Oregon Leased Personal Property Workform

Description

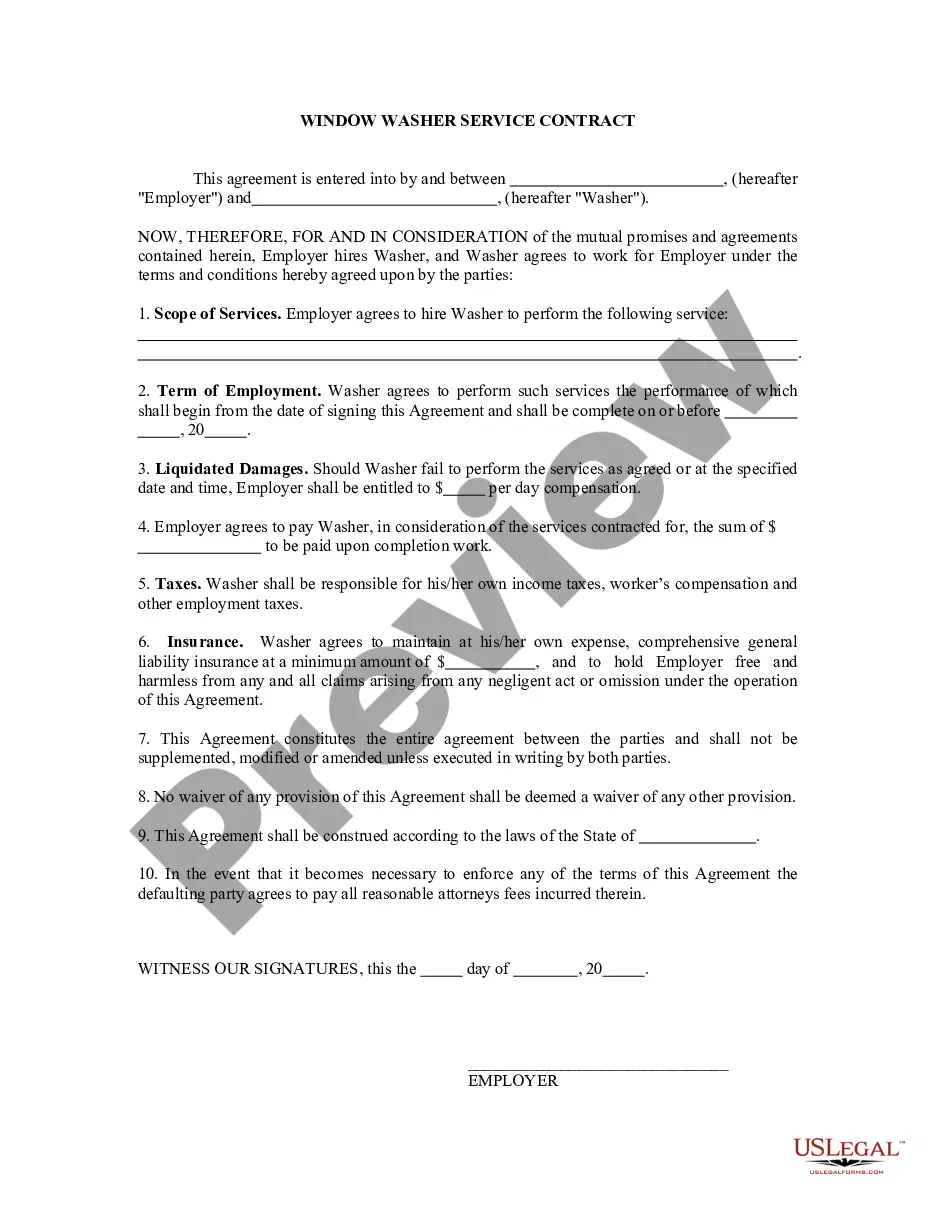

How to fill out Leased Personal Property Workform?

Selecting the appropriate legal document template can be challenging. Clearly, there are multiple designs available online, but how can you find the legal form you need.

Utilize the US Legal Forms website. The service provides a vast array of templates, such as the Oregon Leased Personal Property Workform, which can be used for both business and personal purposes. All documents are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to access the Oregon Leased Personal Property Workform. Use your account to browse the legal forms you have purchased previously. Navigate to the My documents section of your account to obtain another copy of the document you need.

Choose the document format and download the legal paper template to your device. Complete, modify, print, and sign the acquired Oregon Leased Personal Property Workform. US Legal Forms is the largest repository of legal documents where you can find many paper templates. Use the service to download professionally crafted documents that adhere to state requirements.

- First, ensure you’ve chosen the correct form for your area/region.

- You can view the form using the Preview button and read the form details to confirm it’s suitable for you.

- If the form does not meet your requirements, use the Search feature to find the correct form.

- Once you are sure the form is appropriate, click the Purchase now button to acquire the form.

- Select the payment plan you prefer and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

Form 40 in Oregon is the primary state income tax return form for individuals. This form gathers key information about your income, deductions, and tax credits to calculate your tax liability. It is crucial for any Oregon resident or anyone earning income in the state. If you have leased personal property, remember to utilize the Oregon Leased Personal Property Workform to ensure compliance with additional tax requirements.

An Oregon Form 24 is a specific tax form used for certain tax situations, such as making estimated tax payments or claiming specific credits. This form facilitates various tax processes and helps ensure compliance with Oregon tax laws. It's vital to understand if this form applies to your situation, especially if you are dealing with leased personal property. The Oregon Leased Personal Property Workform might also play a role in your overall tax strategy.

Form 40 for taxes in Oregon is used by residents to file their state income tax returns. It helps you report your wages, interest, dividends, and other types of income. By completing this form, you can claim deductions and credits that may lower your taxable income. Don't forget to check if you're required to file the Oregon Leased Personal Property Workform if you have leased personal property.

Anyone who earns income in the United States typically needs to complete a 1040 form. This includes employees, freelancers, and business owners, regardless of whether they are self-employed or not. By submitting a 1040, you report your income and determine your tax obligations for the year. If you also have rental or leased property in Oregon, the Oregon Leased Personal Property Workform may be necessary to accurately report those assets.

Form 40 Oregon is the state tax return form that residents use to report their income, deductions, and tax credits to the Oregon Department of Revenue. It is essential for filing taxes if you live or earn income in Oregon. Completing this form accurately can help ensure you take full advantage of applicable tax benefits. Additionally, you might need the Oregon Leased Personal Property Workform if you're involved with leased personal property.

The 1040 form and the W-2 serve different purposes in tax filing. The W-2 is a wage and tax statement provided by your employer, detailing your earnings and taxes withheld. On the other hand, the 1040 is the individual income tax return form you complete to report your overall income and calculate your taxes owed. If you're filing taxes in Oregon, don't forget to consider the Oregon Leased Personal Property Workform for any relevant leased assets.

Yes, Oregon has personal property tax regulations that can affect vehicles, especially those used for business purposes. If you lease a vehicle, the Oregon Leased Personal Property Workform is a valuable tool to help you manage the associated tax responsibilities. Being informed about these taxes not only aids in compliance but also assists in financial planning. Understanding these requirements is crucial for vehicle owners and business operators alike.

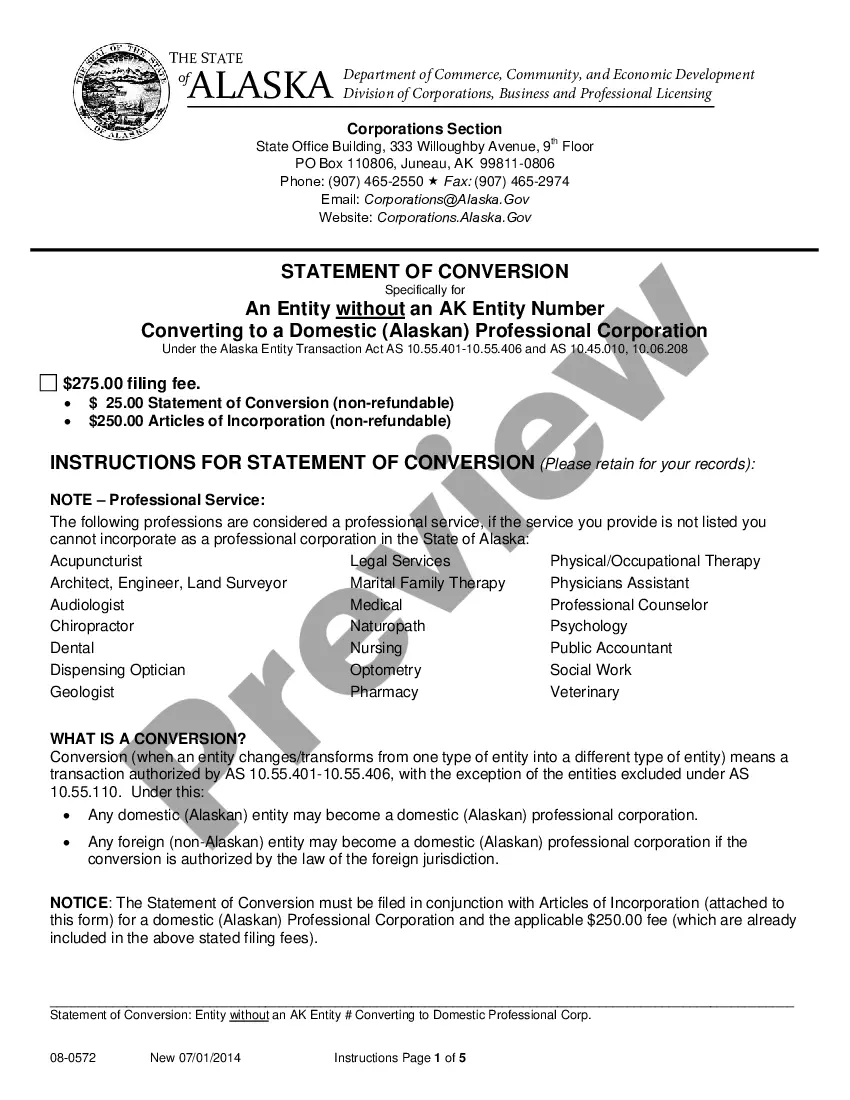

In Oregon, you may need to file a form related to your personal property, such as the Oregon Leased Personal Property Workform. Whether you should file depends on the nature of your assets and your obligations. If you're unsure, consult with a tax professional or use resources on uslegalforms to guide you in determining the appropriate forms to file. This proactive approach ensures you remain compliant and informed.

Form 40P in Oregon is a personal property tax return specifically designed for reporting business personal property. This form captures detailed information about your assets, ensuring you meet your tax requirements appropriately. If you're dealing with leased personal property, the Oregon Leased Personal Property Workform can assist in seamless record management and compliance. Properly filing Form 40P is crucial for avoiding penalties or tax issues.

In Oregon, a CPPR, or Certificate of Personal Property Registration, is a legal document that pertains to personal property. This form is essential for ensuring proper record-keeping and tax compliance for leased personal property. The Oregon Leased Personal Property Workform fits within this framework, providing a clear structure for reporting and managing leased equipment or assets. Understanding CPPR can help you navigate your personal property obligations effectively.