Oregon Self-Employed Independent Contractor Chemist Agreement

Description

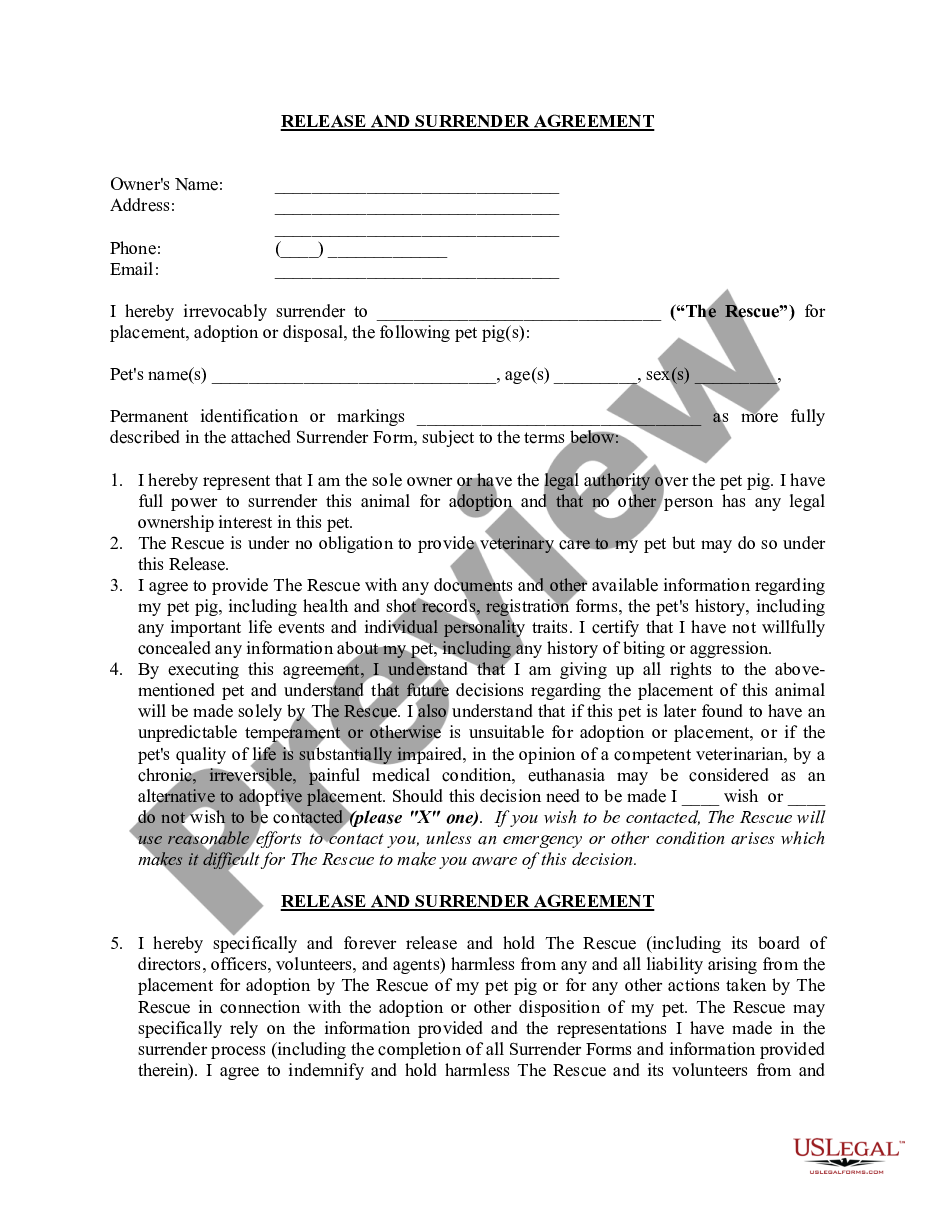

How to fill out Self-Employed Independent Contractor Chemist Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or print. By using the site, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest forms, such as the Oregon Self-Employed Independent Contractor Chemist Agreement, in moments.

If you already have a subscription, Log In and download the Oregon Self-Employed Independent Contractor Chemist Agreement from the US Legal Forms collection. The Download option will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

If you are using US Legal Forms for the first time, here are straightforward instructions to get you started: Ensure you have selected the correct form for your location/region. Click the Preview option to review the form’s content. Check the form description to confirm you have selected the correct one. If the form does not meet your requirements, use the Search box at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then choose the pricing plan that suits you and provide your details to register for the account.

Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Select the format and download the form to your device.

- Make modifications. Fill out, edit, and print and sign the downloaded Oregon Self-Employed Independent Contractor Chemist Agreement.

- Every template you added to your account has no expiration date and is yours indefinitely.

- So, if you want to download or print another copy, just go to the My documents section and click on the form you need.

- Access the Oregon Self-Employed Independent Contractor Chemist Agreement with US Legal Forms, one of the most extensive libraries of legal document templates.

Form popularity

FAQ

To establish an Oregon Self-Employed Independent Contractor Chemist Agreement, you must fill out several essential documents. Primarily, you need a contract that clearly outlines the terms of your work and payment. Additionally, you may require a W-9 form for tax purposes, which provides your taxpayer identification information to your clients. It’s beneficial to consult the USLegalForms platform, where you can find templates specifically tailored for Oregon independent contractors, ensuring you have all the necessary paperwork completed correctly.

Yes, independent contractors typically file as self-employed when it comes to tax purposes. This means they report their income from contracts, such as those detailed in the Oregon Self-Employed Independent Contractor Chemist Agreement, on their tax returns. It is important for contractors to keep accurate records of their earnings and expenses throughout the year. Utilizing a reputable platform like uslegalforms can simplify the documentation process extensively, ensuring compliance.

To write an independent contractor agreement, begin by introducing both parties and outlining the project specifics. Clearly state the compensation structure, including payment timelines and methods. Include applicable terms from the Oregon Self-Employed Independent Contractor Chemist Agreement, such as confidentiality and dispute resolution clauses. Lastly, ensure each party signs the document, making it a legally binding contract.

Filling out an independent contractor agreement involves detailing the roles and responsibilities of both the contractor and the client. Start by identifying each party involved and outlining the project, including deadlines and payment rates. It is crucial to incorporate any legal stipulations from the Oregon Self-Employed Independent Contractor Chemist Agreement template, as these can protect both parties. Once complete, review the contract for clarity before signing.

To fill out an independent contractor form, begin by providing your basic information, including your name and contact details. Next, specify the scope of work and payment terms clearly to establish a mutual understanding. Make sure to review the Oregon Self-Employed Independent Contractor Chemist Agreement terms for any specific clauses that may apply. Finally, sign and date the form, ensuring all parties have copies for their records.

In Oregon, independent contractors may need a business license depending on their location and the nature of their work. It's essential to check local regulations to determine specific requirements. Generally, having a proper license can enhance credibility and ensure compliance. For assistance, consider utilizing the US Legal resources to ensure your Oregon Self-Employed Independent Contractor Chemist Agreement aligns with all legal standards.

Creating an independent contractor agreement is straightforward. Begin by clearly defining the project scope, including duties and deliverables. Include payment terms, timelines, and conditions for termination. Using the US Legal platform can help you draft a comprehensive Oregon Self-Employed Independent Contractor Chemist Agreement that ensures both parties understand their obligations.

Yes, an independent contractor is considered self-employed, as they work for themselves rather than for a specific employer. They manage their own business activities, which includes handling their own taxes and benefits. This self-employed status offers flexibility and independence in working arrangements. For a comprehensive understanding of this status, refer to the Oregon Self-Employed Independent Contractor Chemist Agreement.

The independent contractor agreement in Oregon is a legal document outlining the relationship between a contractor and a client. It specifies the tasks to be performed, payment terms, deadlines, and expectations. This agreement is crucial for maintaining professionalism and protecting the rights of both parties. Utilizing the Oregon Self-Employed Independent Contractor Chemist Agreement from USLegalForms can provide you with a reliable template tailored to your needs.

The new federal rule on independent contractors aims to clarify the classification of workers under the Fair Labor Standards Act. This rule affects the determination of whether a worker is an independent contractor or an employee. Factors like the degree of control the employer has can influence this classification. To navigate these complexities, consider using the Oregon Self-Employed Independent Contractor Chemist Agreement, which can help establish clear terms.