Oregon Affidavit of Heirship for House

Description

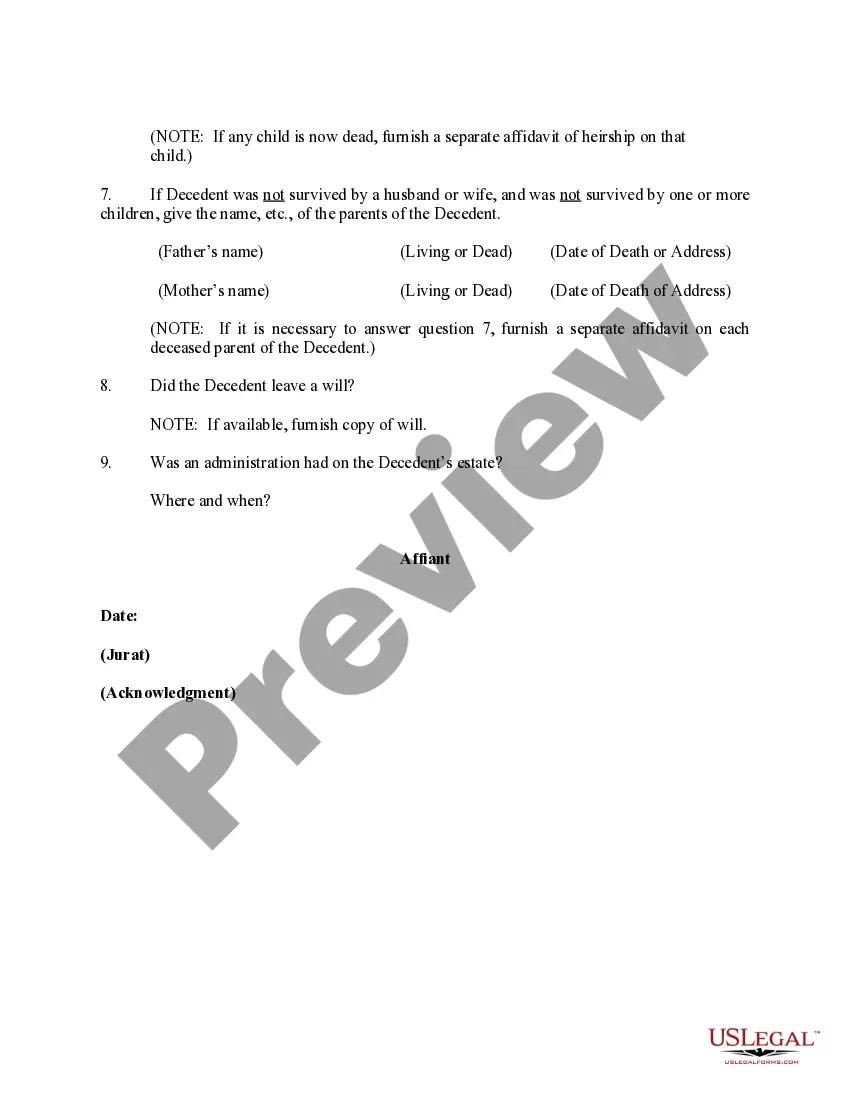

How to fill out Affidavit Of Heirship For House?

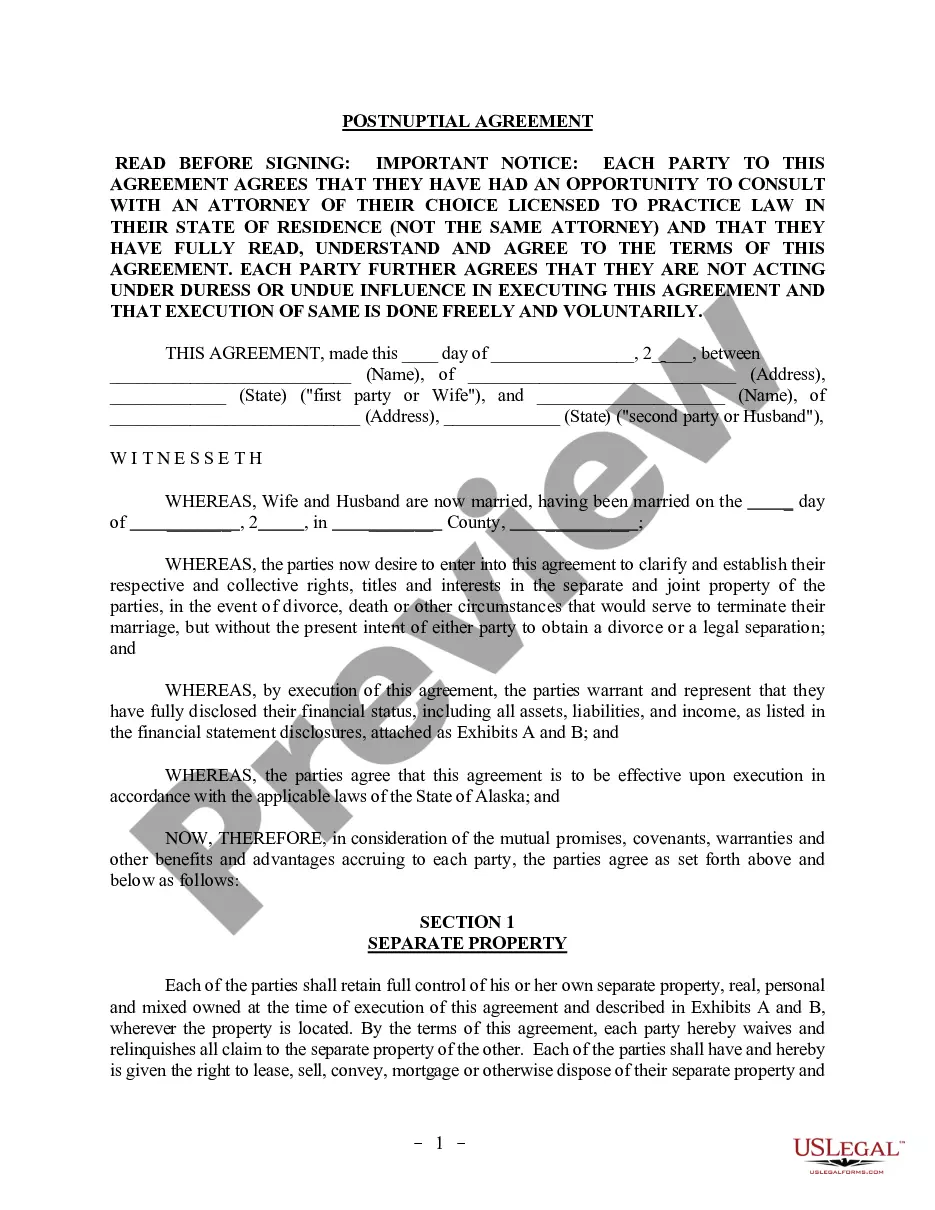

US Legal Forms - one of the most significant libraries of legitimate kinds in the USA - offers a variety of legitimate papers layouts you may obtain or produce. Utilizing the internet site, you can get 1000s of kinds for company and specific reasons, sorted by types, says, or keywords and phrases.You can find the most up-to-date models of kinds such as the Oregon Affidavit of Heirship for House within minutes.

If you already possess a membership, log in and obtain Oregon Affidavit of Heirship for House through the US Legal Forms catalogue. The Down load switch will appear on every form you perspective. You get access to all in the past delivered electronically kinds in the My Forms tab of your profile.

If you want to use US Legal Forms the very first time, listed below are easy instructions to help you started off:

- Be sure to have chosen the proper form to your town/region. Click the Review switch to review the form`s articles. Browse the form description to ensure that you have selected the appropriate form.

- In case the form does not fit your requirements, utilize the Research area towards the top of the monitor to obtain the one who does.

- When you are pleased with the form, affirm your choice by clicking on the Buy now switch. Then, choose the pricing prepare you prefer and give your qualifications to register on an profile.

- Procedure the deal. Make use of bank card or PayPal profile to perform the deal.

- Choose the format and obtain the form on your device.

- Make alterations. Fill out, change and produce and signal the delivered electronically Oregon Affidavit of Heirship for House.

Every format you included in your bank account lacks an expiration day which is your own property permanently. So, in order to obtain or produce yet another version, just check out the My Forms portion and click on about the form you want.

Gain access to the Oregon Affidavit of Heirship for House with US Legal Forms, one of the most extensive catalogue of legitimate papers layouts. Use 1000s of specialist and express-distinct layouts that meet your organization or specific requirements and requirements.

Form popularity

FAQ

You must promptly notify the court and any party entitled to a required notice. ? A regular probate case must be started. You must turn over estate assets to the personal representative of the estate. Amended Affidavits must include all prior information in addition to new information.

Even without a statutory guideline on executor fees in Oregon, the common understanding among legal professionals suggests that an executor can expect to receive about 2-5% of the estate's value. However, this percentage can vary based on the specifics of the estate and the executor's duties.

In Oregon, the following intestate laws apply if you are married and died without a will: If you are married and have no surviving child, your spouse inherits everything. If you are married and have children with your spouse, your entire estate will go to your surviving spouse.

This more streamlined process is known as the small estate proceeding, and it breaks down pretty much like this: Personal property in the estate must have a value less than $75,000. Real property in the estate must have a fair market value less than $200,000.

An estate is considered settled when the executor has completed a series of tasks: submitting the will to probate court, inventorying the estate, notifying and paying off creditors, settling any taxes owed, and distributing the remaining assets ing to the will.

An affidavit of heir is a written statement that allows an estate to move forward with an uncontested probate. The person who signs the affidavit is agreeing that they are the rightful owner of the assets and that they will transfer them to the appropriate parties as soon as the probate process is complete.

A: The probate filing fee paid to the court ranges from $275-$1,200, depending on the value of the estate. Most people find the probate process complicated enough that they need to hire a lawyer.

All of the requirements in the Affidavit of Claiming Successor Testate Estate must be completed. The Affidavit must be filled out correctly and the mailings completed as required, one copy to Department of Human Services and one copy to the Oregon Health Authority. The filing fee for a Small Estate is $124.00.