The Massachusetts Decree of Sale of Real Estate Debts, Legacies, and Charges of Administration is a set of laws and regulations that govern the sale of real estate debts, legacies, and charges of administration in the state of Massachusetts. It provides the necessary legal framework for the sale of real estate debts, legacies, and charges of administration in the state and outlines the specific procedures and rules that must be followed. The Massachusetts Decree of Sale of Real Estate Debts, Legacies, and Charges of Administration is administered by the Massachusetts Department of Revenue and is applicable to all counties in the state. The Massachusetts Decree of Sale of Real Estate Debts, Legacies, and Charges of Administration consists of two types: a regular Decree of Sale and a Special Decree of Sale. The regular Decree of Sale requires the creditor to provide a written statement outlining the terms of the sale and to post a bond with the court. The Special Decree of Sale is used when the creditor is unable to provide a written statement or post a bond. In these cases, the court will appoint a Trustee to oversee the sale. The Massachusetts Decree of Sale of Real Estate Debts, Legacies, and Charges of Administration also outlines the process for filing a petition for sale in court, and the requirements for a sale to be approved. The Decree also outlines the fees and costs associated with a sale, including the fees for advertising, court costs, and fees for the trustee. The Decree also outlines the procedure for the sale itself, including the rules for auctioning the debt or legacy, and the procedure for distributing the proceeds of the sale. Finally, the Decree outlines the procedures for appealing a sale, and for the enforcement of a sale.

Massachusetts Decree of Sale of Real Estate Debts, Legacies, Charges of Administration

Description

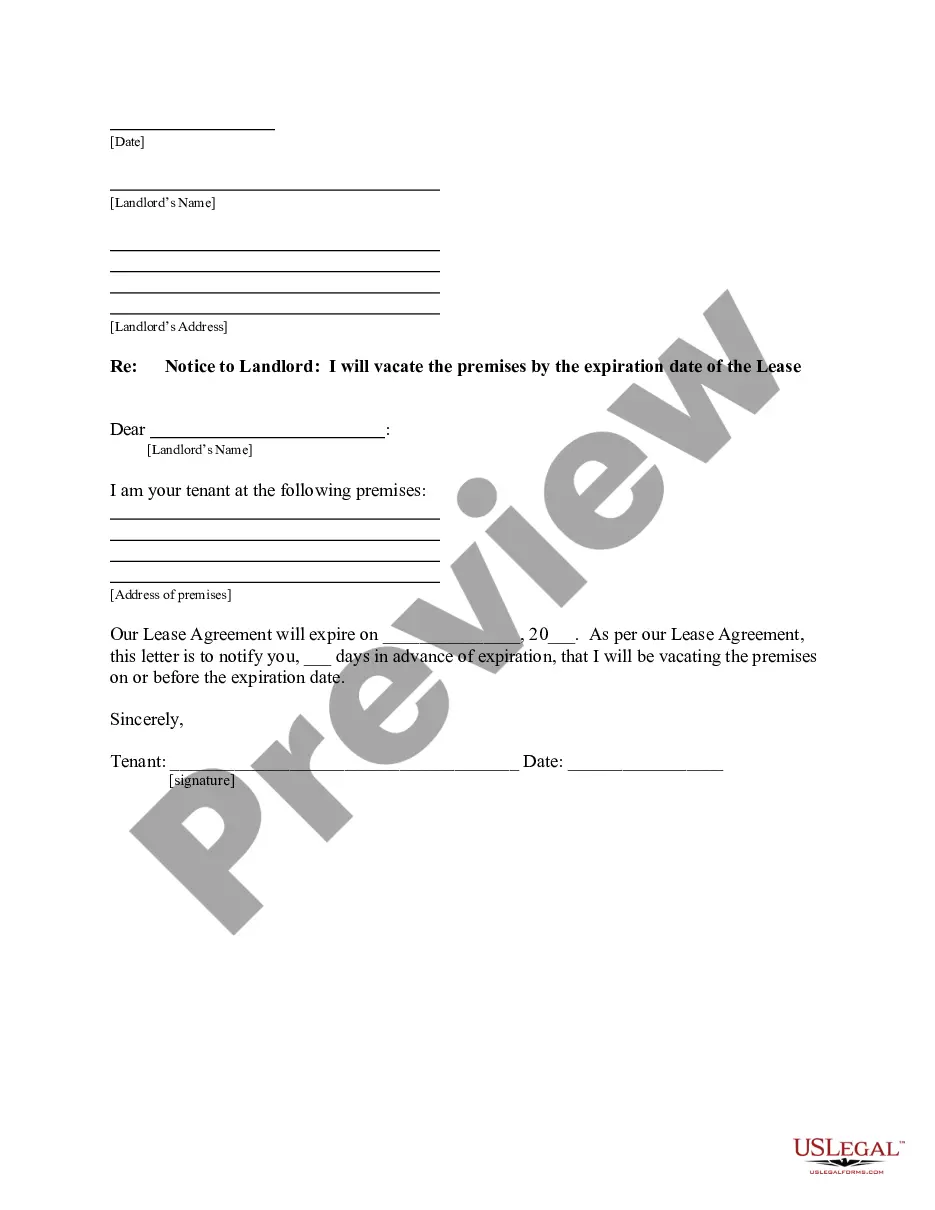

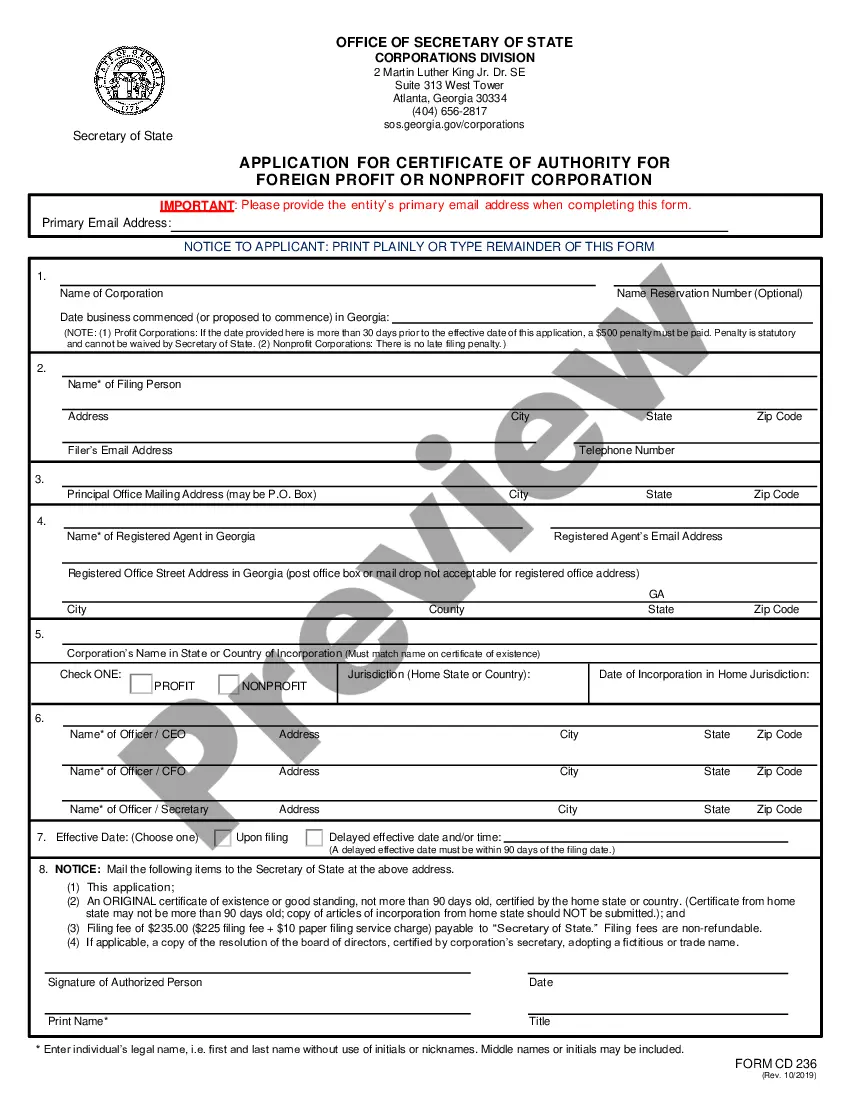

How to fill out Massachusetts Decree Of Sale Of Real Estate Debts, Legacies, Charges Of Administration?

Working with legal paperwork requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Massachusetts Decree of Sale of Real Estate Debts, Legacies, Charges of Administration template from our library, you can be sure it complies with federal and state regulations.

Working with our service is straightforward and fast. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to find your Massachusetts Decree of Sale of Real Estate Debts, Legacies, Charges of Administration within minutes:

- Make sure to carefully check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another formal template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Massachusetts Decree of Sale of Real Estate Debts, Legacies, Charges of Administration in the format you need. If it’s your first experience with our website, click Buy now to proceed.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Massachusetts Decree of Sale of Real Estate Debts, Legacies, Charges of Administration you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!