Oregon Agreement for Rights under Third Party Deed of Trust

Description

How to fill out Agreement For Rights Under Third Party Deed Of Trust?

Are you presently inside a place that you need to have papers for either enterprise or personal purposes virtually every time? There are tons of authorized papers templates available on the net, but discovering kinds you can depend on isn`t straightforward. US Legal Forms delivers a huge number of develop templates, like the Oregon Agreement for Rights under Third Party Deed of Trust, which are created to fulfill federal and state requirements.

If you are previously knowledgeable about US Legal Forms web site and possess a free account, merely log in. Afterward, you may down load the Oregon Agreement for Rights under Third Party Deed of Trust template.

If you do not offer an account and wish to begin to use US Legal Forms, abide by these steps:

- Obtain the develop you will need and ensure it is for the appropriate city/area.

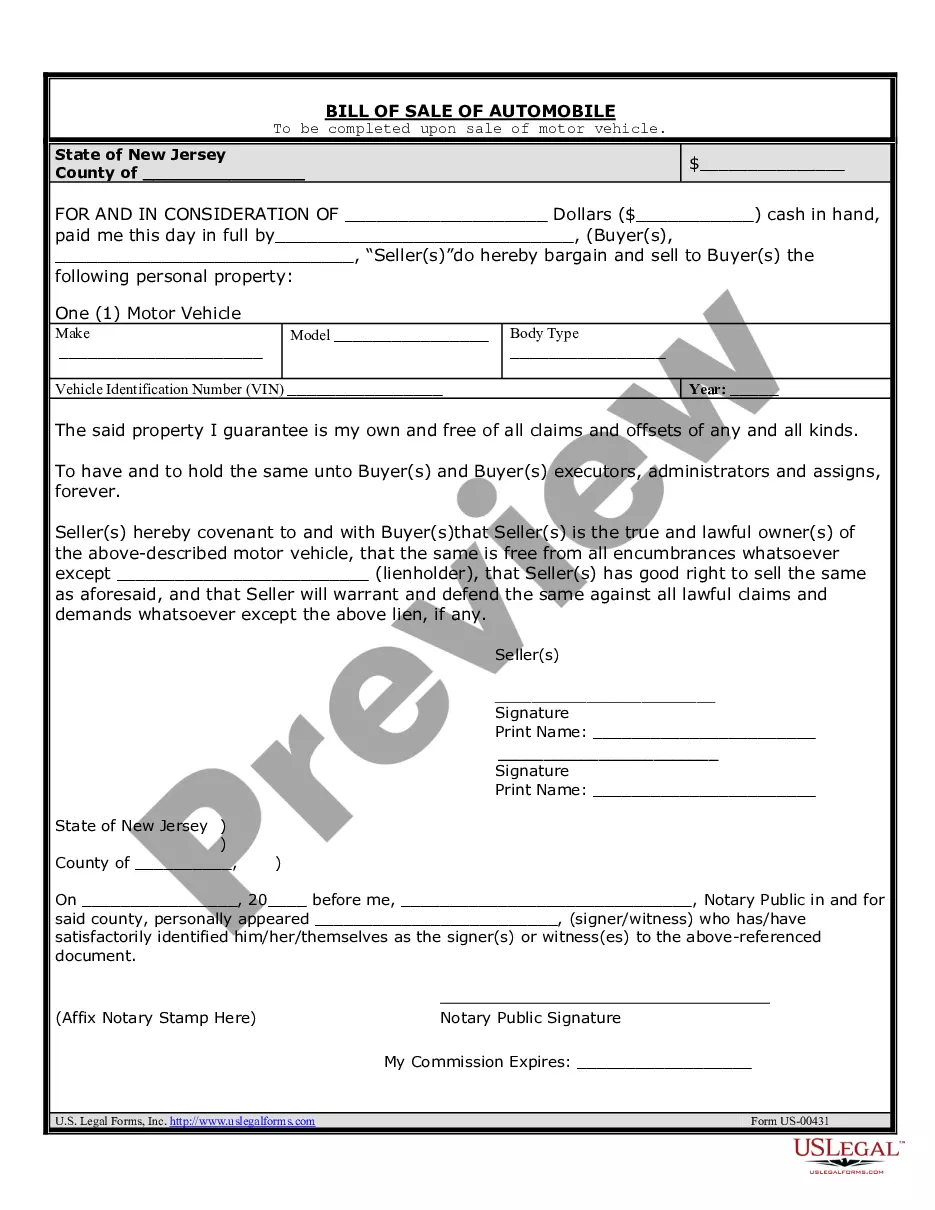

- Utilize the Review button to check the form.

- See the explanation to ensure that you have selected the appropriate develop.

- In case the develop isn`t what you are searching for, make use of the Look for industry to obtain the develop that fits your needs and requirements.

- When you obtain the appropriate develop, click on Acquire now.

- Choose the pricing program you need, fill out the necessary information and facts to make your bank account, and purchase an order with your PayPal or credit card.

- Choose a convenient data file structure and down load your backup.

Get all of the papers templates you possess bought in the My Forms menus. You can obtain a more backup of Oregon Agreement for Rights under Third Party Deed of Trust any time, if necessary. Just click on the essential develop to down load or print the papers template.

Use US Legal Forms, the most substantial variety of authorized varieties, in order to save some time and avoid faults. The services delivers appropriately created authorized papers templates that can be used for an array of purposes. Make a free account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

Trust deeds are an alternative to mortgages in certain states. Instead of an agreement directly between a lender and a borrower, a trust deed places the title of a property in the hands of a third party, or trustee.

There are three parties involved in a deed of trust: Trustor: This is the borrower. Trustee: This is the third party who will hold the legal title to the real property. Beneficiary: This is the lender.

Virtually all voluntary liens secured by Oregon real estate are trust deeds and are therefore governed by the Oregon Trust Deed Act, ORS 86.705 ? 86.795, which has been in existence since 1959.

The Oregon Trust Deed Act was established in 1959 to make the foreclosure process easier and faster by not involving the courts. The Act allows the lender to file a trust deed, which assigns the deed to a third-party (trustee).

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

The Oregon Trust Deed Act was established in 1959 to make the foreclosure process easier and faster by not involving the courts. The Act allows the lender to file a trust deed, which assigns the deed to a third-party (trustee).

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.