Oklahoma Memorandum of Trust Agreement

Description

What Is a Memorandum of Trust Agreement?

A memorandum of trust agreement is a simplified version of a trust document that provides essential information without revealing the specifics of the assets contained within the trust. This kind of document is primarily used in transactions that require proof of the trust's existence and its terms, such as real estate transactions or when dealing with financial institutions.

Key Concepts & Definitions

- Trust Agreement: A legal document that sets up a trust and outlines how it will be managed and by whom.

- Estate Planning: The process of arranging for the management and disposal of a person's estate during their life and after death.

- Certification Trust: A document issued by the trustee that certifies the trust's existence, trustees, and powers.

Step-by-Step Guide to Creating a Memorandum of Trust Agreement

- Identify the trust agreement you need to certify.

- Consult with an attorney experienced in estate planning to help draft the memorandum.

- Include key elements such as the name of the trust, trustee names, and the powers given to the trustee.

- Ensure the language complies with state laws and financial institutions' requirements.

- Sign and notarize the memorandum as required.

Risk Analysis for Using a Memorandum of Trust Agreement

While a memorandum of trust agreement provides necessary privacy and efficiency, it poses risks such as misinterpretation if not drafted clearly, and potential legal challenges if it contradicts the full trust document.

Best Practices

- Always consult with legal professionals when drafting a memorandum.

- Keep the memorandum updated alongside any changes to the trust agreement.

- Utilize free resources and templates cautiously, ensuring compliance with local laws and practices.

Frequently Asked Questions

What is the purpose of a memorandum of trust? Mainly to provide a snapshot of the trust's existence and terms, useful for transactions requiring proof without compromising the privacy of the trust's details.

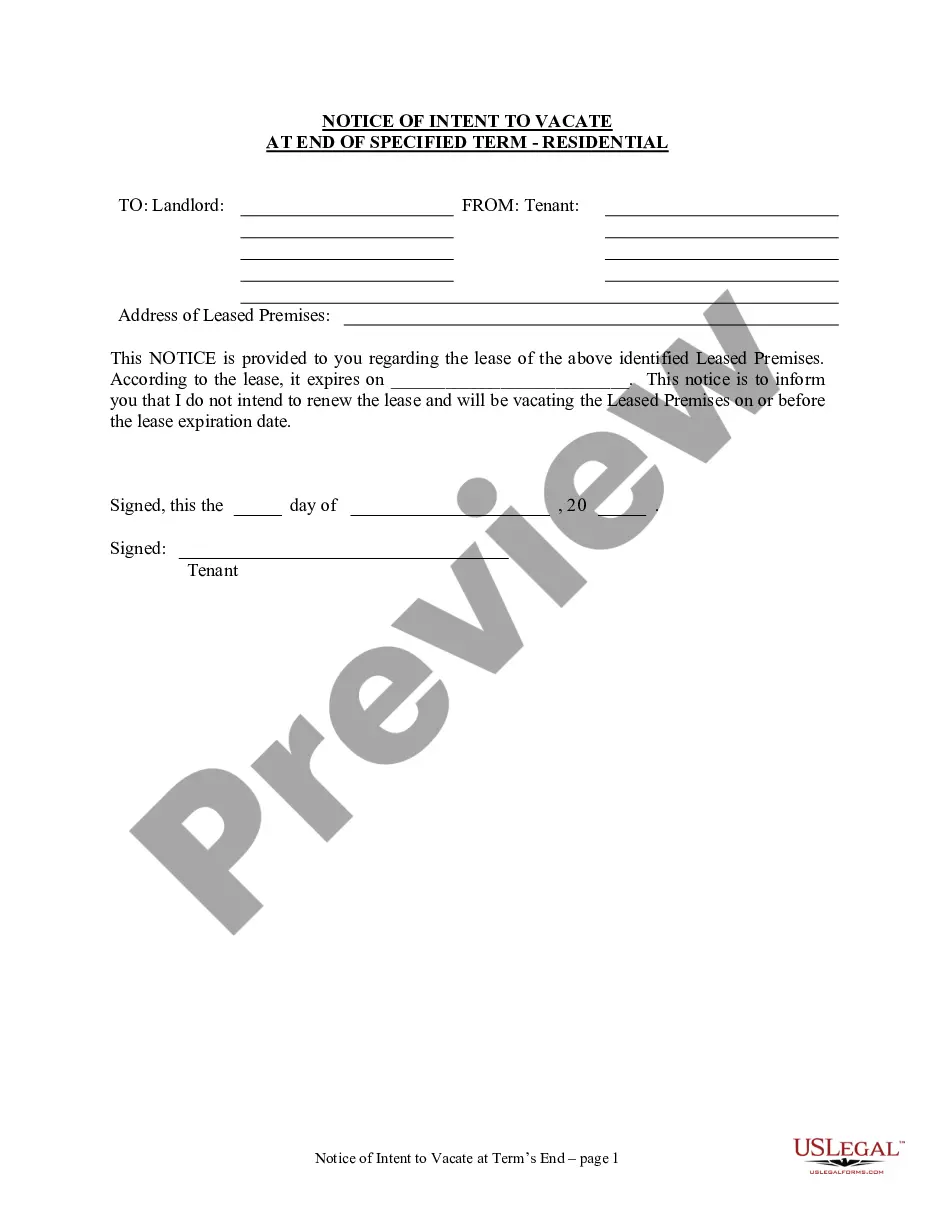

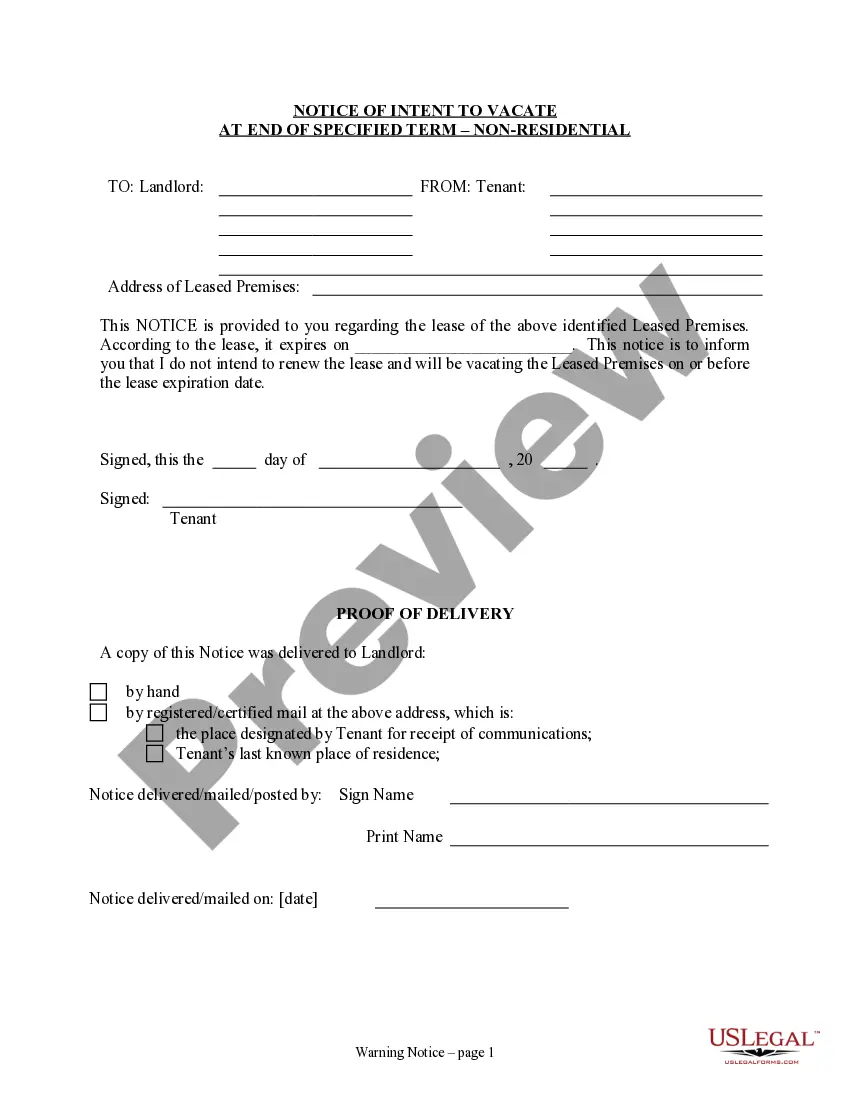

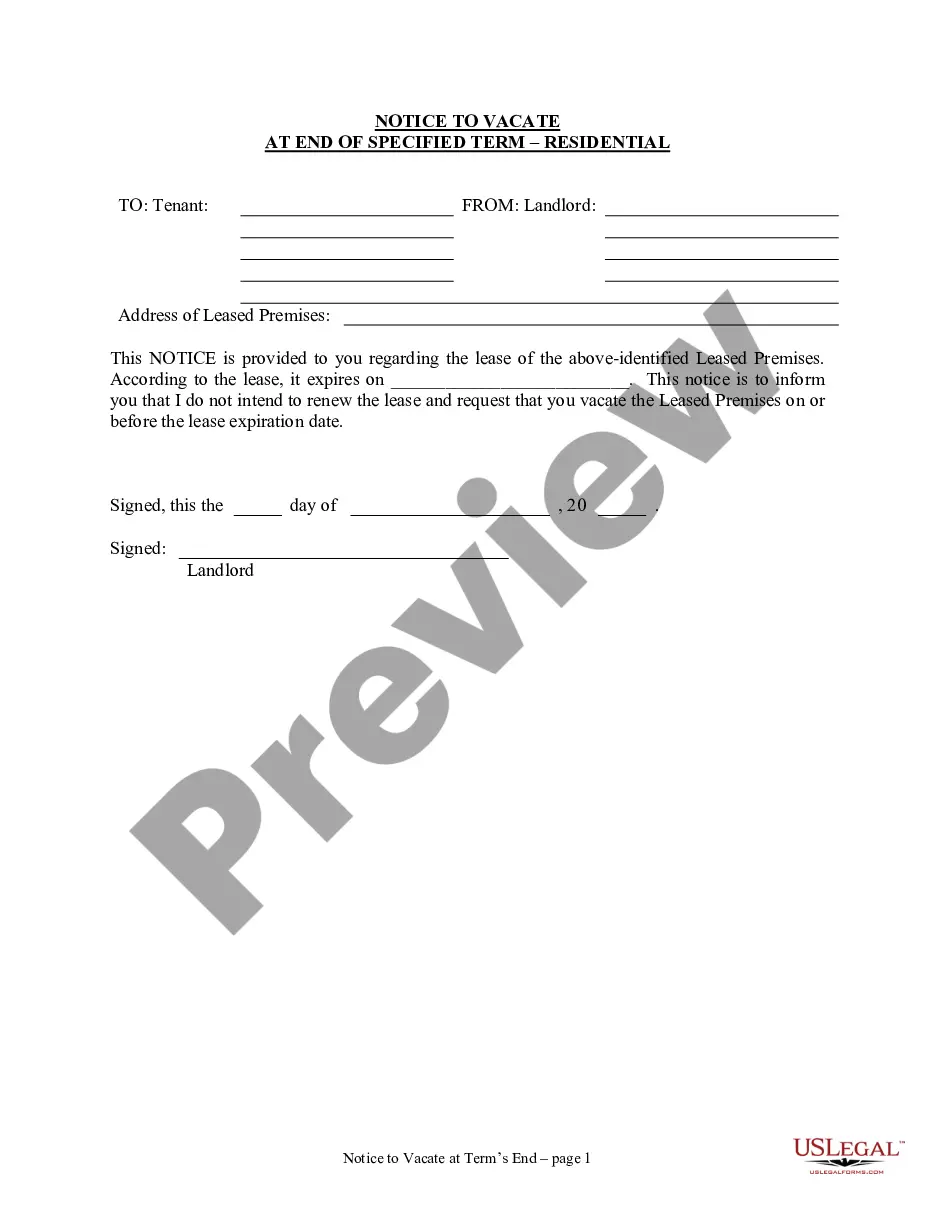

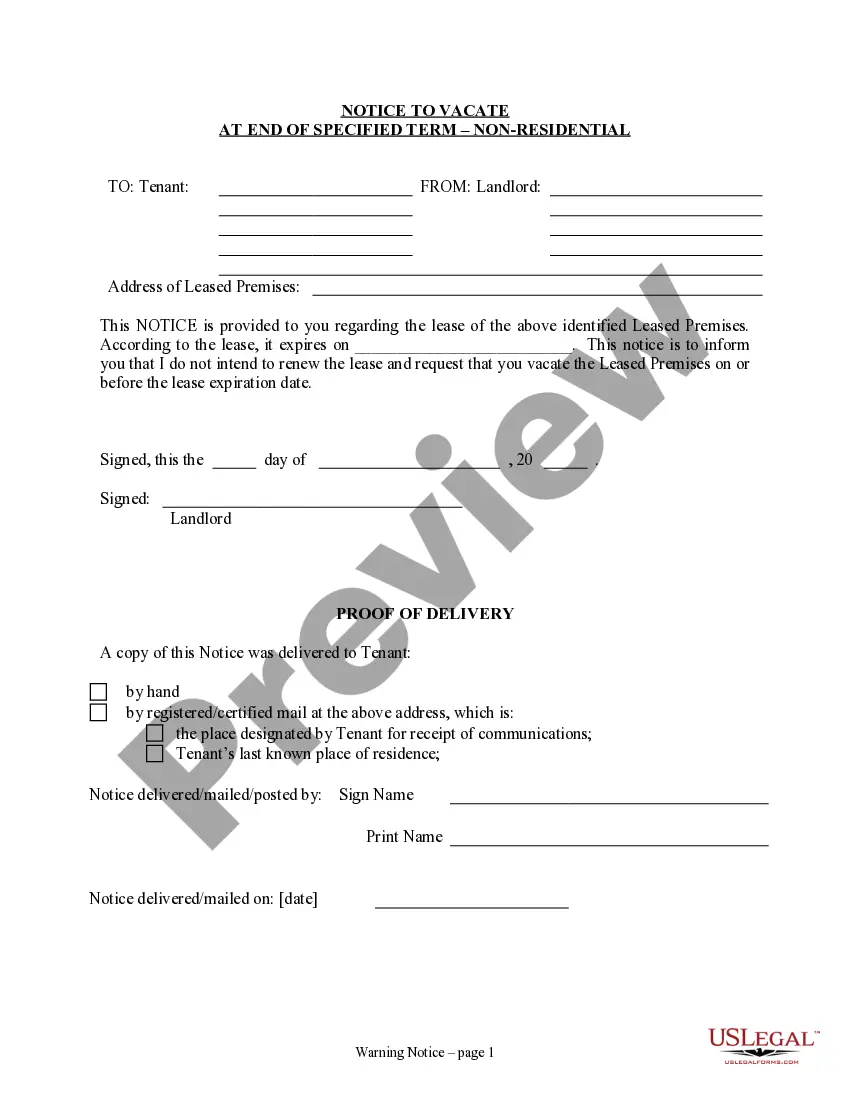

How to fill out Oklahoma Memorandum Of Trust Agreement?

In terms of filling out Oklahoma Memorandum of Trust Agreement, you most likely visualize a long process that consists of getting a appropriate sample among hundreds of very similar ones and after that being forced to pay out legal counsel to fill it out to suit your needs. On the whole, that’s a slow-moving and expensive option. Use US Legal Forms and choose the state-specific template within clicks.

If you have a subscription, just log in and click on Download button to have the Oklahoma Memorandum of Trust Agreement template.

In the event you don’t have an account yet but need one, keep to the point-by-point guideline below:

- Make sure the document you’re saving is valid in your state (or the state it’s required in).

- Do it by looking at the form’s description and through clicking on the Preview function (if readily available) to find out the form’s content.

- Click on Buy Now button.

- Select the suitable plan for your budget.

- Sign up for an account and select how you want to pay: by PayPal or by credit card.

- Download the document in .pdf or .docx format.

- Get the record on the device or in your My Forms folder.

Professional lawyers work on drawing up our templates to ensure after saving, you don't have to worry about editing and enhancing content material outside of your individual details or your business’s info. Be a part of US Legal Forms and receive your Oklahoma Memorandum of Trust Agreement example now.

Form popularity

FAQ

The declaration of trust is your trust. The certificate of trust is not needed but can help keep things private and provide a easier way to open bank or stock accounts...

Either draft or have an attorney draft a Trustee's Deed transferring ownership of the real estate out of the trust to the beneficiary. After it is signed, you and the beneficiary must go to the clerk of the court to have the deed recorded in the public records.

Under O.R.C. 5301.255, the memorandum of trust is a document that certifies a trustee has the authority to act on behalf of an existing trust. The trustee is the person or entity who holds title to a trust's assets on behalf of a settlor.

California Trust Certificates Law. Delaware Trust Certificates Law. Idaho Trust Certificates Law. Iowa Trust Certificates Law. Minnesota Trust Certificates Law. Mississippi Trust Certificates Law. Nevada Trust Certificates Law. Ohio Trust Certificates Law.

A certificate of trust is used by an acting trustee or trustees of a trust to prove to financial institutions or other third parties that he/she/they has/have the authority to act on behalf of the trust.The certificate also specifies how the trust will vest title to real property.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

A Memorandum of Trust is a synopsis of a trust that is used when transferring real property into a trust. It's then recorded in county in which the property is owned. The Memorandum of Trust is used in place of the actual trust to identify the grantor and trustees as well as the basic details of the trust.

Create the certificate of trust Sign the living trust in front of a notary public to notarize it. In case your spouse or partner made the trust together, you both need to sign the certification. If one has died, the surviving part can make a certification.

Once a declaration of trust has been executed, subsequent declarations can be issued to confirm current terms or amend the existing agreement. Depending on the jurisdiction, the declaration of trust can also be referred to as a trust agreement or a trust document.