In this agreement, a senior attorney desires to be relieved of the active management and business of the law practice, and to eventually retire. His younger partner will undertake the active management and business of the law practice, with the view of eventually taking it over.

Pennsylvania Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner

Description

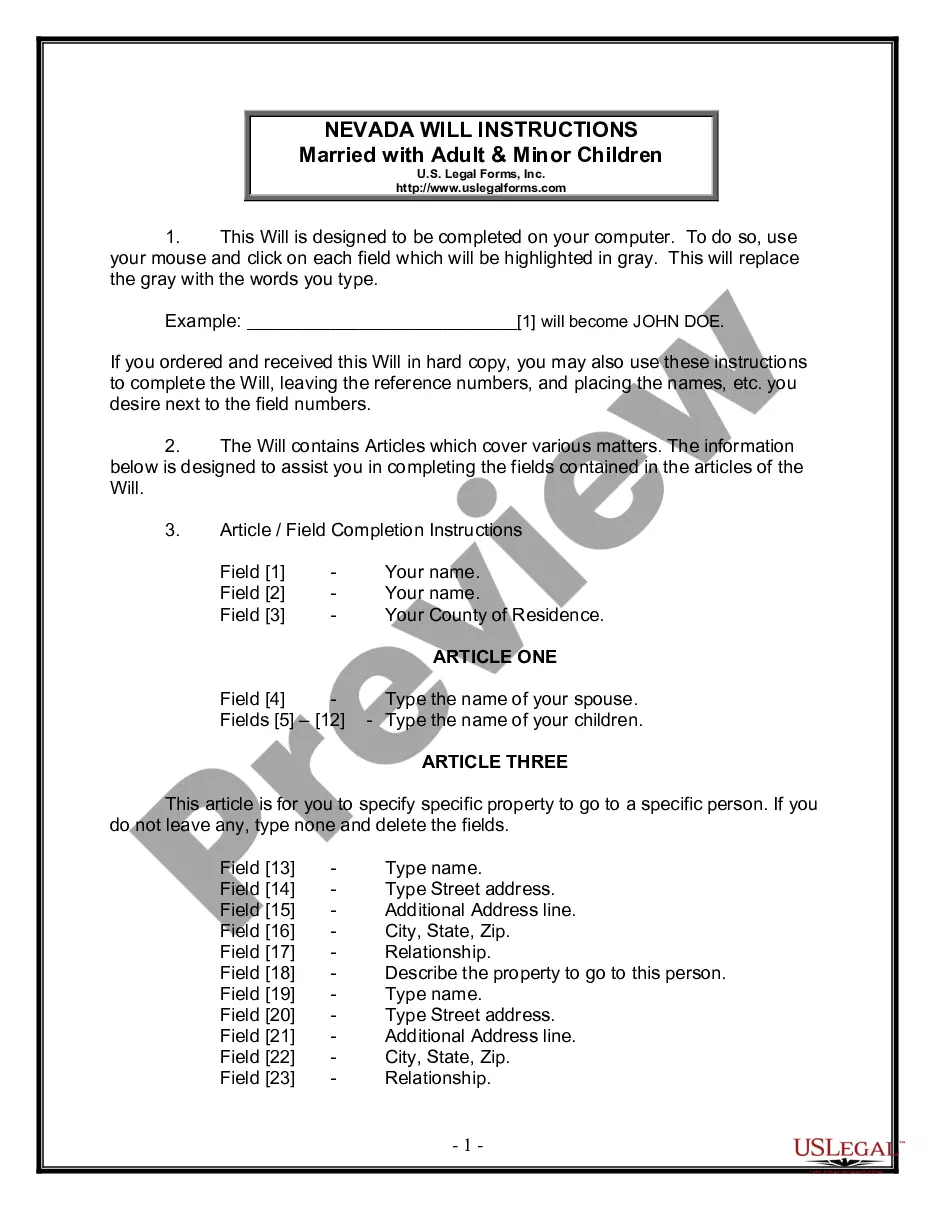

How to fill out Law Partnership Agreement Between Two Partners With Provisions For Eventual Retirement Of Senior Partner?

Finding the correct legal document template can be a challenge. Of course, there are numerous templates available online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the Pennsylvania Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner, which can be used for business and personal purposes. All of the forms are verified by experts and comply with state and federal regulations.

If you are already a registered user, Log In to your account and click the Download button to obtain the Pennsylvania Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner. Use your account to search through the legal forms you may have previously purchased. Go to the My documents tab in your account and download an additional copy of the documents you need.

Select the document format and download the legal document template to your device. Complete, edit, and print the obtained Pennsylvania Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner. US Legal Forms is indeed the largest collection of legal forms where you can find various document templates. Take advantage of the service to download properly crafted documents that comply with state requirements.

- First, ensure that you have selected the correct form for your region/locality.

- You can review the document using the Review option and read the document details to confirm it is suitable for your needs.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are certain that the document is correct, click the Get now button to obtain the form.

- Choose the pricing plan you wish to use and enter the required information.

- Create your account and pay for the transaction using your PayPal account or credit card.

Form popularity

FAQ

If a partner dies, the remaining partners can continue the business as per the terms outlined in the Pennsylvania Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner. This agreement often specifies how the deceased partner's share will be handled, including buyout options for the remaining partners. Proper planning ensures that the firm can operate smoothly and adapt to this significant change.

When a partner retires from a partnership firm, the specifics depend on the Pennsylvania Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner. Typically, retirement involves final financial settlements and adjustments to the partnership structure. It's crucial for remaining partners to communicate effectively to ensure all expectations align during this transition.

Yes, a partnership can continue to operate even if one partner leaves, provided the partnership agreement allows for it. The Pennsylvania Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner usually includes clauses that detail the process for handling a partner's departure, ensuring that the remaining partners can manage the business without disruption.

In Pennsylvania, partnerships must register their business with the appropriate state authorities, which includes submitting a registration form and paying any necessary fees. Depending on the nature of the partnership, you may also need to obtain an Employer Identification Number (EIN) from the IRS. The Pennsylvania Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner can help structure these requirements effectively.

When a partner retires, the partnership must typically follow the terms outlined in the Pennsylvania Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner. This agreement often details how the assets and responsibilities will be divided among the remaining partners. Additionally, the retired partner may receive a payout based on their share of the partnership equity, ensuring a smooth transition for all parties involved.

A PA limited partnership is a specific type of business entity recognized in Pennsylvania, consisting of both general and limited partners. The general partners manage the business while bearing full personal liability, while limited partners invest capital with limited liability. This structure benefits many businesses by allowing for easy access to funding while clearly defining management roles. As with any partnership, including a Pennsylvania Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner can simplify the process of transitioning leadership.

Yes, a general partnership can be formed without a written agreement, simply by two or more people operating a business together. However, operating without a formal agreement can lead to misunderstandings about each partner’s roles and responsibilities. Without clear guidelines, partners may struggle to resolve disputes, especially concerning financial contributions or the retirement of a senior partner. It’s advisable to create a Pennsylvania Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner to provide structure and clarity.

General partnerships do not require formal registration in Pennsylvania, making them easy to establish. However, it is wise to have a written agreement that outlines the terms of the partnership. This agreement can address various issues such as profit sharing, responsibilities, and even provisions for the eventual retirement of a senior partner. Establishing clarity upfront can prevent potential disputes down the road.

Someone might choose a limited partnership to combine the benefits of limited liability with the ability to invest without managing the business. This structure also attracts investors who want to minimize their risk while benefiting from potential profits. Furthermore, a partnership agreement can establish clear terms regarding responsibilities and compensation, making it easier for partners to part ways, especially when planning for the eventual retirement of a senior partner.

In simple terms, a limited partnership is a business partnership where not all partners are actively involved in managing the business. Generally, one or more partners take on the active role and management, while others contribute financially but keep their involvement limited. This arrangement benefits those who want to invest without taking on the day-to-day responsibilities. It is crucial to consider incorporating a Pennsylvania Law Partnership Agreement between Two Partners with Provisions for Eventual Retirement of Senior Partner to address future transitions.