Pennsylvania Sample Letter regarding Modification Agreement

Description

How to fill out Sample Letter Regarding Modification Agreement?

Are you currently in a placement in which you need files for possibly enterprise or specific uses virtually every day? There are plenty of authorized document layouts accessible on the Internet, but finding kinds you can rely isn`t straightforward. US Legal Forms provides thousands of type layouts, much like the Pennsylvania Sample Letter regarding Modification Agreement, that happen to be composed in order to meet federal and state needs.

Should you be already knowledgeable about US Legal Forms internet site and also have a free account, basically log in. After that, it is possible to download the Pennsylvania Sample Letter regarding Modification Agreement template.

If you do not provide an account and want to begin to use US Legal Forms, follow these steps:

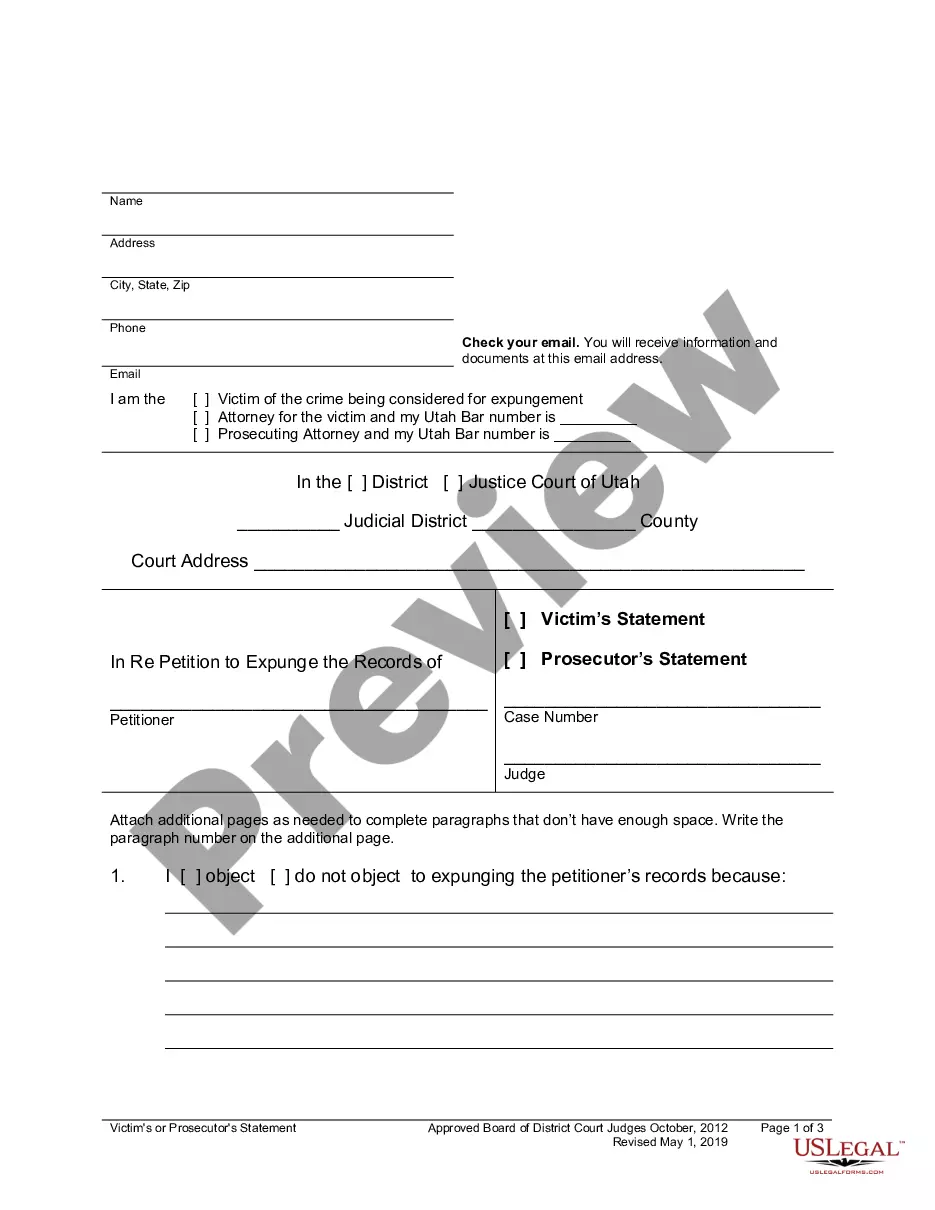

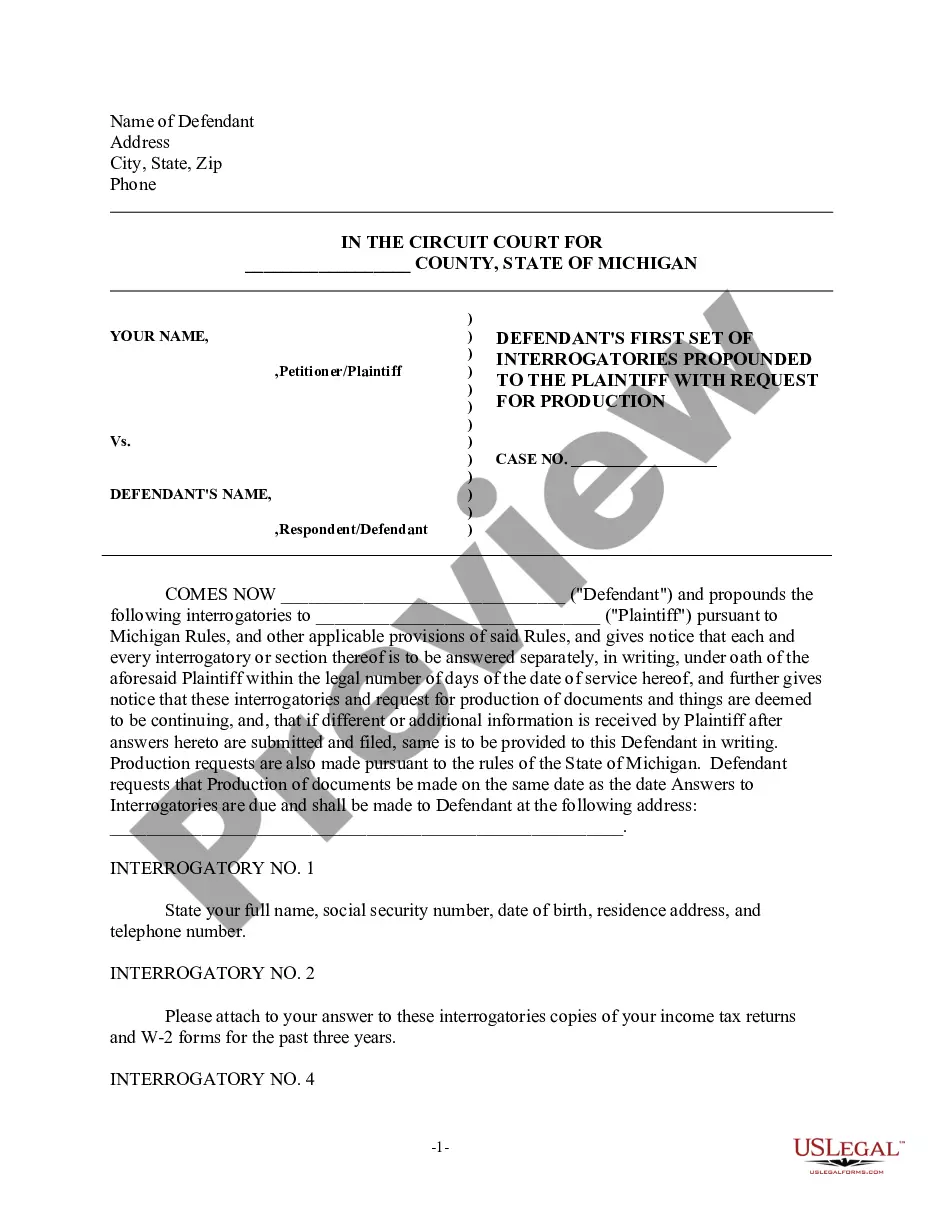

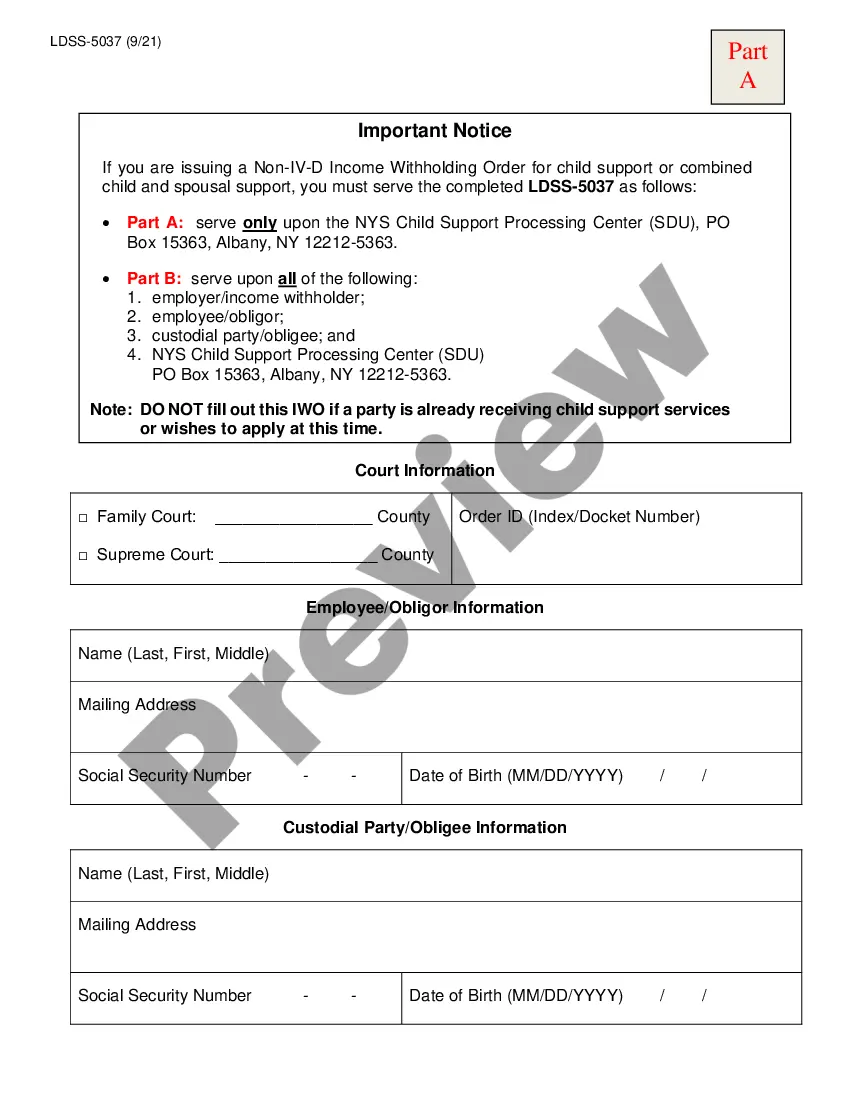

- Find the type you require and ensure it is for the proper town/region.

- Take advantage of the Preview button to examine the form.

- See the explanation to ensure that you have selected the appropriate type.

- In the event the type isn`t what you are trying to find, use the Research industry to get the type that fits your needs and needs.

- When you obtain the proper type, just click Purchase now.

- Choose the rates plan you want, submit the specified information and facts to produce your money, and purchase an order with your PayPal or credit card.

- Choose a convenient file file format and download your duplicate.

Discover all of the document layouts you might have bought in the My Forms menu. You may get a more duplicate of Pennsylvania Sample Letter regarding Modification Agreement at any time, if possible. Just select the required type to download or print out the document template.

Use US Legal Forms, one of the most comprehensive variety of authorized varieties, to save lots of time and prevent faults. The service provides skillfully created authorized document layouts which can be used for a selection of uses. Create a free account on US Legal Forms and commence generating your lifestyle easier.

Form popularity

FAQ

Making a Loan Modification Letter allows you to seek relief from your lenders when your financial situation changes. Unlike a forbearance, which is typically temporary, a loan modification permanently alters your loan payment plan and is a long-term solution if you do not think your financial situation will improve.

If your modification is temporary, you'll likely need to return to the original terms of your mortgage and repay the amount that was deferred before you can qualify for a new purchase or refinance loan.

A modification agreement is meant for all changes to the loan which represent a new agreement between the parties different from the initial agreement. Typically, this will be used for material terms such as the maturity date, interest rate, an increase or decrease in the loan amount, or an adjustment to holdbacks.

If you are looking to request a loan modification, your lender will most likely ask you to write a hardship letter. The purpose of the letter is to describe why the borrower may not be able to make their mortgage, car loan, or other debt payments.

Loan term changes: If you're having trouble making your monthly payments, you may be able to modify your loan and extend your term. This gives you more time to repay your loan and reduces the amount you must pay every month.