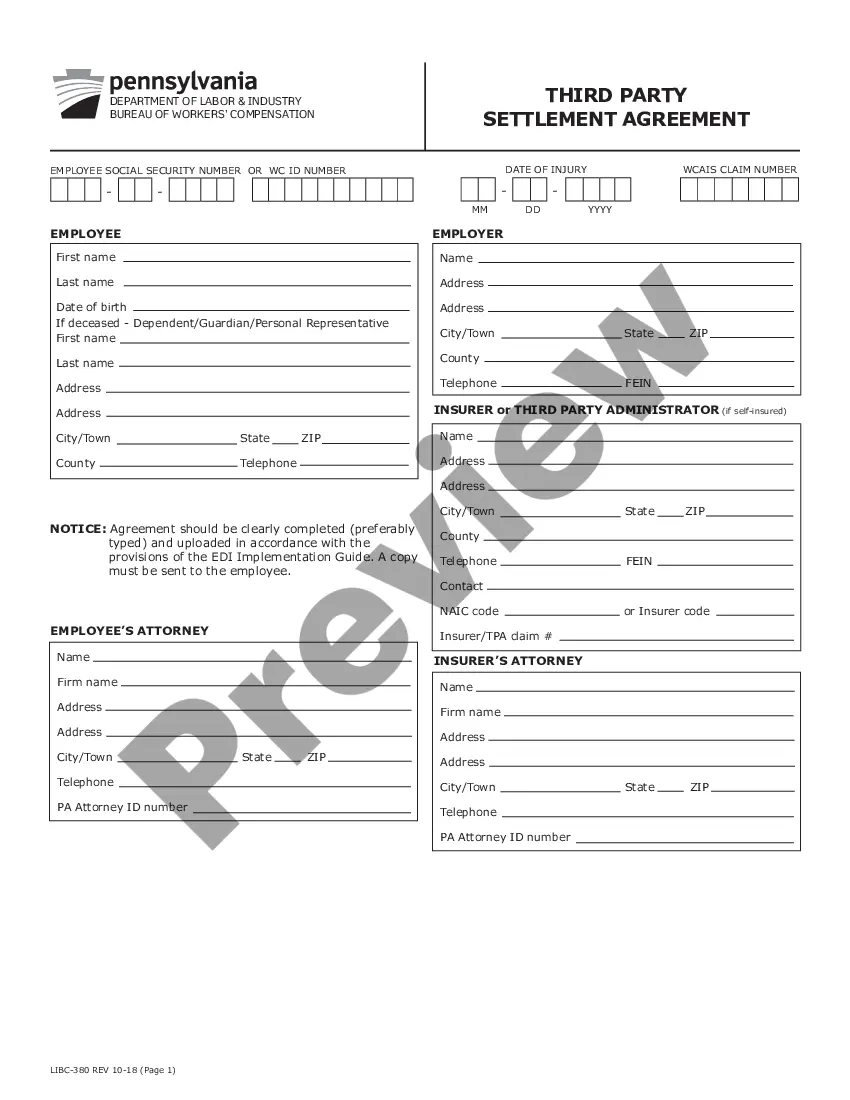

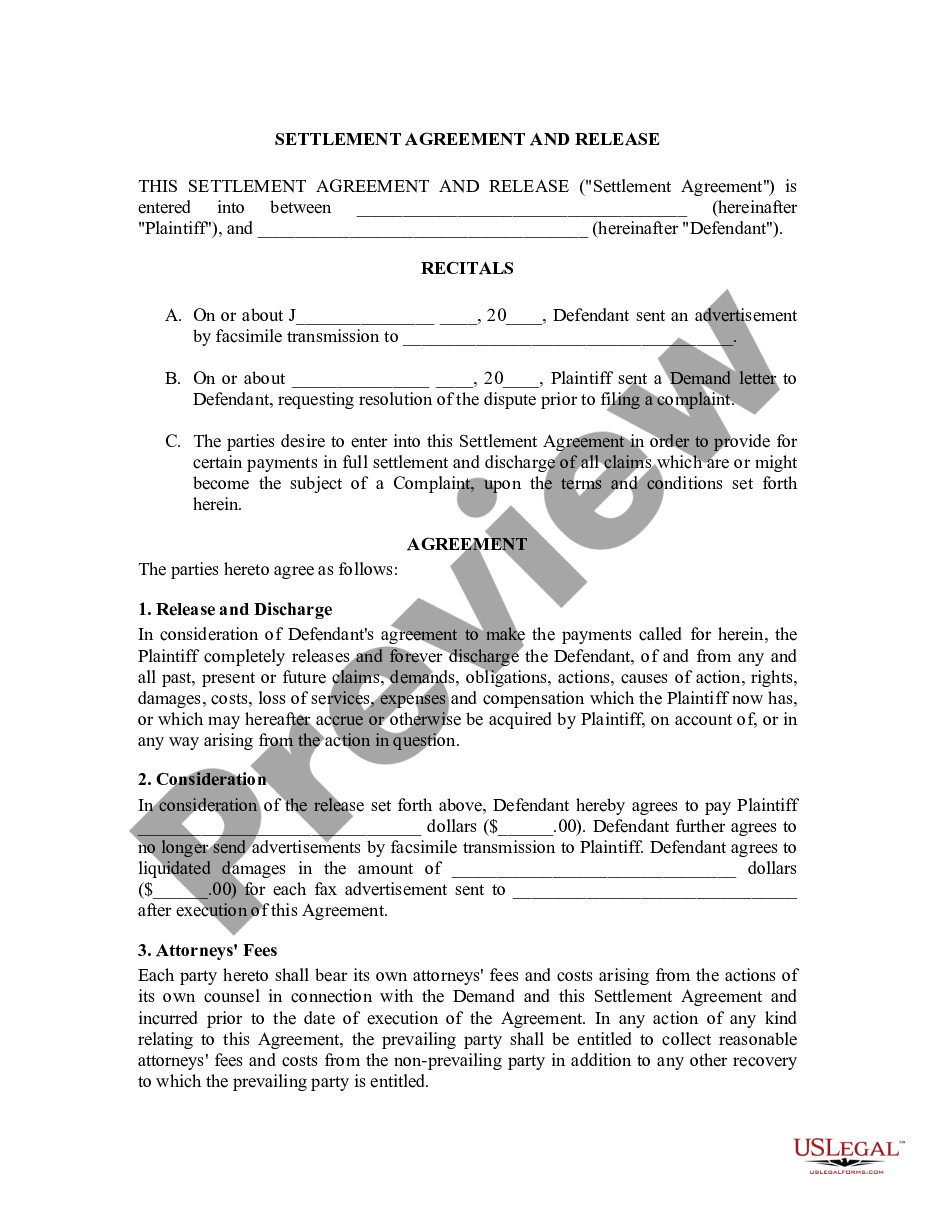

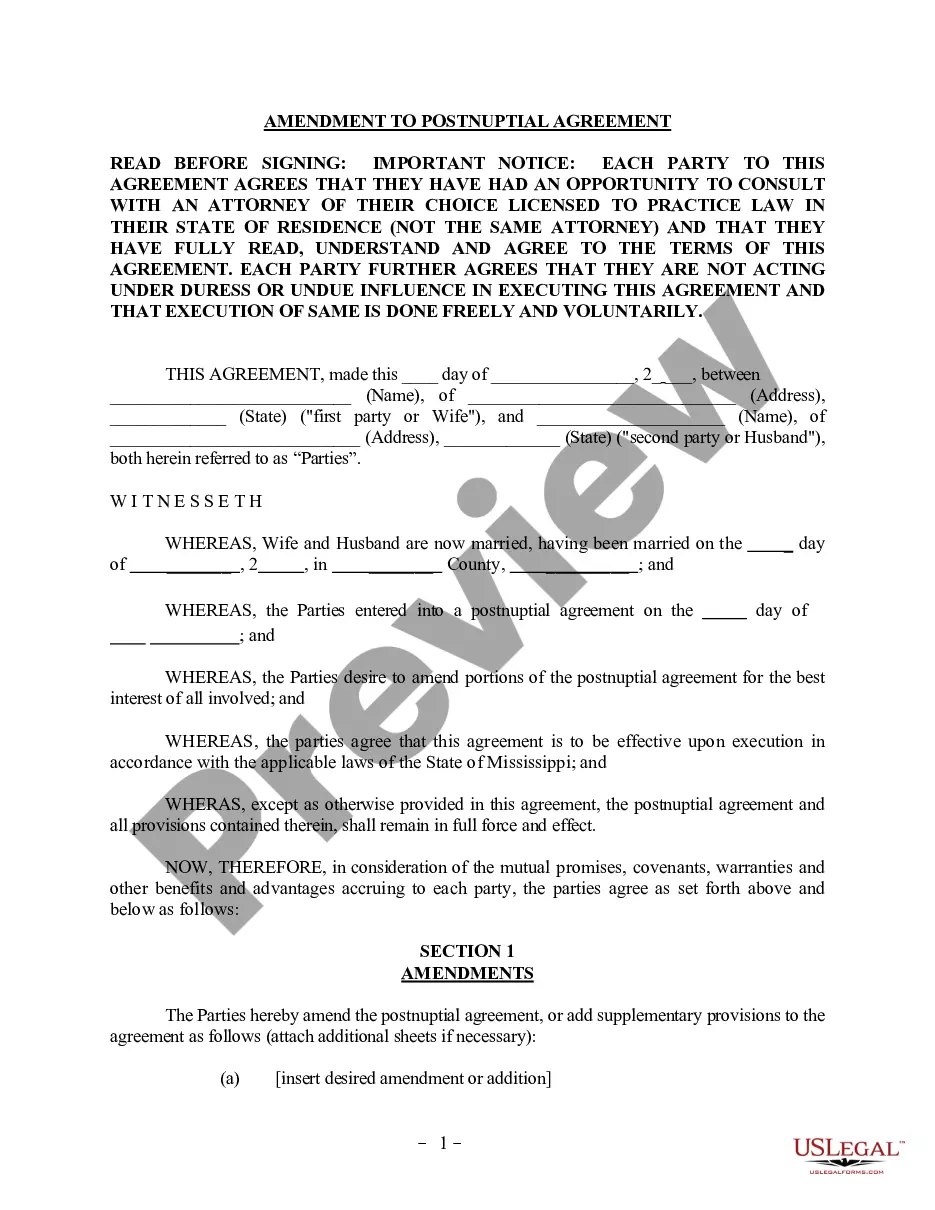

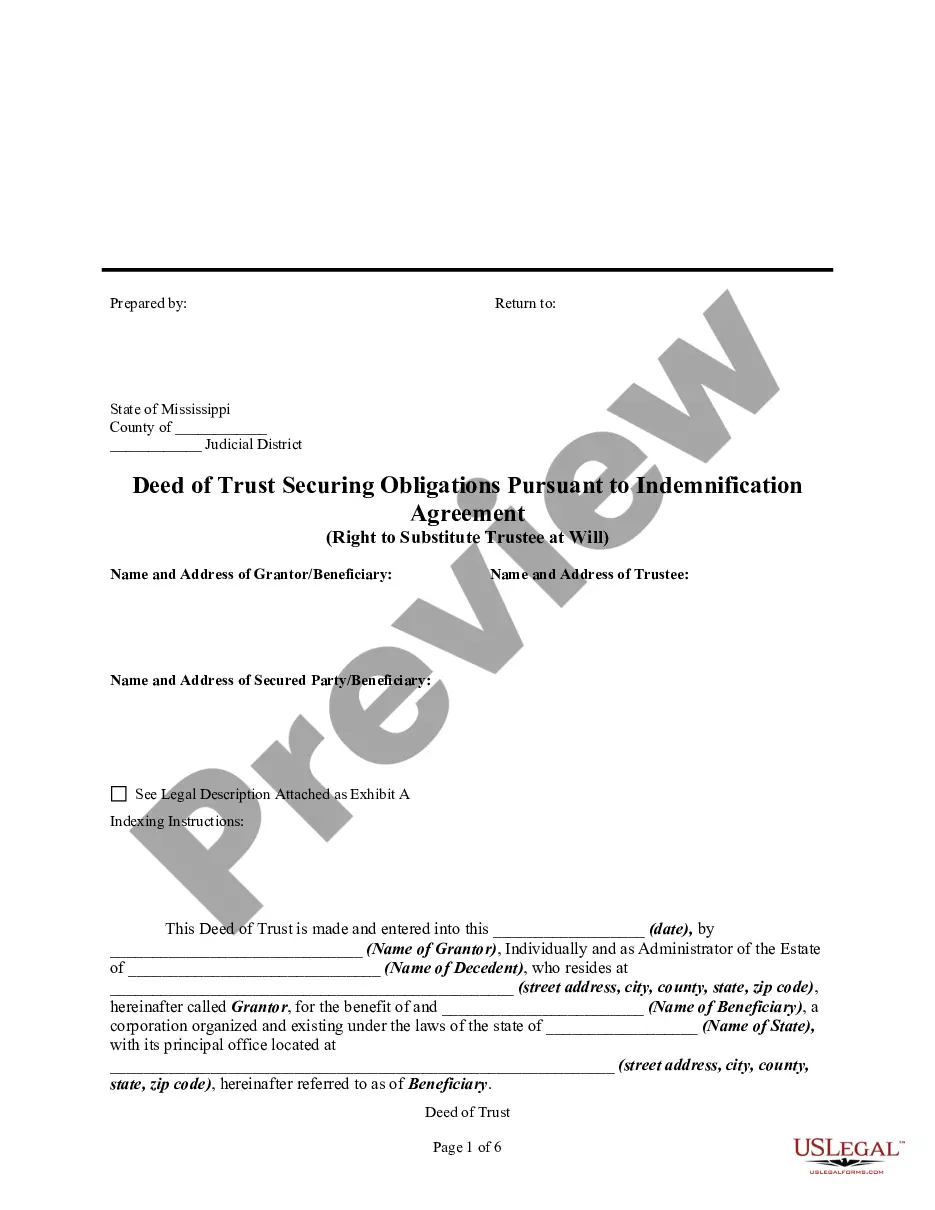

A Pennsylvania Third Party Settlement Agreement is an agreement between two or more parties that resolves a dispute without going to court. This agreement may involve the payment of money, the exchange of goods or services, or the performance of a certain action. There are several types of Third Party Settlement Agreements in Pennsylvania, including: • Compromise and Release Agreement: This agreement resolves a dispute without going to court and is usually used in cases involving personal injury or workers' compensation claims. • Structured Settlement Agreement: This agreement is used to settle a dispute through the payment of a structured, predetermined sum of money over an extended period of time. • Mediated Settlement Agreement: This agreement is used to resolve a dispute through mediation, which is a process in which a neutral third party helps the parties reach a mutually acceptable resolution. • Arbitration Agreement: This agreement is used to resolve a dispute through an arbitration hearing, in which a neutral third party hears evidence and makes a decision. • Settlement Agreement with a Third Party Provider: This agreement is used to resolve a dispute through a third-party provider, such as a lawyer or an insurance company.

Pennsylvania Third Party Settlement Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Pennsylvania Third Party Settlement Agreement?

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state regulations and are checked by our specialists. So if you need to prepare Pennsylvania Third Party Settlement Agreement, our service is the perfect place to download it.

Getting your Pennsylvania Third Party Settlement Agreement from our library is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they locate the correct template. Later, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a quick instruction for you:

- Document compliance verification. You should carefully review the content of the form you want and make sure whether it suits your needs and fulfills your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab above until you find an appropriate template, and click Buy Now when you see the one you want.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Pennsylvania Third Party Settlement Agreement and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Section 319 of the Pennsylvania Workers' Compensation Act provides the statutory authority for the Employer to subrogate to a third party action. The Employer's subrogation interest is a creature of statute, as opposed to an equitable or contractual right to subrogation.

Most people have contact with service providers such as Paypal, Venmo, EBay and Stubhub. Paypal and Venmo are examples of third-party settlement organizations. EBay and Stubhub are examples of third-party payment organizations.

The IRS requires the payer to send the recipient a 1099-MISC, as long as the settlement meets the following conditions: The payee received more than $600 in a calendar year. The settlement money is taxable in the first place.

(1) In general The term ?payment settlement entity? means? (A) in the case of a payment card transaction, the merchant acquiring entity, and (B) in the case of a third party network transaction, the third party settlement organization.

Whitmoyer states that an employer may no longer take a credit against payment of future medical expenses, pursuant to Section 319 of the Pennsylvania Workers' Compensation Act (the Act) when there is a balance of recovery remaining after a third party settlement or recovery.

A compromise and release is an agreement for the insurance company to issue you a lump sum payment to settle the entire workers' compensation case. The value of the settlement is determined mainly by your present (and projected future) lost wages and medical care expenses.

The most common example of a third-party settlement organization is an online auction-payment facilitator, which operates merely as an intermediary between buyer and seller by transferring funds between accounts in settlement of an auction/purchase.

A. The Internal Revenue Code uses the term ?third party settlement organization.? A third party settlement organization is the central organization that has the contractual obligation to make payments to participating payees (generally, a merchant or business) of third party network transactions.