Pennsylvania Executor's Deed - Co-Executors to Two or More Grantees

Understanding this form

The Executor's Deed - Co-Executors to Two or More Grantees is a legal document used to transfer real property from the estate of a deceased individual to one or more grantees. This deed is specifically designed for situations where there are multiple co-executors handling the estate and multiple grantees receiving the property. It ensures that the transfer is legally compliant and clearly outlines the rights of the grantors and grantees involved in the transaction.

Key parts of this document

- Identifies the co-executors acting on behalf of the deceased's estate.

- Details the property being transferred, including a legal description.

- Includes language that confirms the authority of the co-executors to convey the property.

- Specifies the names of the grantees receiving the property.

- Contains spaces for signatures of the grantors and witnesses, if required.

Situations where this form applies

This form should be used during the transfer of real estate property from a deceased person's estate when there are multiple co-executors and multiple beneficiaries receiving the property. It is particularly relevant when the estate is in the process of being settled and property needs to be officially conveyed to the new owners as part of the estate distribution.

Who can use this document

This form is intended for:

- Co-executors of a deceased individual's estate who have been appointed to oversee the distribution of the estate's assets.

- Individuals or entities designated as grantees who will receive real property from the estate.

- Attorneys assisting in the estate settlement process.

How to prepare this document

- Identify the co-executors and provide their names as they appear in the will.

- Clearly describe the property being transferred, including its legal description.

- List the names of the grantees who will receive ownership of the property.

- Sign and date the form in the presence of witnesses, if required.

- Consider notarizing the deed to ensure its legality and acceptance by local authorities.

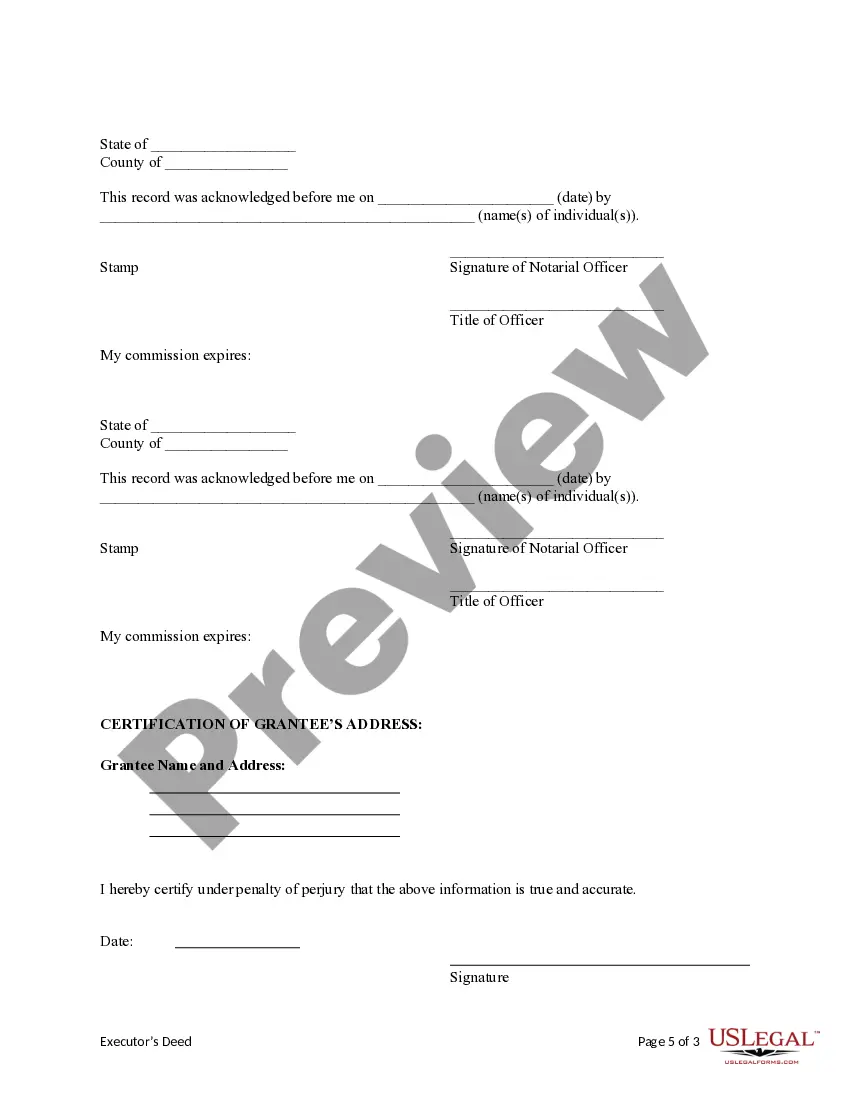

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

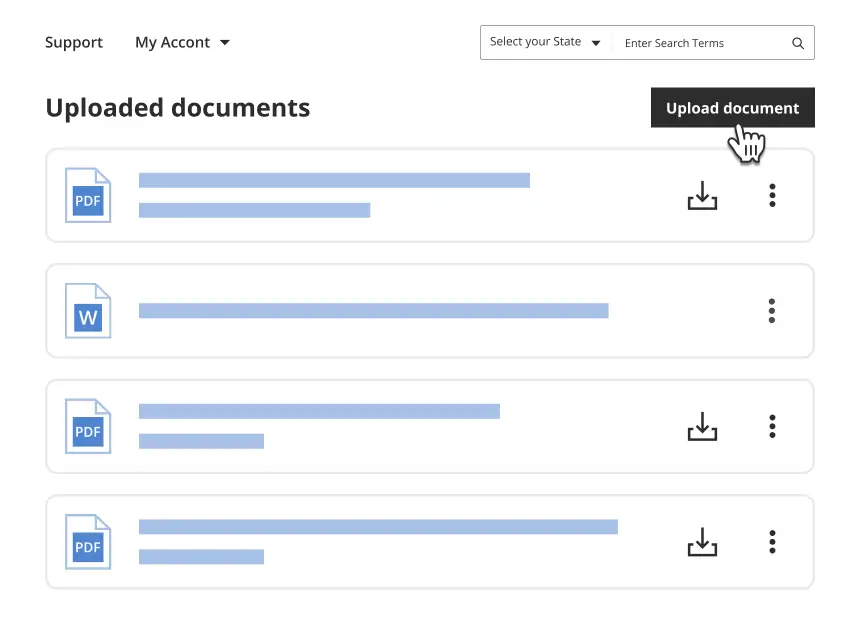

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to accurately describe the property being transferred.

- Not including all co-executors in the deed.

- Omitting signatures or dates from the document.

- Leaving out necessary witness signatures or notarization.

Benefits of completing this form online

- Convenience of completing the form digitally at your own pace.

- Editability allows for easy updates and modifications as necessary.

- Access to accurate and legally compliant templates drafted by licensed attorneys.

- Immediate download for quick turnaround in legal transactions.

Summary of main points

- The Executor's Deed - Co-Executors to Two or More Grantees facilitates the transfer of property in estate matters.

- It is crucial for co-executors to accurately complete and sign the deed.

- Notarization is often required to ensure the document's legal validity.

- This form can be easily obtained and filled out online for convenience.

Looking for another form?

Form popularity

FAQ

When you and someone else are named as co-executors in a Will, that essentially means that you must execute the Will together. You must both apply to Probate the Will together. You must both sign checks and title transfers together. Basically, neither of you may act independently of the other.

A sole Executor is usually able to act alone during Probate, although there are some important factors to consider. A joint Executor will not usually be able to act alone unless the other Executors formally agree to this.

If one of the co-executors does not agree, then the estate cannot take the action. So, each co executor should be working together with the other co executor to administer the estate.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

Pennsylvania does not allow real estate to be transferred with transfer-on-death deeds.

Both executors must sign the initial petition with the probate court. Typically, both executors will have to sign checks and other estate paperwork. Both executors may be responsible for filing tax returns. You have a duty to monitor the actions of the other executor and to report any unethical or illegal behavior.

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

Can I start the estate process without them? Co-Executors in Pennsylvania must serve jointly.