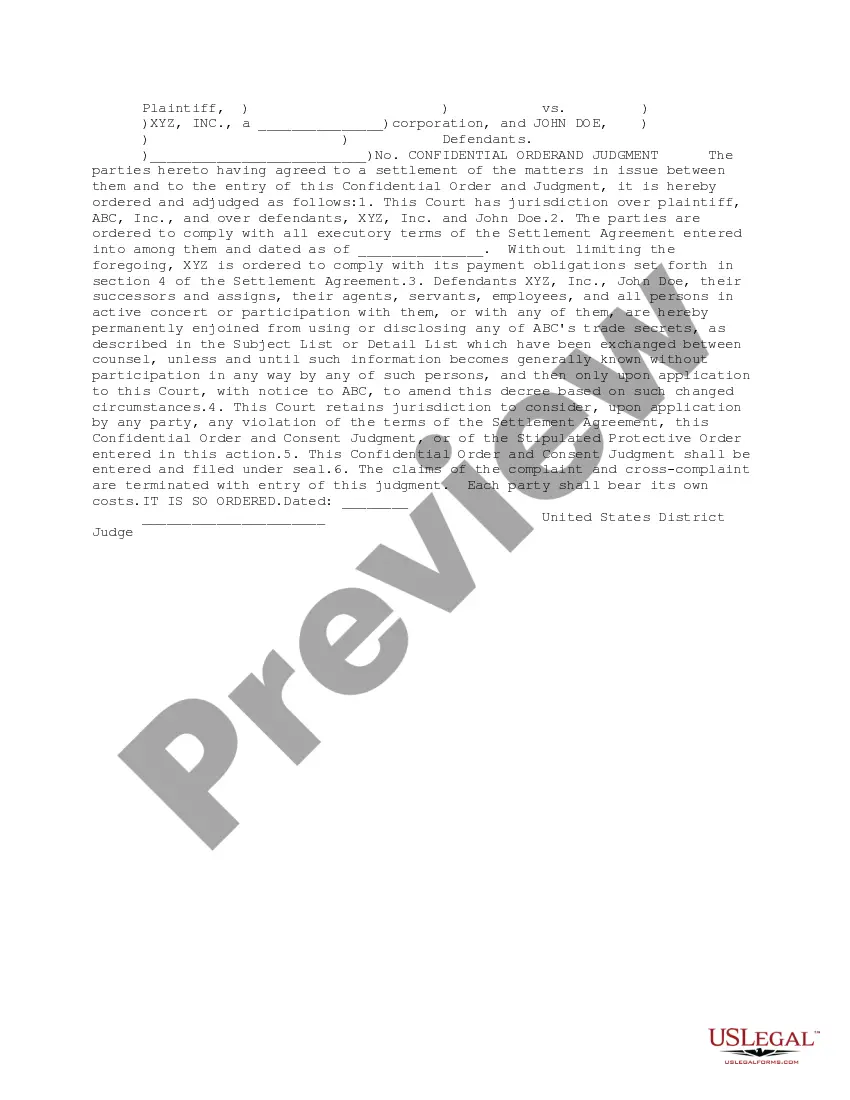

This form is a Settlement Agreement usable in cases where licensing, patents, or commercial trade secrets are a factor.

Oregon Settlement Agreement

Description

How to fill out Settlement Agreement?

If you have to complete, acquire, or produce authorized file themes, use US Legal Forms, the biggest assortment of authorized types, which can be found online. Make use of the site`s easy and practical lookup to get the files you require. Numerous themes for enterprise and specific reasons are categorized by types and claims, or key phrases. Use US Legal Forms to get the Oregon Settlement Agreement with a few clicks.

Should you be previously a US Legal Forms consumer, log in to your account and click on the Acquire switch to have the Oregon Settlement Agreement. Also you can gain access to types you in the past saved in the My Forms tab of the account.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for the appropriate metropolis/nation.

- Step 2. Utilize the Review method to check out the form`s information. Do not forget about to see the explanation.

- Step 3. Should you be unhappy together with the develop, utilize the Look for discipline at the top of the monitor to find other models from the authorized develop web template.

- Step 4. When you have found the shape you require, go through the Get now switch. Choose the costs prepare you choose and include your accreditations to register for an account.

- Step 5. Procedure the purchase. You can utilize your Мisa or Ьastercard or PayPal account to finish the purchase.

- Step 6. Pick the file format from the authorized develop and acquire it in your device.

- Step 7. Full, edit and produce or signal the Oregon Settlement Agreement.

Each authorized file web template you acquire is the one you have eternally. You have acces to each and every develop you saved in your acccount. Go through the My Forms portion and choose a develop to produce or acquire once again.

Compete and acquire, and produce the Oregon Settlement Agreement with US Legal Forms. There are millions of specialist and condition-distinct types you can utilize to your enterprise or specific needs.

Form popularity

FAQ

Even if you're unable to pay your entire balance, you should pay what you can until you receive a bill from us. We offer payment plans up to 36 months, visit Revenue Online to set up a payment plan . If you are unable to set up a payment plan using Revenue Online, call us.

(a) Residents: An Oregon resident is allowed a credit for taxes paid to another state on mutually taxed income if the other state does not allow the credit.

Oregon Settlement Offer If you can't afford to pay your tax bill, the state may be willing to settle it for less than you owe. This is similar to the IRS's offer in compromise program. However, unlike the IRS, the OR DOR will only let you have one settlement offer in your lifetime -- the DOR is very strict about this.

No statute of limitation runs on a tax self-assessed or additionally assessed by the Department in the time allowed by ORS 314.410 and collectible by warrant. However, the statute of 10 years limitation on judgment liens begins to run on a tax lien as soon as the tax warrant is filed pursuant to ORS 314.430.

The agreement must include all of the things that you want to be a part of the final judgment. It must take into account projected future losses and suffering. The judgment must spell out any details that go along with the agreement. In addition, the agreement cannot be made with misrepresentation, duress or fraud.

Oregon Settlement Offer If you can't afford to pay your tax bill, the state may be willing to settle it for less than you owe. This is similar to the IRS's offer in compromise program. However, unlike the IRS, the OR DOR will only let you have one settlement offer in your lifetime -- the DOR is very strict about this.

Expansion to Oregon's Workplace Fairness Act Effective January 1, 2023, additional restrictions on settlement and severance agreements include language that prevents a non-disparagement provision as related to sexual assault or harassment claims.

To be enforceable under Code of Civil Procedure §664.6, the material terms of the settlement must be explicitly defined in the agreement. A settlement agreement, like any other contract, is unenforceable if the parties fail to agree on a material term or if a material term is not reasonably certain.