Oregon Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest

Description

How to fill out Disclaimer And Quitclaim Of Interest In Mineral / Royalty Interest?

You may devote several hours on the web searching for the authorized papers design which fits the federal and state requirements you want. US Legal Forms provides a huge number of authorized types that happen to be analyzed by specialists. It is possible to download or print out the Oregon Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest from your assistance.

If you already possess a US Legal Forms account, it is possible to log in and then click the Down load switch. Afterward, it is possible to comprehensive, edit, print out, or indication the Oregon Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest. Every single authorized papers design you get is the one you have permanently. To have an additional duplicate for any obtained form, visit the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms site initially, stick to the straightforward directions listed below:

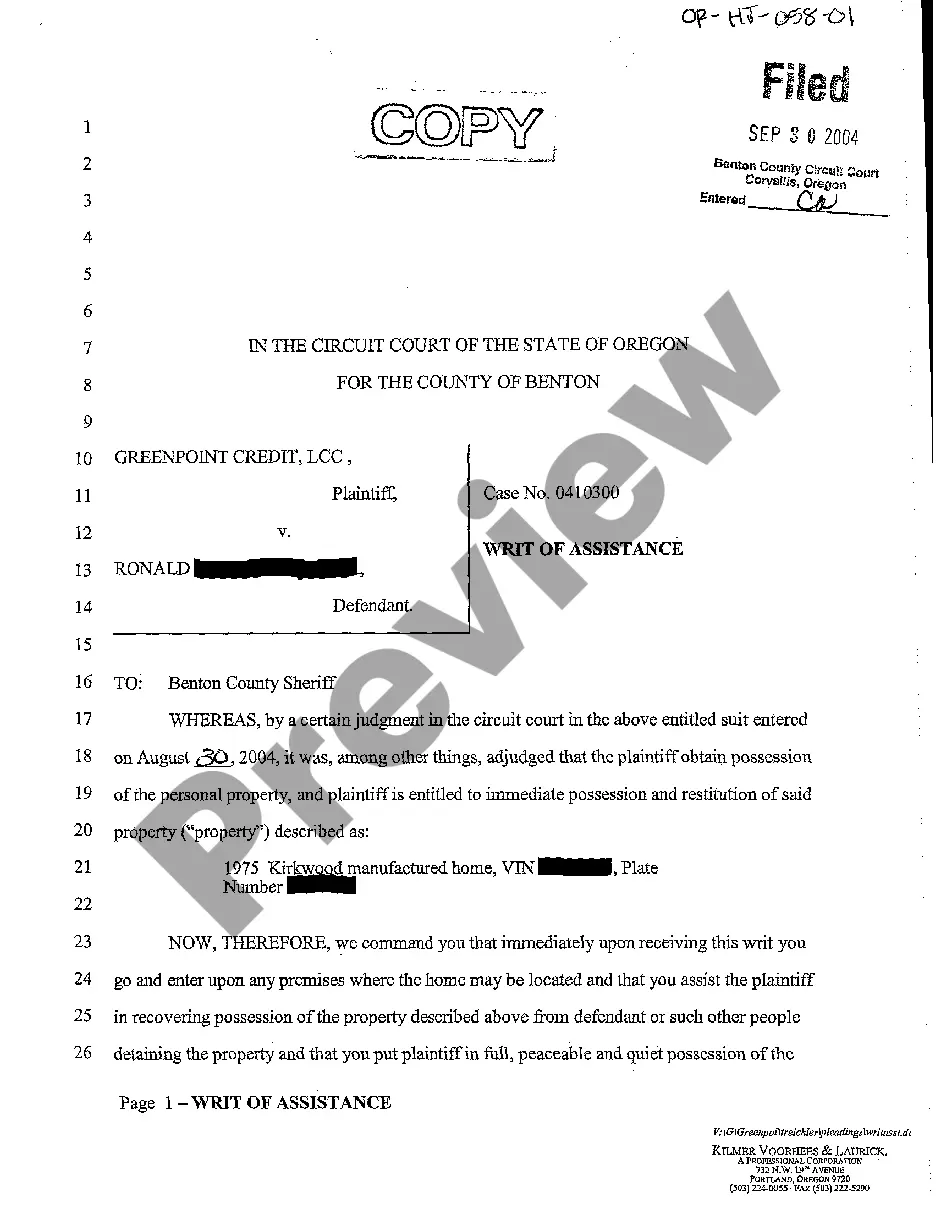

- Initially, make certain you have selected the best papers design for that state/metropolis that you pick. Browse the form information to make sure you have chosen the appropriate form. If available, take advantage of the Review switch to search through the papers design at the same time.

- If you wish to locate an additional variation from the form, take advantage of the Lookup discipline to discover the design that fits your needs and requirements.

- After you have discovered the design you desire, click Buy now to proceed.

- Select the pricing program you desire, key in your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the transaction. You should use your Visa or Mastercard or PayPal account to fund the authorized form.

- Select the structure from the papers and download it in your gadget.

- Make alterations in your papers if possible. You may comprehensive, edit and indication and print out Oregon Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest.

Down load and print out a huge number of papers web templates while using US Legal Forms site, which offers the most important selection of authorized types. Use specialist and express-certain web templates to take on your organization or specific requires.

Form popularity

FAQ

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.

A royalty interest is a property interest that entitles the owner to receive a share of the production revenue. An individual or company that owns a royalty interest does not have to pay for any of the operational costs required to produce the resource, but they still own a portion of the revenue produced.

The general policy of the State Land Board is to retain all mineral and geothermal resource rights unless they are determined to be of no significant value, in which case they may be sold upon approval by the Board.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

A mineral interest is simply a real property interest obtained from the severance or exploitation of minerals ? say natural gas ? from the surface. On the other hand, a royalty interest is the property interest that grants an owner a portion of the production revenue generated.

Blanchard Interests or Blanchard Royalties refer to the way that royalty owners were to be paid by the various Working Interest owners in a well when each working interest owner entered into a separate gas sale contract for their proportionate share of gas produced and sold.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

The easiest way to invest for royalty income is by purchasing shares of a royalty trust. These are publicly traded corporations that acquire ownership of rights to leases and deposits of oil, gas and minerals. The income generated from royalties is distributed to shareholders as dividends.