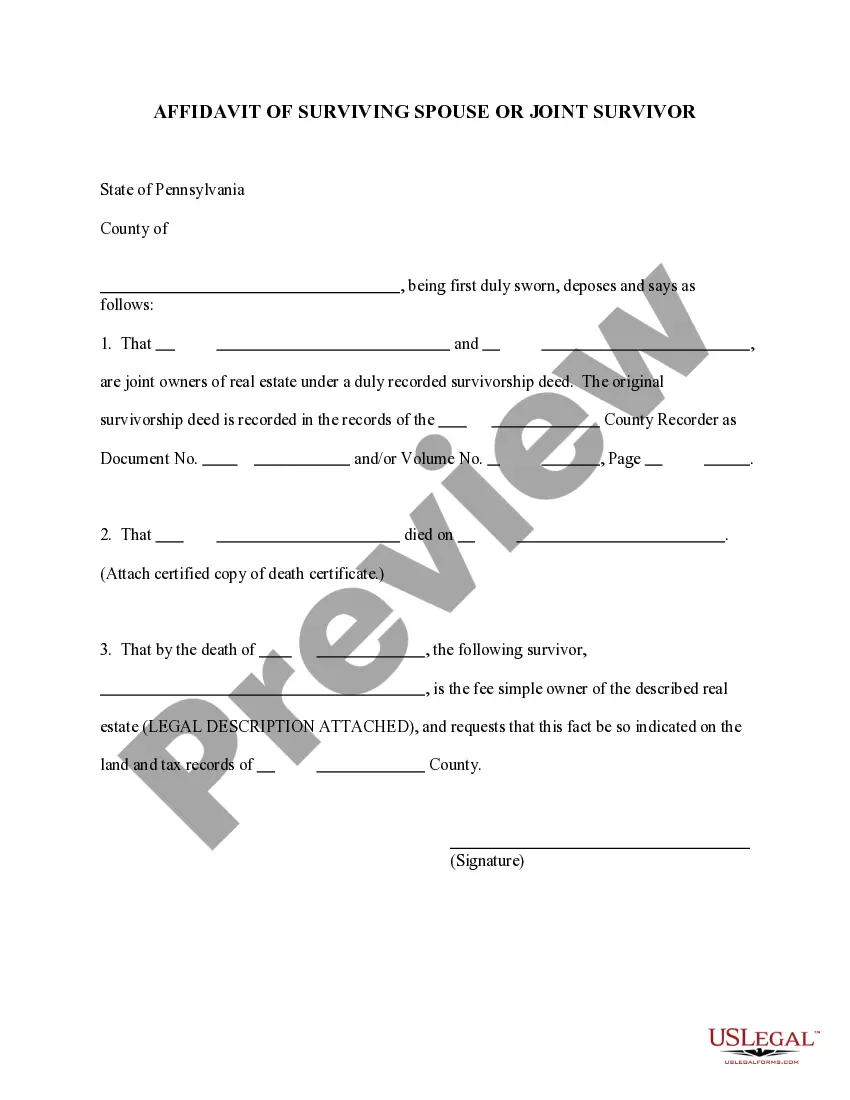

This form is an affidavit in which the affiant is the surviving tenant and former spouse in a joint tenancy, or tenancy by the entireties, with the decedent. The form is used to establish the death of the decedent and the succession of the affiant to the interest of the decedent as a result of the joint interest.

Pennsylvania Affidavit of Surviving Spouse or Joint Survivor

Description

How to fill out Pennsylvania Affidavit Of Surviving Spouse Or Joint Survivor?

Creating papers isn't the most simple task, especially for people who rarely work with legal paperwork. That's why we advise making use of accurate Pennsylvania Affidavit of Surviving Spouse or Joint Survivor samples created by professional lawyers. It gives you the ability to eliminate difficulties when in court or handling official organizations. Find the documents you need on our website for high-quality forms and exact information.

If you’re a user having a US Legal Forms subscription, just log in your account. When you’re in, the Download button will automatically appear on the template page. Soon after accessing the sample, it’ll be stored in the My Forms menu.

Users with no a subscription can easily create an account. Utilize this brief step-by-step guide to get the Pennsylvania Affidavit of Surviving Spouse or Joint Survivor:

- Ensure that the form you found is eligible for use in the state it is required in.

- Confirm the file. Make use of the Preview feature or read its description (if available).

- Buy Now if this file is the thing you need or utilize the Search field to find another one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After finishing these simple actions, you are able to fill out the form in a preferred editor. Double-check filled in data and consider asking a legal representative to examine your Pennsylvania Affidavit of Surviving Spouse or Joint Survivor for correctness. With US Legal Forms, everything gets much simpler. Try it now!

Form popularity

FAQ

Proof of Death: 1. Attach an original death certificate (copies are not acceptable) or have the proper portion of Form MV-39 completed by attending physician or funeral director. d. Vehicle insurance information (insurance company name, policy number, effective date and expiration date) if the vehicle is registered.

Joint tenancy is a way of avoiding probate simply by putting the words "joint tenancy" in the title of an asset.If property is owned in joint tenancy, the surviving joint tenant will receive the deceased joint tenant's interest in the property, regardless of what that person's will or trust says about the property.

If the deceased was sole owner, or co-owned the property without right of survivorship, title passes according to his will. Whoever the will names as the beneficiary to the house inherits it, which requires filing a new deed confirming her title. If the deceased died intestate -- without a will -- state law takes over.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Joint tenancy often works well when couples (married or not) acquire real estate, vehicles, bank accounts, securities, or other valuable property together.

Jointly-owned property.There is no need for probate or letters of administration unless there are other assets that are not jointly owned. The property might have a mortgage. However, if the partners are tenants in common, the surviving partner does not automatically inherit the other person's share.

' Spouses typically acquire title as tenants by the entireties, which only applies to spouses. Sometimes you will see a couple who acquired the property before marriage. In some states, a premarital joint tenancy automatically becomes tenants by the entireties upon marriage.

If the deceased owned real property in NSW as 'joint tenants' with another person, the property will need to be transferred to the surviving joint tenant.You do not need to apply for a grant of probate or letters of administration to transfer property held in joint names.

In cases where a couple shares a home but only one spouse's name is on it, the home will not automatically pass to the surviving pass, if his or her name is not on the title.