Oregon Affidavit of Heirship for Real Property

Description

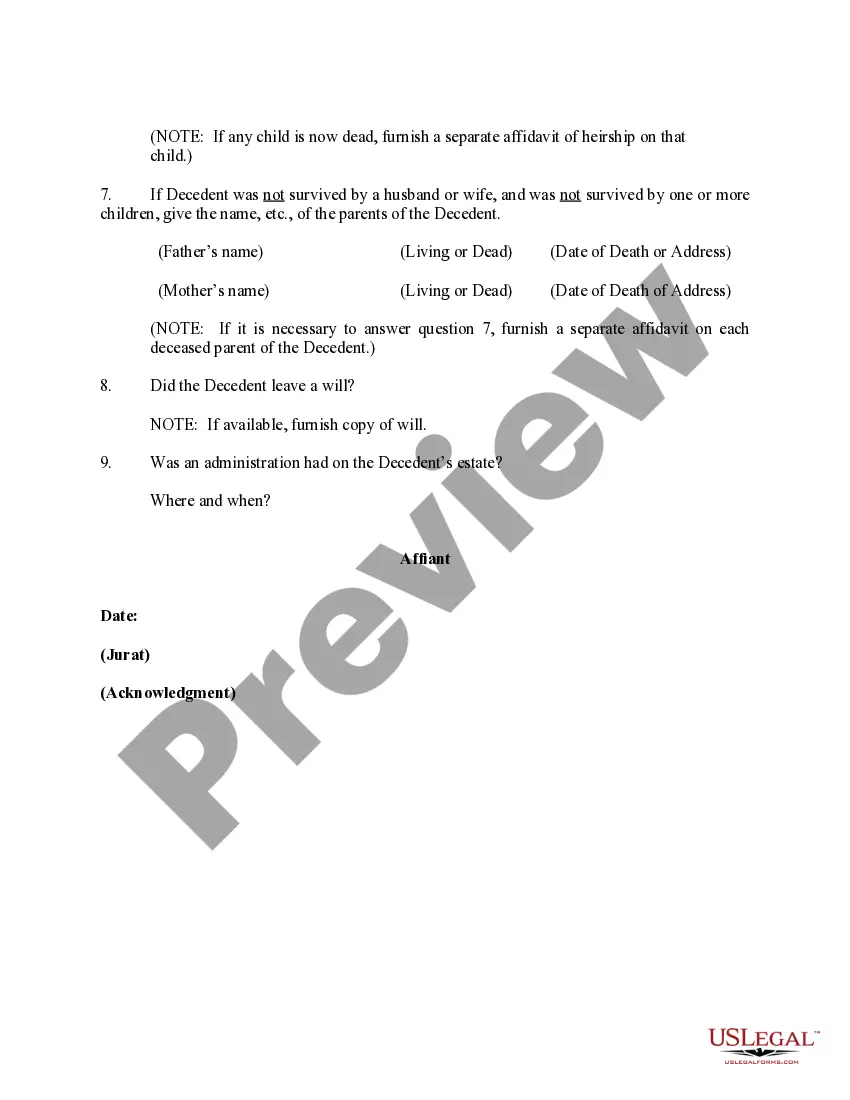

How to fill out Affidavit Of Heirship For Real Property?

If you want to complete, obtain, or produce legal papers web templates, use US Legal Forms, the greatest selection of legal varieties, that can be found on the Internet. Make use of the site`s easy and handy search to find the files you want. A variety of web templates for business and person uses are sorted by groups and states, or keywords and phrases. Use US Legal Forms to find the Oregon Affidavit of Heirship for Real Property in just a few clicks.

In case you are presently a US Legal Forms customer, log in for your bank account and click the Down load key to have the Oregon Affidavit of Heirship for Real Property. You may also accessibility varieties you previously acquired in the My Forms tab of your own bank account.

If you are using US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for that correct town/region.

- Step 2. Make use of the Review option to look through the form`s information. Never forget about to read the information.

- Step 3. In case you are unsatisfied together with the form, take advantage of the Look for industry towards the top of the monitor to get other variations from the legal form template.

- Step 4. Once you have identified the shape you want, select the Buy now key. Choose the pricing prepare you choose and add your accreditations to sign up on an bank account.

- Step 5. Procedure the deal. You can utilize your Мisa or Ьastercard or PayPal bank account to finish the deal.

- Step 6. Find the format from the legal form and obtain it on the gadget.

- Step 7. Total, modify and produce or sign the Oregon Affidavit of Heirship for Real Property.

Each legal papers template you purchase is the one you have eternally. You possess acces to each and every form you acquired inside your acccount. Select the My Forms segment and decide on a form to produce or obtain once more.

Contend and obtain, and produce the Oregon Affidavit of Heirship for Real Property with US Legal Forms. There are many skilled and state-particular varieties you can use to your business or person requirements.

Form popularity

FAQ

If you are married and have children with your spouse, your entire estate will go to your surviving spouse. If you have surviving children from another partner, your surviving spouse could receive up to one-half of the estate, and the remaining shares will be passed on to them.

An affidavit of claiming successor can be filed by an heir or devisee of the decedent, or by a creditor of the estate. Forms are available here. When you file a Small Estate Affidavit, you are swearing that the information in the affidavit is true.

In Oregon, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

The estate is large. Full probate may be avoided when handling small estates. Under Oregon law, a small estate affidavit can be filed if the estate has no more than $75,000 in personal property and no more that $200,000 in real property. These limits may be subject to change. A larger estate may require probate.

In Oregon, the following intestate laws apply if you are married and died without a will: If you are married and have no surviving child, your spouse inherits everything. If you are married and have children with your spouse, your entire estate will go to your surviving spouse.

In Oregon, if a person dies without a will, their assets are distributed ing to the state's laws of intestate succession. Under these laws, the deceased person's assets are distributed to their surviving spouse and children, or to their next closest relatives if they have no spouse or children.

The Estate Settlement Timeline: Even though Oregon law does not specify a strict deadline for this, it is generally advisable to do so within a month to prevent unnecessary delays in the probate process.

Only about a third of all states have laws specifying that assets owned by the deceased are automatically inherited by the surviving spouse.