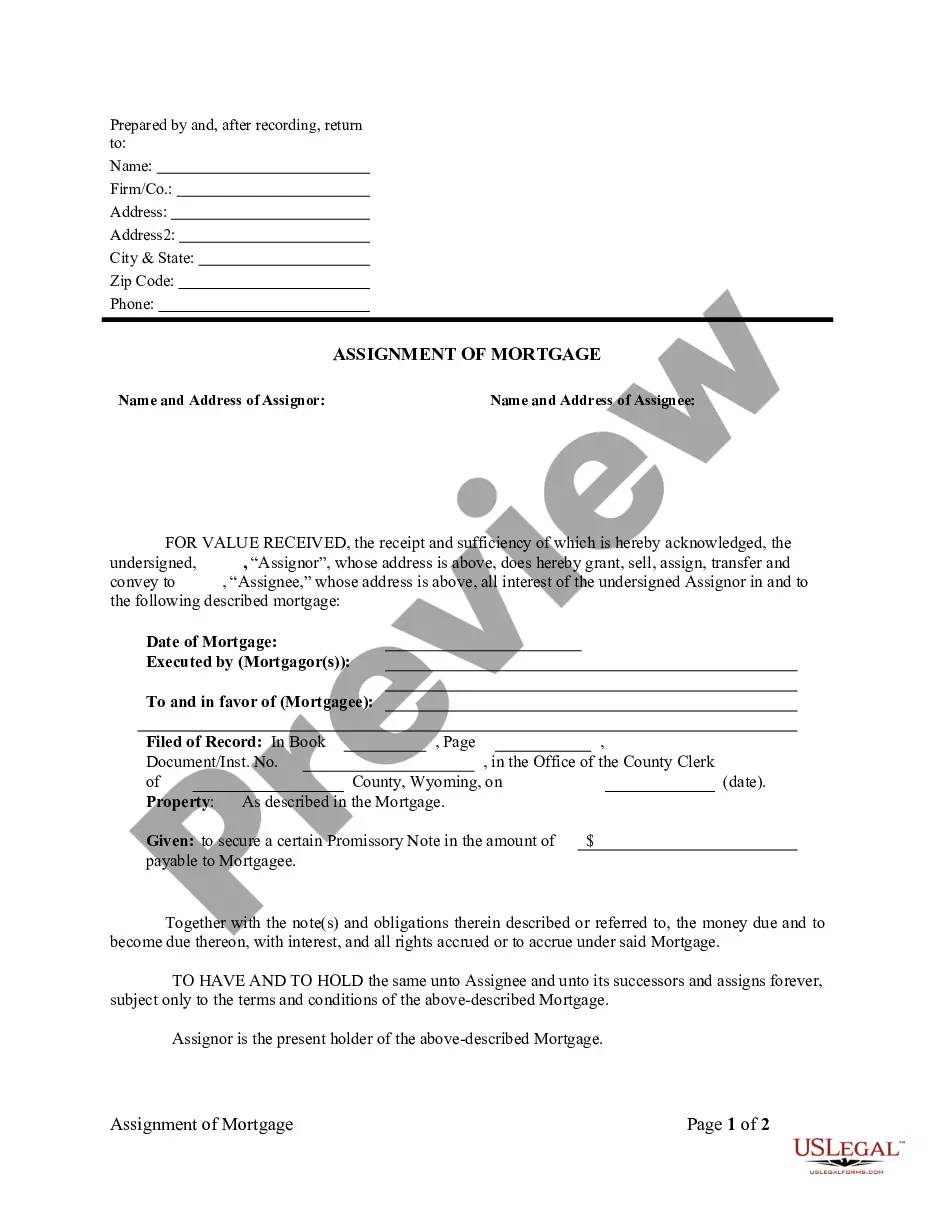

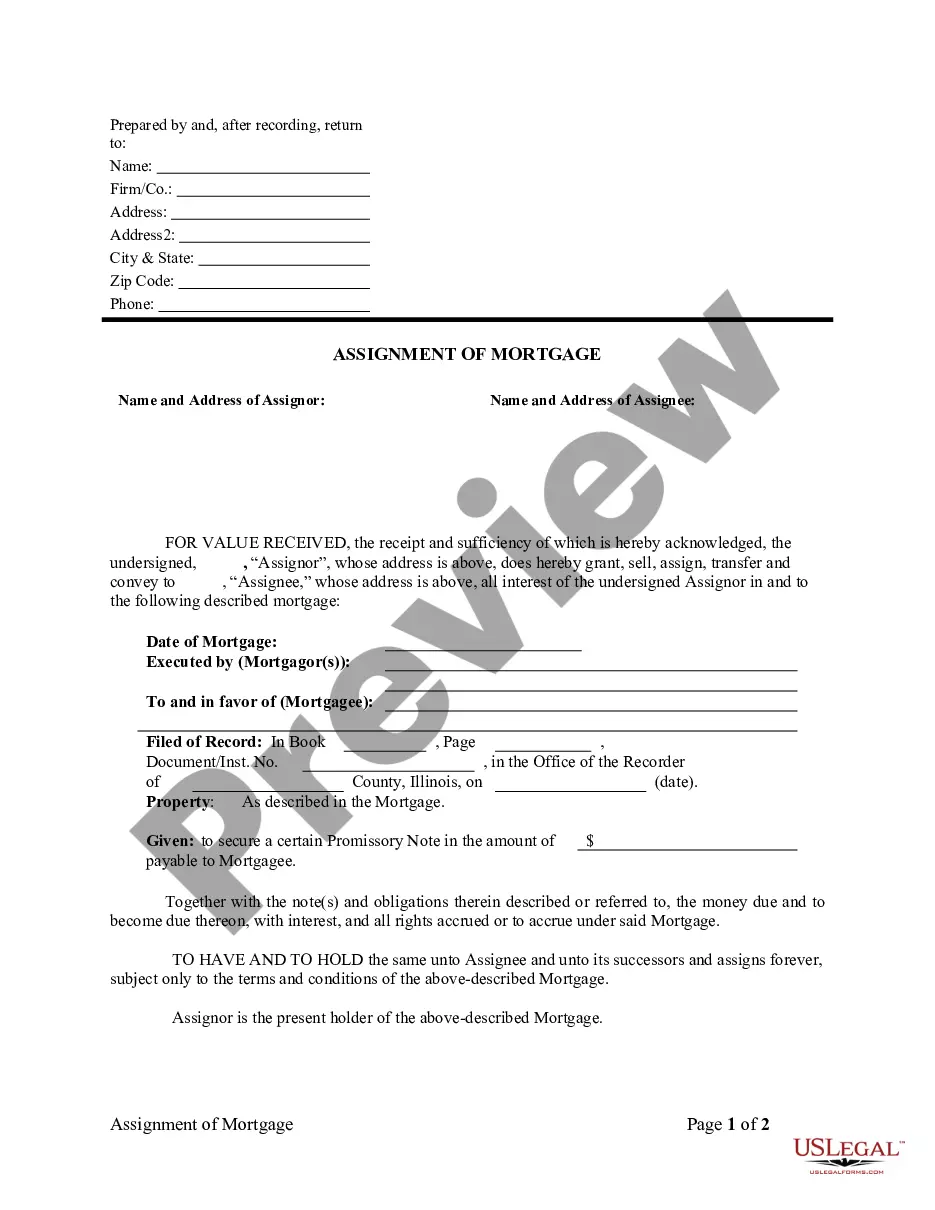

Assignment of Mortgage by Individual Mortgage Holder

Assignments Generally: Lenders, or holders

of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee (person

who received the assignment) steps into the place of the original lender

or assignor. To effectuate an assignment, the general rule is that the

assignment must be in proper written format and recorded to provide notice

of the assignment.

Satisfactions Generally:

Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Wyoming Law

Execution of Assignment or Satisfaction:

To be executed and acknowledged by Mortgagee.

Assignment:

An assignment must be in writing and recorded.

Demand to Satisfy:

Upon full payoff, written request by mortgagor may be sent to mortgagee by registered or ceritified

mail, requesting satisfaction, whereupon the mortgagee must record satisfaction

within 30 days.

Recording Satisfaction:

Mortgagee shall, within 30 days after receiving written request for satisfaction, execute

and acknowledge a deed of discharge if there has been full performance

of the mortgage.

Marginal Satisfaction:

Any mortgage or deed of trust shall be discharged upon the record thereof ... and the county

clerk shall make a reference to such release upon the margin of the record

of the mortgage or trust deed.

Penalty:

A mortgagee who fails to discharge a mortgage within the 30 day period following notice is liable to the mortgagor

or his assignees for actual damages resulting from the failure and special

damages in the amount of one-tenth of one percent (.10%) of the original

principal amount of the mortgage for each additional day (maximum of $100

per day) after the 30 day period until the mortgage is discharged.

Acknowledgment:

An assignment or satisfaction must contain a proper Wyoming acknowledgment, or other acknowledgment approved

by Statute.

Wyoming Statutes

34-1-130. County clerk to discharge mortgage or deed

of trust on record when certificate of release recorded.

Any mortgage or deed of trust shall be discharged upon the record

thereof, by the county clerk in whose custody it shall be, or in whose

office it is recorded, when there shall be recorded in his office a certificate

or deed of release executed by the mortgagee, trustee or beneficiary, his

assignee or legally authorized representative, or by a title agent or title

insurer ... acknowledged or proven and certified as by law prescribed to

entitle conveyances to be recorded, specifying that such mortgage or deed

of trust has been paid or otherwise satisfied or discharged, and the county

clerk shall make a reference to such release upon the margin of the record

of the mortgage or trust deed.

34-1-131. Force and effect of section 34-1-130

on mortgages and deeds of trust executed and deeds of trust discharged

prior to act.

The preceding section [§ 34-1-130], as hereby amended, shall

apply to all mortgages and deeds of trust, heretofore as well as those

which may be hereafter, executed and the release or discharge of any deed

of trust heretofore made in accordance with said section, by the trustee

named in said deed of trust or his successor, is hereby legalized and declared

to be as binding upon all parties in interest as though such release or

discharge had been made after the passage of this act.

34-1-132. Liability of mortgagee for failing

to discharge; damage limitations; definition.

(a) A mortgagee shall, within

thirty (30) days after having received by certified or registered mail

a request in writing for the discharge or release of a mortgage, execute

and acknowledge a certificate or deed of discharge or release of the mortgage

if there has been full performance of the condition of the mortgage and

if there is no other written agreement between the mortgagee and mortgagor

encumbering the property subject to the mortgage.

(b) A mortgagee who fails or refuses

to discharge or release a mortgage within the thirty (30) day period required

by subsection (a) of this section is liable to the mortgagor or his assignees

for:

(i) All actual

damages resulting from the mortgagee's failure or refusal to discharge

or release the mortgage; and

(ii) Special

damages in the amount of one-tenth of one percent (.10%) of the original

principal amount of the mortgage for each additional day after the thirty

(30) day period until the mortgage is released or discharged. Special

damages authorized by this paragraph shall not exceed one hundred dollars

($100.00) per day.

(c) Notwithstanding any assignment

of the mortgage, the mortgagee of record is liable for the damages

specified in subsection (b) of this section unless, within sixty (60) days

after receipt of the request for discharge or release as provided by subsection

(a) of this section, he furnishes to the person making the request the

name and address of the current assignee or holder of the mortgage who

has legal authority to execute the discharge or release.

(d) As used in this section "mortgagee"

means the mortgagee named in the original mortgage or, if assigned, the

current holder of the mortgage or the servicing agent for the current holder

of the mortgage.

34-1-142. Instrument transferring title to real property;

procedure; exceptions; confidentiality.

(a) When a deed, contract or other document transferring legal

or equitable title to real property is presented to a county clerk for

recording, the instrument shall be accompanied by a statement under oath

by the grantee or his agent disclosing the name of the grantor and grantee,

the date of transfer, date of sale, a legal description of the property

transferred, the actual full amount paid or to be paid for the property,

terms of sale and an estimate of the value of any nonreal property included

in the sale.

(b) No instrument evidencing a transfer of real property may

be accepted for recording until the sworn statement is received by the

county clerk. The validity or effectiveness of an instrument as between

the parties is not affected by the failure to comply with subsection (a)

of this section.

(c) This section does not apply to:

(i) An instrument which confirms, corrects, modifies or supplements

a previously recorded instrument without added consideration;

(ii) A transfer pursuant to mergers, consolidations or reorganizations

of business entities;

(iii) A transfer by a subsidiary corporation to its parent

corporation without actual consideration or in sole consideration of the

cancellation or surrender of a subsidiary stock;

(v) A transfer between husband and wife or parent and child

with only nominal consideration therefor;

(viii) Any other transfers which the state board of equalization

and department of revenue exempts upon a finding that the information is

not useful or relevant in determining sales-price ratios.

(d) The sworn statements shall be used by the county assessors

and the state board of equalization and the department of revenue along

with other statements filed only as data in a collection of statistics

which shall be used collectively in determining sales-price ratios by county.

An individual statement shall not, by itself, be used by the county assessor

to adjust the assessed value of any individual property.

(e) The statement is not a public record and shall be held

confidential by the county clerk, county assessor, the state board of equalization

the department of revenue and when disclosed under subsection (g) of this

section, any person wishing to review or contest his property tax assessment

or valuation and the county board of equalization. These statements shall

not be subject to discovery in any other county or state proceeding.

(f) Repealed by Laws 1991, ch. 174, §3.

(g) Any person or his agent who wishes to review his property

tax assessment or who contests his property tax assessment or valuation

in a timely manner as provided by law is entitled to review statements

of consideration and all other information used by the county assessor

in determining the value of the property at issue as provided under W.S.

39-13-109(b)(i). During a review, the county assessor shall disclose information

sufficient to permit identification of the real estate parcels used by

the county assessor in determining the value of the property at issue and

provide the person or his agent papers of all information, including statements

of consideration, the assessor relied upon in determining the property value.

The county assessor and the contestant shall disclose those statements

of consideration to the county board of equalization in conjunction with

any hearing before the board with respect to the value or assessment of

that property. As used in W.S. 34-1-142 through 34-1-144:

(i) A "review" is considered the initial meetings between

the taxpayer and the county assessor's office;

(h) The state board of equalization shall adopt rules and

regulations to implement W.S. 34-1-142 and 34-1-143 which shall include

forms to be used and which shall be used by county assessors and county

clerks.

34-1-143. Information to be furnished to department of revenue

and the state board of equalization.

The county clerk shall place the recording data on the statement

of consideration paid and deliver the statement to the county assessor.

The county assessor shall furnish information from the statements of consideration

to the state board of equalization and department of revenue as the board

or department shall require, and when disclosed under W.S. 34-1-142(g)

and 39-13-109(b)(i), any person or his agent wishing to review or contest

his property tax assessment or valuation and the county board of equalization.

The county assessor may furnish information from the statements of consideration

to a county assessor in another county in this state to be used as provided

by law.

34-1-145. Definitions.

(a) As used in W.S. 34-1-145 through 34-1-150:

(i) "Beneficiary" means the record owner of the beneficiary's

interest under a trust deed, including successors in interest;

(iii) "Mortgagee" means the record owner of the mortgagee's

interest under a mortgage, including a successor in interest;

(iv) "Satisfactory evidence of the full payment of the obligation

secured by a trust deed or mortgage" means the original cancelled check

or a copy of a cancelled check, showing all endorsements, payable to the

beneficiary, servicer or mortgagee and reasonable documentary evidence

that the check was to effect full payment under the trust deed or an encumbrance

upon the property covered by the trust deed or mortgage;

(v) "Servicer" means a person or entity that collects loan

payments on behalf of a beneficiary or mortgagee;

(vi) "Title agent" means a title insurance agent licensed

as an organization under W.S. 26-23-316 and bonded as a title abstractor

under W.S. 26-23-308 or 33-2-101;

(vii) "Title insurer" means a title insurer authorized to

conduct business in the state under the Wyoming Insurance Code;

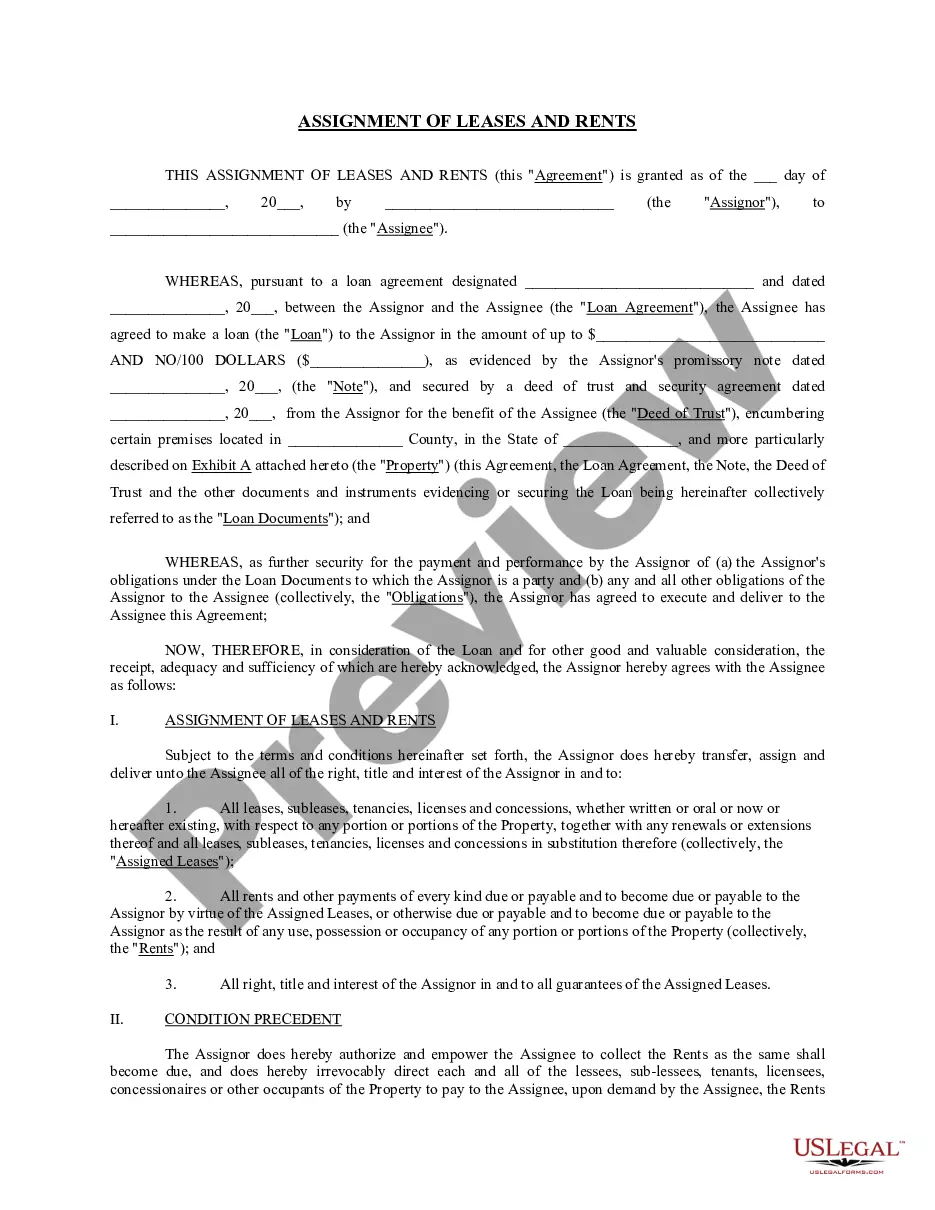

34-1-146. Reconveyance of trust deed or release of mortgage;

procedures; forms.

(a) A title insurer or title agent may reconvey a trust deed

or release a mortgage in accordance with the provisions of subsections

(b) through (f) of this section if:

(i) The obligation secured by the trust deed or mortgage has

been fully paid by the title insurer or title agent; or

(ii) The title insurer or title agent possesses satisfactory

evidence of the full payment of the obligation secured by a trust deed

or mortgage.

(b) A title insurer or title agent may reconvey a trust deed

or release a mortgage under subsection (a) of this section regardless of

whether the title insurer or title agent is named as a trustee under a

trust deed or has the authority to release a mortgage.

(c) No sooner than thirty (30) days after payment in full

of the obligation secured by a trust deed or mortgage, and after notice

is given pursuant to W.S. 34-1-132, the title insurer or title agent shall

deliver to the beneficiary, mortgagee or servicer, or send by certified

mail to the beneficiary, mortgagee or servicer, at the address specified

in the trust deed or mortgage or at any address for the beneficiary or

mortgagee specified in the last recorded assignment of the trust

deed or mortgage a notice of intent to release or reconvey and a copy of

the release or reconveyance to be recorded as provided in subsections (d)

and (e) of this section.

(d) The notice of intent to release or reconvey shall contain

the name of the beneficiary or mortgagee and the servicer if loan payments

on the trust deed or mortgage are collected by a servicer, the name of

the title insurer or title agent, [and] the date ...

(e) If, within thirty (30) days from the day on which the

title insurer or title agent delivered or mailed the notice of intent to

release or reconvey in accordance with subsections (c) and (d) of this

section, the beneficiary, mortgagee or servicer does not send by certified

mail to the title insurer or title agent a notice that the obligation secured

by the trust deed or mortgage has not been paid in full or that the beneficiary,

mortgagee or servicer objects to the release of the mortgage or reconveyance

of the trust deed, the title insurer or title agent may execute, acknowledge

and record a reconveyance of a trust deed or release of a mortgage. ...

(f) A release of mortgage or reconveyance of trust deed under

this section does not discharge an obligation that was secured by the trust

deed or mortgage at the time the trust deed was reconveyed or the mortgage

was released.

34-2-113. Cancellation form for mortgage or deed of

trust; recordation; effect.

(a) ...

(b) Such cancellation or discharge shall be entered in

a book kept for that purpose, and signed by the mortgagee or trustee,

his attorney-in-fact, executor, administrator or assigns, in the presence

of the county clerk or this deputy who shall subscribe the same as a witness,

and such cancellation or discharge shall have the same effect as a deed

or release duly acknowledged and recorded.