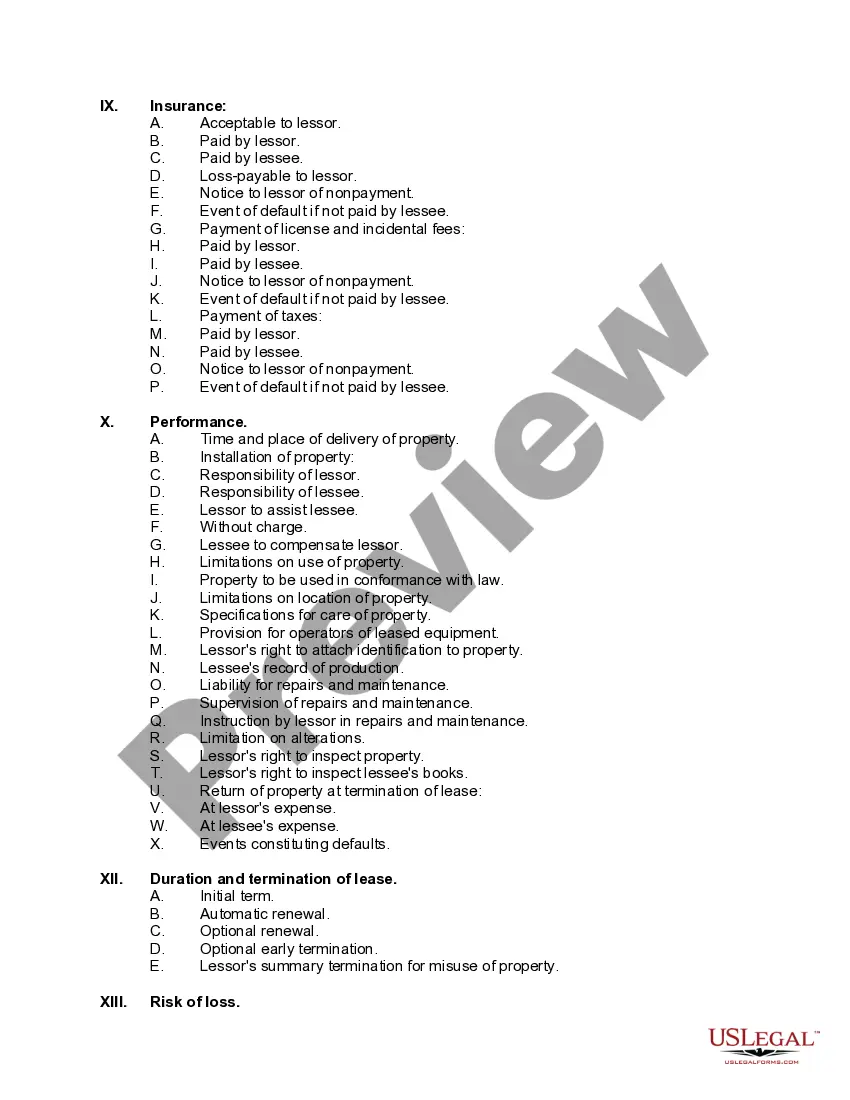

Oregon Equipment Lease Checklist

Description

How to fill out Equipment Lease Checklist?

Locating the appropriate legal document template can be a challenge.

Certainly, there are numerous templates available online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The platform offers a vast selection of templates, such as the Oregon Equipment Lease Checklist, which you can utilize for both business and personal purposes.

You can browse the form using the Review button and examine the form description to confirm it is the correct one for you.

- All the forms are vetted by professionals and meet federal and state requirements.

- If you are already registered, Log In to your account and click on the Obtain button to retrieve the Oregon Equipment Lease Checklist.

- Use your account to search through the legal forms you have previously acquired.

- Navigate to the My documents tab of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions that you should follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

A good equipment lease rate typically falls between 5% and 15%, depending on the equipment type and the borrower's creditworthiness. Rates can vary based on market conditions, making it essential to compare offers. Using an Oregon Equipment Lease Checklist can help you evaluate multiple leasing options and negotiate favorable terms.

Typical terms for equipment financing can range from two to seven years. This duration allows businesses to balance manageable monthly payments with the useful life of the equipment. By consulting an Oregon Equipment Lease Checklist, you can identify terms that best suit your financial strategy and equipment use.

Equipment typically needs to be returned to the leasing company at the end of the lease period. However, you might negotiate a buyout option or renewal terms, depending on your agreement. It's essential to revisit your lease conditions, and the Oregon Equipment Lease Checklist can help clarify these important details for you.

At the end of a lease, the equipment typically must be returned to the lessor unless other arrangements are made, such as a buyout option. The lessor may also offer to lease the asset again, depending on your needs. Always review your lease terms carefully, using the Oregon Equipment Lease Checklist for better clarity on your options.

In a finance lease, the lessor retains ownership of the equipment while you, the lessee, benefit from using it. This arrangement typically lasts for a significant portion of the asset's useful life. Understanding these terms can be complex, so the Oregon Equipment Lease Checklist is a valuable resource to navigate your responsibilities and rights.

In Oregon, notarization of leases is not generally required unless specified by state law or the lease agreement itself. However, having a lease notarized can add a layer of authenticity and can protect you in case of disputes. To ensure your lease meets all necessary requirements, utilize the Oregon Equipment Lease Checklist as your guide.

An equipment lease typically represents an expense on your financial statements. This classification occurs because monthly lease payments do not provide ownership of the asset. However, you may still treat the leased equipment as an operating asset for operational purposes. For a comprehensive understanding, refer to the Oregon Equipment Lease Checklist.

Filling out a commercial lease agreement involves entering information such as the duration, rent amount, and terms governing use and maintenance. It is crucial to ensure clarity and compliance with local regulations. The Oregon Equipment Lease Checklist can help you systematically complete each section of the agreement.

Filling out a commercial lease agreement requires careful attention to detail. You should input crucial information, such as tenant and landlord names, lease terms, and specific clauses related to the property. The Oregon Equipment Lease Checklist serves as a helpful guide to ensure all sections are accurately completed.

Yes, writing your own lease agreement is possible, provided that you ensure it meets legal requirements and includes all necessary terms. However, this can be complex without proper guidance. The Oregon Equipment Lease Checklist can serve as a valuable resource to help you draft an effective lease.