A Pennsylvania Writ of Execution Mortgage Foreclosure is a legal process that a lender (mortgage holder) can use to recover a mortgage debt when a borrower (mortgagee) fails to make payments. The lender can request the court to issue a Writ of Execution, which allows the sheriff to seize the mortgaged property and sell it in order to satisfy the debt. There are two types of Pennsylvania Writ of Execution Mortgage Foreclosure: Judicial Foreclosure and Non-Judicial Foreclosure. In Judicial Foreclosure, the lender must file a complaint in court and serve the borrower with notice. After a hearing, the court will issue a Writ of Execution which allows the sheriff to seize the mortgaged property and sell it in order to pay off the debt. In Non-Judicial Foreclosure, the lender is not required to go through the court system. Instead, the lender must provide the borrower with notice of their intent to foreclose and the borrower has the right to redeem the property by paying the outstanding balance. If the borrower fails to redeem the property, the lender will file a Notice of Sale with the sheriff, who will then sell the property to satisfy the debt.

Pennsylvania Writ of Execution Mortgage Foreclsure

Description

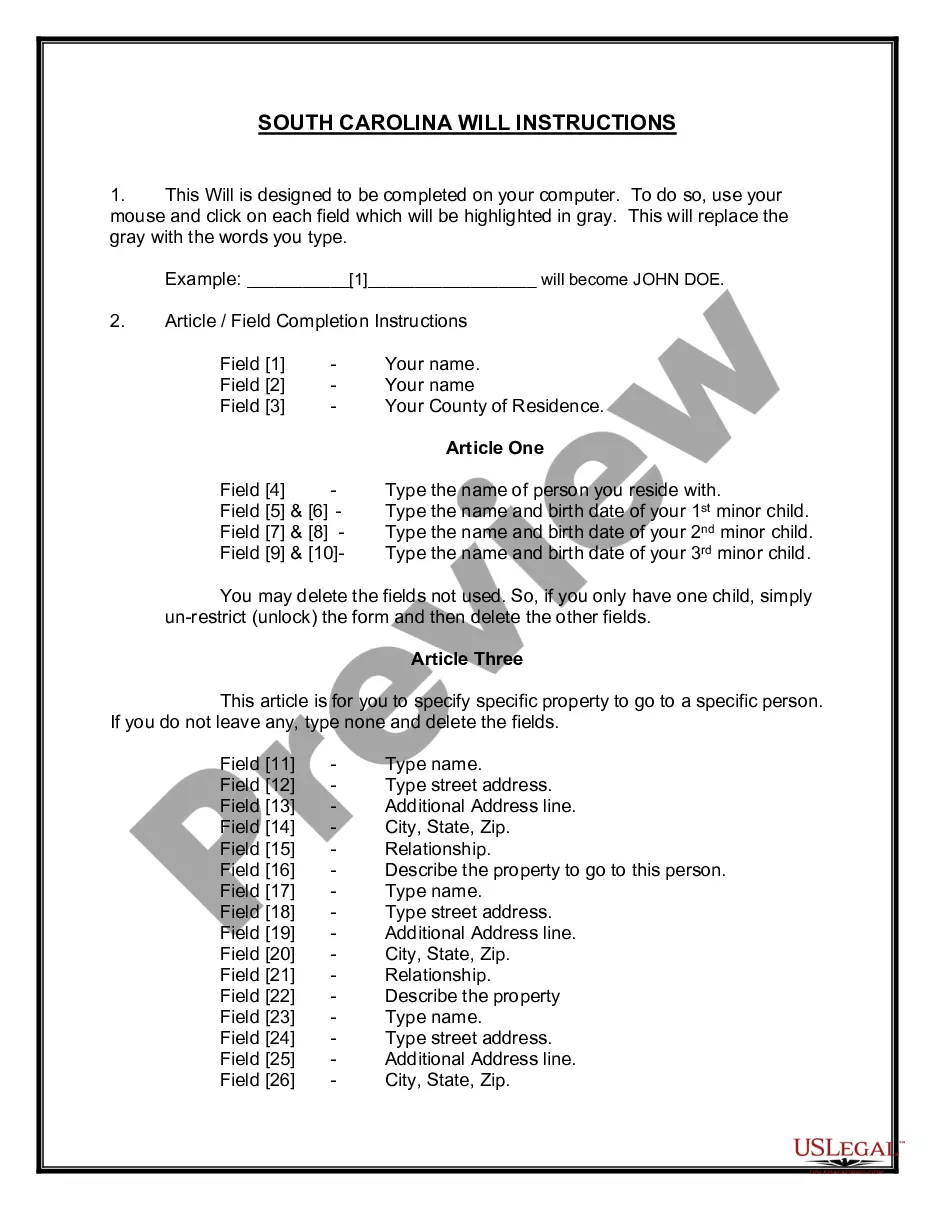

How to fill out Pennsylvania Writ Of Execution Mortgage Foreclsure?

If you’re looking for a way to properly prepare the Pennsylvania Writ of Execution Mortgage Foreclsure without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every personal and business situation. Every piece of documentation you find on our web service is designed in accordance with federal and state regulations, so you can be certain that your documents are in order.

Follow these straightforward guidelines on how to obtain the ready-to-use Pennsylvania Writ of Execution Mortgage Foreclsure:

- Ensure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the document name in the Search tab on the top of the page and select your state from the list to locate an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to save your Pennsylvania Writ of Execution Mortgage Foreclsure and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Once granted, a Writ of Execution is good for 90 days.

Stopping the Writ of Execution The most effective way to stop a writ of execution is to ask the Judgment Creditor to stop it. The sheriff will often back off if the parties are working to resolve the judgment.

The statute of limitations for such documents is 20 years unless some other statute sets a different time. Mortgage loans. The state of Pennsylvania has no legal requirement for a mortgage lender to foreclose within a stipulated period after a default.

Foreclosure service Pennsylvania foreclosure proceedings require the foreclosure notice to be served along with a 20-day summons. If no response is received, the borrower must receive a second, 10-day summons. As such, borrowers may file a response to the foreclosure complaint within 30 days of receiving the complaint.

The writ authorizes the sheriff's office to take certain action to collect the monies against the debtor. When you file a writ of execution you are then directing the sheriff to take some additional action concerning the judgment. This can apply significant pressure for the debtor to pay.

What happens if a defendant does not pay a judgement? A creditor can enforce the judgement and use state laws to seize assets in the hands of the debtor or third parties to collect the amount owed.

Once granted, a Writ of Execution is good for 90 days.

Simply put, the Motion to Stay the Writ of Possession is a document filed with the court asking the judge to ?stay? or ?stop? the sheriff from executing the Writ of Possession and removing the resident. It can be a typed or handwritten document filed by the resident or the resident's attorney if one is retained.