Pennsylvania Simple Partnership Agreement

Description

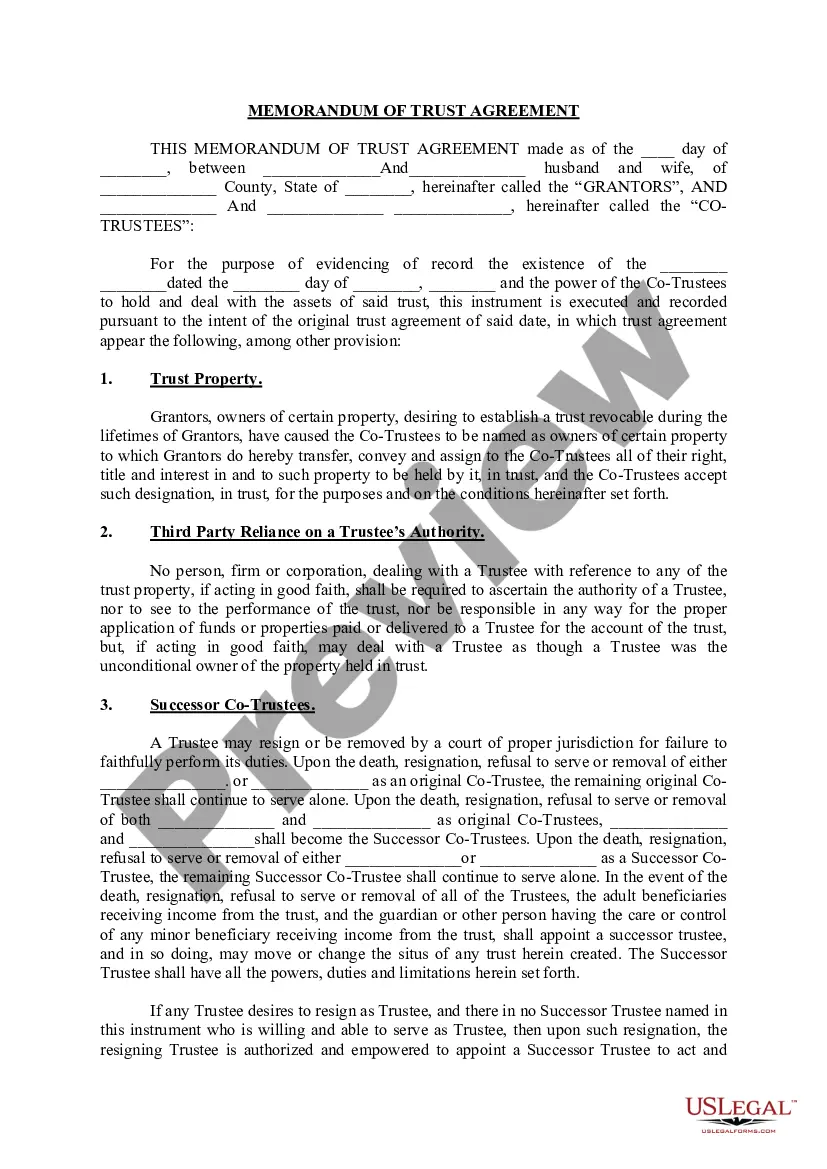

How to fill out Simple Partnership Agreement?

If you want to completely acquire, download, or create legal document templates, utilize US Legal Forms, the primary collection of legal templates available online.

Employ the site's user-friendly and convenient search to find the documents you need.

Various templates for business and personal purposes are categorized by types and suggestions, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions in the legal form format.

Step 4. Once you have found the form you want, click the Buy now button. Select the pricing plan you prefer and fill in your details to sign up for an account.

- Use US Legal Forms to obtain the Pennsylvania Simple Partnership Agreement with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Pennsylvania Simple Partnership Agreement.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you select the form for the appropriate city/state.

- Step 2. Use the Review option to examine the content of the form. Be sure to read the description.

Form popularity

FAQ

A Pennsylvania Simple Partnership Agreement should include essential elements such as the names of the partners, business purpose, and capital contributions. Moreover, it should outline profit-sharing methods, decision-making processes, and procedures for resolving disputes. Including these details ensures clarity and helps avoid misunderstandings between partners.

Filling out an agreement, such as the Pennsylvania Simple Partnership Agreement, requires careful attention to detail. Start by clearly stating all parties involved and the purpose of the partnership. Additionally, be specific about contributions and profit-sharing, and remember to include signatures from all partners to make the agreement legally binding.

Forming a simple partnership in Pennsylvania begins with identifying your partners and agreeing on business goals. Next, draft a Pennsylvania Simple Partnership Agreement that outlines the roles, responsibilities, and financial arrangements of each partner. Finally, ensure each partner signs the agreement to solidify your partnership legally.

Filling out a Pennsylvania Simple Partnership Agreement involves detailing the specifics of your partnership. Start by entering the names and addresses of each partner, followed by the agreed-upon business operations and financial contributions. It's crucial to outline how profits and losses will be shared, and ensure all partners sign and date the document to validate the agreement.

To format a Pennsylvania Simple Partnership Agreement effectively, begin with a title that clearly states the purpose. Include sections such as the names of the partners, business purpose, capital contributions, profit sharing, and dispute resolution methods. Use headings and bullet points for clarity, ensuring each section is easy to read and understand.

While it is not legally required to notarize a Pennsylvania Simple Partnership Agreement, having it notarized can provide an extra layer of security. Notarization ensures that the signatures on the document are authentic, which can help prevent disputes in the future. If you are preparing a Pennsylvania Simple Partnership Agreement, consider using resources from U.S. Legal Forms to streamline the process and add credibility to your agreement.

To form a general partnership in Pennsylvania, first, choose your business partners and agree on the partnership details. Next, create a Pennsylvania Simple Partnership Agreement that outlines the roles, responsibilities, and profit-sharing arrangements for each partner. While registration is not necessary, having this written agreement is highly recommended to avoid potential disputes. Uslegalforms provides templates that can guide you through creating your partnership agreement seamlessly.

In Pennsylvania, partnerships typically do not need to register formally with the state; however, you must obtain any required business licenses. It’s crucial to have a Pennsylvania Simple Partnership Agreement in place to define the terms of the partnership. This agreement serves as a crucial document for protecting your interests and managing your partnership. Consulting with uslegalforms can help ensure you meet all legal requirements.

Writing a simple partnership agreement involves clearly stating the names of all partners and the business purpose. In your Pennsylvania Simple Partnership Agreement, include details such as capital contributions, profit and loss distribution, decision-making processes, and dispute resolution methods. Make sure all partners review the agreement to ensure clarity and consensus. Using resources from uslegalforms can guide you in creating a comprehensive and legally sound document.

To establish a 50/50 partnership, you and your partner should first outline your business goals and expectations. Next, draft a Pennsylvania Simple Partnership Agreement that includes each partner's roles, responsibilities, and profit-sharing arrangements. This agreement helps clarify obligations and can prevent misunderstandings in the future. Utilizing a platform like uslegalforms can simplify the drafting process, ensuring you cover all essential aspects.