When the parties have not clearly indicated whether or not their business constitutes a partnership, the law has determined several guidelines to aid Courts in determining whether the parties have created a partnership. The fact that the parties share profits and losses is strong evidence of a partnership.

Pennsylvania Disclaimer of Partnership

Description

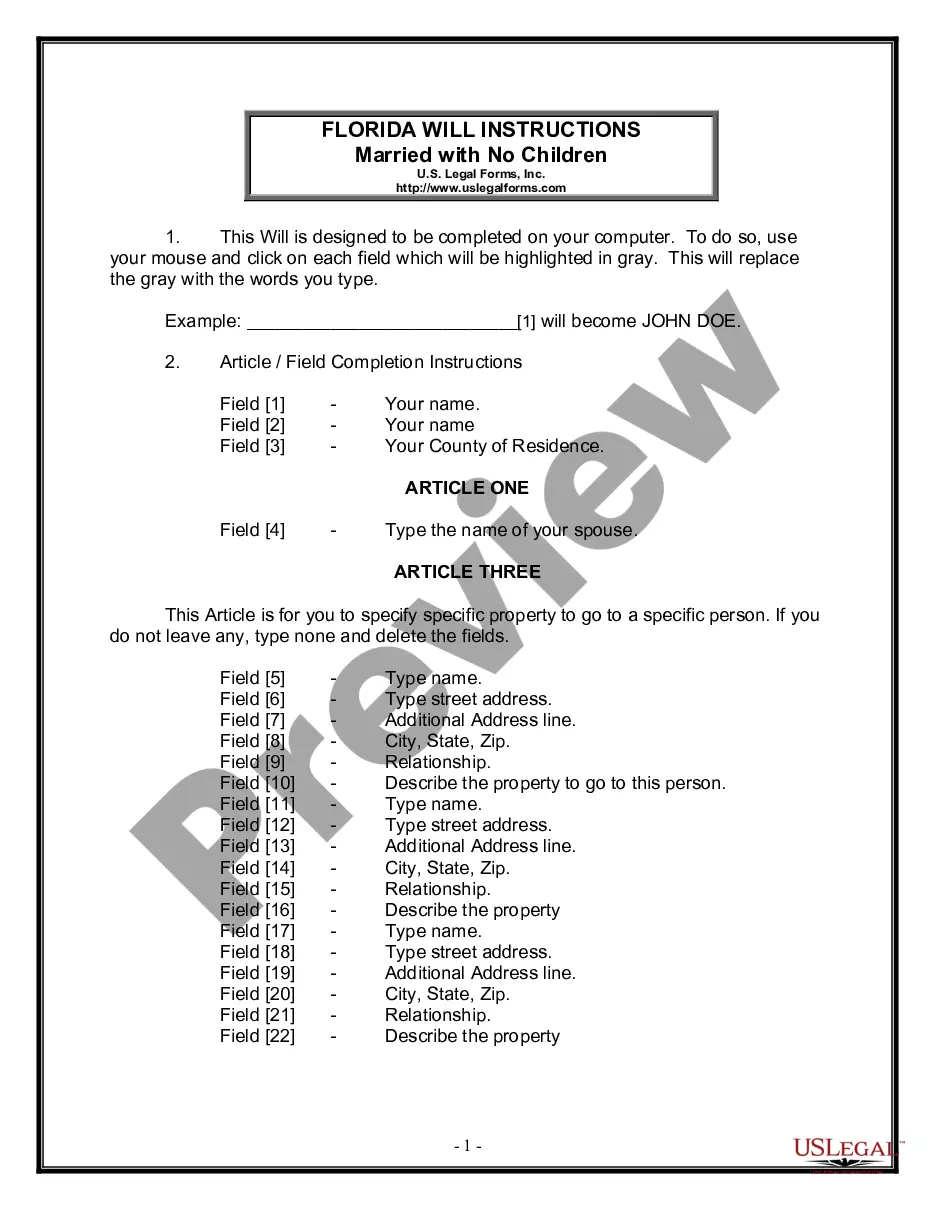

How to fill out Disclaimer Of Partnership?

Are you currently in a situation where you require documents for potential business or personal purposes almost every working day.

There are numerous legitimate document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Pennsylvania Disclaimer of Partnership, which are crafted to meet federal and state regulations.

Once you locate the right form, click Buy now.

Select the pricing plan you prefer, fill in the necessary details to create your account, and pay for your order using either PayPal or a credit card.

- If you are already acquainted with the US Legal Forms site and possess an account, simply Log In.

- You can then download the Pennsylvania Disclaimer of Partnership template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the appropriate city/state.

- Use the Review button to examine the form.

- Check the summary to confirm that you have chosen the correct form.

- If the form does not meet your requirements, use the Search box to find the form that matches your needs and specifications.

Form popularity

FAQ

Limited partnerships in Pennsylvania are generally required to register with the state, but they enjoy certain protections and benefits. Failing to register may leave partners exposed to liabilities typical of unregistered entities. For clarity and security in your business dealings, consider utilizing a Pennsylvania Disclaimer of Partnership to outline roles and responsibilities.

The four main types of partnerships include general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type presents different levels of liability and management structure. Understanding these distinctions is crucial when deciding how to structure your partnership in Pennsylvania, and a Pennsylvania Disclaimer of Partnership can provide essential guidance.

Yes, domestic partnerships are recognized in Pennsylvania, and they offer certain legal benefits. However, it is important to understand the specific rights and obligations that come with this status. If you are considering forming a domestic partnership, a Pennsylvania Disclaimer of Partnership can help define the framework of your relationship.

General partnerships do not need to be registered in Pennsylvania; however, clarifying your partnership through a Pennsylvania Disclaimer of Partnership can be beneficial. This disclaimer defines the terms of your partnership and helps manage expectations among partners. Even without registration, having a written agreement clarifies roles and responsibilities.

Yes, Pennsylvania does impose taxes on partnerships, but they are usually taxed at the partner level rather than as a separate entity. As a result, partners report their share of the partnership's income on their personal income tax returns. Understanding how taxes apply to your partnership can help you navigate your financial responsibilities in Pennsylvania.

Partnerships in Pennsylvania do not require formal registration, but filing a Pennsylvania Disclaimer of Partnership can provide clarity about your business's structure. While general partnerships are often formed through mutual agreements, a disclaimer can help protect individual partners from liabilities. It is advisable to check local regulations for specific requirements related to your partnership type.

Removing a partner from an LLC in Pennsylvania typically requires a vote by the existing members and compliance with the operating agreement. It's essential to ensure all legal procedures are followed, which often includes amending the operating agreement. Utilizing a Pennsylvania Disclaimer of Partnership can provide clarity on the removal process and protect remaining partners.

Closing a partnership in Pennsylvania involves dissolving the business officially and settling any outstanding debts and obligations. Partners must also file a statement of dissolution with the Department of State to formalize the closure. The Pennsylvania Disclaimer of Partnership can aid in outlining the process and protecting partners' interests during this transition.

To file as a partnership in Pennsylvania, the business must submit a registration form with the state, especially if doing business under a name not owned by the partners. Additionally, partnerships must maintain accurate records and file a tax return annually. This is where a Pennsylvania Disclaimer of Partnership plays a key role in protecting partners from unexpected liabilities.

Partnership ownership in Pennsylvania requires at least two individuals or entities to collaborate in a business venture. All partners should understand their roles and contributions to the partnership, ideally documented in a formal agreement. The Pennsylvania Disclaimer of Partnership is essential for defining each partner's liabilities and responsibilities, protecting personal assets.