If you need to full, acquire, or print out legitimate document layouts, use US Legal Forms, the most important variety of legitimate kinds, which can be found on the web. Use the site`s simple and handy look for to find the paperwork you need. Various layouts for company and specific reasons are categorized by classes and suggests, or search phrases. Use US Legal Forms to find the Pennsylvania Complaint Against Guarantor of Open Account Credit Transactions - Breach of Oral or Implied Contracts in a handful of mouse clicks.

In case you are already a US Legal Forms client, log in to the profile and click on the Down load button to find the Pennsylvania Complaint Against Guarantor of Open Account Credit Transactions - Breach of Oral or Implied Contracts. Also you can gain access to kinds you earlier saved within the My Forms tab of your respective profile.

If you work with US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for your right metropolis/nation.

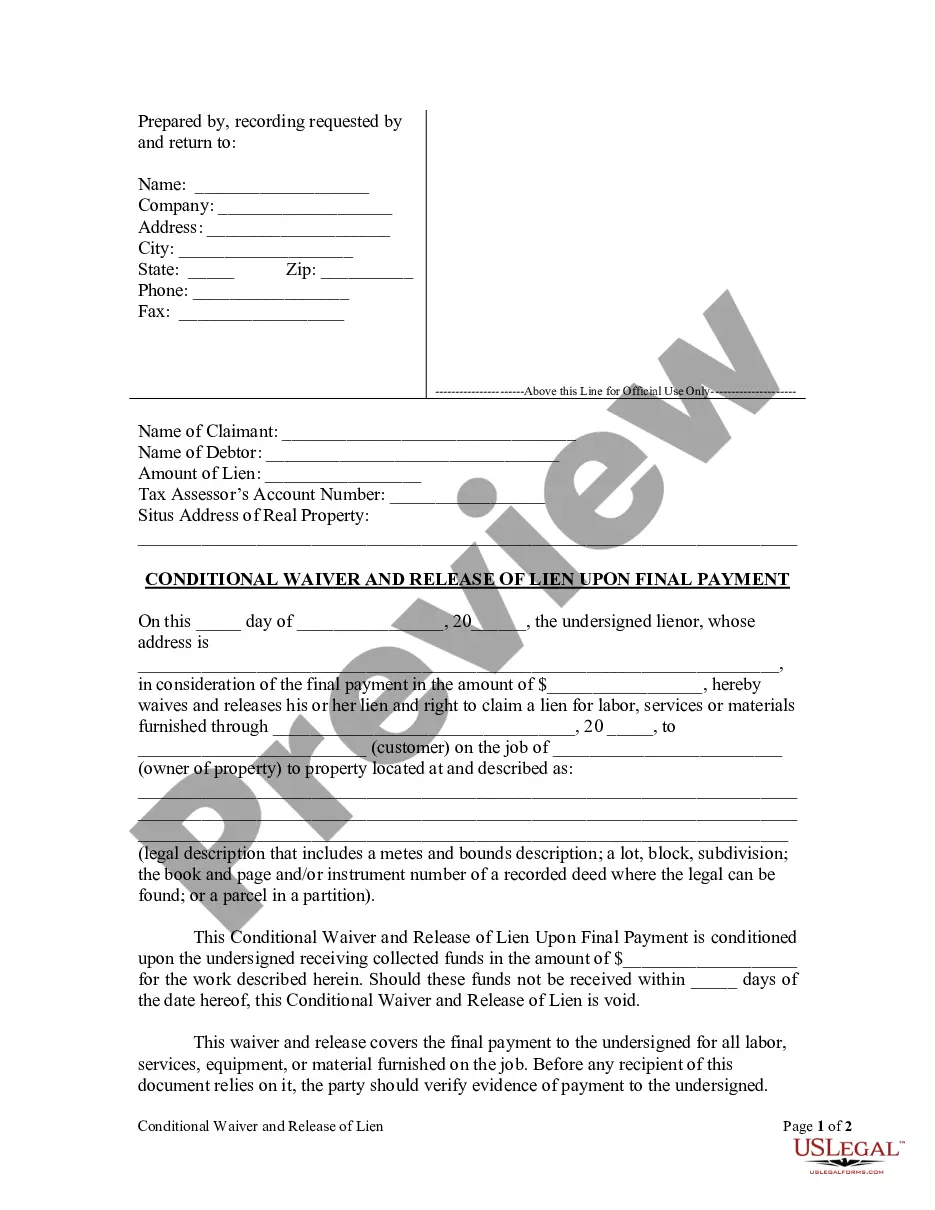

- Step 2. Utilize the Review option to check out the form`s information. Do not overlook to see the explanation.

- Step 3. In case you are not happy using the kind, use the Lookup area towards the top of the display screen to discover other models from the legitimate kind design.

- Step 4. Upon having discovered the shape you need, go through the Buy now button. Select the rates plan you choose and put your references to sign up to have an profile.

- Step 5. Method the financial transaction. You can use your credit card or PayPal profile to finish the financial transaction.

- Step 6. Find the formatting from the legitimate kind and acquire it on your own device.

- Step 7. Full, revise and print out or sign the Pennsylvania Complaint Against Guarantor of Open Account Credit Transactions - Breach of Oral or Implied Contracts.

Every legitimate document design you get is yours permanently. You may have acces to every single kind you saved with your acccount. Select the My Forms area and select a kind to print out or acquire again.

Be competitive and acquire, and print out the Pennsylvania Complaint Against Guarantor of Open Account Credit Transactions - Breach of Oral or Implied Contracts with US Legal Forms. There are millions of professional and condition-particular kinds you can utilize to your company or specific requires.