The Pennsylvania STEP COMMON LEVEL Ratio EFFECTIVE JULY 1, 2016 (6.4 KiB) is a document published by the Pennsylvania Department of Education that provides the Common Level Ratio (CLR) for use in the calculation of the State Tax Equalization BoardsteelEB) property tax assessment appeals. The CLR is used to adjust assessed values of real property to reflect the differences in the property’s market value relative to the state’s median market value. There are two types of CLR, the statewide CLR and the county-specific CLR. The statewide CLR is a single uniform percentage that is applied to all real property in the state, while the county-specific CLR is a unique percentage that is applied to real property within each county. The CLR Effective JULY 1, 2016 (6.4 KiB) document contains the statewide CLR, county-specific Cars, and a CLR lookup table.

Pennsylvania STEB COMMON LEVEL RATiO EFFECTIVE JULY 1 2016 (6.4 KiB)

Description

How to fill out Pennsylvania STEB COMMON LEVEL RATiO EFFECTIVE JULY 1 2016 (6.4 KiB)?

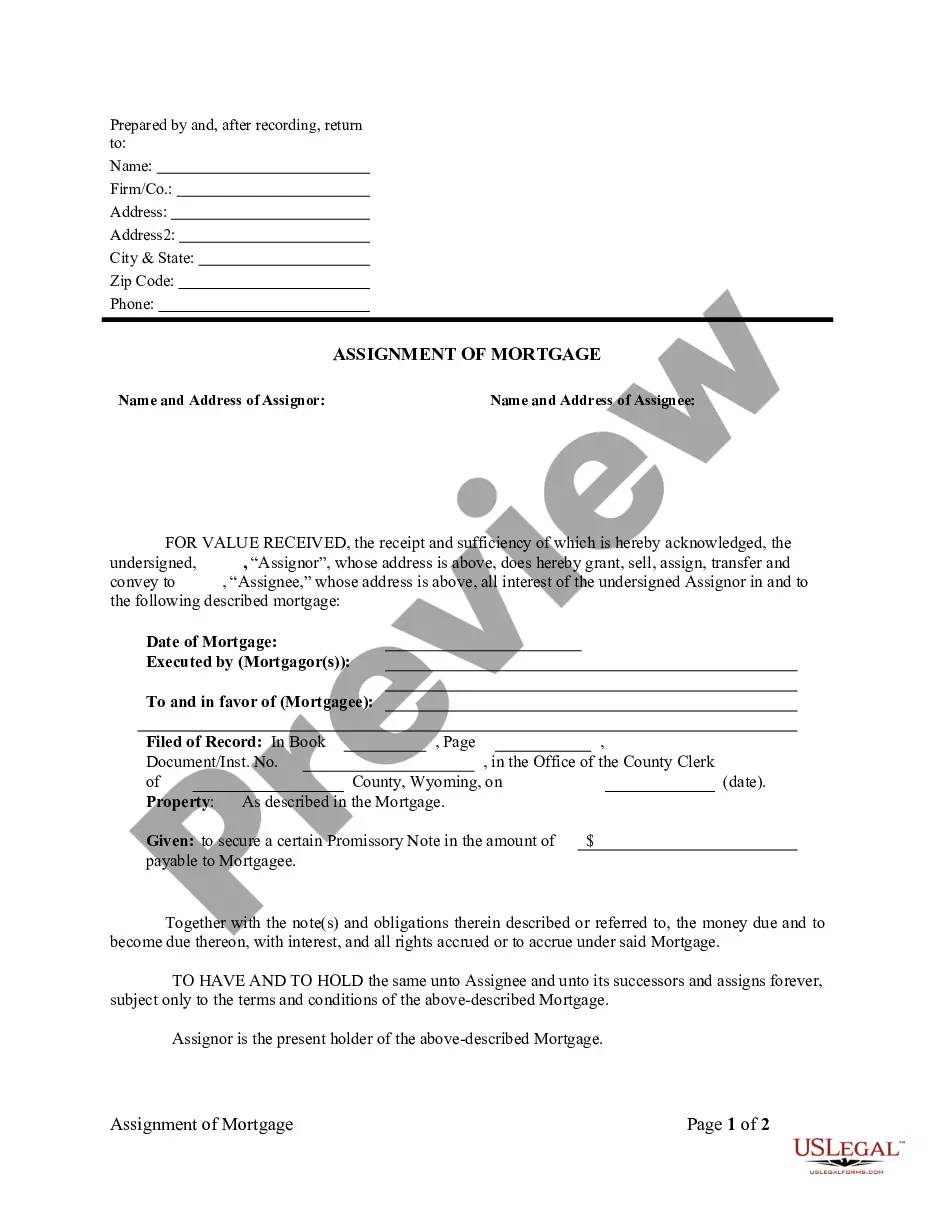

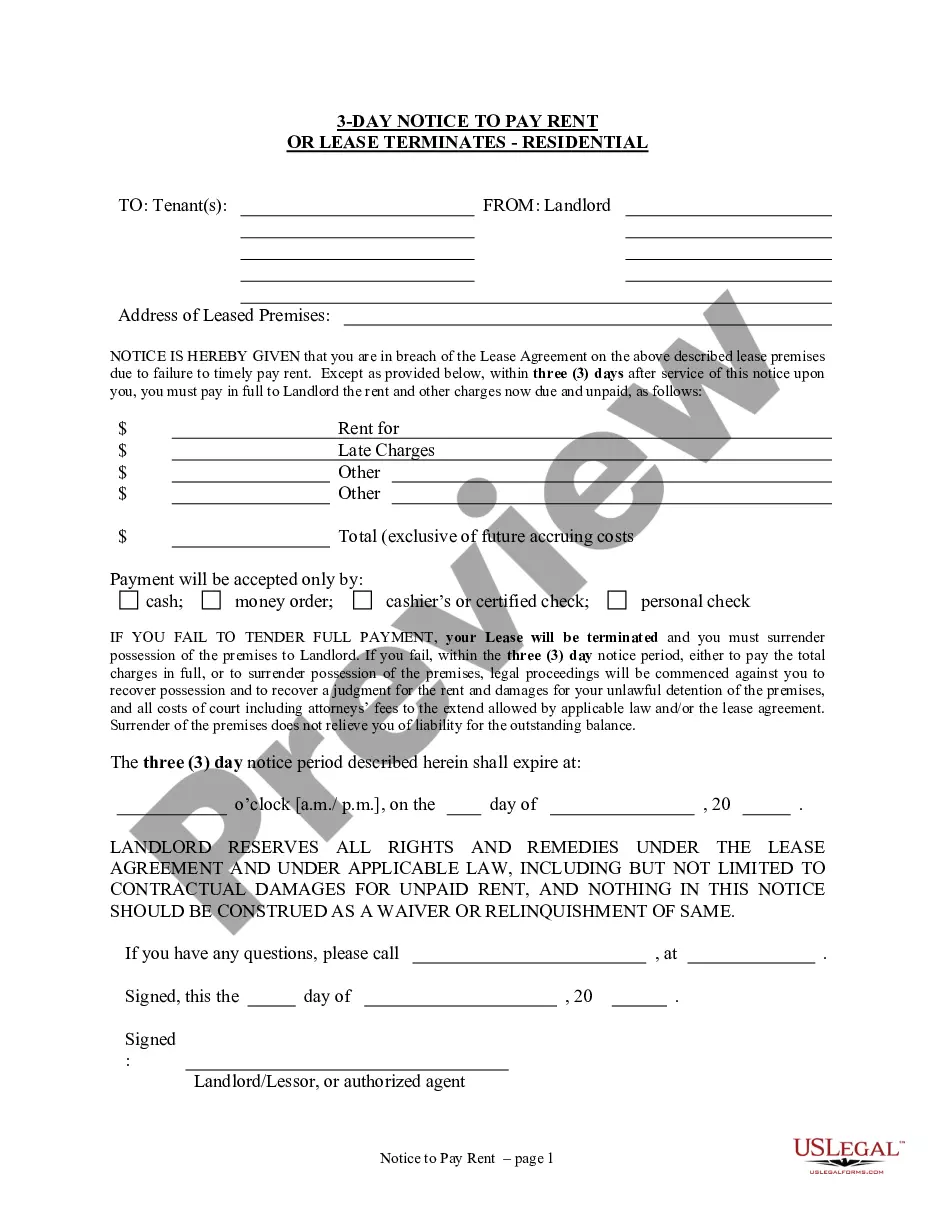

How much time and resources do you often spend on composing official paperwork? There’s a greater option to get such forms than hiring legal specialists or wasting hours browsing the web for a proper template. US Legal Forms is the premier online library that provides professionally designed and verified state-specific legal documents for any purpose, including the Pennsylvania STEB COMMON LEVEL RATiO EFFECTIVE JULY 1 2016 (6.4 KiB).

To acquire and prepare an appropriate Pennsylvania STEB COMMON LEVEL RATiO EFFECTIVE JULY 1 2016 (6.4 KiB) template, follow these simple steps:

- Examine the form content to make sure it meets your state requirements. To do so, check the form description or take advantage of the Preview option.

- In case your legal template doesn’t meet your requirements, find a different one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Pennsylvania STEB COMMON LEVEL RATiO EFFECTIVE JULY 1 2016 (6.4 KiB). Otherwise, proceed to the next steps.

- Click Buy now once you find the correct document. Choose the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely reliable for that.

- Download your Pennsylvania STEB COMMON LEVEL RATiO EFFECTIVE JULY 1 2016 (6.4 KiB) on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously acquired documents that you securely keep in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as often as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trusted web solutions. Sign up for us today!

Form popularity

FAQ

As a result, Allegheny County has already made a change for the 2023 tax year and significantly lowered the common level ratio from a prior ratio of 81.1% of market value in 2022, down to 63.6%. The exact common level ratio for tax year 2022 is not yet determined due to ongoing litigation over Judge Hertzberg's ruling.

STEB reviews the assessed values and sales data to determine how closely each county's values compare to market value as determined by STEB. They publish a Common Level Ratio (CLR) to indicate these results on a percentage basis. Philadelphia's most recent CLR was 92.61% (2021).

The 2023 CLR is 63.6% and is not in dispute at this time. With the significant reduction of the CLR and the opportunity to challenge two years at once, property owners may be entitled to unprecedented tax savings.

Pennsylvania's average effective property tax rate is 1.58%, compared to the national average of 1.08% in 2022. Homeowners paid a median of $3,442 in property taxes in 2022.

Further defined in Pennsylvania law, ?Common Level Ratio shall mean the ratio of assessed value to current market value used generally in the county as last determined by the State Tax Equalization Board (STEB).? For more information, see the PA Dept. of Community and Economic Development.

Some real estate transfers are exempt from realty transfer tax, including certain transfers among family members, to governmental units, between religious organizations, to shareholders or partners and to or from nonprofit industrial development agencies.