Oregon Boiler And Radiator Services Contract - Self-Employed

Description

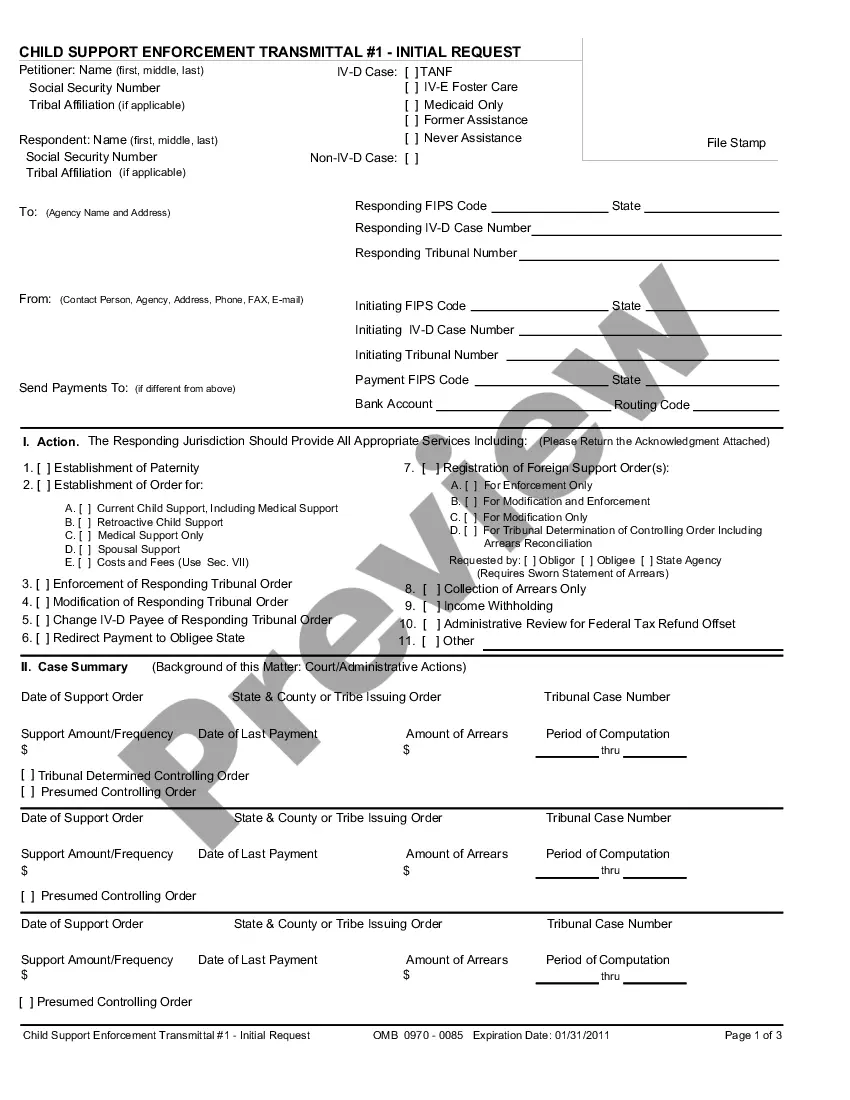

How to fill out Boiler And Radiator Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print. By utilizing the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Oregon Boiler And Radiator Services Agreement - Self-Employed in just a few minutes.

If you already have an account, Log In and download the Oregon Boiler And Radiator Services Agreement - Self-Employed from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

To use US Legal Forms for the first time, here are simple steps to get you started: Make sure you have selected the correct form for your city/county. Click on the Preview button to review the form's content. Check the form summary to ensure you have chosen the correct form. If the form does not meet your needs, use the Search box at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, select the payment plan you prefer and provide your details to register for an account. Complete the transaction. Use a credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make edits. Fill out, modify, and print and sign the downloaded Oregon Boiler And Radiator Services Agreement - Self-Employed. Each template you add to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you desire.

- Access the Oregon Boiler And Radiator Services Agreement - Self-Employed with US Legal Forms, the most comprehensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

In Oregon, handymen can perform a variety of tasks without a license, but strict limitations apply, especially around electrical, plumbing, and structural work. Under an Oregon Boiler And Radiator Services Contract, handymen might be able to handle simple repairs and maintenance tasks, but it’s crucial to know the legal boundaries. To protect yourself and ensure quality service, verify the handyperson's capabilities. US Legal Forms can provide you with valuable resources to understand what services can be safely performed.

Hiring an unlicensed contractor in Oregon can lead to several challenges, including potential legal issues and subpar work. If something goes wrong, your options for recourse may be limited. Specifically, under an Oregon Boiler And Radiator Services Contract, you may not have the same protections as when hiring a licensed worker. It’s advisable to always check for proper licensing to avoid unnecessary complications and ensure quality service.

In Oregon, the scope of work for a handyman is limited, and plumbing tasks typically require a licensed plumber. If you hire someone for services under an Oregon Boiler And Radiator Services Contract, ensure they hold the appropriate licenses for any plumbing work. Doing so will protect you from potential code violations and ensure quality work. Consider using US Legal Forms to find properly licensed professionals who can safely handle your plumbing needs.

In Oregon, labor laws generally apply to all workers, but the specifics can differ for 1099 independent workers. As a self-employed professional operating under an Oregon Boiler And Radiator Services Contract, you must understand your rights and obligations. For instance, while you may not receive certain benefits like unemployment insurance, you still need to adhere to safety regulations. Navigating these laws can be complex, and using a platform like US Legal Forms can help you ensure you follow all necessary guidelines.

Yes, Oregon requires independent contractors to have a business license. This applies even if you work under the Oregon Boiler And Radiator Services Contract - Self-Employed framework. Obtaining a business license not only legitimizes your services but also helps you comply with tax obligations and contributes to your professionalism in the market. You can find helpful resources through platforms like uslegalforms to guide you in this process.

Yes, a license is typically required to perform HVAC work in Oregon. This includes installation, repair, or maintenance of heating and cooling systems. If your projects involve Oregon Boiler And Radiator Services Contract - Self-Employed, obtaining the appropriate licenses will ensure you meet state standards and regulations. Investing in the right licenses helps maintain quality and safety in your services.

As a self-employed individual, you can undertake various small-scale tasks without a contractor's license in Oregon. This includes repairs, maintenance, and installations that do not exceed the $1,000 limit. However, when it comes to specialized services like Oregon Boiler And Radiator Services Contract - Self-Employed, a license may be necessary. It is crucial to confirm your specific job's requirements to avoid legal issues.

In Oregon, self-employed individuals can perform limited amounts of work without a contractor license. Specifically, you can engage in projects valued under $1,000, including materials and labor. However, engaging in Oregon Boiler And Radiator Services Contract - Self-Employed activities often requires a proper license, especially for larger projects. Always verify the state regulations to ensure compliance.

Yes, subcontractors need a license to operate legally in Oregon. This requirement helps ensure that all services provided meet the necessary standards for quality and safety. If you are looking into an Oregon Boiler And Radiator Services Contract - Self-Employed, be sure to check that all subcontractors hold the appropriate licenses. Legal compliance can protect you and your business while delivering reliable services.

Yes, hiring an unlicensed contractor in Oregon is illegal and can lead to significant consequences. It is crucial to ensure that your contractor has the appropriate licenses for services, such as those covered under the Oregon Boiler And Radiator Services Contract - Self-Employed. Engaging licensed professionals protects you from legal issues and ensures high-quality service. You can find essential resources and legal forms through uslegalforms to avoid hiring unlicensed contractors.