Connecticut Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment

Description

How to fill out Agreement For Assignment And Sale Of Partnership Interest And Reorganization With Purchaser As New Partner Including Assignment?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can obtain the most recent versions of forms like the Connecticut Agreement for Transfer and Sale of Partnership Interest and Reorganization with Buyer as New Partner, including Transfer, in seconds.

Check the form details to confirm you have selected the right one.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you already have a subscription, Log In to download the Connecticut Agreement for Transfer and Sale of Partnership Interest and Reorganization with Buyer as New Partner, including Transfer, from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You will have access to all previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to check the form's content.

Form popularity

FAQ

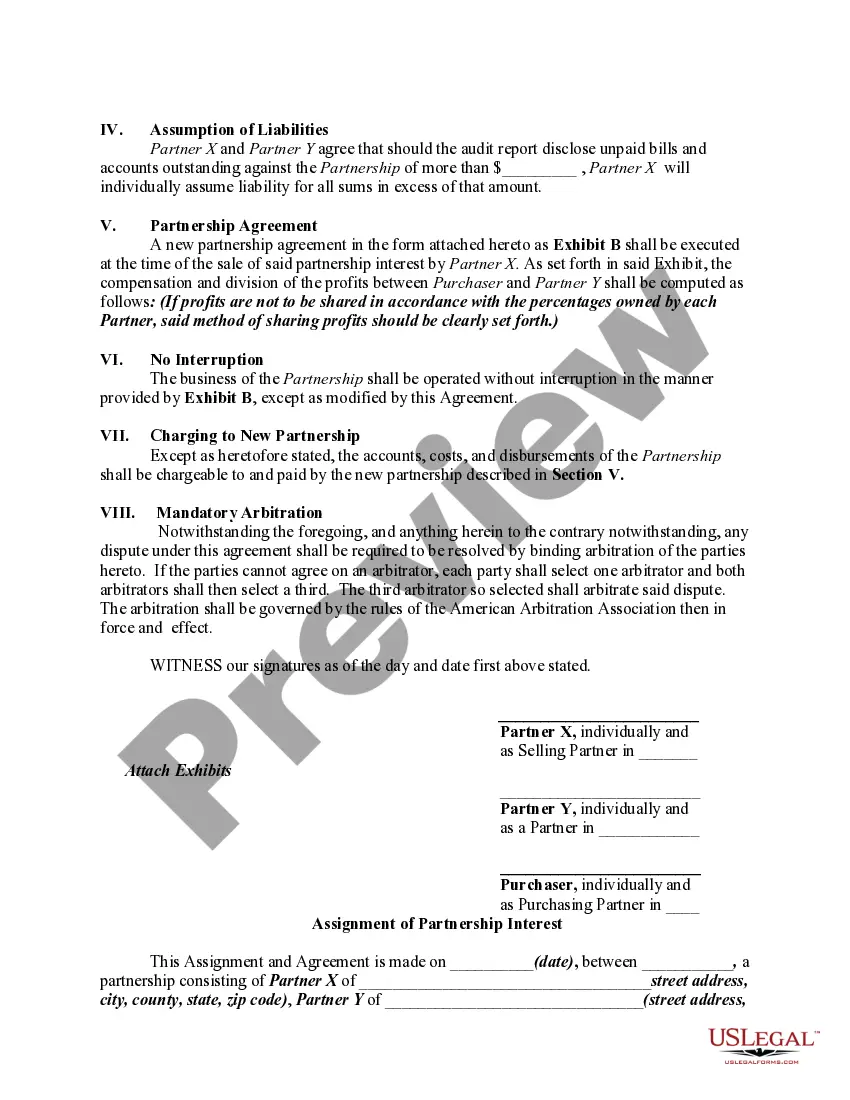

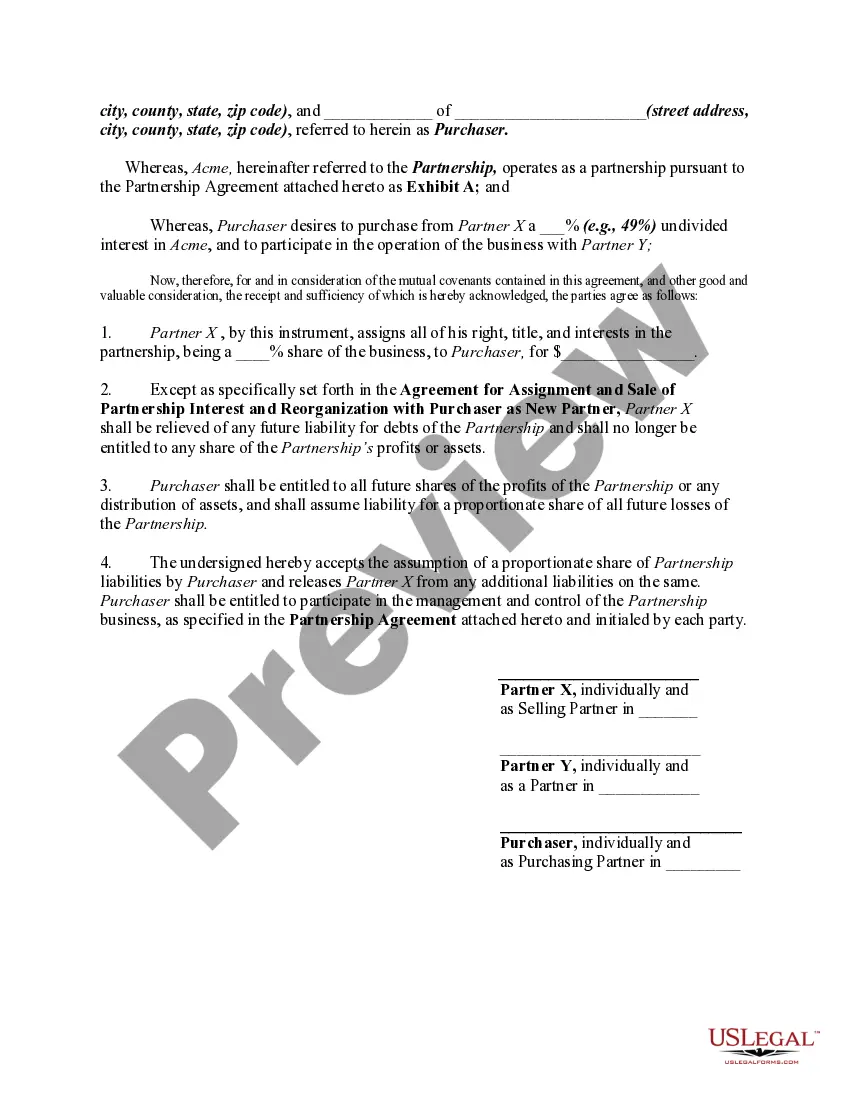

A partner's interest in a partnership is generally transferable, but this may depend on the terms set forth in the partnership agreement. Some agreements may restrict or require consent from other partners before a transfer can occur. For a smooth transition, the Connecticut Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment outlines the necessary steps to facilitate such transfers.

To report a sale of partnership interest, you should prepare the necessary tax forms detailing the transaction and any gains or losses. This includes filing Schedule D and Form 8949 with your individual tax returns. It is advisable to consult the Connecticut Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment to understand your reporting obligations fully.

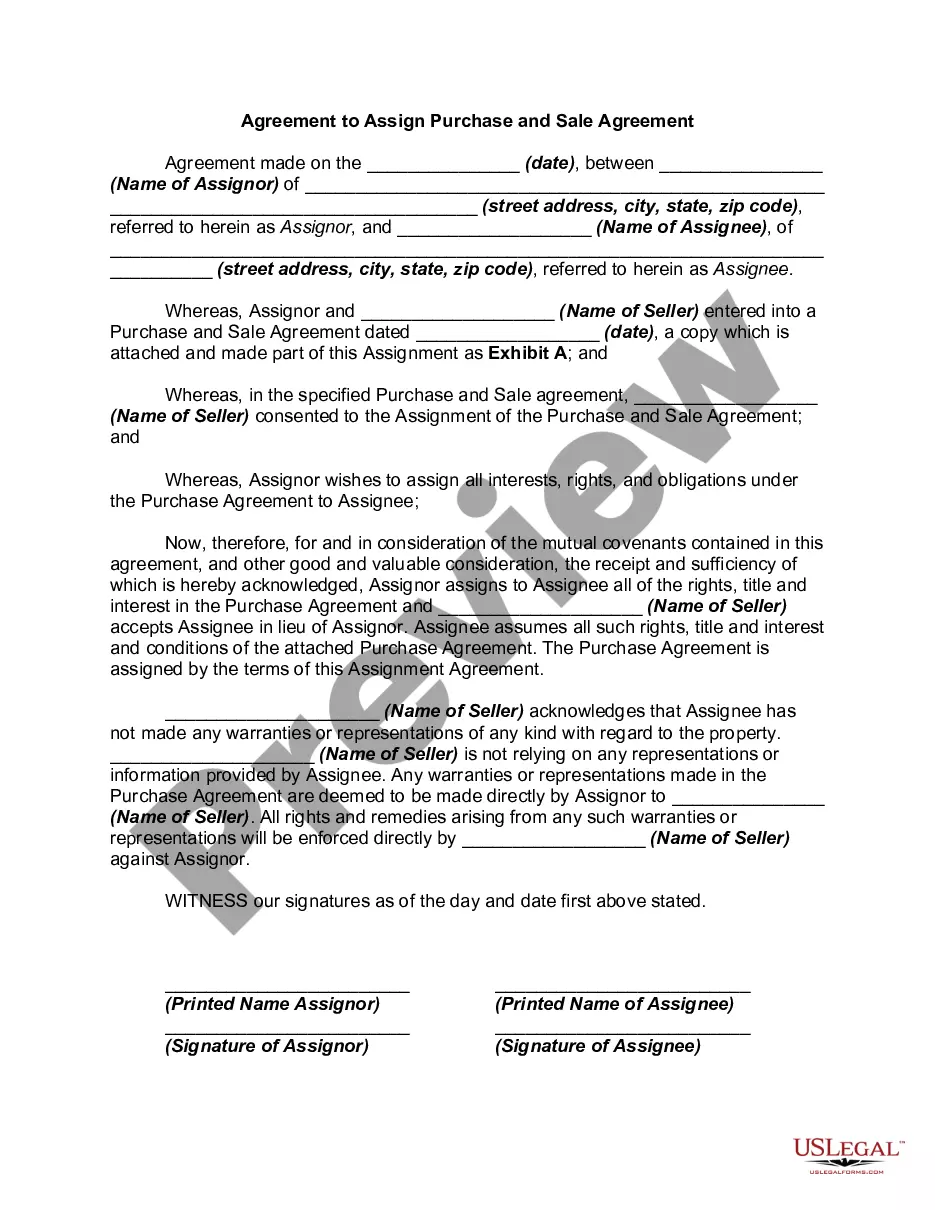

A transfer of partnership interest refers to moving a partner's ownership rights to another entity or individual, usually governed by the partnership agreement. This action can have tax implications and affect the management structure of the partnership. For ensuring a smooth transition, consider the Connecticut Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment as a comprehensive guide.

Yes, you can assign a partnership interest, but it typically requires the consent of the other partners. Assignment of interest modifies the distribution of profits and responsibilities within the partnership. Utilizing the Connecticut Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can help streamline this process and ensure all legal requirements are met.

A transfer of partnership interest to another partner involves one partner selling or assigning their stake to another partner within the same partnership. This process may require the approval of remaining partners, depending on the partnership agreement. For clarity and compliance, refer to the Connecticut Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment to facilitate this arrangement.

The transfer of interest signifies the process where a partner relinquishes their ownership stake in a partnership. This transfer can occur through sale, gift, or inheritance, affecting the distribution of profits, losses, and control over partnership affairs. When considering such transfers, it's wise to refer to the Connecticut Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment.

A 351 transfer of partnership interest refers to a non-recognition event under the Internal Revenue Code where partners transfer property to a partnership in exchange for partnership interests. This transfer allows partners to defer acknowledging any gain or loss at the time of the transaction. For partners involved, documenting this transfer within a Connecticut Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment ensures compliance.

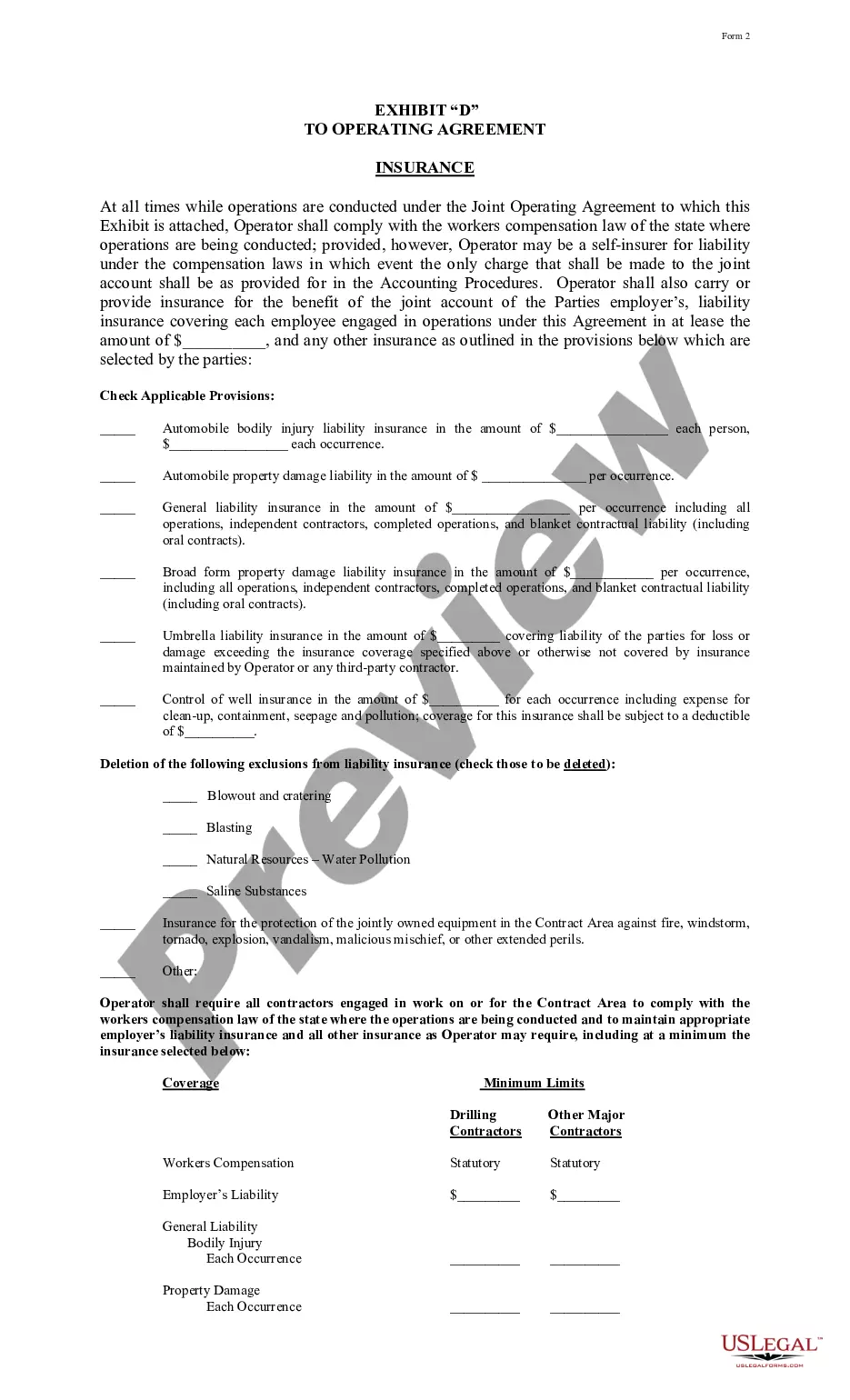

To structure a partnership agreement effectively, start by defining each partner’s contributions, responsibilities, and profit-sharing ratio. Include terms related to governance, dispute resolution, and amendment procedures. By establishing a clear framework, you ensure a smoother operation. For specifics, utilizing the Connecticut Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment can provide essential guidance.

The transfer of partnership interest involves a partner assigning their stake and associated rights to another individual. This process must be documented properly, as seen in a Connecticut Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment, to validate the transition and notify all parties involved about the changes.

The four main types of partnerships include general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type has different structures and implications for liability and management. Understanding these differences is essential when creating a Connecticut Agreement for Assignment and Sale of Partnership Interest and Reorganization with Purchaser as New Partner including Assignment to ensure it aligns with your partnership's needs.