The Massachusetts Instructions for Completing MPC 455 Combo Assent Form is a document provided by the Massachusetts Department of Revenue (FOR) that must be completed by taxpayers who are filing a combined return with multiple business entities. The form is used to provide the FOR with the necessary information to properly assess taxes and fees on the combined return. The form includes instructions on how to complete the form, including how to enter the business entities' information, the applicable tax rates and filing requirements, and the deadlines for filing. The form also outlines any special instructions or exemptions that may apply to the taxpayer. The instructions are broken down into two categories: Basic Instructions and General Instructions. Basic Instructions cover the basic information required to file the form, including the taxpayer's name, address, filing status, and gross income. It also includes information on the applicable tax rates and filing requirements, as well as instructions on computing the total tax due. General Instructions cover more specific information, such as entering business entities' information, any special instructions or exemptions, and the deadlines for filing. It also provides instructions on how to complete the form correctly and how to submit it to the FOR. In addition, the Massachusetts Instructions for Completing MPC 455 Combo Assent Form includes information on the forms that must be included with the return, as well as instructions on how to file an amended return, if needed.

Massachusetts Instructions for Completing MPC 455 Combo Assent Form

Description

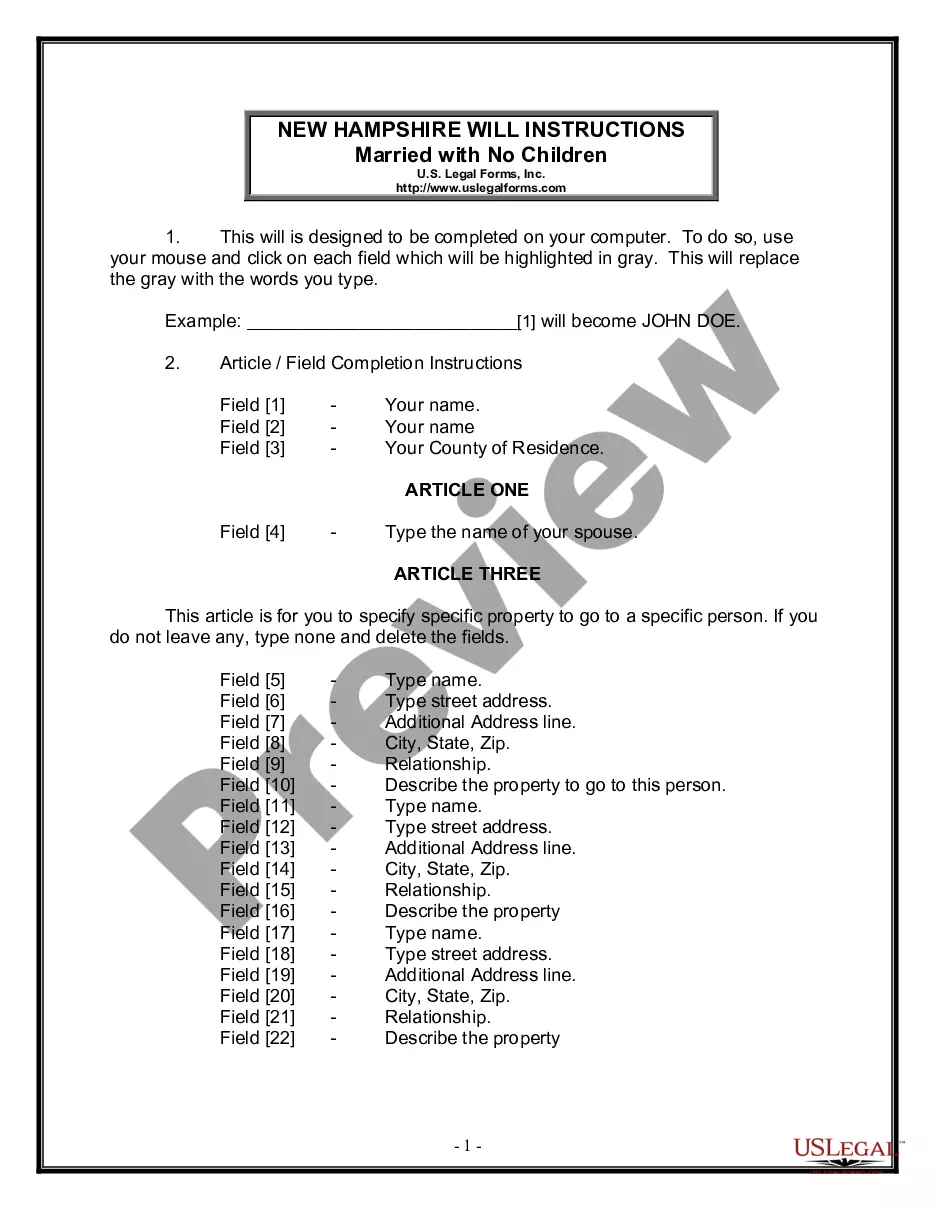

How to fill out Massachusetts Instructions For Completing MPC 455 Combo Assent Form?

Engaging with legal paperwork demands focus, accuracy, and utilizing appropriately drafted templates. US Legal Forms has been assisting individuals across the country with this for 25 years, so when you select your Massachusetts Instructions for Completing MPC 455 Combo Assent Form template from our platform, you can trust it adheres to federal and state regulations.

Using our service is simple and efficient. To acquire the required document, all you need is an account with an active subscription. Here’s a concise guide for you to obtain your Massachusetts Instructions for Completing MPC 455 Combo Assent Form in just a few minutes.

All documents are designed for multiple uses, like the Massachusetts Instructions for Completing MPC 455 Combo Assent Form featured on this page. If you require them again, you can fill them out without any additional payment - simply navigate to the My documents tab in your profile and complete your document whenever necessary. Experience US Legal Forms and prepare your business and personal documents swiftly and in full legal compliance!

- Ensure to carefully review the form content and its alignment with general and legal standards by previewing it or looking over its description.

- Look for an alternative official blank if the one you have opened doesn’t fit your requirements or state laws (the option for that is located at the top page corner).

- Log in to your account and save the Massachusetts Instructions for Completing MPC 455 Combo Assent Form in your desired format. If it’s your first time using our site, click Buy now to continue.

- Create an account, select your subscription plan, and pay using your credit card or PayPal account.

- Decide on the format you wish to save your document and click Download. Print the blank or open it in a professional PDF editor to format it electronically.

Form popularity

FAQ

When the probate court appoints a personal representative, it issues a document called "Letters." This document is proof of the personal representative's legal authority to collect and manage estate property. The personal representative is entitled to collect a reasonable fee for the work performed for the estate.

You will definitely need to apply for probate if: You need to sell property on behalf of the estate. Any banks or organisations the person who died held accounts with have told you they will need to see the Grant of Probate in order to release funds.

Below are 4 options for closing down an estate in Massachusetts. Option 1 ? Not filing Anything.Option 2 ? Filing a Small Estate Closing Statement.Option 3 ? Filing a Closing Statement.Option 4 ? Petition for Complete Settlement of Estate.

You skipped the table of contents section. Begin the process & give notice. A magistrate can issue an informal probate order as soon as 7 days after the decedent's death.Fill out the forms.Gather the fees.File the forms and fees.Post a publication notice.

Assent and Waiver of Notice Select this box if you assent agree to the content of the pleading being filed with the Court and you agree to waive any legal right to notice to which you are entitled related to that specific pleading.

Letters and probate fees Type of pleadingFiling feeFormal Probate of Will, Adjudication of Intestacy and Appointment of Personal Representative, Petition$375Formal Appointment of Successor Personal Representative, Petition$375Formal Removal of Personal Representative, Petition$100General Petition, Probate$15027 more rows

Massachusetts probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

Is there a deadline to probate an estate? The general rule is that an estate has to be probated within 3 years of when the decedent died.