Arkansas Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment

Description

How to fill out Agreement For Assignment And Sale Of Partnership Interest And Reorganization With Purchaser As New Partner Including Assignment?

Selecting the optimal authorized document format could be a challenge.

Clearly, there are numerous templates available online, but how do you locate the authorized form you require.

Utilize the US Legal Forms website. The service offers a vast selection of templates, such as the Arkansas Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment, suitable for business and personal needs.

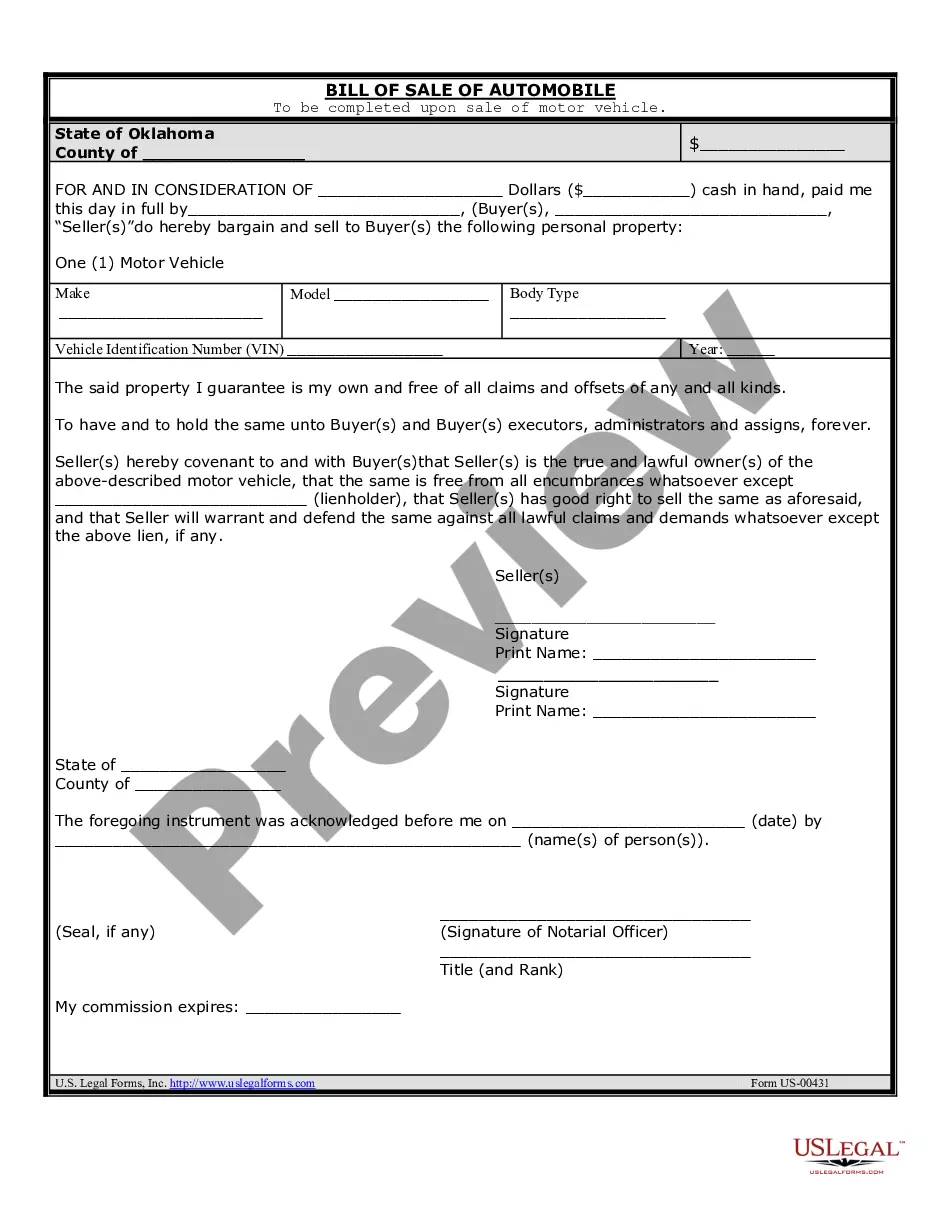

You can view the form using the Preview button and examine the form description to confirm it is the right one for your needs.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Acquire button to obtain the Arkansas Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment.

- Use your account to browse the legal forms you may have acquired previously.

- Navigate to the My documents tab of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Gifting an interest in a partnership is possible, but it usually requires the consent of the other partners as outlined in the partnership agreement. The Arkansas Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can be adapted to document the gift properly. Engaging all partners in this process promotes transparency and helps maintain relationships.

To record the sale of a partnership interest, you must document the transaction formally with an agreement that outlines the terms of the sale. Utilizing the Arkansas Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment ensures compliance and provides a clear record of the transfer. Proper record-keeping is essential for legal protection and tax purposes.

A partnership agreement typically includes the names of the partners, the business purpose, the distribution of profits and losses, and the procedures for adding or removing partners. Each element provides clarity and direction for the partnership. The Arkansas Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can help structure these provisions effectively.

Transferring partnership interest to another person is indeed possible, but it usually requires consent from the remaining partners. The Arkansas Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment serves as an excellent tool to document this transfer legally. Ensuring all parties are informed will help maintain harmony within the partnership.

Yes, a partnership can be transferred, though the process depends on the partnership agreement and state laws. The Arkansas Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment provides a structured method for such transfers. It is crucial to follow appropriate legal channels to avoid complications and ensure a valid transfer.

Changing partners in a partnership is possible and often requires a formal agreement among the existing and new partners. Utilizing the Arkansas Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can help ensure that all terms are clearly outlined and understood. This approach minimizes disputes and fosters transparency among partners.

Yes, you can exchange a partnership interest, but it typically requires the consent of all partners. The Arkansas Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can facilitate this process. Proper documentation is essential to ensure a smooth transition and to maintain legal compliance.

When you sell your partnership interest, you must document the sale properly for tax purposes. This involves detailing the transaction on your tax return and possibly completing additional IRS forms regarding capital gains. The Arkansas Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can serve as a key document to support your reporting efforts. Additionally, seeking guidance from a tax professional can ensure you handle the reporting correctly.

To report a sale of partnership interest, you need to provide details of the transaction on your tax returns, specifically using IRS forms related to capital gains. The Arkansas Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment will help document the sale and specify the terms. It is advisable to maintain proper records and consult with a tax advisor for accurate reporting and compliance.

The assignment of partnership interest agreement is a legal document that facilitates the transfer of a partner's share of the partnership to another party. This agreement outlines the rights, duties, and benefits associated with the partnership interest being assigned. Utilizing an Arkansas Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment ensures that the transaction is legal and binding. This structured approach minimizes misunderstandings among partners.