Pennsylvania Asset Purchase Agreement - Business Sale

Description

How to fill out Asset Purchase Agreement - Business Sale?

Locating the appropriate legal document template can be a challenge.

Of course, there is a wide range of templates accessible online, but how can you find the legal type you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Pennsylvania Asset Purchase Agreement - Business Sale, suitable for business and personal purposes.

First, ensure you have selected the correct form for your jurisdiction. You can preview the form using the Preview button and read the form description to confirm it is suitable for you.

- All documents are reviewed by experts and adhere to state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Pennsylvania Asset Purchase Agreement - Business Sale.

- Use your account to search for the legal forms you have previously acquired.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new US Legal Forms user, here are simple instructions to follow.

Form popularity

FAQ

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

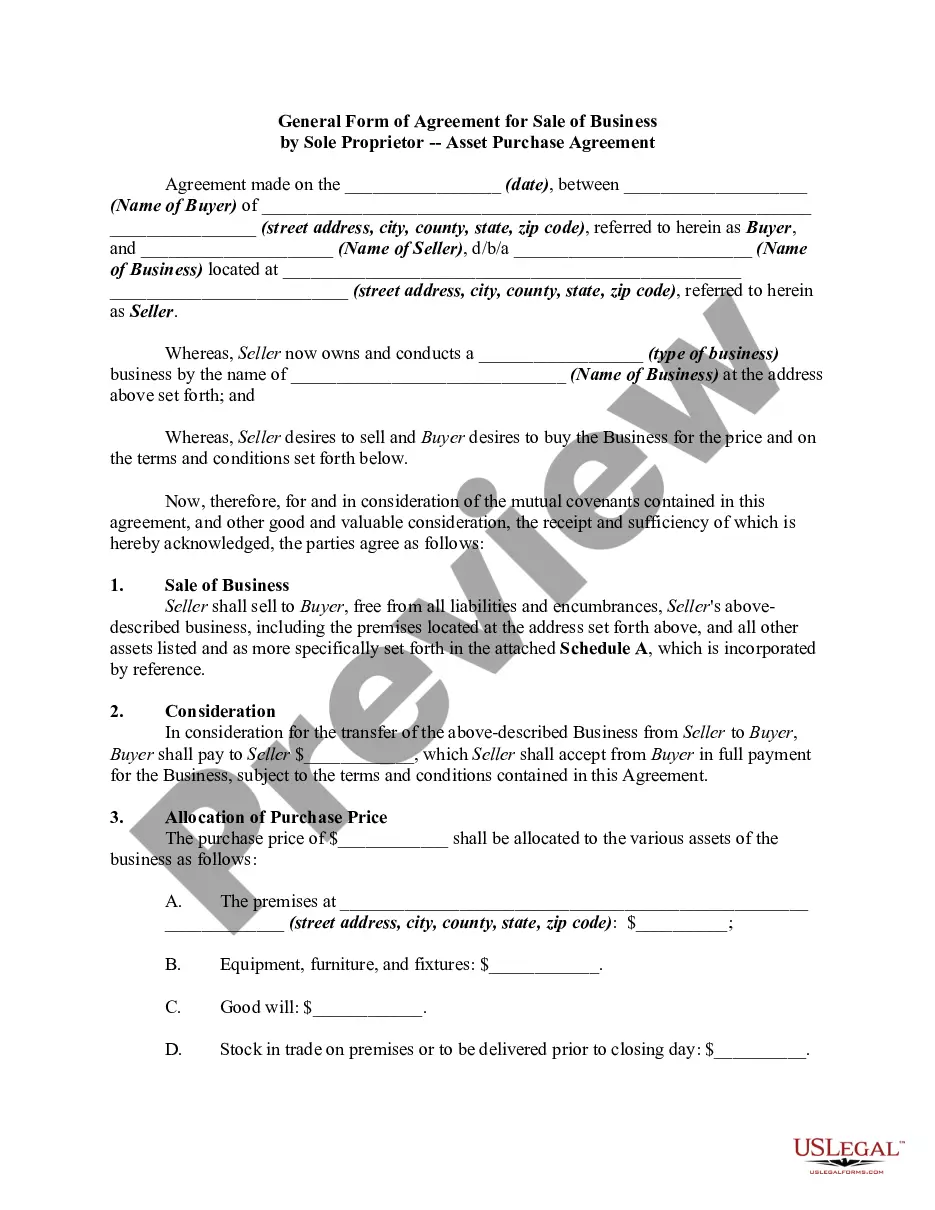

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

An asset sale involves the purchase of some or all of the assets owned by a company. Examples of common assets which are sold include; plant and equipment, land, buildings, machinery, stock, goodwill, contracts, records and intellectual property (including domain names and trademarks).

An asset purchase agreement is an agreement between a buyer and a seller to purchase property, like business assets or real property, either on their own or as part of a merger-acquisition.