Oregon Self-Employed Awning Services Contract

Description

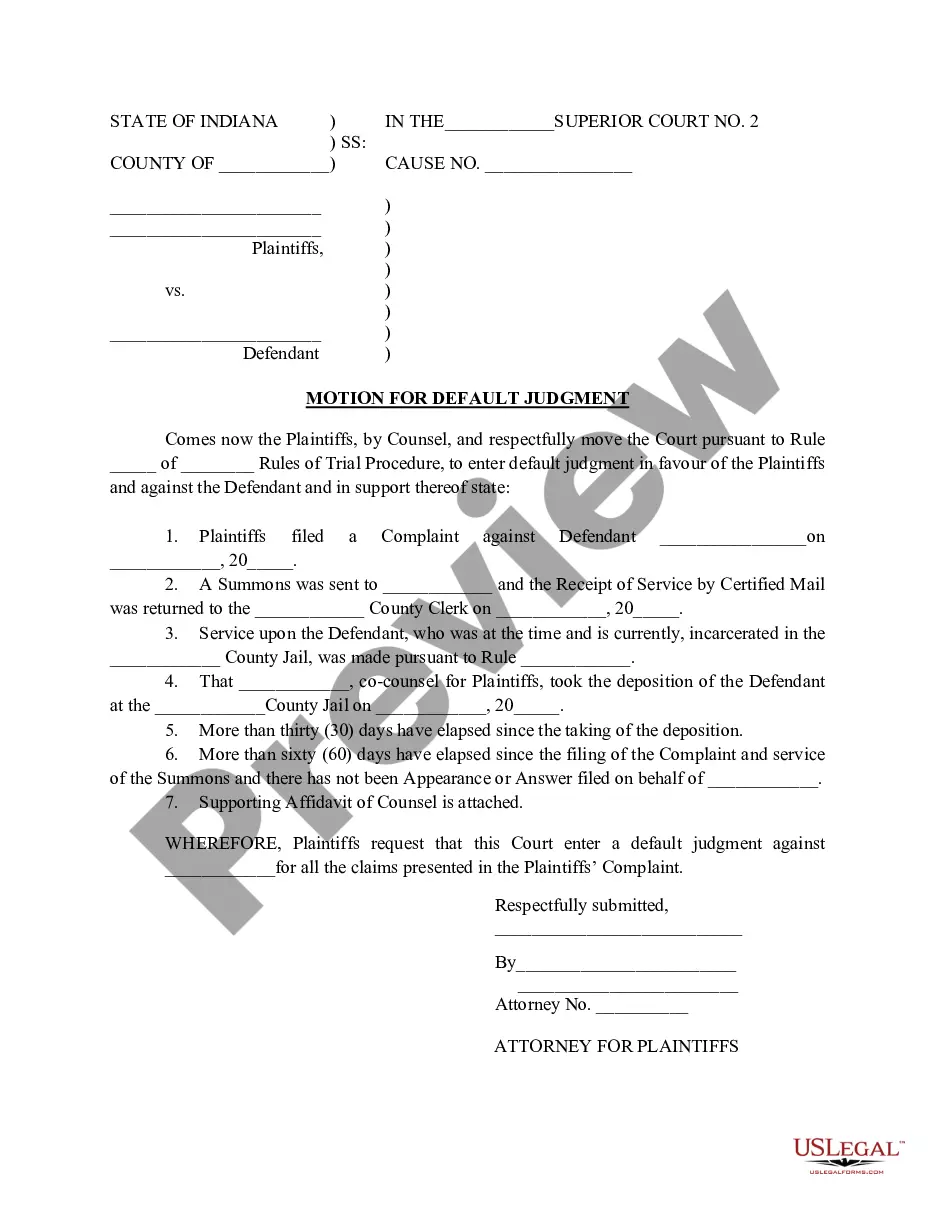

How to fill out Self-Employed Awning Services Contract?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms like the Oregon Self-Employed Awning Services Contract in just seconds.

If you hold a subscription, Log In and download the Oregon Self-Employed Awning Services Contract from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are straightforward instructions to assist you in getting started: Make sure you have selected the correct form for your locality/county. Click the Review button to examine the form's content. Check the form summary to confirm that you have chosen the right form. If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

Access the Oregon Self-Employed Awning Services Contract with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Choose the format and download the form onto your device.

- Make modifications. Fill out, edit, print, and sign the downloaded Oregon Self-Employed Awning Services Contract.

- Every template you add to your account has no expiration date and belongs to you indefinitely. Thus, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

Form popularity

FAQ

You can perform various types of work without a contractor's license in Oregon, such as landscaping, painting, and basic repairs. However, work involving structural changes, plumbing, or electrical systems generally requires a licensed contractor. For your Oregon Self-Employed Awning Services Contract, clarify the scope of work to ensure it adheres to legal standards.

In Oregon, you can perform a limited amount of work without a contractor's license, typically involving minor repairs and maintenance tasks. However, the threshold for what constitutes 'minor' can vary, especially for specialized work. When considering an Oregon Self-Employed Awning Services Contract, it is crucial to be aware of these limits to ensure compliance with state regulations.

Yes, labor laws do apply to 1099 independent workers in Oregon, but the protections may vary compared to traditional employees. Independent contractors are generally responsible for their taxes and benefits. If you are drafting an Oregon Self-Employed Awning Services Contract, it is wise to include details about work conditions and payment to remain compliant with labor laws.

Hiring an unlicensed contractor in Oregon can lead to several issues, including potential legal liability and lack of recourse if the work is subpar. Unlicensed contractors may not have the necessary insurance or bonding, leaving you vulnerable to damages. To avoid such risks, consider using an Oregon Self-Employed Awning Services Contract with a licensed provider to ensure compliance and quality.

An independent contractor agreement in Oregon outlines the terms of work between a contractor and a client. This document specifies the nature of the work, payment terms, and responsibilities. When entering into an Oregon Self-Employed Awning Services Contract, having a clear agreement can help protect both parties and clarify expectations.

In Oregon, a handyman can perform various tasks without a contractor's license, such as minor repairs, painting, and simple home maintenance. However, it's important to note that certain jobs, especially those involving plumbing or electrical work, may require a licensed contractor. If you are considering an Oregon Self-Employed Awning Services Contract, ensure that your handyman's tasks fall within legal boundaries to avoid complications.

Writing a simple employment contract involves stating the job title, responsibilities, payment terms, and duration of employment. Be sure to include a section on confidentiality and termination conditions. For a straightforward approach, explore the Oregon Self-Employed Awning Services Contract from US Legal Forms, which can simplify the drafting process.

To write a self-employment contract, start by detailing your business services, payment structure, and timelines. Clearly outline the expectations and responsibilities for both parties. Consider using the Oregon Self-Employed Awning Services Contract from US Legal Forms, which provides a comprehensive framework that covers essential elements to protect your interests.

Writing a contract for a 1099 employee requires you to define the work relationship and specify tasks, payment, and deadlines clearly. Include clauses that describe the independent nature of the work and the lack of employer benefits. Using a structured template like the Oregon Self-Employed Awning Services Contract from US Legal Forms can ensure you include all critical elements.

Filling out an independent contractor agreement involves inputting specific information about both parties, the nature of the work, and payment terms. Clearly outline the responsibilities and deliverables to avoid misunderstandings. To streamline this process, consider using the Oregon Self-Employed Awning Services Contract template from US Legal Forms, which guides you through necessary sections.