Pennsylvania Executor's Deed - Co-Executors to Two or More Grantees

What this document covers

The Executor's Deed - Co-Executors to Two or More Grantees is a legal document used to transfer real property from the estate of a deceased individual to two or more designated grantees. This form is specific to scenarios where multiple co-executors of an estate are involved in the transfer of property, differentiating it from standard deeds used in simpler transactions. It ensures that all co-executors are recognized as signatory parties in the transaction, which is crucial for the validity of the deed.

Key components of this form

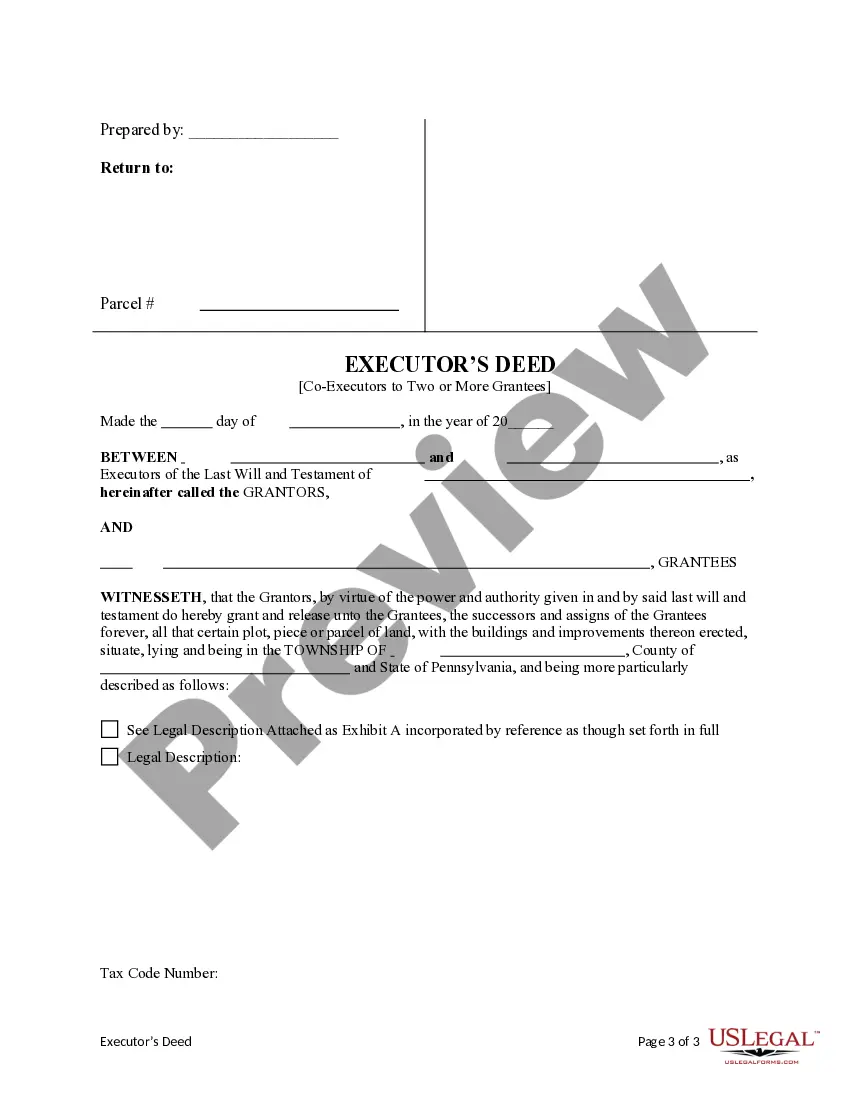

- Names and addresses of the co-executors and grantees.

- Description of the property being transferred.

- Recitals regarding the authority of the co-executors to convey the property.

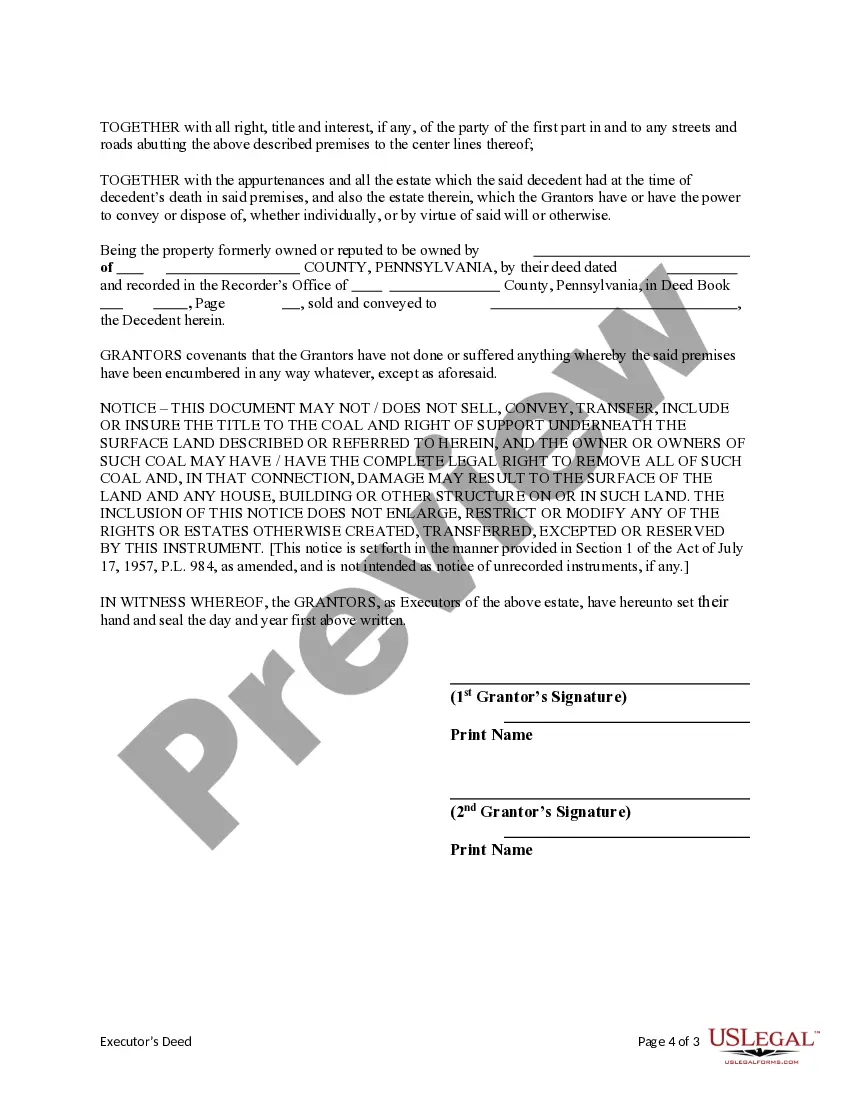

- Signatures of all co-executors indicating their agreement to the transfer.

- Date of execution of the deed.

Situations where this form applies

This form should be used when co-executors are responsible for administering an estate and need to transfer real property to two or more beneficiaries or grantees. Common situations include the sale of property to heirs, distribution of estate assets, or when fulfilling the conditions of a will that specifies multiple recipients. It is essential whenever there is shared responsibility among executors in executing property transfers.

Who needs this form

This form is intended for:

- Co-executors managing the estate of a deceased individual.

- Individuals or entities designated as grantees receiving property through the estate.

- Attorneys assisting clients with estate administration and property transfers.

Steps to complete this form

- Identify and enter the names and addresses of all co-executors and grantees.

- Provide a detailed description of the property being transferred.

- Include any necessary recitals regarding the authority of the co-executors.

- All co-executors should sign and date the deed.

- Ensure all information is reviewed for accuracy before finalizing.

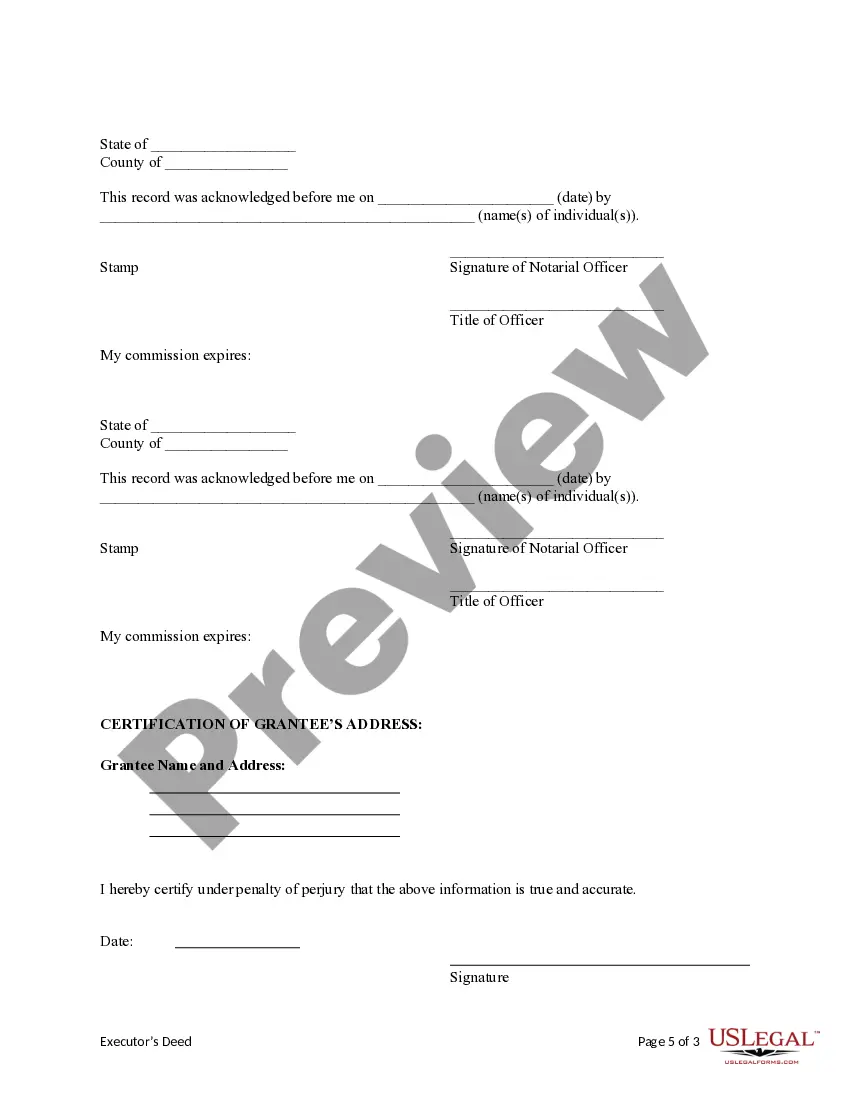

Does this form need to be notarized?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Neglecting to include all co-executors in the signing process.

- Failing to provide a clear property description.

- Skipping the date of execution or signatures.

- Using outdated forms or not adapting the language as required by state law.

Benefits of completing this form online

- Convenience of accessing and downloading the form from anywhere.

- Editability allows for quick adjustments to details before printing.

- Reliable format ensures compliance with legal standards.

- Immediate access to the latest version of the form, reflecting current laws.

Looking for another form?

Form popularity

FAQ

When you and someone else are named as co-executors in a Will, that essentially means that you must execute the Will together. You must both apply to Probate the Will together. You must both sign checks and title transfers together. Basically, neither of you may act independently of the other.

A sole Executor is usually able to act alone during Probate, although there are some important factors to consider. A joint Executor will not usually be able to act alone unless the other Executors formally agree to this.

If one of the co-executors does not agree, then the estate cannot take the action. So, each co executor should be working together with the other co executor to administer the estate.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

Pennsylvania does not allow real estate to be transferred with transfer-on-death deeds.

Both executors must sign the initial petition with the probate court. Typically, both executors will have to sign checks and other estate paperwork. Both executors may be responsible for filing tax returns. You have a duty to monitor the actions of the other executor and to report any unethical or illegal behavior.

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

Can I start the estate process without them? Co-Executors in Pennsylvania must serve jointly.