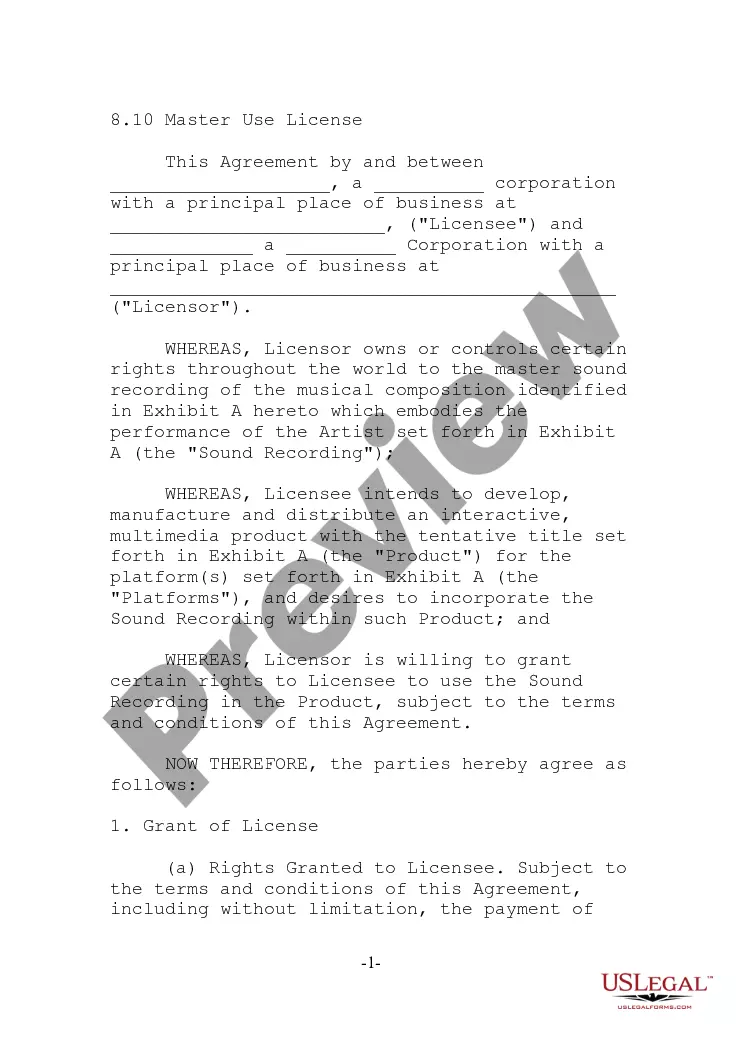

A guarantee is an agreement through which an individual or legal entity undertakes to meet certain obligations, such as paying a third party's debt if the latter defaults.

A guarantee can be released by agreementeither be made as a deed or be supported by sufficient consideration. In some cases, when a guarantee is released, the guaranteed party will return the guarantee document to the guarantor.

In the same way, a guarantee produces a legal effect wherein one party affirms the promise of another (usually to pay) by promising to themselves pay if default occurs. At law, the giver of a guarantee is called the surety or the "guarantor".

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.